Answered step by step

Verified Expert Solution

Question

1 Approved Answer

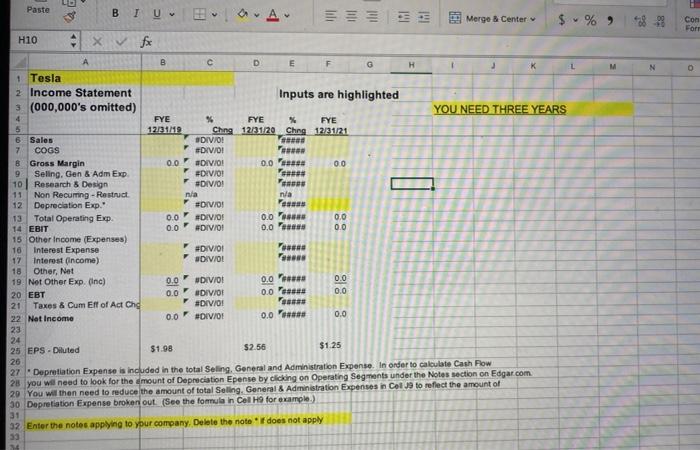

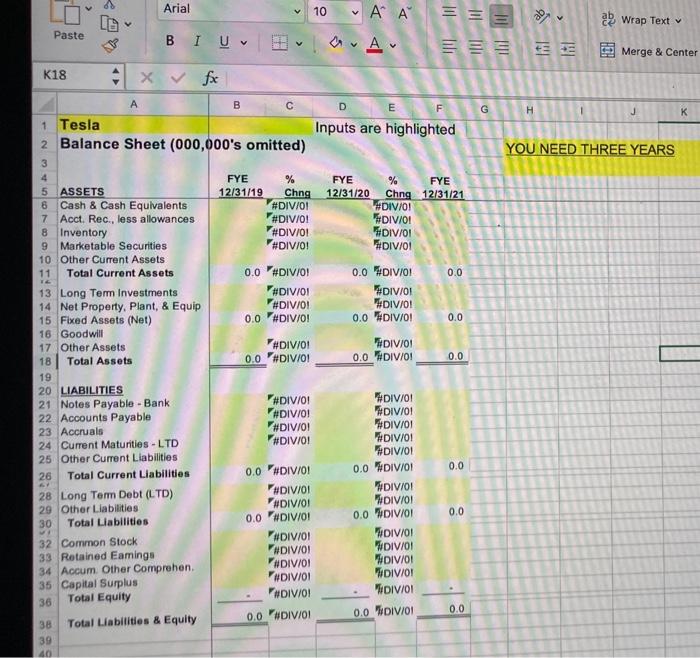

hello i just need help with cells that are higlighted in yellow. this is for Tesla inc (tsla). LO Paste BIU EA ===== = Merge

hello i just need help with cells that are higlighted in yellow. this is for Tesla inc (tsla).

LO Paste BIU EA ===== = Merge & Center $ % ) Con Forr H10 x M N B c D E F G H 1 Tesla 2 Income Statement Inputs are highlighted 3 (000,000's omitted) YOU NEED THREE YEARS 4 FYE % FYE % FYE 5 12/31/19 Cr4 12320 Chng 12A1 6 Sales #DIV/0! *** 7 COGS DIV/01 B Gross Margin 0.0 #DIV/0! 0.0 00 9 Seling. Gen & Adm Exp F #DIV/0! 10 Research & Design F #DIV/0! 11 Non Recumng - Restruct nia n/a 12 Depreciation Exp. #DIV/0! 13 Total Operating Exp 0.0 #DIV/0! 0.0 0.0 14 EBIT 0.0 F #DIV/0! 0.0 0.0 15 Other Income (Expenses) 10 Interest Expense #DIV/OI *** 17 Interest income) #DIV/0! 18 Other Net 19 Not Other Exp. Onc) 0.0 DIV/0! 0.0 ms 0.0 20 EBT 0.0 HDIV/01 0.0 Pes 0.0 21 Taxes & Cum Eff of Act Chd 22 Not Income 0.0 #DIV/01 0.0's 0.0 23 24 25 EPS-Diluted $1.98 $2.56 $125 26 27 Depretation Expense is included in the total Seling. General and Administration Expense. In order to calculate Cash Flow 28 you will need to look for the amount of Depreciation Epense by clicking on Operating Segments under the Notes section on Edgar.com 20 You will then need to reduce the amount of total Selling. General & Administration Expenses in Col Je to reflect the amount of 30 Depretation Expense broken out. (See the fomula in Cel H9 for example) 31 32 Enter the notes applying to your company. Delete the note does not apply F DIVIO! Y > Paste v K18 Arial 10 A ab Wrap Text BIU a. Av === - -- Merge & Center & & fox A B D E G H J K 1 Tesla Inputs are highlighted 2 Balance Sheet (000,000's omitted) YOU NEED THREE YEARS 3 4 FYE % FYE % FYE 5 ASSETS 12/31/19 Chng 12/31/20 Chng 12/31/21 6 Cash & Cash Equivalents #DIV/01 DIV/0! 7 Acct. Rec., less allowances #DIV/0! DIV/0! 8 Inventory #DIV/0! DIV/01 9 Marketable Securities #DIV/01 #DIV/01 10 Other Current Assets 11 Total Current Assets 0.0 "#DIV/0! 0.0 HDIVIO 0.0 13 Long Term Investments #DIV/OI DIV/OI 14 Net Property. Plant, & Equip #DIV/01 "DIV/0! 15 Fixed Assets (Net) 0.0 #DIV/0! 0.0 "#DIV/0! 0.0 16 Goodwill 17 Other Assets #DIV/0! "DIV/ 18 Total Assets 0.0 "#DIV/01 0.0 "DIV/OI 0.0 19 20 LIABILITIES 21 Notes Payable - Bank #DIV/0! #DIV/0! 22 Accounts Payable #DIV/01 #DIV/01 23 Accruals #DIV/OI #DIV/01 #DIV/01 DIVIO 24 Current Maturities - LTD #DIV/01 25 Other Current Liabilities 26 0.0 Total Current Liabilities 0.0 #DIV/01 0.0 HDIVOI #DIVIOI DIV/0! 28 Long Term Debt (LTD) #DIV/01 HIV/OI 29 Other Liabilities 0.0 0.0 HDIV/OI 30 Total Liabilities 0.0 "#DIV/01 #DIV/0! DIV/01 32 Common Stock #DIV/01 WDIV/01 33 Retained Eamings #DIV/01 WDIV/01 34 Accum. Other Comprehen. #DIV/01 "DIV/01 35 Capital Surplus #DIV/0! DIV/01 36 Total Equity 0.0 0.0 "DIV/01 0.0 #DIV/OI 38 Total Liabilities & Equity 39 40 LO Paste BIU EA ===== = Merge & Center $ % ) Con Forr H10 x M N B c D E F G H 1 Tesla 2 Income Statement Inputs are highlighted 3 (000,000's omitted) YOU NEED THREE YEARS 4 FYE % FYE % FYE 5 12/31/19 Cr4 12320 Chng 12A1 6 Sales #DIV/0! *** 7 COGS DIV/01 B Gross Margin 0.0 #DIV/0! 0.0 00 9 Seling. Gen & Adm Exp F #DIV/0! 10 Research & Design F #DIV/0! 11 Non Recumng - Restruct nia n/a 12 Depreciation Exp. #DIV/0! 13 Total Operating Exp 0.0 #DIV/0! 0.0 0.0 14 EBIT 0.0 F #DIV/0! 0.0 0.0 15 Other Income (Expenses) 10 Interest Expense #DIV/OI *** 17 Interest income) #DIV/0! 18 Other Net 19 Not Other Exp. Onc) 0.0 DIV/0! 0.0 ms 0.0 20 EBT 0.0 HDIV/01 0.0 Pes 0.0 21 Taxes & Cum Eff of Act Chd 22 Not Income 0.0 #DIV/01 0.0's 0.0 23 24 25 EPS-Diluted $1.98 $2.56 $125 26 27 Depretation Expense is included in the total Seling. General and Administration Expense. In order to calculate Cash Flow 28 you will need to look for the amount of Depreciation Epense by clicking on Operating Segments under the Notes section on Edgar.com 20 You will then need to reduce the amount of total Selling. General & Administration Expenses in Col Je to reflect the amount of 30 Depretation Expense broken out. (See the fomula in Cel H9 for example) 31 32 Enter the notes applying to your company. Delete the note does not apply F DIVIO! Y > Paste v K18 Arial 10 A ab Wrap Text BIU a. Av === - -- Merge & Center & & fox A B D E G H J K 1 Tesla Inputs are highlighted 2 Balance Sheet (000,000's omitted) YOU NEED THREE YEARS 3 4 FYE % FYE % FYE 5 ASSETS 12/31/19 Chng 12/31/20 Chng 12/31/21 6 Cash & Cash Equivalents #DIV/01 DIV/0! 7 Acct. Rec., less allowances #DIV/0! DIV/0! 8 Inventory #DIV/0! DIV/01 9 Marketable Securities #DIV/01 #DIV/01 10 Other Current Assets 11 Total Current Assets 0.0 "#DIV/0! 0.0 HDIVIO 0.0 13 Long Term Investments #DIV/OI DIV/OI 14 Net Property. Plant, & Equip #DIV/01 "DIV/0! 15 Fixed Assets (Net) 0.0 #DIV/0! 0.0 "#DIV/0! 0.0 16 Goodwill 17 Other Assets #DIV/0! "DIV/ 18 Total Assets 0.0 "#DIV/01 0.0 "DIV/OI 0.0 19 20 LIABILITIES 21 Notes Payable - Bank #DIV/0! #DIV/0! 22 Accounts Payable #DIV/01 #DIV/01 23 Accruals #DIV/OI #DIV/01 #DIV/01 DIVIO 24 Current Maturities - LTD #DIV/01 25 Other Current Liabilities 26 0.0 Total Current Liabilities 0.0 #DIV/01 0.0 HDIVOI #DIVIOI DIV/0! 28 Long Term Debt (LTD) #DIV/01 HIV/OI 29 Other Liabilities 0.0 0.0 HDIV/OI 30 Total Liabilities 0.0 "#DIV/01 #DIV/0! DIV/01 32 Common Stock #DIV/01 WDIV/01 33 Retained Eamings #DIV/01 WDIV/01 34 Accum. Other Comprehen. #DIV/01 "DIV/01 35 Capital Surplus #DIV/0! DIV/01 36 Total Equity 0.0 0.0 "DIV/01 0.0 #DIV/OI 38 Total Liabilities & Equity 39 40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started