Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I do require the answer for all the three required questions. Thank you. Please look into the question and give the correct answer to

Hello,

I do require the answer for all the three required questions. Thank you.

Please look into the question and give the correct answer to all the three questions, Thank you in advance!!

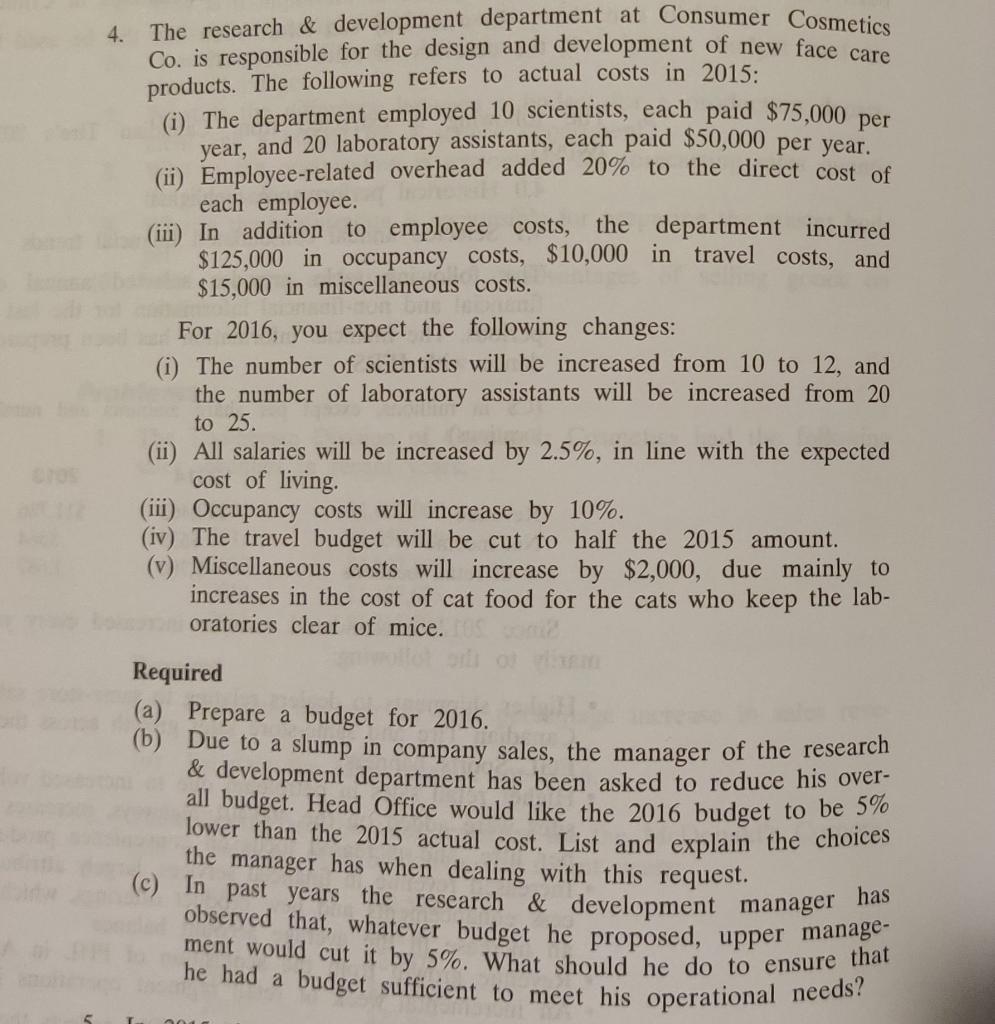

4. The research & development department at Consumer Cosmetics Co. is responsible for the design and development of new face care products. The following refers to actual costs in 2015: (i) The department employed 10 scientists, each paid $75,000 per year, and 20 laboratory assistants, each paid $50,000 per year. (ii) Employee-related overhead added 20% to the direct cost of each employee. (iii) In addition to employee costs, the department incurred $125,000 in occupancy costs, $10,000 in travel costs, and $15,000 in miscellaneous costs. For 2016, you expect the following changes: (i) The number of scientists will be increased from 10 to 12, and the number of laboratory assistants will be increased from 20 to 25. (ii) All salaries will be increased by 2.5%, in line with the expected cost of living. (iii) Occupancy costs will increase by 10%. (iv) The travel budget will be cut to half the 2015 amount. (v) Miscellaneous costs will increase by $2,000, due mainly to increases in the cost of cat food for the cats who keep the lab- oratories clear of mice. Required (a) Prepare a budget for 2016. (b) Due to a slump in company sales, the manager of the research & development department has been asked to reduce his over- all budget. Head Office would like the 2016 budget to be 5% lower than the 2015 actual cost. List and explain the choices the manager has when dealing with this request. (C) In past years the research & development manager has observed that, whatever budget he proposed, upper manage- ment would cut it by 5%. What should he do to ensure that he had a budget sufficient to meet his operational needs? 4. The research & development department at Consumer Cosmetics Co. is responsible for the design and development of new face care products. The following refers to actual costs in 2015: (i) The department employed 10 scientists, each paid $75,000 per year, and 20 laboratory assistants, each paid $50,000 per year. (ii) Employee-related overhead added 20% to the direct cost of each employee. (iii) In addition to employee costs, the department incurred $125,000 in occupancy costs, $10,000 in travel costs, and $15,000 in miscellaneous costs. For 2016, you expect the following changes: (i) The number of scientists will be increased from 10 to 12, and the number of laboratory assistants will be increased from 20 to 25. (ii) All salaries will be increased by 2.5%, in line with the expected cost of living. (iii) Occupancy costs will increase by 10%. (iv) The travel budget will be cut to half the 2015 amount. (v) Miscellaneous costs will increase by $2,000, due mainly to increases in the cost of cat food for the cats who keep the lab- oratories clear of mice. Required (a) Prepare a budget for 2016. (b) Due to a slump in company sales, the manager of the research & development department has been asked to reduce his over- all budget. Head Office would like the 2016 budget to be 5% lower than the 2015 actual cost. List and explain the choices the manager has when dealing with this request. (C) In past years the research & development manager has observed that, whatever budget he proposed, upper manage- ment would cut it by 5%. What should he do to ensure that he had a budget sufficient to meet his operational needsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started