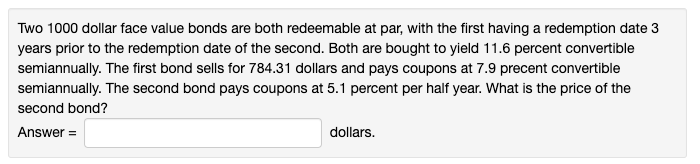

Question

Hello, I have attached some chegg links to problems that are the same as this one but have different numbers, they may be helpful. https://www.chegg.com/homework-help/questions-and-answers/two-1000-dollar-face-value-bonds-redeemable-par-first-redemption-date-3-years-prior-redemp-q48278086?trackid=2ca238581945&strackid=8dc3aa85e97b

Hello, I have attached some chegg links to problems that are the same as this one but have different numbers, they may be helpful.

https://www.chegg.com/homework-help/questions-and-answers/two-1000-dollar-face-value-bonds-redeemable-par-first-redemption-date-3-years-prior-redemp-q48278086?trackid=2ca238581945&strackid=8dc3aa85e97b https://www.chegg.com/homework-help/questions-and-answers/two-1000-dollar-face-value-bonds-redeemable-par-first-redemption-date-3-years-prior-redemp-q105344042?trackid=002f696f822d&strackid=8dc3aa85e97b https://www.chegg.com/homework-help/questions-and-answers/two-1000-dollar-face-value-bonds-redeemable-par-first-redemption-date-3-years-prior-redemp-q105463385?trackid=99db8234e657&strackid=8dc3aa85e97b https://www.chegg.com/homework-help/questions-and-answers/two-1000-dollar-face-value-bonds-redeemable-par-first-redemption-date-3-years-prior-redemp-q105487315?trackid=bbf54635f85e&strackid=8dc3aa85e97b

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started