Question

Hello I am doing a Portfolio Management assignment and experiencing a lot of difficulties. The questions that I would like to ask are written below:

Hello I am doing a Portfolio Management assignment and experiencing a lot of difficulties. The questions that I would like to ask are written below:

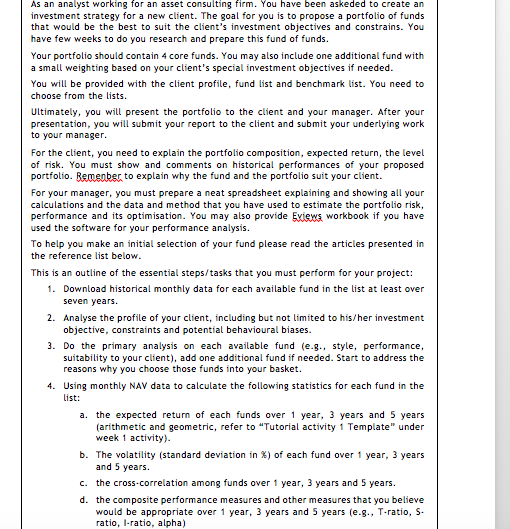

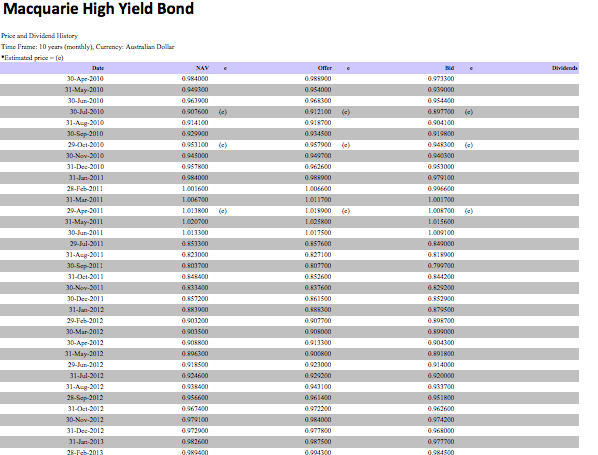

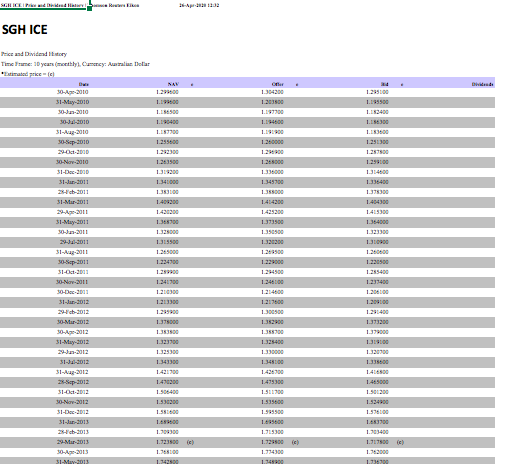

1.Download historical monthly data for each available fund in the list at least over seven years. (I have attached 3 pictures of 3 different funds which shows their data) Do the primary analysis on each available fund (e.g., style, performance, suitability to your client), add one additional fund if needed. Start to address the reasons why you choose those funds into your basket.

2.Using monthly NAV data to calculate the following statistics for each fund in the list: (this part need to conducted in the excel, which i am really struggling with)

a.the expected return of each funds over 1 year, 3 years and 5 years (arithmetic and geometric, refer to "Tutorial activity 1 Template" under week 1 activity).

b.The volatility (standard deviation in %) of each fund over 1 year, 3 years and 5 years.

c.the cross-correlation among funds over 1 year, 3 years and 5 years.

d.the composite performance measures andother measuresthat you believe would be appropriate over 1 year, 3 years and 5 years (e.g., T-ratio, S-ratio, I-ratio, alpha)

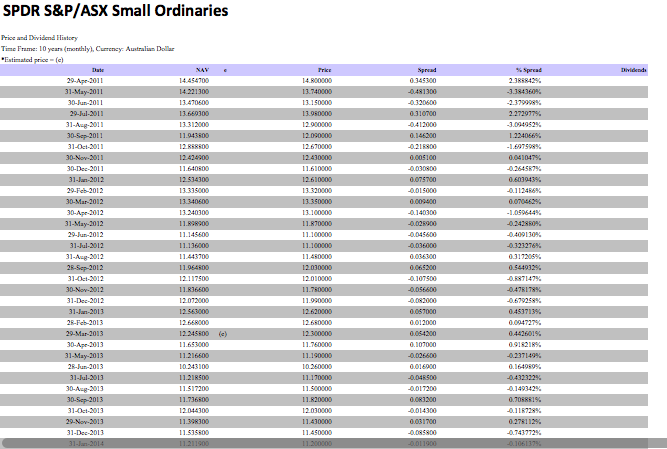

As an analyst working for an asset consulting firm. You have been askeded to create an investment strategy for a new client. The goal for you is to propose a portfolio of funds that would be the best to suit the client's investment objectives and constrains. You have few weeks to do you research and prepare this fund of funds. Your portfolio should contain 4 core funds. You may also include one additional fund with a small weighting based on your client's special investment objectives if needed. You will be provided with the client profile, fund list and benchmark list. You need to choose from the lists. Ultimately, you will present the portfolio to the client and your manager. After your presentation, you will submit your report to the client and submit your underlying work to your manager. For the client, you need to explain the portfolio composition, expected return, the level of risk. You must show and comments on historical performances of your proposed portfolio. Remember to explain why the fund and the portfolio suit your client. For your manager, you must prepare a neat spreadsheet explaining and showing all your calculations and the data and method that you have used to estimate the portfolio risk, performance and its optimisation. You may also provide Exiews workbook if you have used the software for your performance analysis. To help you make an initial selection of your fund please read the articles presented in the reference list below. This is an outline of the essential steps/tasks that you must perform for your project: 1. Download historical monthly data for each available fund in the list at least over seven years. 2. Analyse the profile of your client, including but not limited to his/her investment objective, constraints and potential behavioural biases. 3. Do the primary analysis on each available fund (e.g., style, performance, suitability to your client), add one additional fund if needed. Start to address the reasons why you choose those funds into your basket. 4. Using monthly NAV data to calculate the following statistics for each fund in the list: a. the expected return of each funds over 1 year, 3 years and 5 years (arithmetic and geometric, refer to "Tutorial activity 1 Template" under week 1 activity). b. The volatility (standard deviation in %) of each fund over 1 year, 3 years and 5 years. c. the cross-correlation among funds over 1 year, 3 years and 5 years. d. the composite performance measures and other measures that you believe would be appropriate over 1 year, 3 years and 5 years (e.g., T-ratio, S- ratio, I-ratio, alpha)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started