Answered step by step

Verified Expert Solution

Question

1 Approved Answer

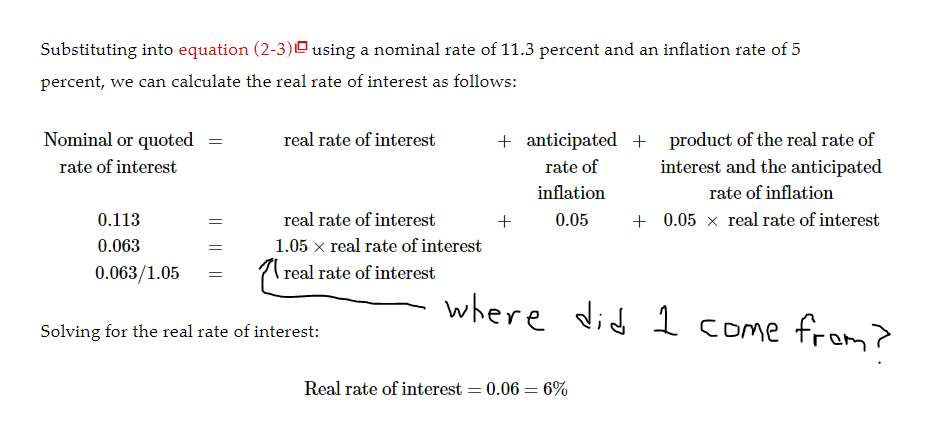

Hello, I am confused by this example of the fisher effect equation from my finance textbook. It seems to me that you would solve algebraically

Hello,

I am confused by this example of the fisher effect equation from my finance textbook. It seems to me that you would solve algebraically to find the real rate of interest, subtracting the anticipated rate of inflation from the nominal rate of inflation and then solving for X. If that is the case though, where did the 1 in "1.05 x real rate of inflation" come from? Perhaps I am not getting something here.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started