Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I have this exercise of my Investment class with the answers but I need to know the manual procedure (not Excel) of how to

Hello, I have this exercise of my Investment class with the answers but I need to know the manual procedure (not Excel) of how to reach those results. Could you help me? Thank you.

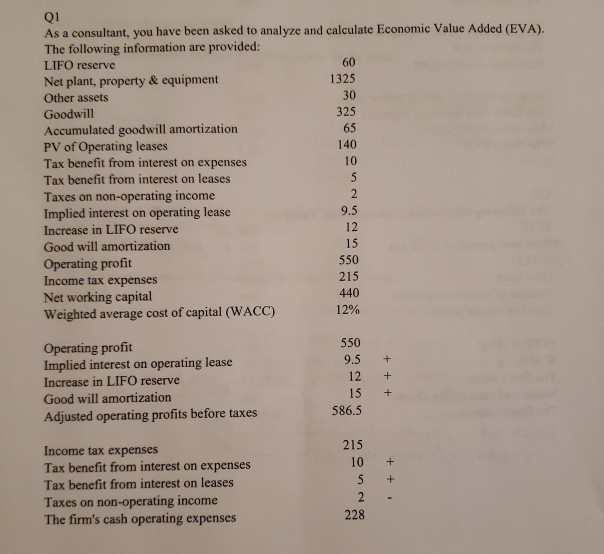

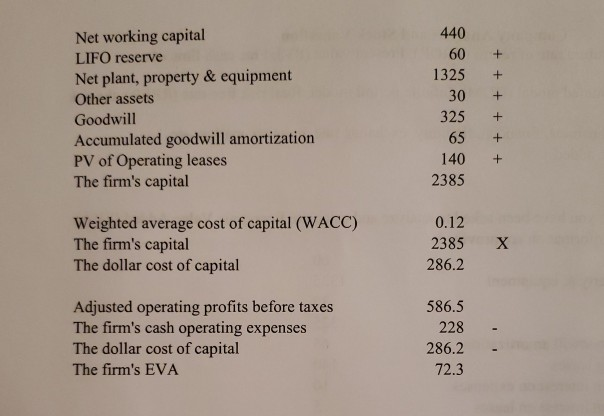

Q1 As a consultant, you have been asked to analyze and calculate Economic Value Added (EVA). The following information are provided: LIFO reserve Net plant, property & equipment 1325 Other assets 30 Goodwill 325 Accumulated goodwill amortization 65 PV of Operating leases Tax benefit from interest on expenses Tax benefit from interest on leases Taxes on non-operating income Implied interest on operating lease Increase in LIFO reserve Good will amortization Operating profit 550 Income tax expenses Net working capital 440 Weighted average cost of capital (WACC) 12% 215 550 9.5 12 15 Operating profit Implied interest on operating lease Increase in LIFO reserve Good will amortization Adjusted operating profits before taxes + + 586.5 215 + + Income tax expenses Tax benefit from interest on expenses Tax benefit from interest on leases Taxes on non-operating income The firm's cash operating expenses + 440 60 1325 + + + 30 + Net working capital LIFO reserve Net plant, property & equipment Other assets Goodwill Accumulated goodwill amortization PV of Operating leases The firm's capital + + 325 65 140 2385 + Weighted average cost of capital (WACC) The firm's capital The dollar cost of capital 0.12 2385 286.2 X 586.5 228 Adjusted operating profits before taxes The firm's cash operating expenses The dollar cost of capital The firm's EVA 286.2 72.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started