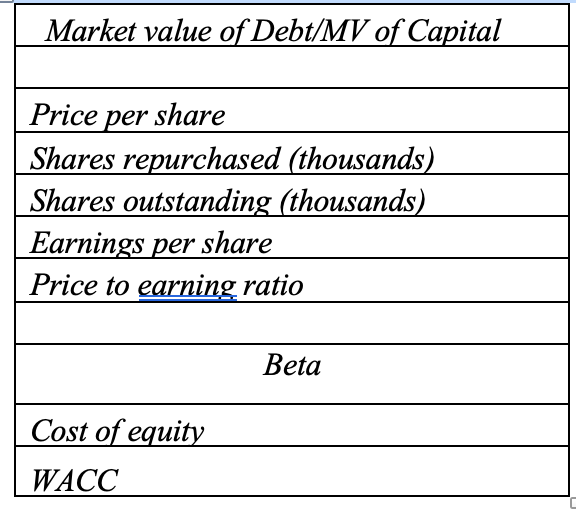

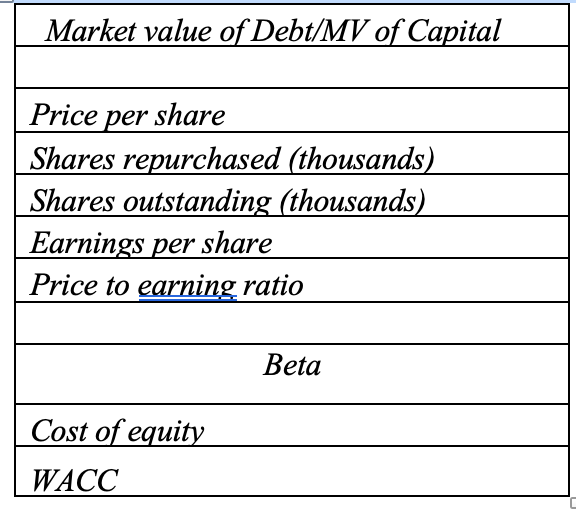

Add the following values to the table provided below using data from Exhibit 9 and complete it for the actual scenario and the three proposed scenarios: (Do in spread sheet thank you)

Add the following values to the table provided below using data from Exhibit 9 and complete it for the actual scenario and the three proposed scenarios: (Do in spread sheet thank you)

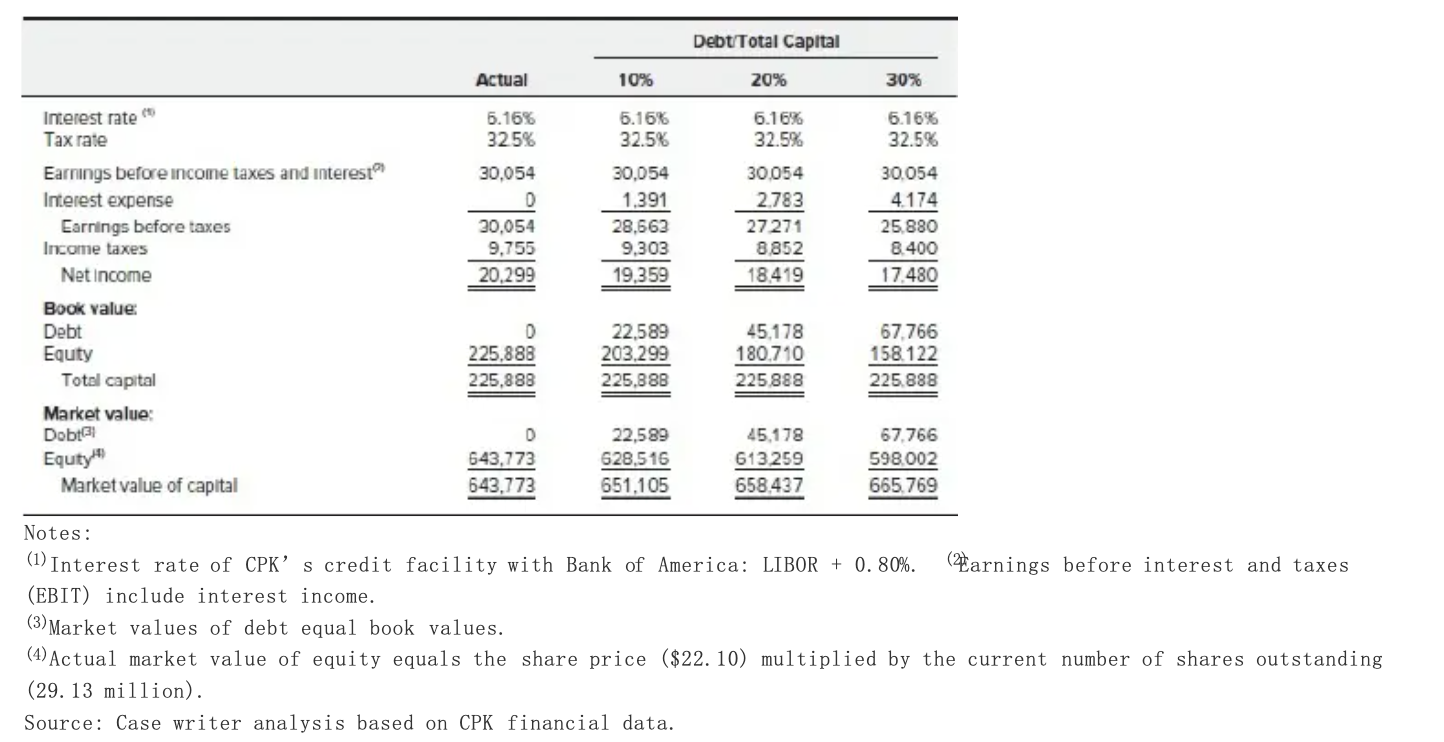

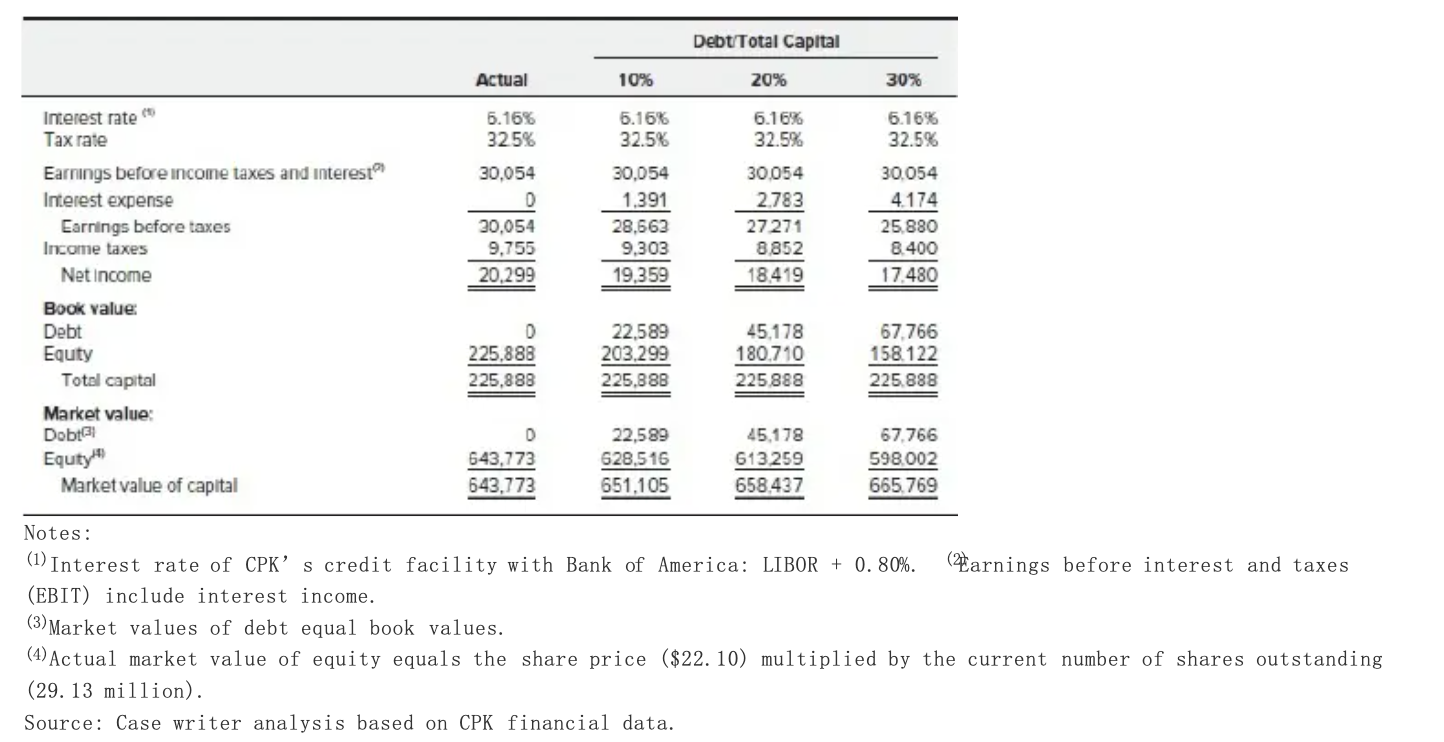

Exhibit 9

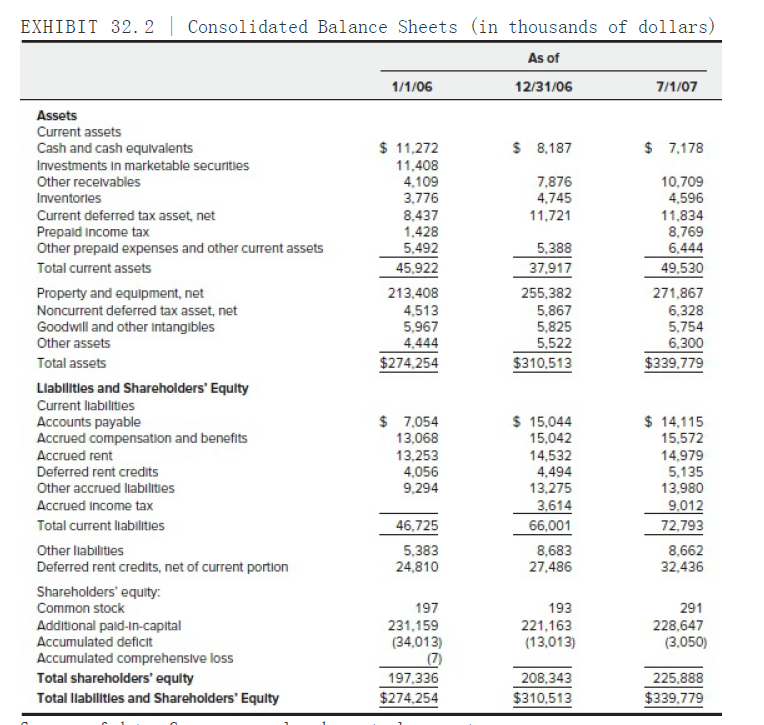

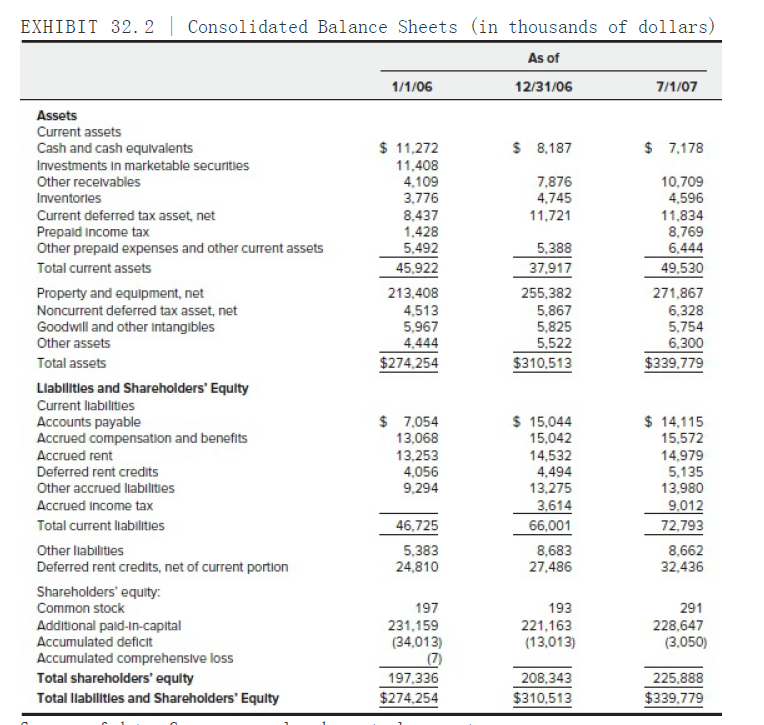

EXHIBIT 32.2 | Consolidated Balance Sheets (in thousands of dollars) As of 1/1/06 12/31/06 7/1/07 Assets Current assets Cash and cash equivalents $ 11,272 $ 8,187 $ 7.178 Investments in marketable securities 11,408 Other receivables 4,109 7.876 10.709 Inventories 3.776 4,745 4.596 Current deferred tax asset, net 8,437 11,721 11.834 Prepaid income tax 1,428 8,769 Other prepaid expenses and other current assets 5.492 5,388 6.444 Total current assets 45.922 37,917 49.530 Property and equipment, net 213.408 255,382 271.867 Noncurrent deferred tax asset, net 4.513 5.867 6.328 Goodwill and other intangibles 5,967 5,825 5,754 Other assets 4.444 5.522 6.300 Total assets $274,254 $310,513 $339.779 Liabilities and Shareholders' Equity Current liabilities Accounts payable $ 7,054 $ 15,044 $ 14,115 Accrued compensation and benefits 13,068 15,042 15,572 Accrued rent 13,253 14,532 14.979 Deferred rent credits 4,056 4.494 5,135 Other accrued liabilities 9,294 13,275 13,980 Accrued Income tax 3,614 9.012 Total current liabilities 46.725 66,001 72,793 Other liabilities 5.383 8,683 8,662 Deferred rent credits, net of current portion 24,810 27,486 32,436 Shareholders' equity: Common stock 197 193 291 Additional paid-in-capital 231,159 221,163 228,647 Accumulated deficit (34.013) (13,013) (3.050) Accumulated comprehensive loss (7) Total shareholders' equity 197,336 208,343 225,888 Total liabilities and Shareholders' Equity $274,254 $310.513 $339,779 Market value of Debt/MV of Capital Price per share Shares repurchased (thousands) Shares outstanding (thousands) Earnings per share Price to earning ratio Beta Cost of equity WACC Debt Total Capital Actual 10% 20% 30% 6.16% 32.5% 5.16% 32.5% 6.16% 32.5% 6.16% 32.5% 30.054 0 30.054 9,755 20.299 30,054 1.391 28.663 9,303 19.359 30.054 2.783 27271 8,852 18.419 30.054 4.174 25.880 8.400 17.480 Interest rate Tax rate Earnings before income taxes and interest Interest expense Earnings before taxes Income taxes Net Income Book value: Debt Equty Total capital Market value: Dobt31 Equity" Market value of capital 0 225,888 225,888 22.589 203,299 225,888 45,178 180.710 225888 67.766 158122 225.888 D 643,773 643,773 22,589 628,516 651,105 45,178 613259 658,437 67.766 598.002 665.769 Notes: (1) Interest rate of CPK's credit facility with Bank of America: LIBOR + 0. 80%. (Parnings before interest and taxes (EBIT) include interest income. (3) Market values of debt equal book values. (1) Actual market value of equity equals the share price ($22. 10) multiplied by the current number of shares outstanding (29. 13 million). Source: Case writer analysis based on CPK financial data. EXHIBIT 32.2 | Consolidated Balance Sheets (in thousands of dollars) As of 1/1/06 12/31/06 7/1/07 Assets Current assets Cash and cash equivalents $ 11,272 $ 8,187 $ 7.178 Investments in marketable securities 11,408 Other receivables 4,109 7.876 10.709 Inventories 3.776 4,745 4.596 Current deferred tax asset, net 8,437 11,721 11.834 Prepaid income tax 1,428 8,769 Other prepaid expenses and other current assets 5.492 5,388 6.444 Total current assets 45.922 37,917 49.530 Property and equipment, net 213.408 255,382 271.867 Noncurrent deferred tax asset, net 4.513 5.867 6.328 Goodwill and other intangibles 5,967 5,825 5,754 Other assets 4.444 5.522 6.300 Total assets $274,254 $310,513 $339.779 Liabilities and Shareholders' Equity Current liabilities Accounts payable $ 7,054 $ 15,044 $ 14,115 Accrued compensation and benefits 13,068 15,042 15,572 Accrued rent 13,253 14,532 14.979 Deferred rent credits 4,056 4.494 5,135 Other accrued liabilities 9,294 13,275 13,980 Accrued Income tax 3,614 9.012 Total current liabilities 46.725 66,001 72,793 Other liabilities 5.383 8,683 8,662 Deferred rent credits, net of current portion 24,810 27,486 32,436 Shareholders' equity: Common stock 197 193 291 Additional paid-in-capital 231,159 221,163 228,647 Accumulated deficit (34.013) (13,013) (3.050) Accumulated comprehensive loss (7) Total shareholders' equity 197,336 208,343 225,888 Total liabilities and Shareholders' Equity $274,254 $310.513 $339,779 Market value of Debt/MV of Capital Price per share Shares repurchased (thousands) Shares outstanding (thousands) Earnings per share Price to earning ratio Beta Cost of equity WACC Debt Total Capital Actual 10% 20% 30% 6.16% 32.5% 5.16% 32.5% 6.16% 32.5% 6.16% 32.5% 30.054 0 30.054 9,755 20.299 30,054 1.391 28.663 9,303 19.359 30.054 2.783 27271 8,852 18.419 30.054 4.174 25.880 8.400 17.480 Interest rate Tax rate Earnings before income taxes and interest Interest expense Earnings before taxes Income taxes Net Income Book value: Debt Equty Total capital Market value: Dobt31 Equity" Market value of capital 0 225,888 225,888 22.589 203,299 225,888 45,178 180.710 225888 67.766 158122 225.888 D 643,773 643,773 22,589 628,516 651,105 45,178 613259 658,437 67.766 598.002 665.769 Notes: (1) Interest rate of CPK's credit facility with Bank of America: LIBOR + 0. 80%. (Parnings before interest and taxes (EBIT) include interest income. (3) Market values of debt equal book values. (1) Actual market value of equity equals the share price ($22. 10) multiplied by the current number of shares outstanding (29. 13 million). Source: Case writer analysis based on CPK financial data

Add the following values to the table provided below using data from Exhibit 9 and complete it for the actual scenario and the three proposed scenarios: (Do in spread sheet thank you)

Add the following values to the table provided below using data from Exhibit 9 and complete it for the actual scenario and the three proposed scenarios: (Do in spread sheet thank you)