Hello, i have recently unlocked this Document on CourseHero: https://www.coursehero.com/file/39689114/IA5pdf/

But, it only contains questions!! I want solutions for this question.. Please help me get solution to this problem..

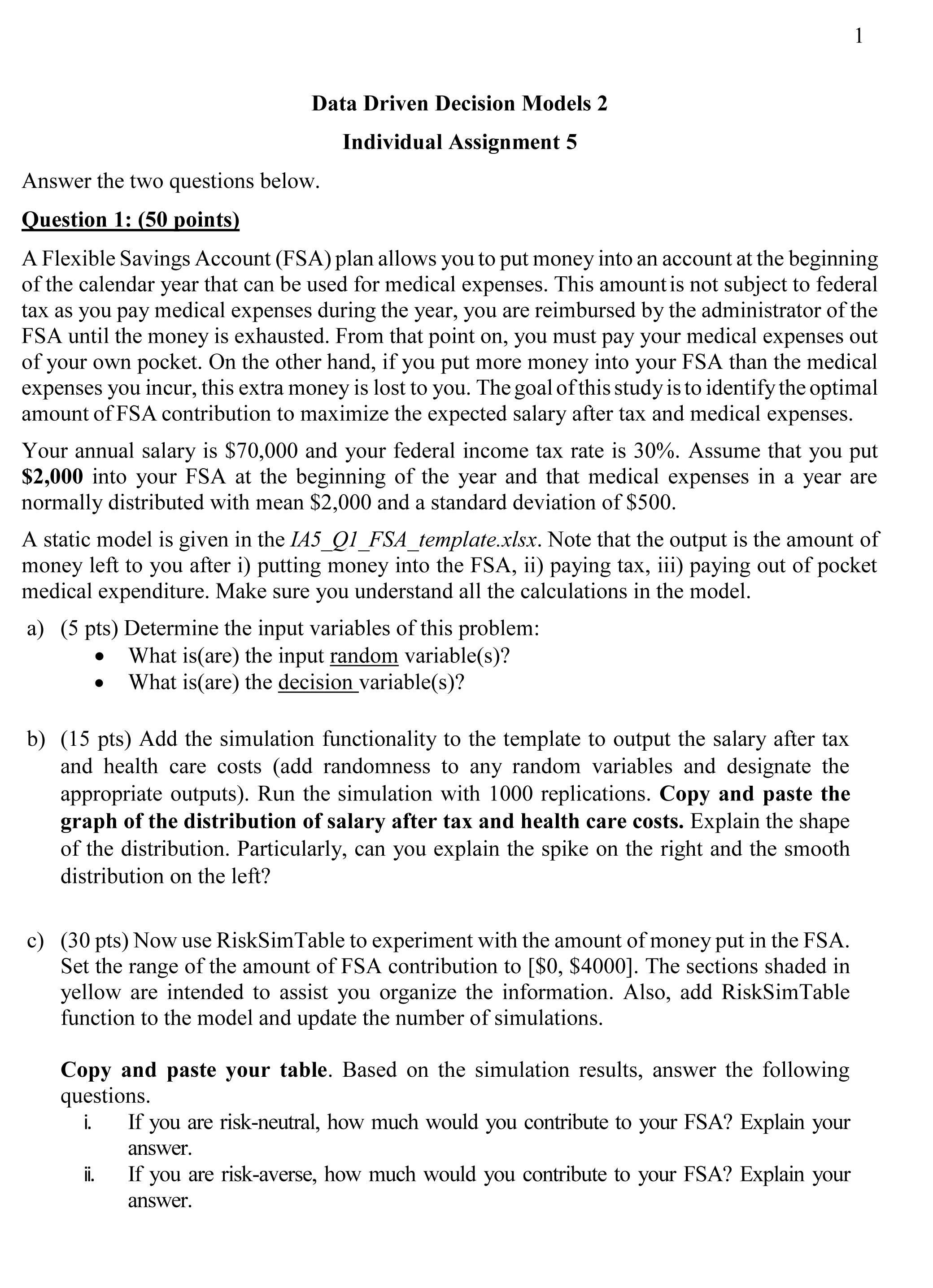

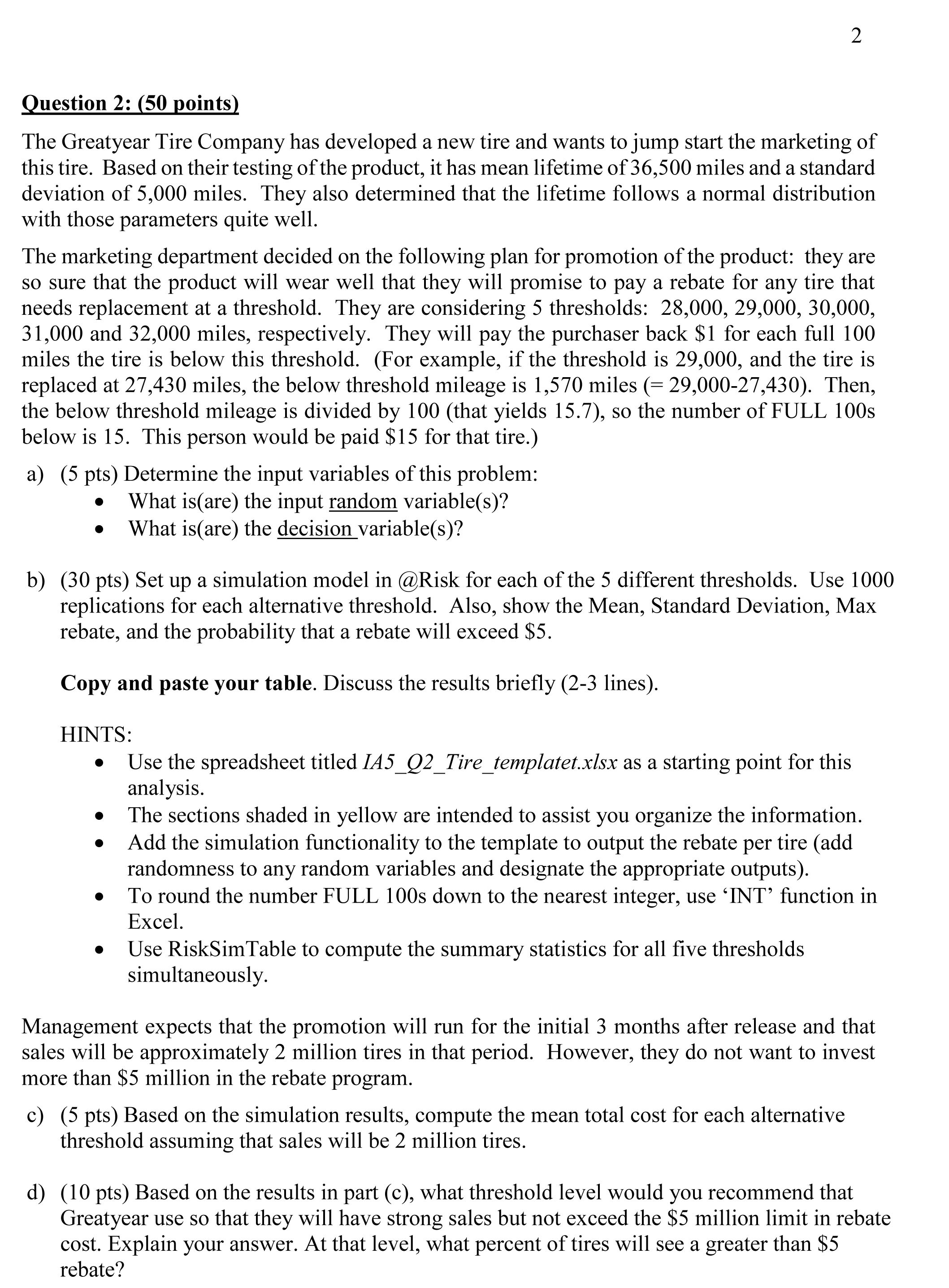

Data Driven Decision Models 2 Individual Assignment 5 Answer the two questions below. Question 1: 150 points) A Flexible Savings Account (FSA) plan allows you to put money into an account at the beginning of the calendar year that can be used for medical expenses. This amountis not subject to federal tax as you pay medical expenses during the year, you are reimbursed by the administrator of the FSA until the money is exhausted. From that point on, you must pay your medical expenses out of your own pocket. On the other hand, if you put more money into your FSA than the medical expenses you incur, this extra money is lost to you. The goal of this study is to identify the optimal amount of FSA contribution to maximize the expected salary after tax and medical expenses. Your annual salary is $70,000 and your federal income tax rate is 30%. Assume that you put $2,000 into your F SA at the beginning of the year and that medical expenses in a year are normally distributed with mean $2,000 and a standard deviation of $500. A static model is given in the IA5_Q]_FSA_template.xlsx. Note that the output is the amount of money left to you after i) putting money into the FSA, ii) paying tax, iii) paying out of pocket medical expenditure. Make sure you understand all the calculations in the model. a) (5 pts) Determine the input variables of this problem: 0 What is(are) the input random variable(s)? o What is(are) the decision variable(s)? b) (15 pts) Add the simulation functionality to the template to output the salary after tax and health care costs (add randomness to any random variables and designate the appropriate outputs). Run the simulation with 1000 replications. Copy and paste the graph of the distribution of salary after tax and health care costs. Explain the shape of the distribution. Particularly, can you explain the spike on the right and the smooth distribution on the left? 0) (30 pts) Now use RiskSimTable to experiment with the amount of money put in the FSA. Set the range of the amount of F SA contribution to [$0, $4000]. The sections shaded in yellow are intended to assist you organize the information. Also, add RiskSimTable function to the model and update the number of simulations. Copy and paste your table. Based on the simulation results, answer the following questions. i. If you are risk-neutral, how much would you contribute to your FSA? Explain your answer. ii. If you are risk-averse, how much would you contribute to your FSA? Explain your answer. Question 2: 150 points) The Greatyear Tire Company has developed a new tire and wants to jump start the marketing of this tire. Based on their testing of the product, it has mean lifetime of 36,500 miles and a standard deviation of 5,000 miles. They also determined that the lifetime follows a normal distribution with those parameters quite well. The marketing department decided on the following plan for promotion of the product: they are so sure that the product will wear well that they will promise to pay a rebate for any tire that needs replacement at a threshold. They are considering 5 thresholds: 28,000, 29,000, 30,000, 31,000 and 32,000 miles, respectively. They will pay the purchaser back $1 for each full 100 miles the tire is below this threshold. (For example, if the threshold is 29,000, and the tire is replaced at 27,430 miles, the below threshold mileage is 1,570 miles (= 29,000-27,430). Then, the below threshold mileage is divided by 100 (that yields 15.7), so the number of FULL 100s below is 15. This person would be paid $15 for that tire.) a) (5 pts) Determine the input variables of this problem: 0 What is(are) the input random variable(s)? o What is(are) the decision variable(s)? b) (30 pts) Set up a simulation model in @Risk for each of the 5 different thresholds. Use 1000 replications for each alternative threshold. Also, show the Mean, Standard Deviation, Max rebate, and the probability that a rebate will exceed $5. Copy and paste your table. Discuss the results briey (2-3 lines). HINTS: 0 Use the spreadsheet titled IA5_Q2_Tire_templatet.xlsx as a starting point for this analysis. 0 The sections shaded in yellow are intended to assist you organize the information. 0 Add the simulation functionality to the template to output the rebate per tire (add randomness to any random variables and designate the appropriate outputs). 0 To round the number FULL 1003 down to the nearest integer, use 'INT' function in Excel. 0 Use RiskSimTable to compute the summary statistics for all ve thresholds simultaneously. Management expects that the promotion will run for the initial 3 months after release and that sales will be approximately 2 million tires in that period. However, they do not want to invest more than $5 million in the rebate program. c) (5 pts) Based on the simulation results, compute the mean total cost for each alternative threshold assuming that sales will be 2 million tires. (1) (10 pts) Based on the results in part (c), What threshold level would you recommend that Greatyear use so that they will have strong sales but not exceed the $5 million limit in rebate cost. Explain your answer. At that level, what percent of tires will see a greater than $5 rebate