Answered step by step

Verified Expert Solution

Question

1 Approved Answer

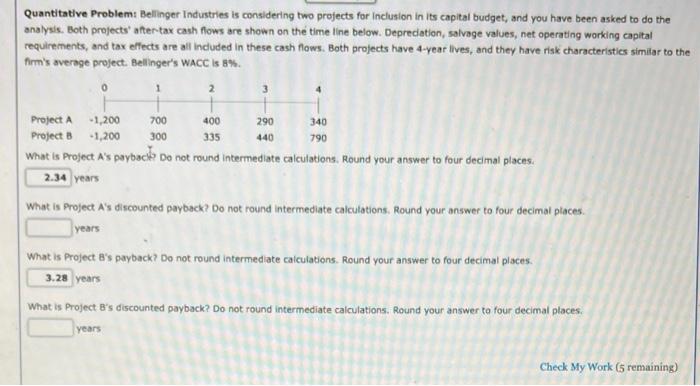

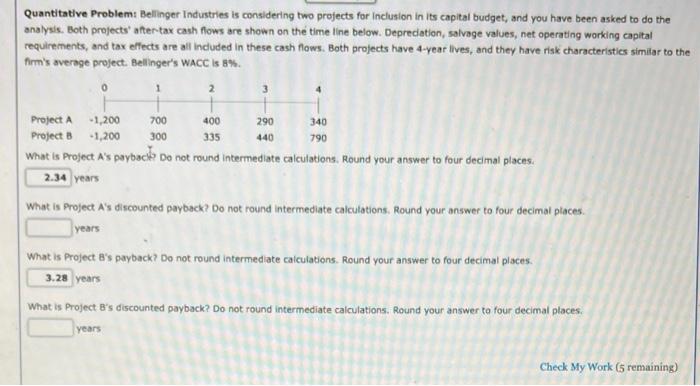

Hello! I just need help with the discounted payback. Thanks! Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and

Hello! I just need help with the discounted payback. Thanks!

Quantitative Problem: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have been asked to do the analysis. Both projects' after tax cash flows are shown on the time line below. Deprecation, salvage values, net operating working capital requirements, and tax effects are all included in these cash flows. Both projects have 4-year lives, and they have risk characteristics similar to the firm's average project. Bellinger's WACC IS 8%. 0 1 2 3 700 290 440 340 790 Project A 1,200 400 Project 8 -3,200 300 335 What is Project A's payback Do not round Intermediate calculations, Round your answer to four decimal places. 2.34 years What is Project A's discounted payback? Do not round intermediate calculations. Round your answer to four decimal places. years What is Project B's payback? Do not round intermediate calculations. Round your answer to four decimal places. 3.28 years What is Project B's discounted payback? Do not round intermediate calculations. Round your answer to four decimal places. years Check My Work (5 remaining)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started