Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I am doing this accounting problem. It keeps sayiny my andwer is incompete but I don't know what I am missing. I think it

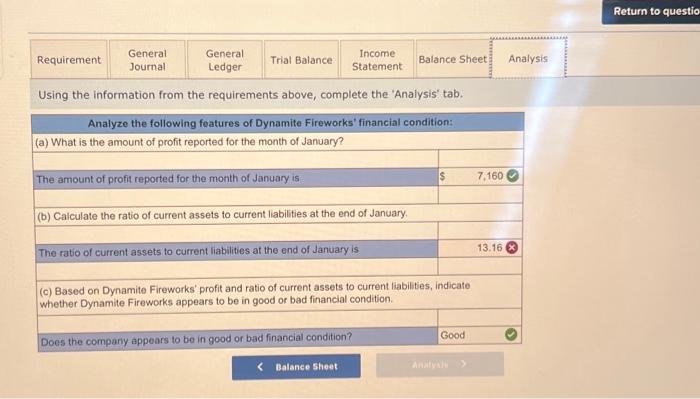

Hello, I am doing this accounting problem. It keeps sayiny my andwer is incompete but I don't know what I am missing. I think it may be the balance sheet. Also on the Anaylsis tab I keep calcluating the ratio wrong?

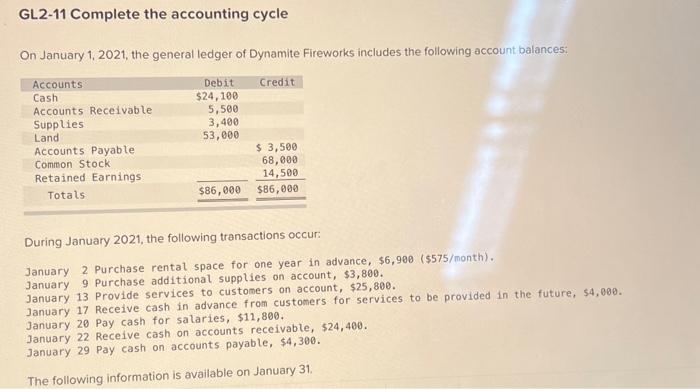

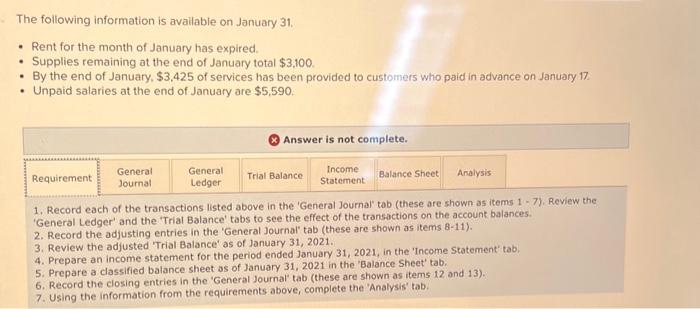

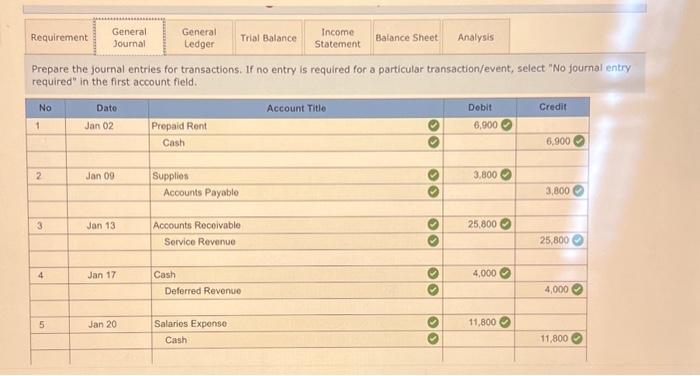

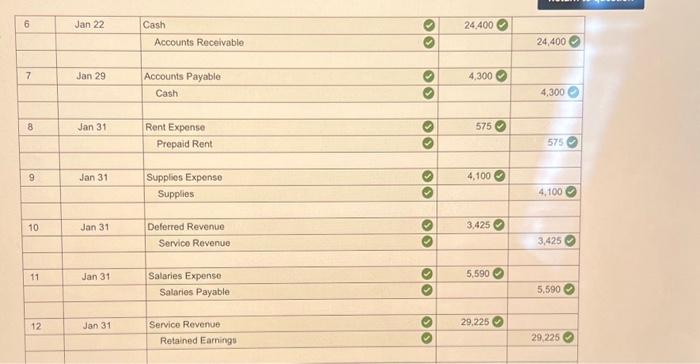

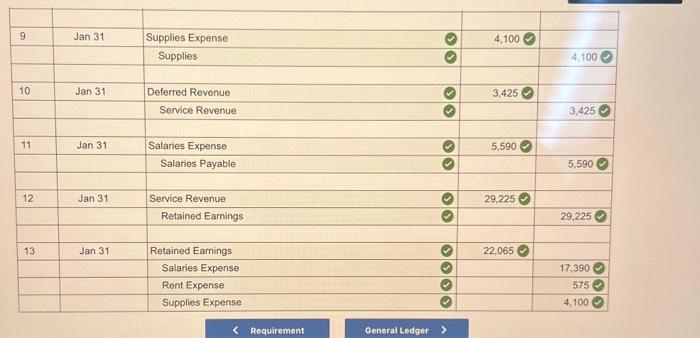

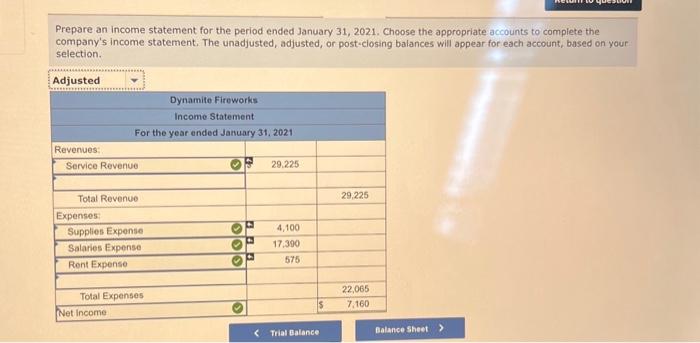

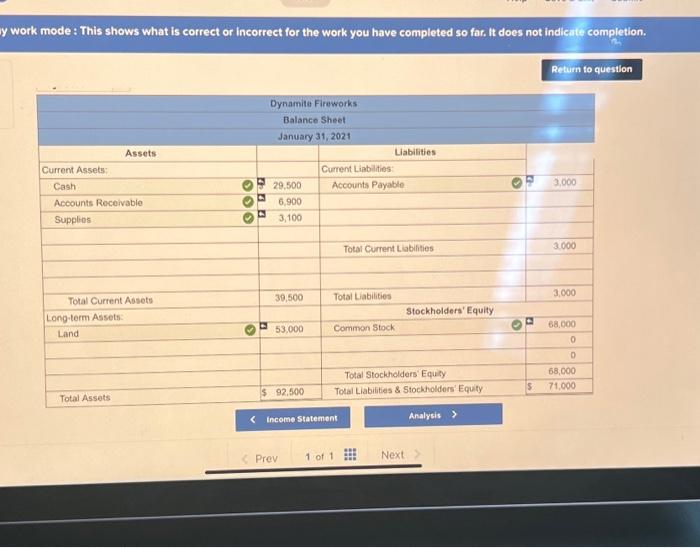

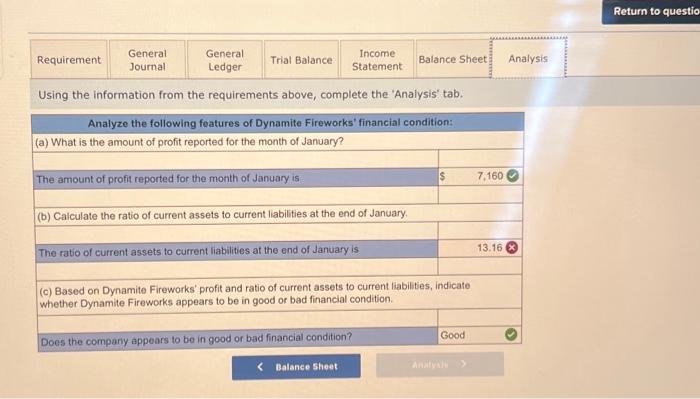

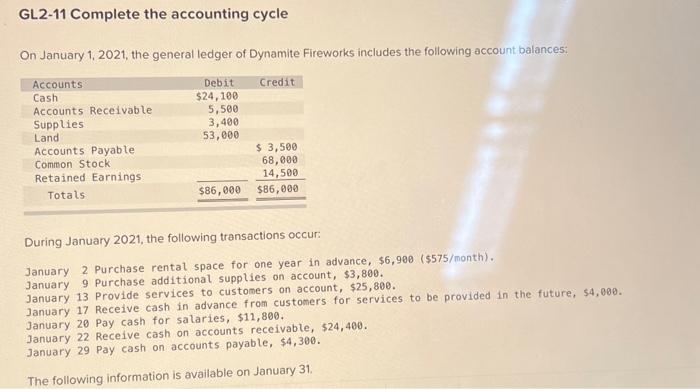

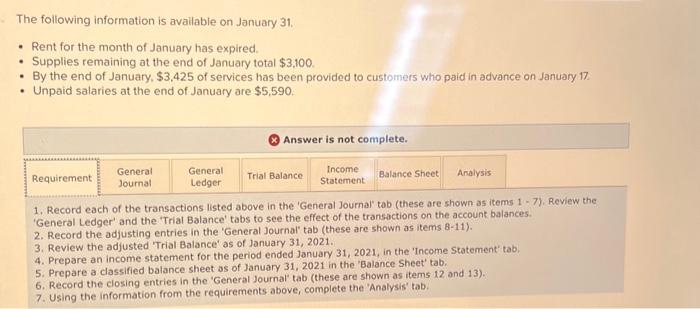

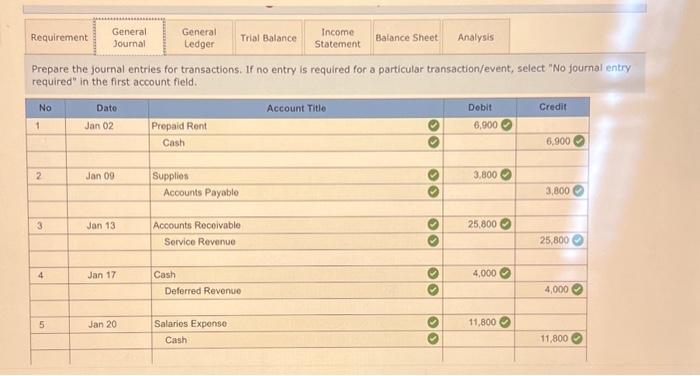

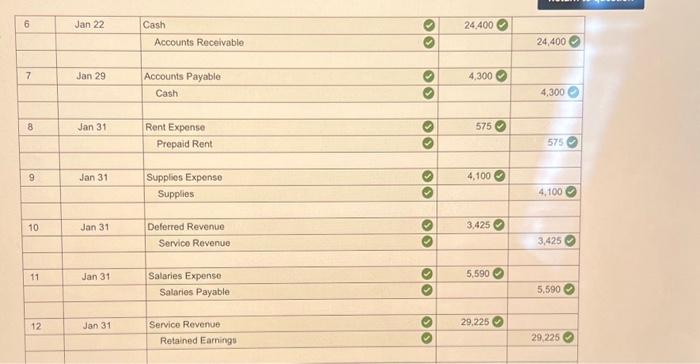

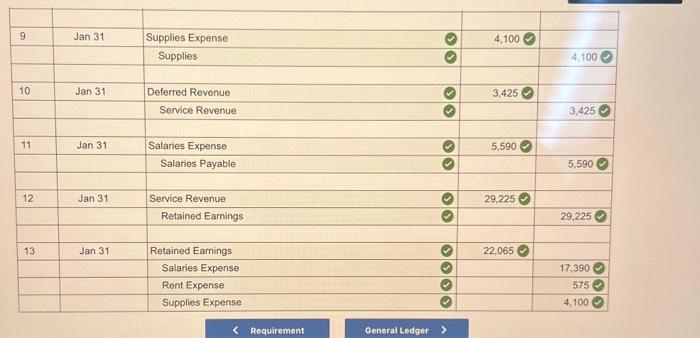

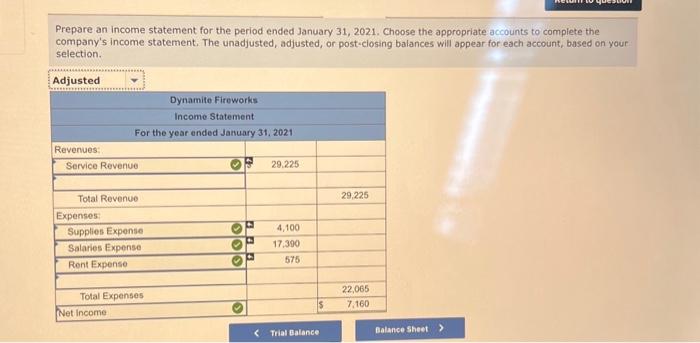

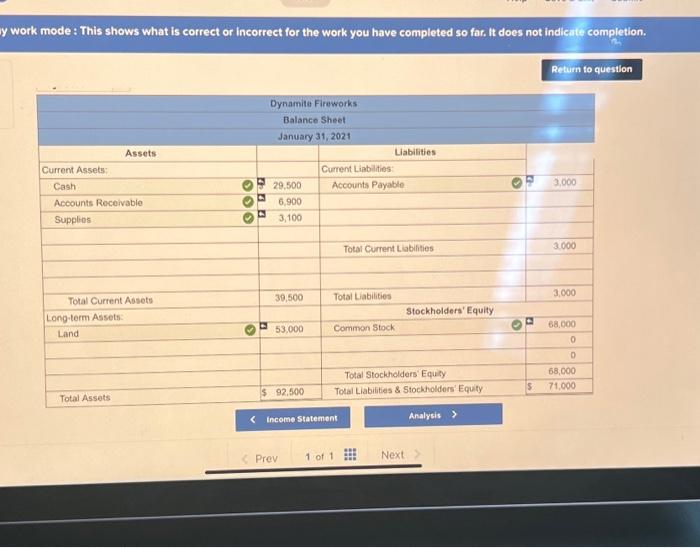

\begin{tabular}{|c|c|c|c|c|c|} \hline \multirow[t]{2}{*}{9} & Jan31 & Supplies Expense & 0 & 4,1000 & \\ \hline & & Supplies & & & 4,1000 \\ \hline \multirow[t]{2}{*}{10} & Jan31 & Deferred Revenue & 0 & 3,425 & \\ \hline & & Service Revenue & 0 & & 3,4250 \\ \hline \multirow[t]{2}{*}{11} & Jan31 & Salaries Expense & 0 & 5,5900 & \\ \hline & & Salaries Payable & & & 5,590 \\ \hline \multirow[t]{2}{*}{12} & Jan31 & Service Revenue & 0 & 29,2250 & \\ \hline & & Retained Earnings & & & 29.225 \\ \hline \multirow[t]{4}{*}{13} & Jan31 & Retained Earnings & & 22,0650 & \\ \hline & & Salaries Expense & & & 17,3900 \\ \hline & & Rent Expense & 2 & & 5750 \\ \hline & & Supplies Expense & & & 4,1000 \\ \hline \end{tabular} The following information is available on January 31. - Rent for the month of January has expired. - Supplies remaining at the end of January total $3,100. - By the end of January, $3,425 of services has been provided to customers who paid in advance on January 17. - Unpaid salaries at the end of January are $5,590. * Answer is not complete. 1. Record each of the transactions listed above in the 'General Joumal' tob (these are shown as items 17 ), Review the 'General Ledger' and the 'Trial Balance' tabs to see the effect of the transactions on the account balances. 2. Record the adjusting entries in the 'General journal' tab (these are shown as items 8-11). 3. Review the adjusted 'Trial Balance' as of January 31,2021. 4. Prepare an income statement for the period ended January 31, 2021, in the 'Income Statement' tab. 5. Prepare a dassified balance sheet os of January 31, 2021 in the 'Balance Sheet' tab. 6. Record the closing entries in the 'General Journal' tab (these are shown as items 12 and 13). 7. Using the information from the requirements above, complete the 'Analysis' tab. Using the information from the requirements above, complete the 'Analysis' tab. Prepare an income statement for the period ended January 31, 2021. Choose the appropriate accounts to complete the company's income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. GL2-11 Complete the accounting cycle On January 1.2021, the general ledger of Dynamite Fireworks includes the following account balances: During January 2021, the following transactions occur: January 2 Purchase rental space for one year in advance, $6,900($575/ month). January 9 Purchase additional supplies on account, $3,800. January 13 Provide services to customers on account, $25,800. January 17 Receive cash in advance from customers for services to be provided in the future, $4,000. January 20 Pay cash for salaries, $11,800. January 22 Receive cash on accounts receivable, $24,400. January 29 pay cash on accounts payable, $4,300. The following information is available on January 31. y work mode : This shows what is correct or incorrect for the work you have completed so far, It does not indlente completion. Return to question \begin{tabular}{|c|c|c|c|c|c|} \hline \multicolumn{6}{|c|}{ Dynamite Fireworks } \\ \hline \multicolumn{6}{|c|}{ Balance Sheet } \\ \hline \multicolumn{6}{|c|}{ January 31,2021} \\ \hline Assets & & & Liabilities & & \\ \hline Current Assets: & & & Current Liabilities: & & \\ \hline Cash & 09 & 29,500 & Accounts Payable & 8% & 3,000 \\ \hline Accounts Receivable & 2 & 6,900 & & & \\ \hline \multirow[t]{2}{*}{ Supplios } & 0D & 3,100 & & & \\ \hline & & & Total Current Labifities & & 3.000 \\ \hline & & & & & \\ \hline Total Current Assets & & 39,500 & Total Liabilities & & 3,000 \\ \hline Long-term Assets: & & & Stockholders' Equity & & \\ \hline \multirow[t]{4}{*}{ Land } & 02 & 53.000 & Common Stock & q & 68.000 \\ \hline & & & & & 0 \\ \hline & & & & & 0 \\ \hline & & & Total Stockholders' Equily & & 68,000 \\ \hline Total Assets & 5 & 92.500 & Total Liabilities \& Stockholdors' Equity & s. & 71,000 \\ \hline \end{tabular} repare the journal entries for transactions. If no entry is required for a particular transaction/event, select "No journal equired" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started