Hello - I am looking for help with the answer indicated as wrong above. I have tried this calculation in many different ways and also got help from a Chegg resource but have not been able to figure the correct answer. Please let me know if anyone can assist. Thank you!

Hello - I am looking for help with the answer indicated as wrong above. I have tried this calculation in many different ways and also got help from a Chegg resource but have not been able to figure the correct answer. Please let me know if anyone can assist. Thank you!

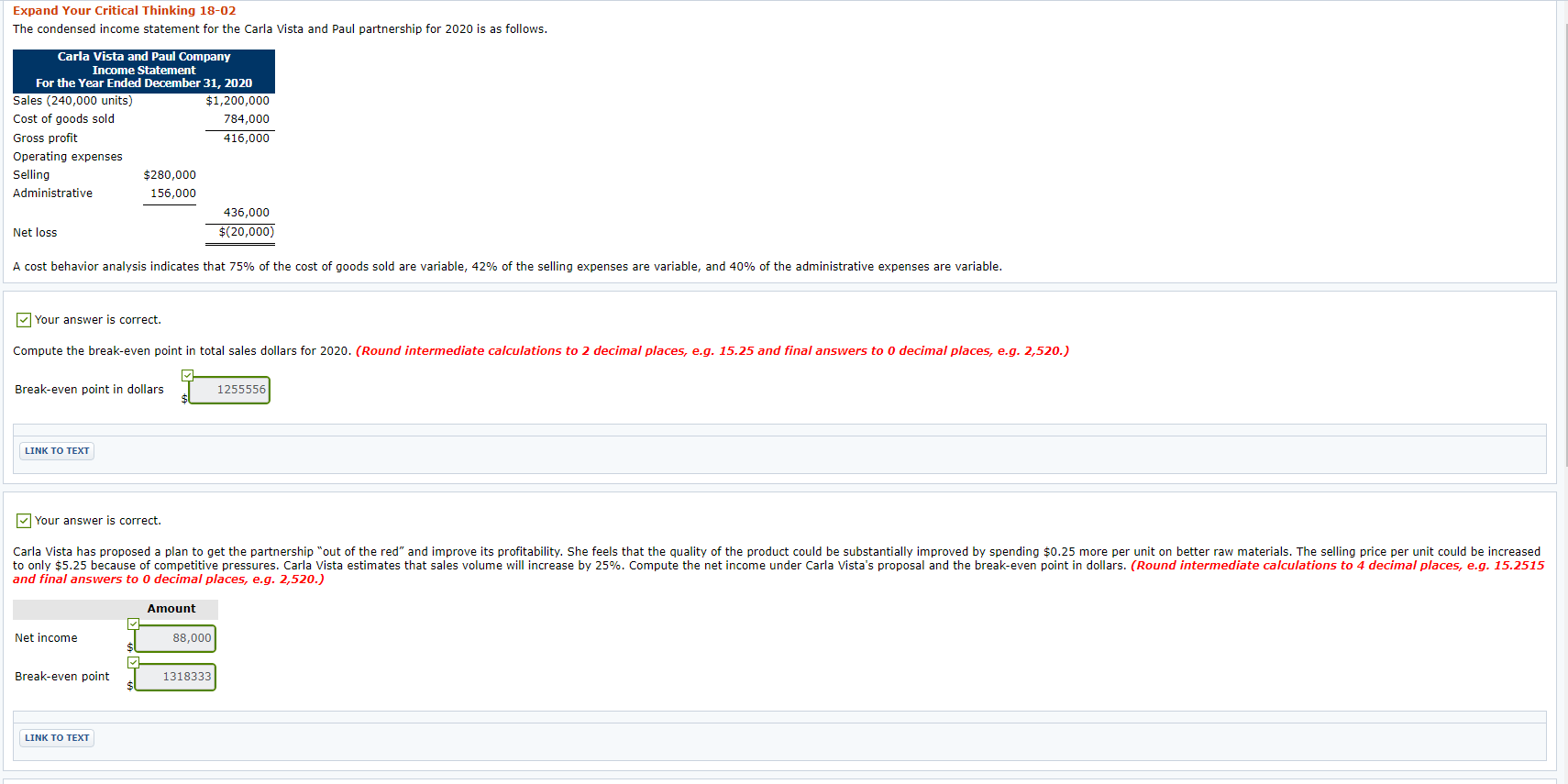

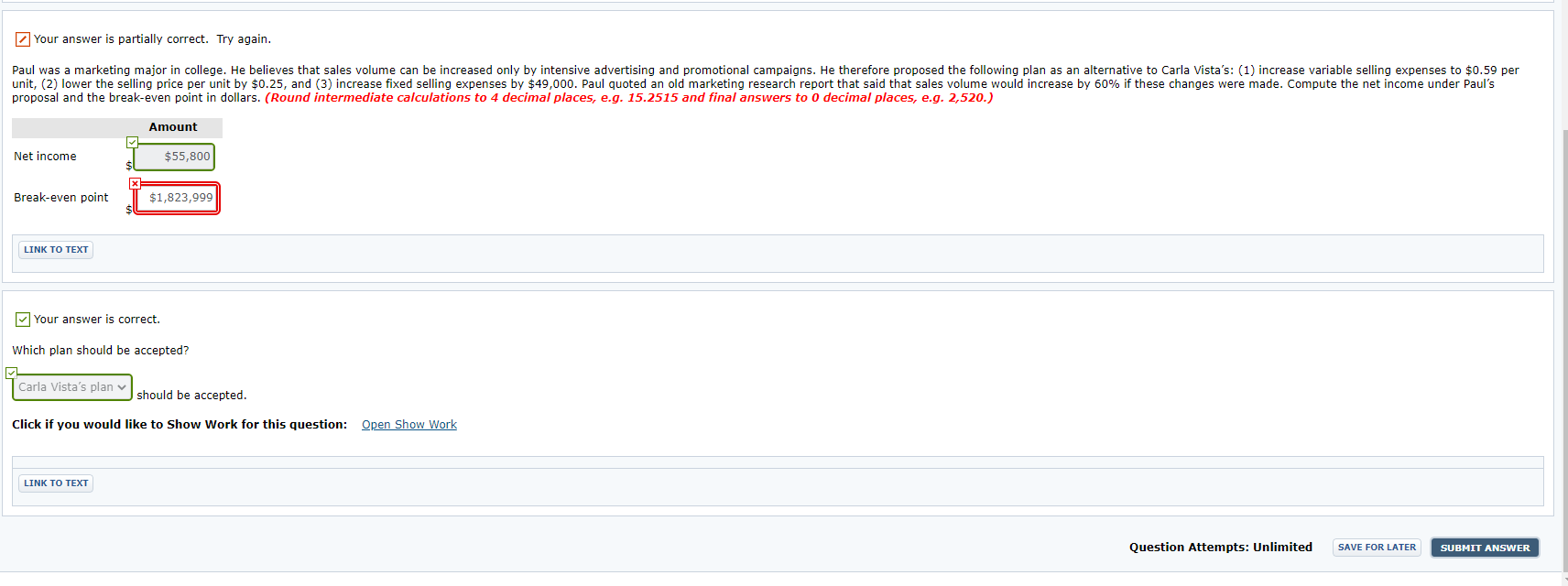

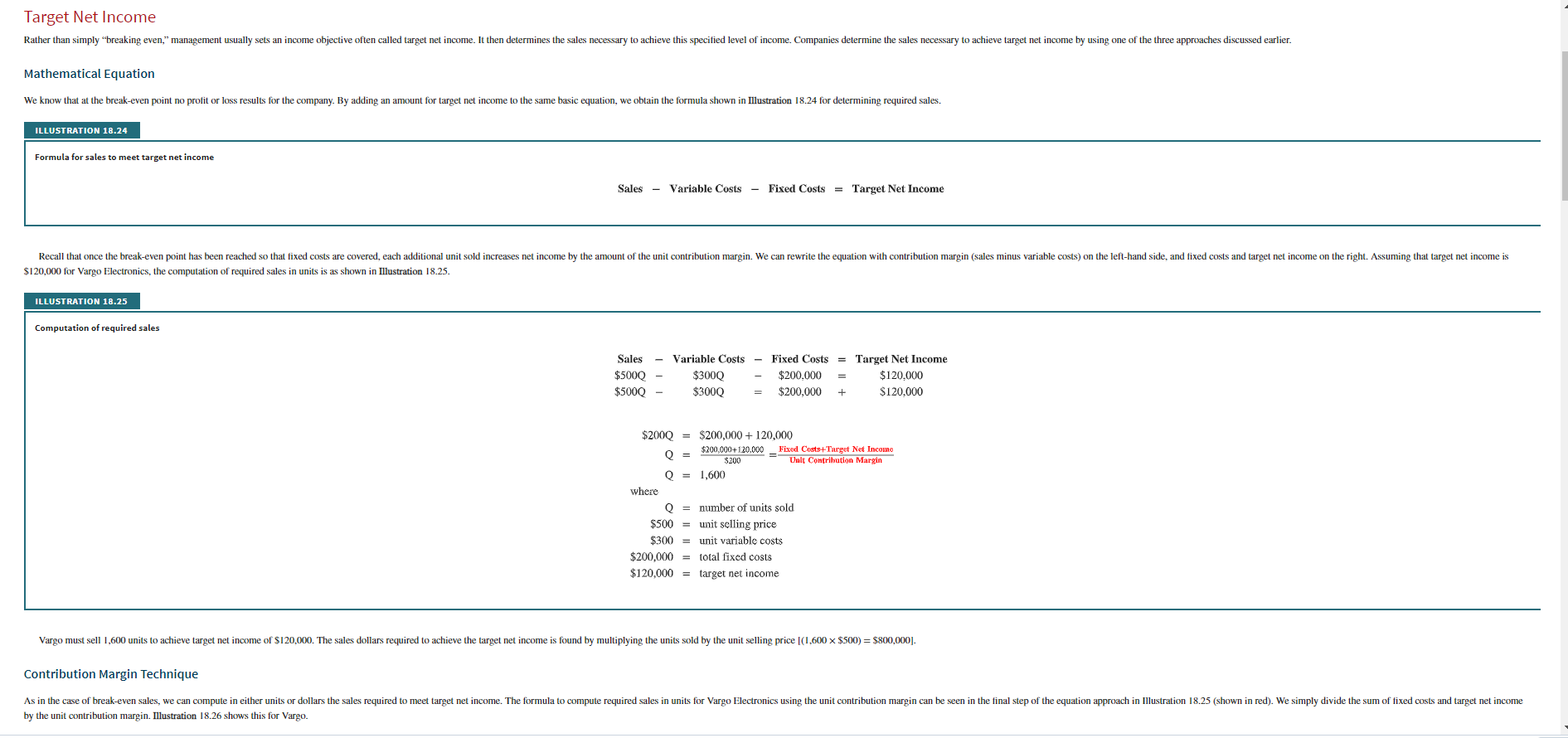

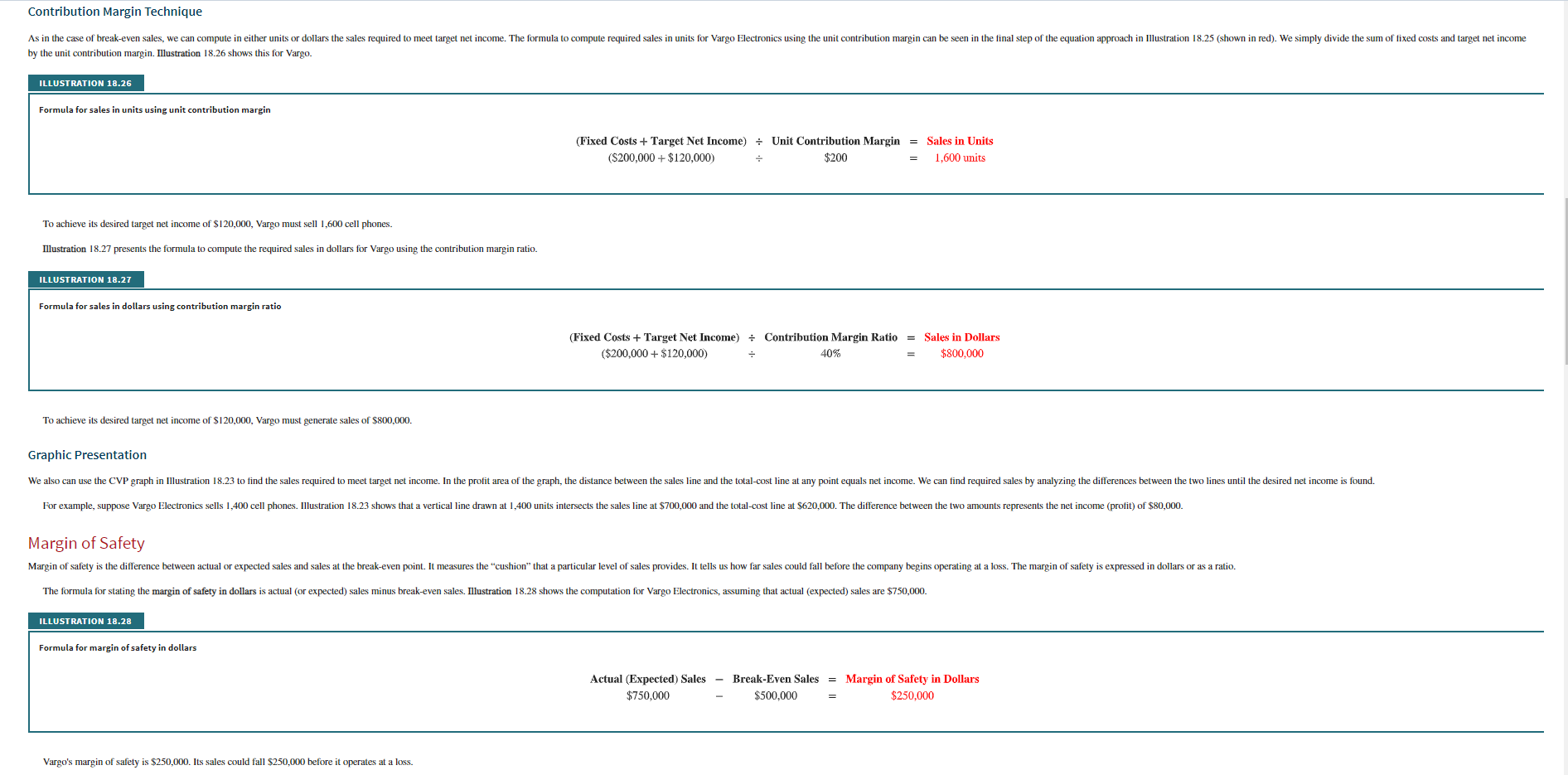

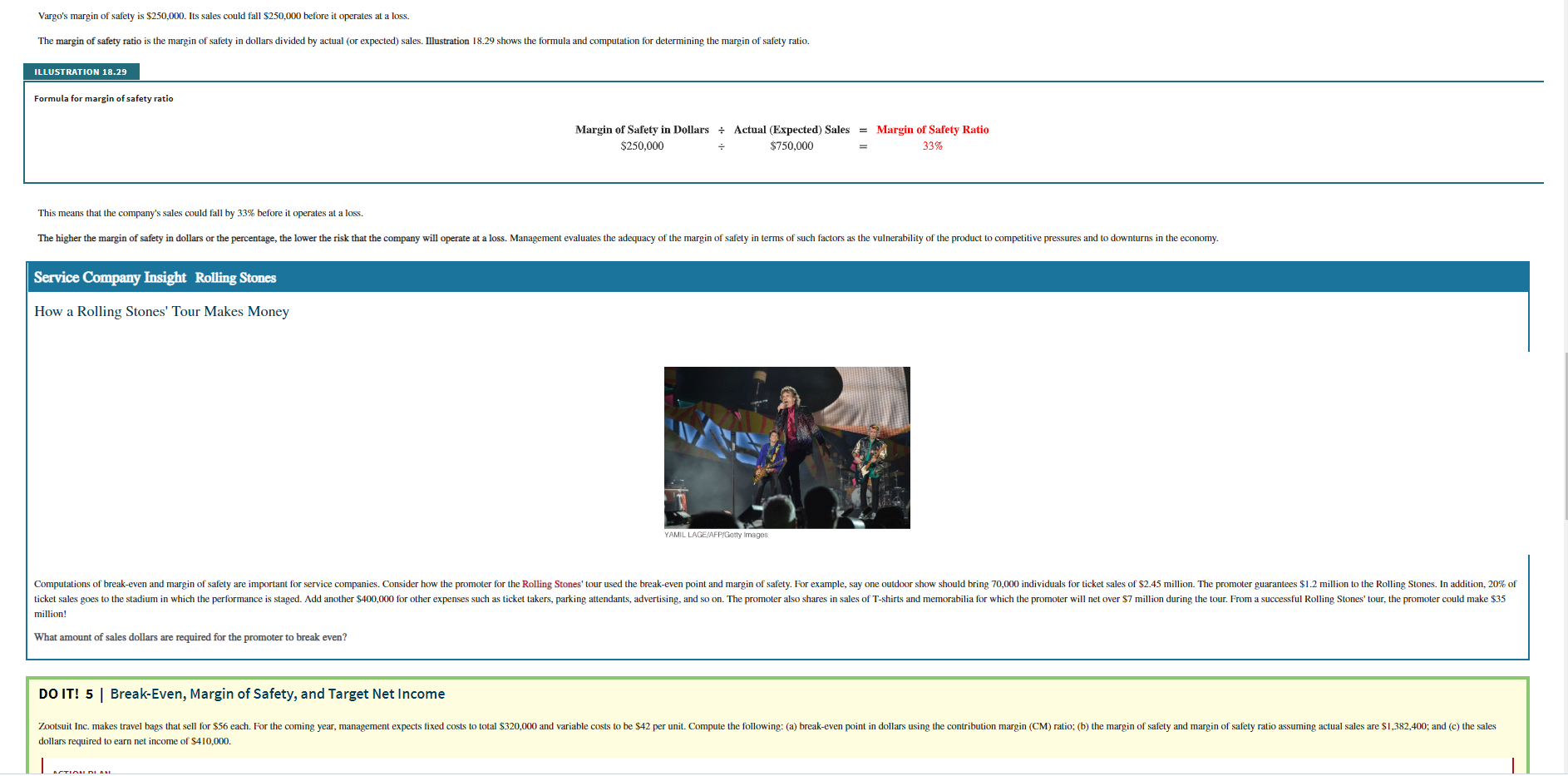

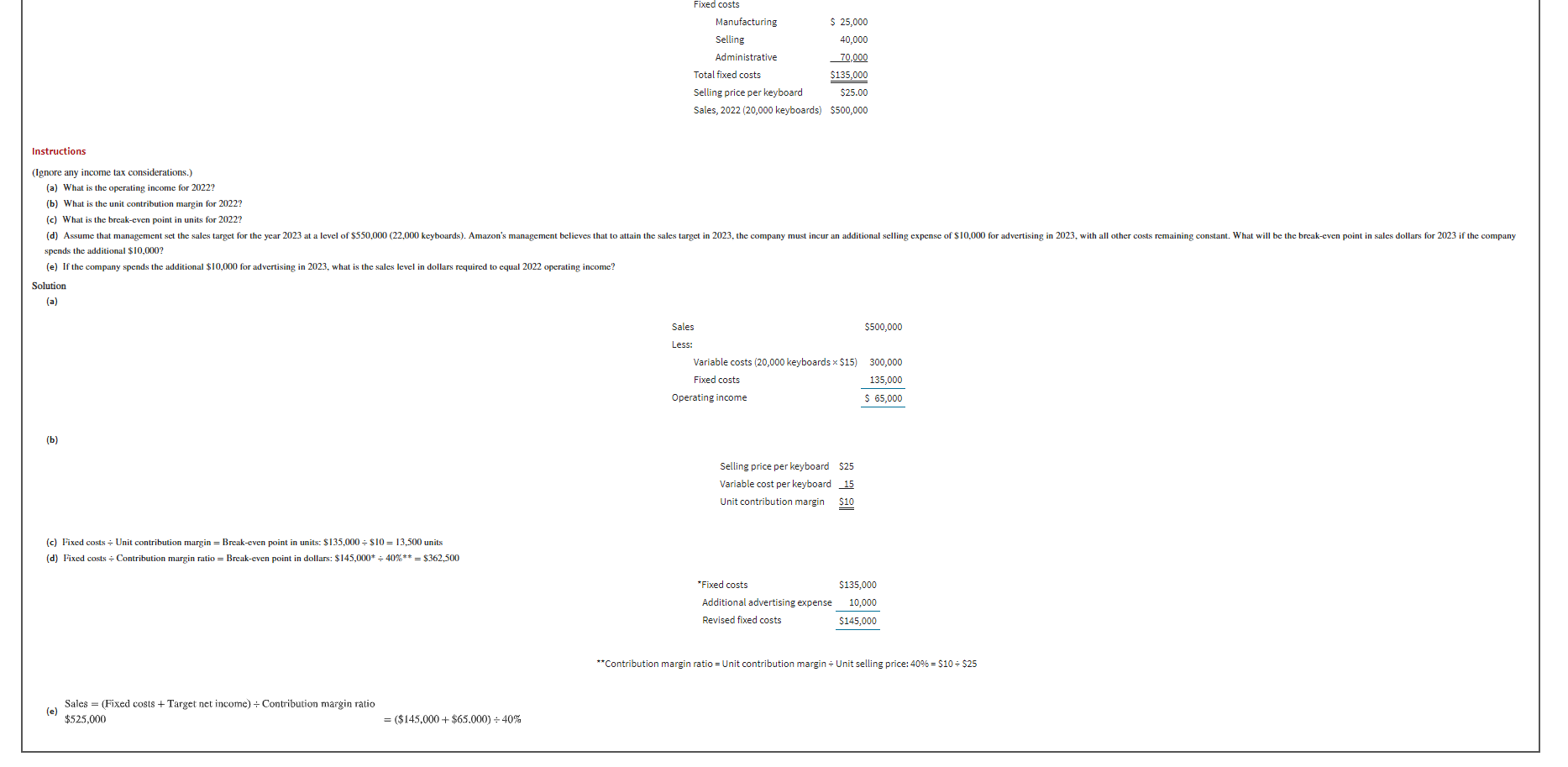

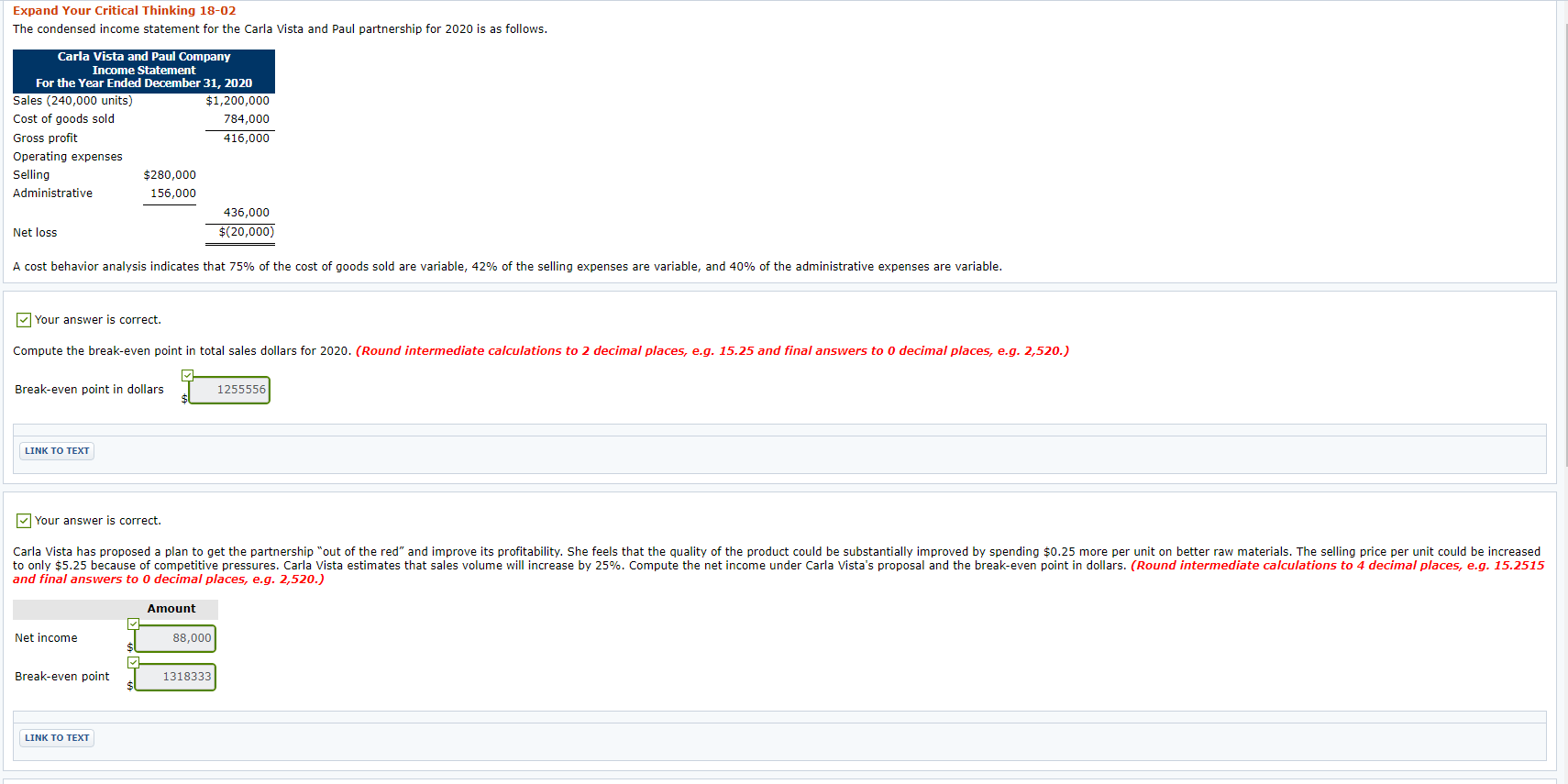

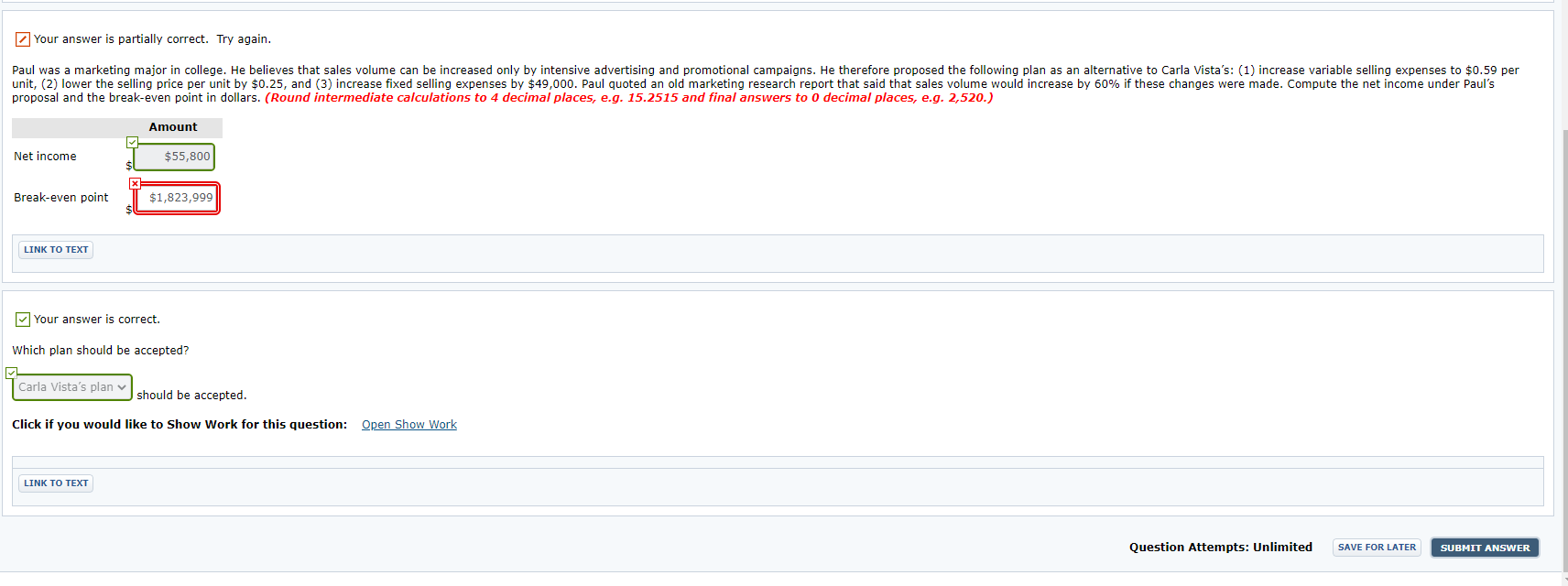

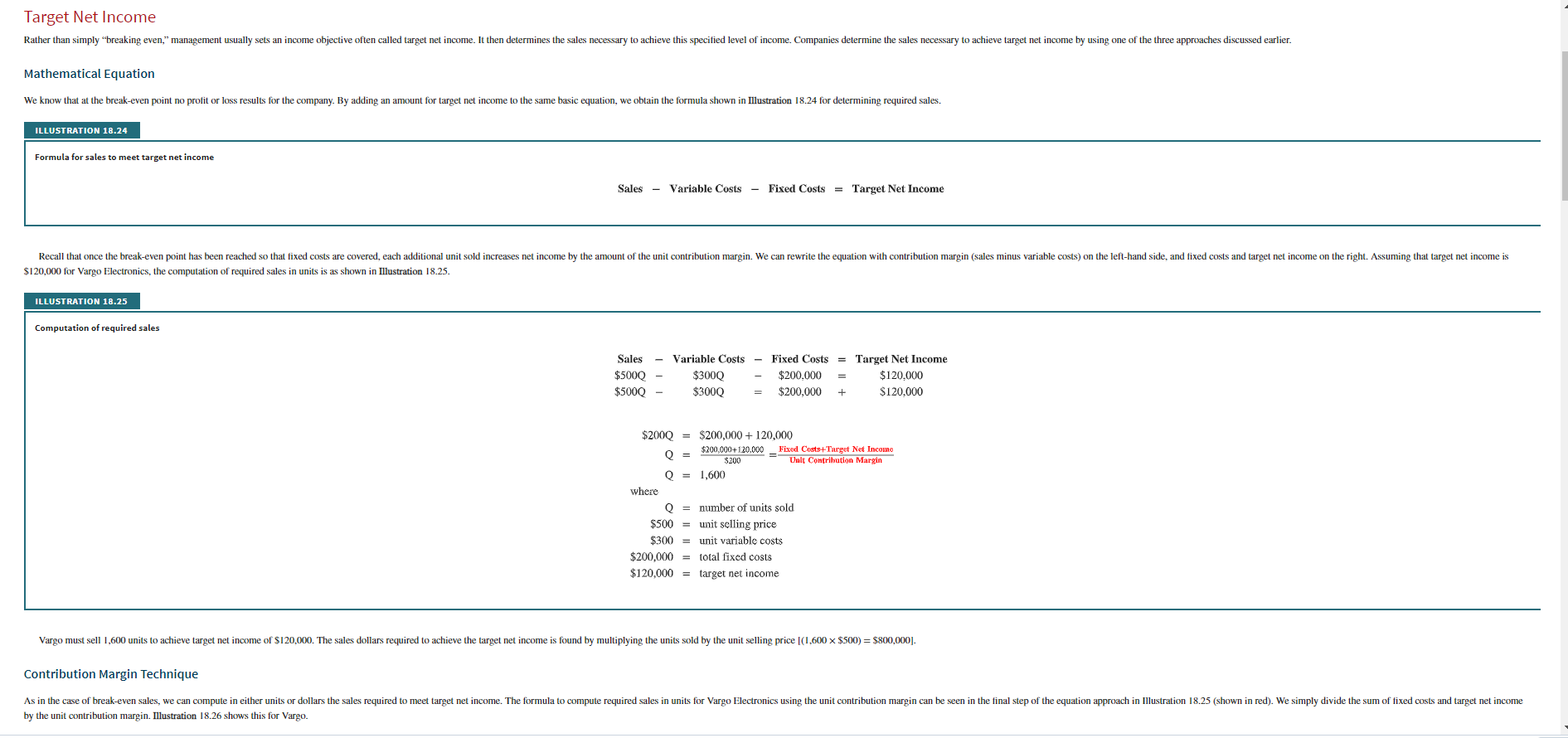

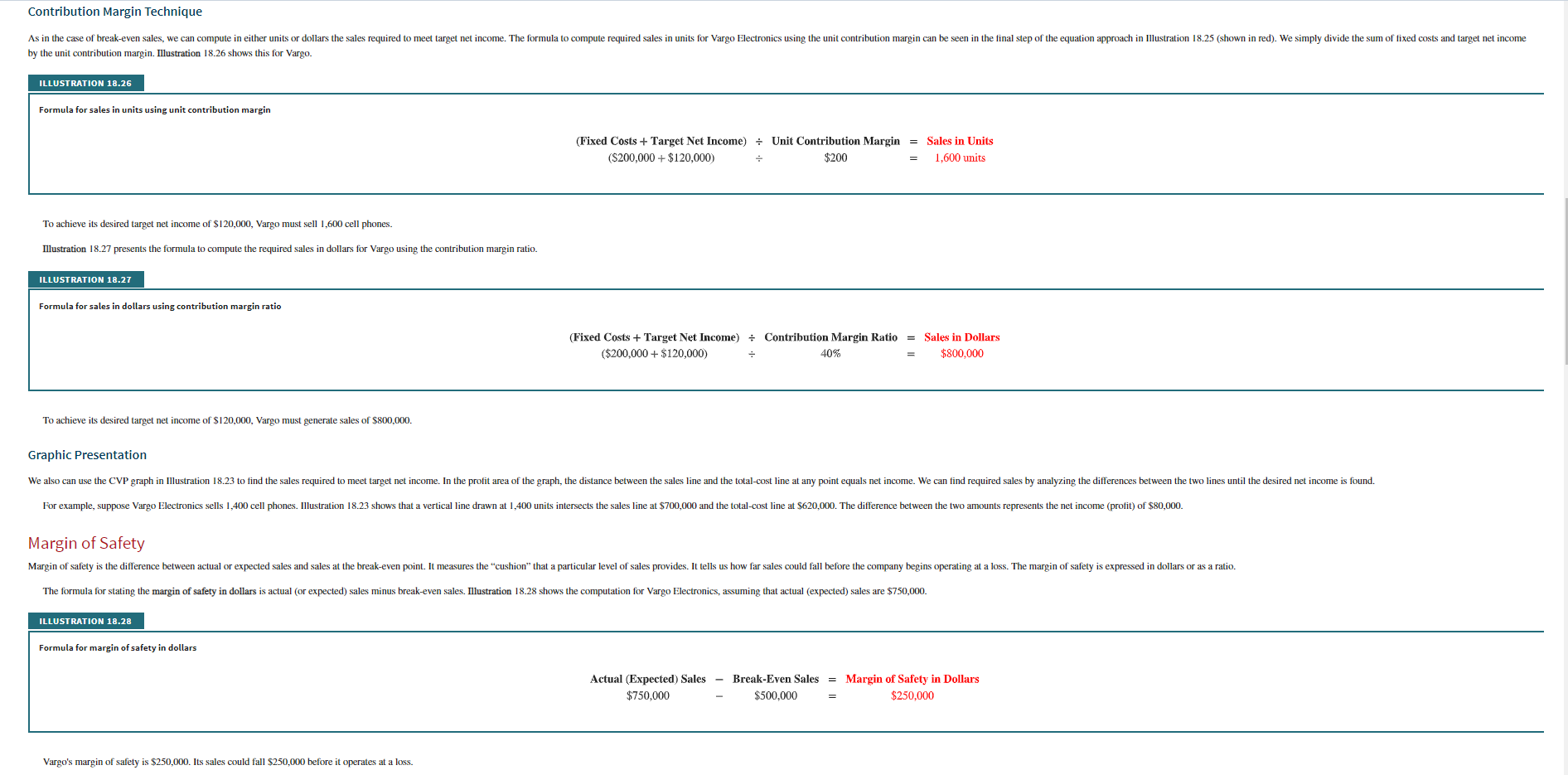

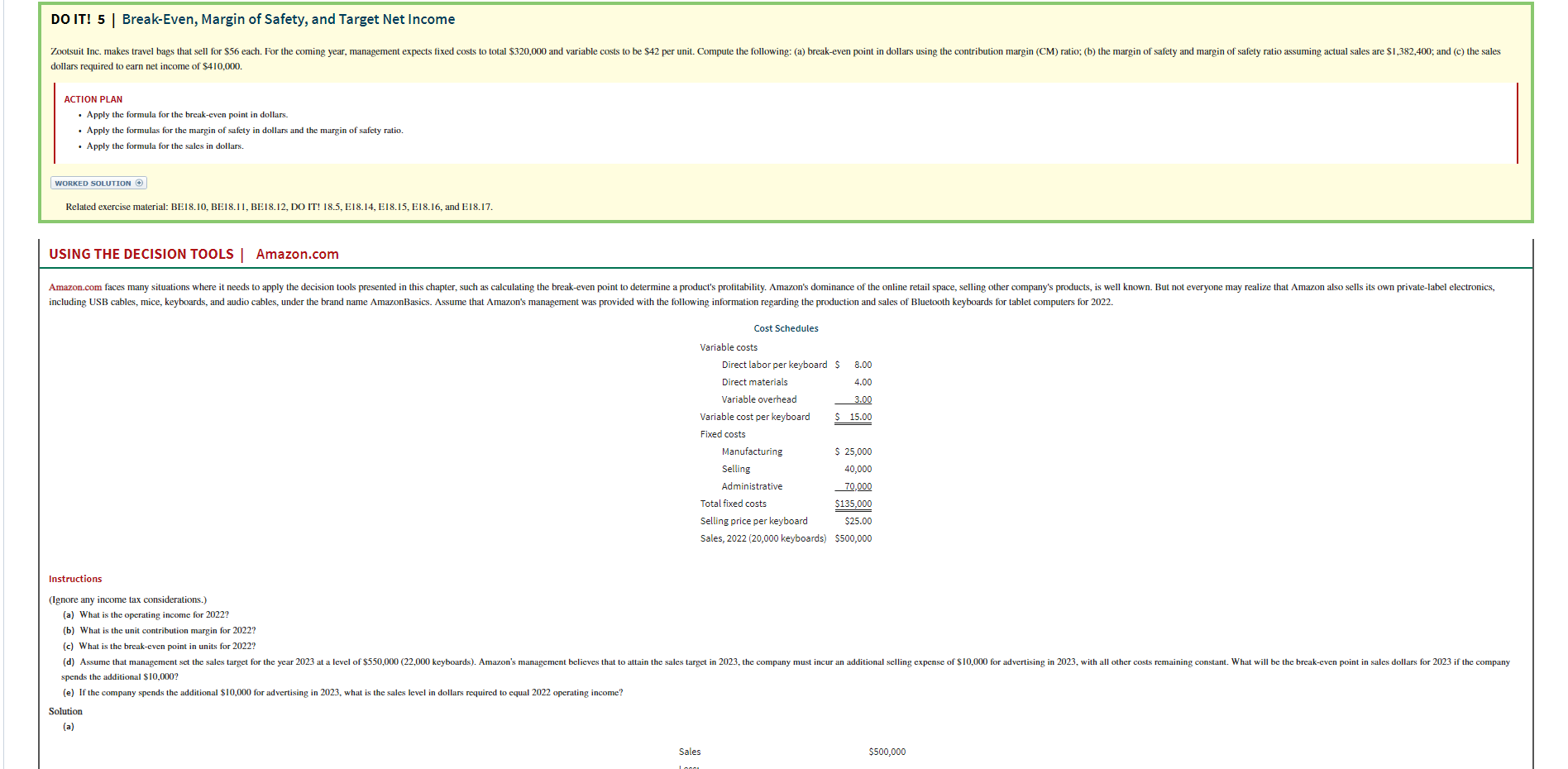

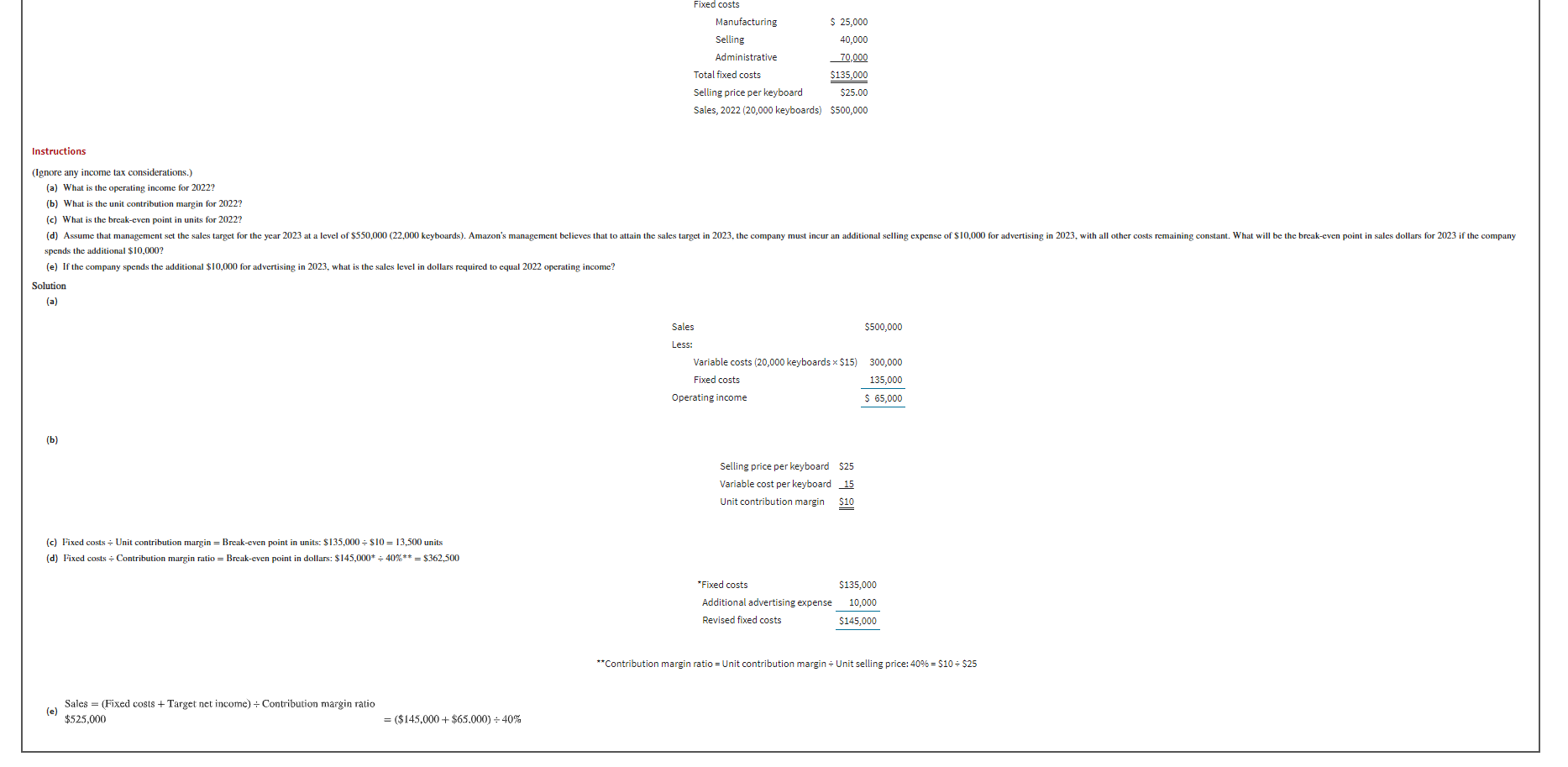

Expand Your Critical Thinking 18-02 The condensed income statement for the Carla Vista and Paul partnership for 2020 is as follows. Carla Vista and Paul Company Income Statement For the Year Ended December 31, 2020 Sales (240,000 units) $1,200,000 Cost of goods sold 784,000 Gross profit 416,000 Operating expenses Selling $280,000 Administrative 156,000 436,000 Net loss $(20,000) A cost behavior analysis indicates that 75% of the cost of goods sold are variable, 42% of the selling expenses are variable, and 40% of the administrative expenses are variable. Your answer is correct. Compute the break-even point in total sales dollars for 2020. (Round intermediate calculations to 2 decimal places, e.g. 15.25 and final answers to o decimal places, e.g. 2,520.) Break-even point in dollars 1255556 LINK TO TEXT Your answer is correct. Carla Vista has proposed a plan to get the partnership "out of the red" and improve its profitability. She feels that the quality of the product could be substantially improved by spending $0.25 more per unit on better raw materials. The selling price per unit could be increased to only $5.25 because of competitive pressures. Carla Vista estimates that sales volume will increase by 25%. Compute the net income under Carla Vista's proposal and the break-even point in dollars. (Round intermediate calculations to 4 decimal places, e.g. 15.2515 and final answers to 0 decimal places, e.g. 2,520.) Amount Net income 88,000 Break-even point 1318333 LINK TO TEXT Your answer is partially correct. Try again. Paul was a marketing major in college. He believes that sales volume can be increased only by intensive advertising and promotional campaigns. He therefore proposed the following plan as an alternative to Carla Vista's: (1) increase variable selling expenses to $0.59 per unit, (2) lower the selling price per unit by $0.25, and (3) increase fixed selling expenses by $49,000. Paul quoted an old marketing research report that said that sales volume would increase by 60% if these changes were made. Compute the net income under Paul's proposal and the break-even point in dollars. (Round intermediate calculations to 4 decimal places, e.g. 15.2515 and final answers to o decimal places, e.g. 2,520.) Amount Net income $55,800 Break-even point $1,823,999 LINK TO TEXT Your answer is correct. Which plan should be accepted? Carla Vista's plan v should be accepted. Click if you would like Show Work for this question: Open Show Work LINK TO TEXT Question Attempts: Unlimited SAVE FOR LATER SUBMIT ANSWER Target Net Income Rather than simply breaking even," management usually sets an income objective often called target net income. It then determines the sales necessary to achieve this specified level of income. Companies determine the sales necessary to achieve target net income by using one of the three approaches discussed earlier. Mathematical Equation We know that at the break-even point no profit or loss results for the company. By adding an amount for target net income to the same basic equation, we obtain the formula shown in Illustration 18.24 for determining required sales. ILLUSTRATION 18.24 Formula for sales to meet target net income Sales - Variable Costs - Fixed Costs = Target Net Income Recall that once the break-even point has been reached so that fixed costs are covered, each additional unit sold increases net income by the amount of the unit contribution margin. We can rewrite the equation with contribution margin (sales minus variable costs) on the left-hand side, and fixed costs and target net income on the right. Assuming that target net income is $120,000 for Vargo Electronics, the computation of required sales units is as shown in Illustration 18.25 ILLUSTRATION 18.25 Computation of required sales Sales $5000 $5000 - Variable Costs - Fixed Costs = Target Net Income $3000 $200.000 $120.000 $3000 $200,000 $120.000 + $2000 = $200,000 + 120,000 $200,000+120.000 Fixed Costs +Target Net Income Q = $200 Unit Contribution Margin Q = 1,600 where Q = number of units sold $500 = unit selling price $300 = unit variable costs $200,000 = total fixed costs $120,000 = target net income Vargo must sell 1,600 units to achieve target net income of $120,000. The sales dollars required to achieve the target net income is found by multiplying the units sold by the unit selling price [(1,600 x $500) = $800,000). Contribution Margin Technique compute required sales in units for Vargo Electronics using the unit contribution margin can be seen in the final step of the equation approach in Illustration 18.25 (shown in red). We simply divide the sum of fixed costs and target net income As in the case of break-even sales, we can compute in either units or dollars the sales required to meet target net income. The formula by the unit contribution margin. Illustration 18.26 shows this for Vargo. Contribution Margin Technique the final step of the equation approach in Illustration 18.25 (shown in red). We simply divide the sum of fixed costs and target net income As in the case of break-even sales, we can compute in either units or dollars the sales required to meet target net income. The formula to compute required sales in units for Vargo Electronics using the unit contribution margin can be seen by the unit contribution margin. Illustration 18.26 shows this for Vargo. ILLUSTRATION 18.26 Formula for sales in units using unit contribution margin (Fixed Costs + Target Net Income) Unit Contribution Margin = Sales in Units ($200,000+ $120,000) $200 1.600 units = To achieve its desired target net income of $120,000, Vargo must sell 1,600 cell phones. Illustration 18.27 presents the formula to compute the required sales in dollars for Vargo using the contribution margin ratio. ILLUSTRATION 18.27 Formula for sales in dollars using contribution margin ratio (Fixed Costs + Target Net Income) Contribution Margin Ratio = Sales in Dollars ($200,000+ $120,000) 40% $800,000 . To achieve its desired target net income of $120,000, Vargo must generate sales of $800,000. Graphic Presentation We also can use the CVP graph in Illustration 18.23 to find the sales required to meet target net income. In the profit area of the graph, the distance between the sales line and the total cost line at any point equals net income. We can find required sales by analyzing the differences between the two lines until the desired net income is found. For example, suppose Vargo Electronics sells 1,400 cell phones. Illustration 18.23 shows that a vertical line drawn at 1,400 units intersects the sales line at $700,000 and the total cost line at $620,000. The difference between the two amounts represents the net income (profit) of $80,000. Margin of Safety Margin of safety is the difference between actual or expected sales and sales at the break-even point. It measures the "cushion" that a particular level of sales provides. It tells us how far sales could fall before the company begins operating at a loss. The margin of safety is expressed in dollars or as a ratio. The formula for stating the margin of safety in dollars is actual (or expected) sales minus break-even sales. Illustration 18.28 shows the computation for Vargo Electronics, assuming that actual (expected) sales are $750,000. ILLUSTRATION 18.28 Formula for margin of safety in dollars Actual (Expected) Sales $750,000 Break-Even Sales = Margin of Safety in Dollars $500,000 $250,000 = Vargo's margin of safety is $250,000. Its sales could fall $250,000 before it operates at a loss. Vargo's margin of safety is $250,000. Its sales could fall $250,000 before it operates at a loss. The margin of safety ratio is the margin of safety in dollars divided by actual (or expected) sales. Illustration 18.29 shows the formula and computation for determining the margin of safety ratio. ILLUSTRATION 18.29 Formula for margin of safety ratio Margin of Safety in Dollars Actual (Expected) Sales = Margin of Safety Ratio $250,000 $750,000 33% This means that the company's sales could fall by 33% before it operates at a loss. The higher the margin of safety in dollars or the percentage, the lower the risk that the company will operate at a loss. Management evaluates the adequacy of the margin of safety in terms of such factors as the vulnerability of the product to competitive pressures and to downturns in the economy. Service Company Insight Rolling Stones How a Rolling Stones' Tour Makes Money YAMIL LAGE/AFP/Getty Images Computations of break-even and margin of safety are important for service companies. Consider how the promoter for the Rolling Stones' tour used the break-even point and margin of safety. For example, say one outdoor show should bring 70,000 individuals for ticket sales of $2.45 million. The promoter guarantees $1.2 million to the Rolling Stones. In addition, 20% of ticket sales goes to the stadium in which the performance is staged. Add another $400,000 for other expenses such as ticket takers, parking attendants, advertising, and so on. The promoter also shares in sales of T-shirts and memorabilia for which the promoter will net over $7 million during the tour. From a successful Rolling Stones' tour, the promoter could make $35 million! What amount of sales dollars are required for the promoter to break even? DO IT! 5 | Break-Even, Margin of Safety, and Target Net Income Zootsuit Inc. makes travel bags that sell for $56 each. For the coming year, management expects fixed costs to total $320,000 and variable costs to be $42 per unit. Compute the following: (a) break-even point in dollars using the contribution dollars required to earn net income of $410,000. (CM) ratio; (b) the margin of safety and argin of safety ratio suming actual sales are $1,382,400; and (c) the sales DO IT! 5 | Break-Even, Margin of Safety, and Target Net Income Zootsuit Inc. makes travel bags that sell for $56 each. For the coming year, management expects fixed costs to total $320,000 and variable costs to be $42 per unit. Compute the following: (a) break-even point in dollars using the contribution margin (CM) ratio; (b) the margin of safety and margin of safety ratio assuming actual sales are $1,382,400; and (c) the sales dollars required to earn net income of $410,000. ACTION PLAN Apply the formula for the break-even point in dollars. Apply the formulas for the margin of safety in dollars and the margin of safety ratio. Apply the formula for the sales in dollars. WORKED SOLUTION Related exercise material: BE18.10, BE18.11, BE18.12, DO IT! 18.5, E18.14, E18.15, E18.16, and E18.17. USING THE DECISION TOOLS Amazon.com Amazon.com faces many situations where it needs to apply the decision tools presented in this chapter, such as calculating the break-even point to determine a product's profitability. Amazon's dominance of the online retail space, selling other company's products, is well known. But not everyone may realize that Amazon also sells its own private-label electronics, including USB cables, mice, keyboards, and audio cables, under the brand name AmazonBasics. Assume that Amazon's management was provided with the following information regarding the production and sales of Bluetooth keyboards for tablet computers for 2022. Cost Schedules Variable costs Direct labor per keyboard $ 8.00 Direct 4.00 Variable overhead 3.00 Variable cost per keyboard $ 15.00 Fixed costs Manufacturing $ 25,000 Selling 40,000 Administrative 70,000 Total fixed costs $135,000 Selling price per keyboard $25.00 Sales, 2022 (20,000 keyboards) $500,000 Instructions (Ignore any income tax considerations.) (a) What is the operating income for 2022? (b) What is the unit contribution margin for 2022? (c) What is the break-even point units for 20222 (d) Assume that management set the sales target for the year 2023 at a level of $550,000 (22,000 keyboards). Amazon's management believes that to attain the sales target in 2023, the company must incur an additional selling expense of $10,000 for advertising in 2023, with all other costs remaining constant. What will be the break-even point in sales dollars for 2023 if the company spends the additional $10,000? (e) If the company spends the additional $10,000 for advertising in 2023, what is the sales level in dollars required to equal 2022 operating income? Solution (a) Sales $500,000 Fixed costs Manufacturing $ 25,000 Selling 40,000 Administrative 70,000 Total fixed costs $135,000 Selling price per keyboard $25.00 Sales, 2022 (20,000 keyboards) $500,000 Instructions (Ignore any income tax considerations.) (a) What is the operating income for 2022? (b) What is the unit contribution margin for 2022? (c) What is the break-even point in units for 2022? (d) Assume that management set the sales target for the year 2023 at a level of $550,000 (22,000 keyboards). Amazon's management believes that to attain the sales target in 2023, the company must incur an additional selling expense of $10,000 for advertising in 2023, with all other costs remaining constant. What will be the break-even point in sales dollars for 2023 if the company spends the additional $10,000? (e) If the company spends the additional $10,000 for advertising in 2023, what is the sales level in dollars required to cqual 2022 operating income? Solution (a) Sales $500,000 Less: Variable costs (20,000 keyboards x $15) 300,000 Fixed costs 135,000 Operating income $ 65,000 (b) Selling price per keyboard $25 Variable cost per keyboard 15 Unit contribution margin $10 (c) Fixed costs - Unit contribution margin = Break-even point in units: $135,000 = $10=13,500 units (d) Fixed costs - Contribution margin ratio = Break-even point in dollars: $145,000+ - 40%** = $362,500 *Fixed costs $135,000 10.000 Additional advertising expense Revised fixed costs $145,000 **Contribution margin ratio = Unit contribution margin = Unit selling price: 40% = $10 = $25 (e) Sales = (Fixed costs + Target net income) - Contribution margin ratio $525,000 = ($145,000+ $65.000) -40%

Hello - I am looking for help with the answer indicated as wrong above. I have tried this calculation in many different ways and also got help from a Chegg resource but have not been able to figure the correct answer. Please let me know if anyone can assist. Thank you!

Hello - I am looking for help with the answer indicated as wrong above. I have tried this calculation in many different ways and also got help from a Chegg resource but have not been able to figure the correct answer. Please let me know if anyone can assist. Thank you!