Question

Hello, I am needing some help with this assignment I've posted it before a couple of times but whoever has tried to help me has

Hello, I am needing some help with this assignment I've posted it before a couple of times but whoever has tried to help me has given me the wrong answers and the math doesn't add up or make sense. If I could receive some actually assistance that would be great as I am very frustrated with this assignment.

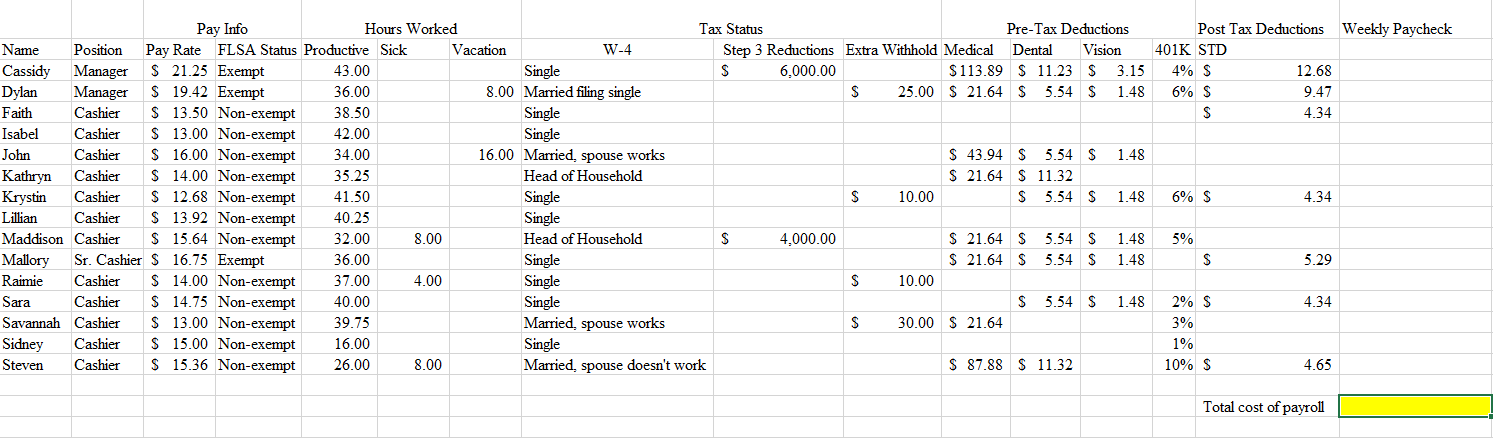

Using the attached information file, Calculate (1) the weekly paycheck for each staff person and (2) total cost of payroll for the organization for the week.

Information you will need:

Hourly rate of pay

Pay status (exempt or non-exempt)

Productive and non-productive hours worked

State of Missouri and federal income tax rates based on filing status.

Social Security tax (employer and employee)

Medicare tax (employer and employee)

Pre- and post- tax insurance deductions

W-4 withholding details (e.g., single, head of household, etc)

W-4 holding reductions/increases

401(k) matching max of 3% (half of employee contribution to 6%)

Employer contribution of $80.77 per week to medical insurance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started