Question: Hello, I have attached multiple questions to this post, please take a look at them and see if you can answer at least one. I

Hello, I have attached multiple questions to this post, please take a look at them and see if you can answer at least one. I will make sure to leave a thumbs up. I have attached chegg links to other questions that are the same concept but different numbers, they may be useful.

#1: https://www.chegg.com/homework-help/questions-and-answers/two-1000-dollar-face-value-bonds-redeemable-par-first-redemption-date-3-years-prior-redemp-q48278086?trackid=2ca238581945&strackid=8dc3aa85e97b https://www.chegg.com/homework-help/questions-and-answers/two-1000-dollar-face-value-bonds-redeemable-par-first-redemption-date-3-years-prior-redemp-q105344042?trackid=002f696f822d&strackid=8dc3aa85e97b https://www.chegg.com/homework-help/questions-and-answers/two-1000-dollar-face-value-bonds-redeemable-par-first-redemption-date-3-years-prior-redemp-q105463385?trackid=99db8234e657&strackid=8dc3aa85e97b https://www.chegg.com/homework-help/questions-and-answers/two-1000-dollar-face-value-bonds-redeemable-par-first-redemption-date-3-years-prior-redemp-q105487315?trackid=bbf54635f85e&strackid=8dc3aa85e97b #2: https://www.chegg.com/homework-help/questions-and-answers/1-point-13-year-bond-face-value-2000-dollars-earns-interest-101-percent-convertible-semian-q105443045?trackid=73f8a7c04e0e&strackid=7e0e0193ff77 https://www.chegg.com/homework-help/questions-and-answers/1-point-14-year-bond-face-value-2000-dollars-earns-interest-93-percent-convertible-semiann-q105322979?trackid=c5d2b46074a8&strackid=7e0e0193ff77 https://www.chegg.com/homework-help/questions-and-answers/1-point-13-year-bond-face-value-2000-dollars-earns-interest-101-percent-convertible-semian-q105440147?trackid=ebf5735c6c37&strackid=7e0e0193ff77 https://www.chegg.com/homework-help/questions-and-answers/1-point-11-year-bond-face-value-2000-dollars-earns-interest-96-percent-convertible-semiann-q88380708?trackid=2e2bb48cfa31&strackid=7e0e0193ff77 #3: https://www.chegg.com/homework-help/questions-and-answers/1-point-10-year-bond-earns-interest-91-percent-convertible-semiannually-yield-rate-8-perce-q48850245?trackid=b215c1e05046&strackid=c1f561ec2d8c https://www.chegg.com/homework-help/questions-and-answers/10-year-bond-earns-interest-91-percent-convertible-semiannually-yield-rate-73-percent-conv-q28111852?trackid=95b4aa1c0bcc&strackid=c1f561ec2d8c https://www.chegg.com/homework-help/questions-and-answers/9-year-bond-earns-interest-92-percent-convertible-semiannually-yield-rate-75-percent-conve-q105343908?trackid=c20e785cbe4f&strackid=c1f561ec2d8c #4: https://www.chegg.com/homework-help/questions-and-answers/suppose-16-year-bond-face-value-3000-dollars-redeemable-par-pays-semiannual-coupons-increa-q105498488?trackid=e202e9366bae&strackid=b11f8f551017 https://www.chegg.com/homework-help/questions-and-answers/suppose-16-year-bond-face-value-3000-dollars-redeemable-par-pays-semiannual-coupons-increa-q105498463?trackid=a708d418c1fe&strackid=b11f8f551017 https://www.chegg.com/homework-help/questions-and-answers/suppose-16-year-bond-face-value-3000-dollars-redeemable-par-pays-semiannual-coupons-increa-q105478586?trackid=68ef395d1ef3&strackid=b11f8f551017 #5: https://www.chegg.com/homework-help/questions-and-answers/1-point-one-bond-face-value-1000-dollars-annual-coupons-rate-78-percent-effective-price-10-q105319489?trackid=e4fd2ed6a379&strackid=0b3060c4c630 https://www.chegg.com/homework-help/questions-and-answers/one-bond-face-value-1000-dollars-annual-coupons-rate-75-percent-effective-price-108481-dol-q105343820?trackid=63b386f2e83d&strackid=0b3060c4c630 https://www.chegg.com/homework-help/questions-and-answers/one-bond-tace-value-1000-dollars-annual-coupons-rate-84-percent-effective-price-130709-dol-q105463865?trackid=423df9406175&strackid=0b3060c4c630 https://www.chegg.com/homework-help/questions-and-answers/one-bond-face-value-1000-dollars-annual-coupons-rate-74-percent-effective-price-10945-doll-q28248657?trackid=5dc7d15f3130&strackid=0b3060c4c630 #6: https://www.chegg.com/homework-help/questions-and-answers/suppose-16-year-bond-face-value-1000-dollars-redeemable-par-earns-interest-95-percent-conv-q105397691?trackid=3783c05ecb1c&strackid=335e5bcfbf41 https://www.chegg.com/homework-help/questions-and-answers/suppose-16-year-bond-face-value-1000-dollars-redeemable-par-earns-interest-92-percent-conv-q105498402?trackid=4d3ce4985246&strackid=335e5bcfbf41 https://www.chegg.com/homework-help/questions-and-answers/suppose-16-year-bond-face-value-1000-dollars-redeemable-par-earns-interest-92-percent-conv-q105498419?trackid=bec7962399c3&strackid=335e5bcfbf41 https://www.chegg.com/homework-help/questions-and-answers/suppose-16-year-bond-face-value-1000-dollars-redeemable-par-earns-interest-92-percent-conv-q105498408?trackid=70ad232ac586&strackid=335e5bcfbf41

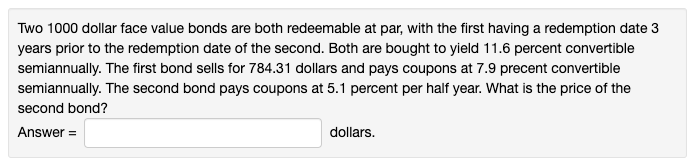

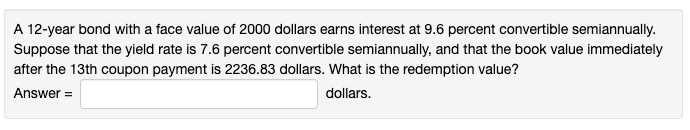

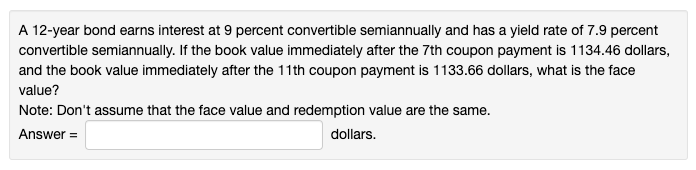

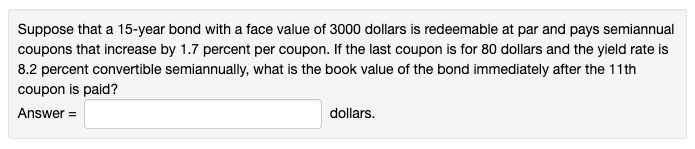

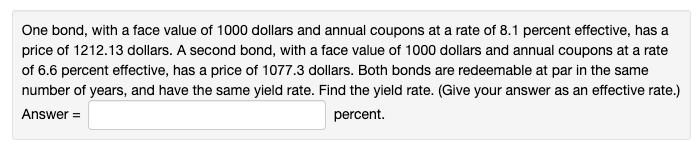

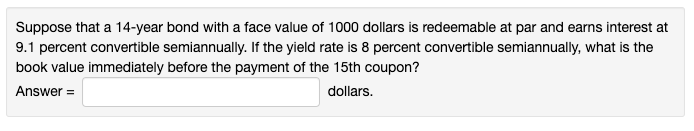

Two 1000 dollar face value bonds are both redeemable at par, with the first having a redemption date 3 years prior to the redemption date of the second. Both are bought to yield 11.6 percent convertible semiannually. The first bond sells for 784.31 dollars and pays coupons at 7.9 precent convertible semiannually. The second bond pays coupons at 5.1 percent per half year. What is the price of the second bond? Answer = dollars. A 12-year bond with a face value of 2000 dollars earns interest at 9.6 percent convertible semiannually. Suppose that the yield rate is 7.6 percent convertible semiannually, and that the book value immediately after the 13th coupon payment is 2236.83 dollars. What is the redemption value? Answer = dollars. A 12-year bond earns interest at 9 percent convertible semiannually and has a yield rate of 7.9 percent convertible semiannually. If the book value immediately after the 7 th coupon payment is 1134.46 dollars, and the book value immediately after the 11th coupon payment is 1133.66 dollars, what is the face value? Note: Don't assume that the face value and redemption value are the same. Answer = dollars. Suppose that a 15-year bond with a face value of 3000 dollars is redeemable at par and pays semiannual coupons that increase by 1.7 percent per coupon. If the last coupon is for 80 dollars and the yield rate is 8.2 percent convertible semiannually, what is the book value of the bond immediately after the 11 th coupon is paid? Answer = dollars. One bond, with a face value of 1000 dollars and annual coupons at a rate of 8.1 percent effective, has a price of 1212.13 dollars. A second bond, with a face value of 1000 dollars and annual coupons at a rate of 6.6 percent effective, has a price of 1077.3 dollars. Both bonds are redeemable at par in the same number of years, and have the same yield rate. Find the yield rate. (Give your answer as an effective rate.) Answer = percent. Suppose that a 14-year bond with a face value of 1000 dollars is redeemable at par and earns interest at 9.1 percent convertible semiannually. If the yield rate is 8 percent convertible semiannually, what is the book value immediately before the payment of the 15 th coupon? Answer = dollars. Two 1000 dollar face value bonds are both redeemable at par, with the first having a redemption date 3 years prior to the redemption date of the second. Both are bought to yield 11.6 percent convertible semiannually. The first bond sells for 784.31 dollars and pays coupons at 7.9 precent convertible semiannually. The second bond pays coupons at 5.1 percent per half year. What is the price of the second bond? Answer = dollars. A 12-year bond with a face value of 2000 dollars earns interest at 9.6 percent convertible semiannually. Suppose that the yield rate is 7.6 percent convertible semiannually, and that the book value immediately after the 13th coupon payment is 2236.83 dollars. What is the redemption value? Answer = dollars. A 12-year bond earns interest at 9 percent convertible semiannually and has a yield rate of 7.9 percent convertible semiannually. If the book value immediately after the 7 th coupon payment is 1134.46 dollars, and the book value immediately after the 11th coupon payment is 1133.66 dollars, what is the face value? Note: Don't assume that the face value and redemption value are the same. Answer = dollars. Suppose that a 15-year bond with a face value of 3000 dollars is redeemable at par and pays semiannual coupons that increase by 1.7 percent per coupon. If the last coupon is for 80 dollars and the yield rate is 8.2 percent convertible semiannually, what is the book value of the bond immediately after the 11 th coupon is paid? Answer = dollars. One bond, with a face value of 1000 dollars and annual coupons at a rate of 8.1 percent effective, has a price of 1212.13 dollars. A second bond, with a face value of 1000 dollars and annual coupons at a rate of 6.6 percent effective, has a price of 1077.3 dollars. Both bonds are redeemable at par in the same number of years, and have the same yield rate. Find the yield rate. (Give your answer as an effective rate.) Answer = percent. Suppose that a 14-year bond with a face value of 1000 dollars is redeemable at par and earns interest at 9.1 percent convertible semiannually. If the yield rate is 8 percent convertible semiannually, what is the book value immediately before the payment of the 15 th coupon? Answer = dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts