Answered step by step

Verified Expert Solution

Question

1 Approved Answer

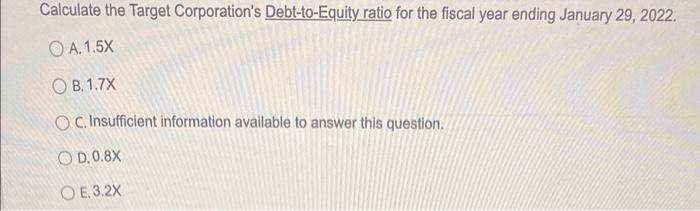

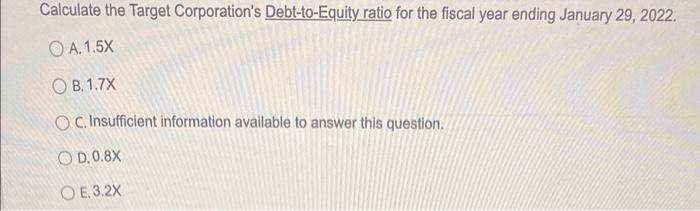

hello, I am stuck on this problem. i got 1.7X and it is wrong. Consolidated Statements of Financial Position Consolidated Statements of Cash Flows (millions)

hello, I am stuck on this problem. i got 1.7X and it is wrong.

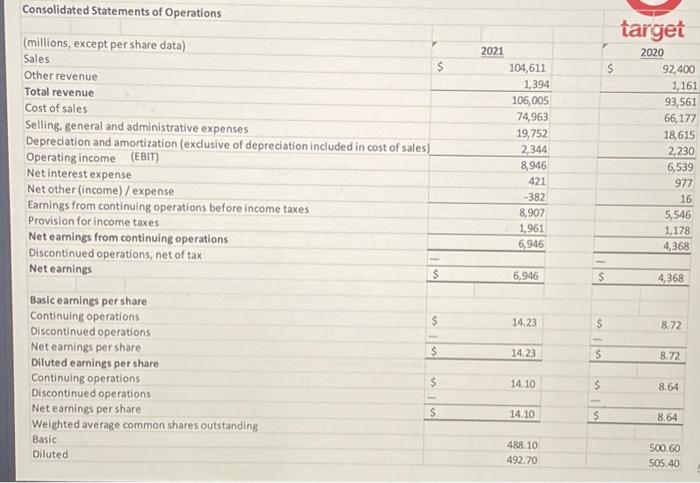

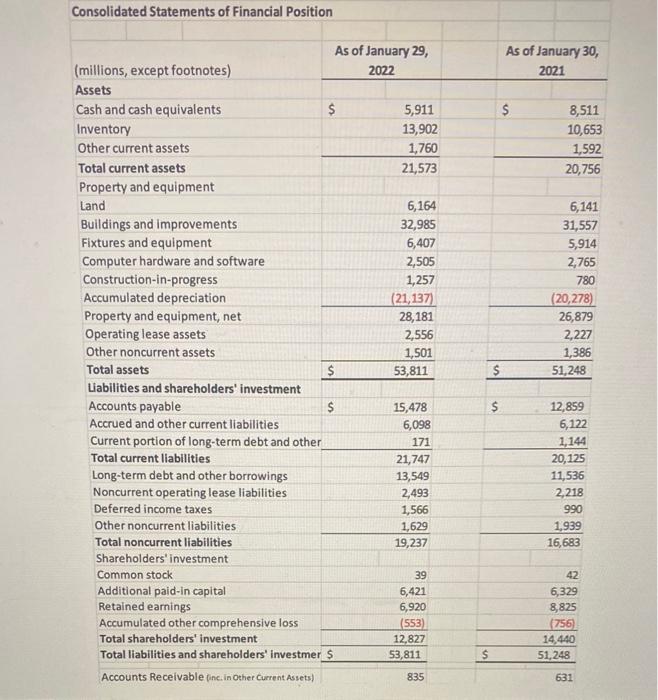

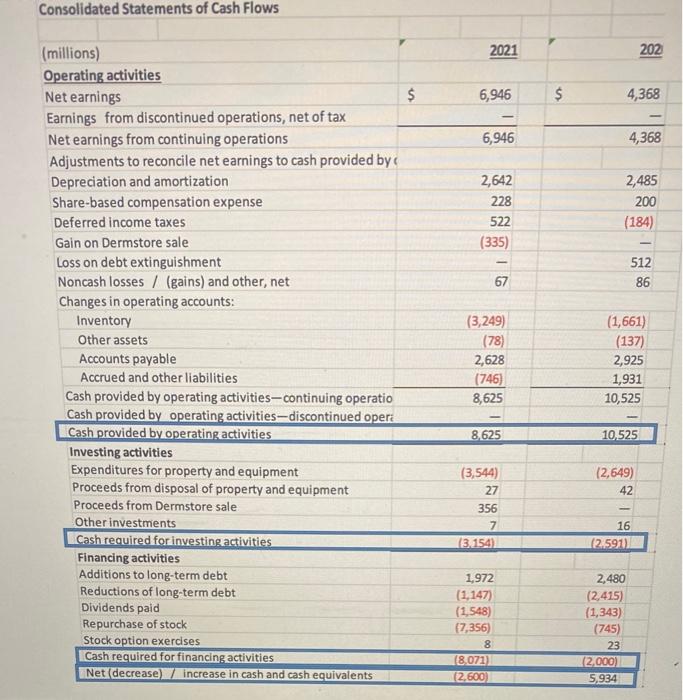

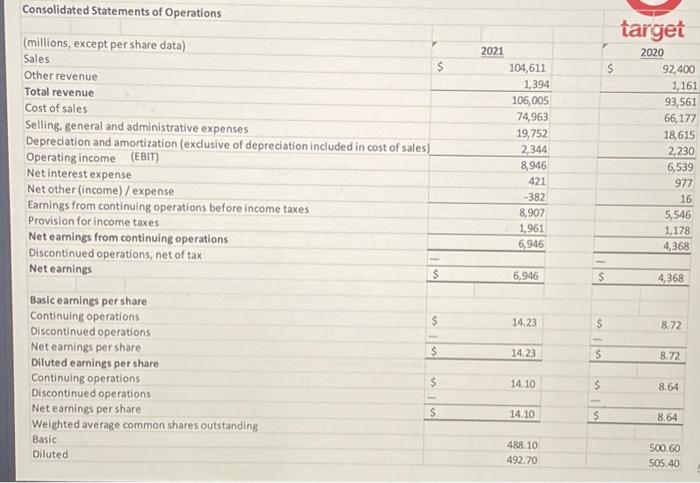

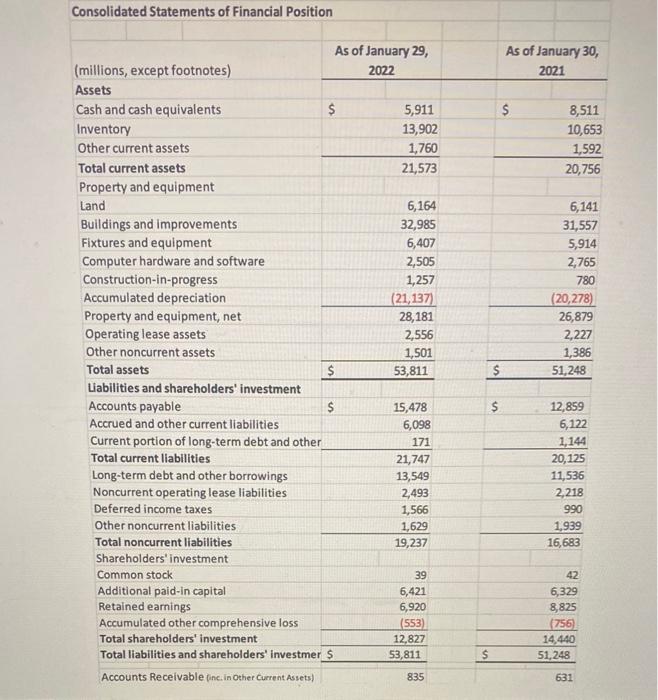

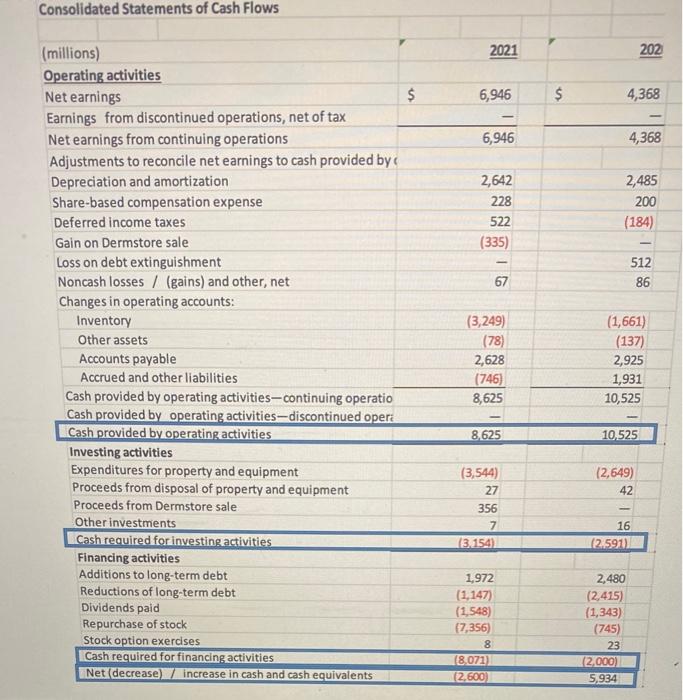

Consolidated Statements of Financial Position Consolidated Statements of Cash Flows (millions) 2021 202 Operating activities Net earnings Earnings from discontinued operations, net of tax Net earnings from continuing operations $,946 - 6,946 Adjustments to reconcile net earnings to cash provided byc Depreciation and amortization Share-based compensation expense Deferred income taxes 2,642 Gain on Dermstore sale 228 Loss on debt extinguishment Noncash losses / (gains) and other, net 522 (335) Changes in operating accounts: Inventory (3,249) (1,661) Other assets (78) (137) Accounts payable Accrued and other liabilities Cash provided by operating activities - continuing operatio Cash provided by operating activities - discontinued oper: Cash provided by operating activities 8,625 2,925 Investing activities Expenditures for property and equipment Proceeds from disposal of property and equipment 2,628 4,368 Proceeds from Dermstore sale Other investments Cash required for investing activities (746) 8,625 1,931 Financing activities Additions to long-term debt Reductions of long-term debt Dividends paid Repurchase of stock (3,544) (2,649) Stock option exercises 27 42 Cash required for financing activities Net (decrease) / increase in cash and cash equivalents 356 10,525 4,368 2,485 200 (184) 512 86 1,93110,52510,525 (3.154) (2.591) 16 a 1,972 2,480 (1,147) (2,415) (1,548) (1,343) (7,356) (745) 8 (8.071) (2.600) (2,000) 5,934 23 Calculate the Target Corporation's Debt-to-Equity ratio for the fiscal year ending January 29, 2022. A. 1.5X B. 1.7X C. Insufficient information available to answer this question. D. 0.8X E. 3.2X Consolidated Statements of Operations (millions, except per share data) Sales Other revenue Total revenue Cost of sales Selling, general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Operating income (EBIT) Net interest expense Net other (income) / expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax Net earnings Basic earnings per share Continuing operations Discontinued operations Net earnings per share Diluted earnings per share Continuing operations Discontinued operations Net earnings per share Weighted average common shares outstanding Basic Diluted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started