Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. I just need the answer of this question. Not a solution. I'm in a hurry, so quick response will be appreciated! Thank you! Question

Hello. I just need the answer of this question. Not a solution. I'm in a hurry, so quick response will be appreciated! Thank you!

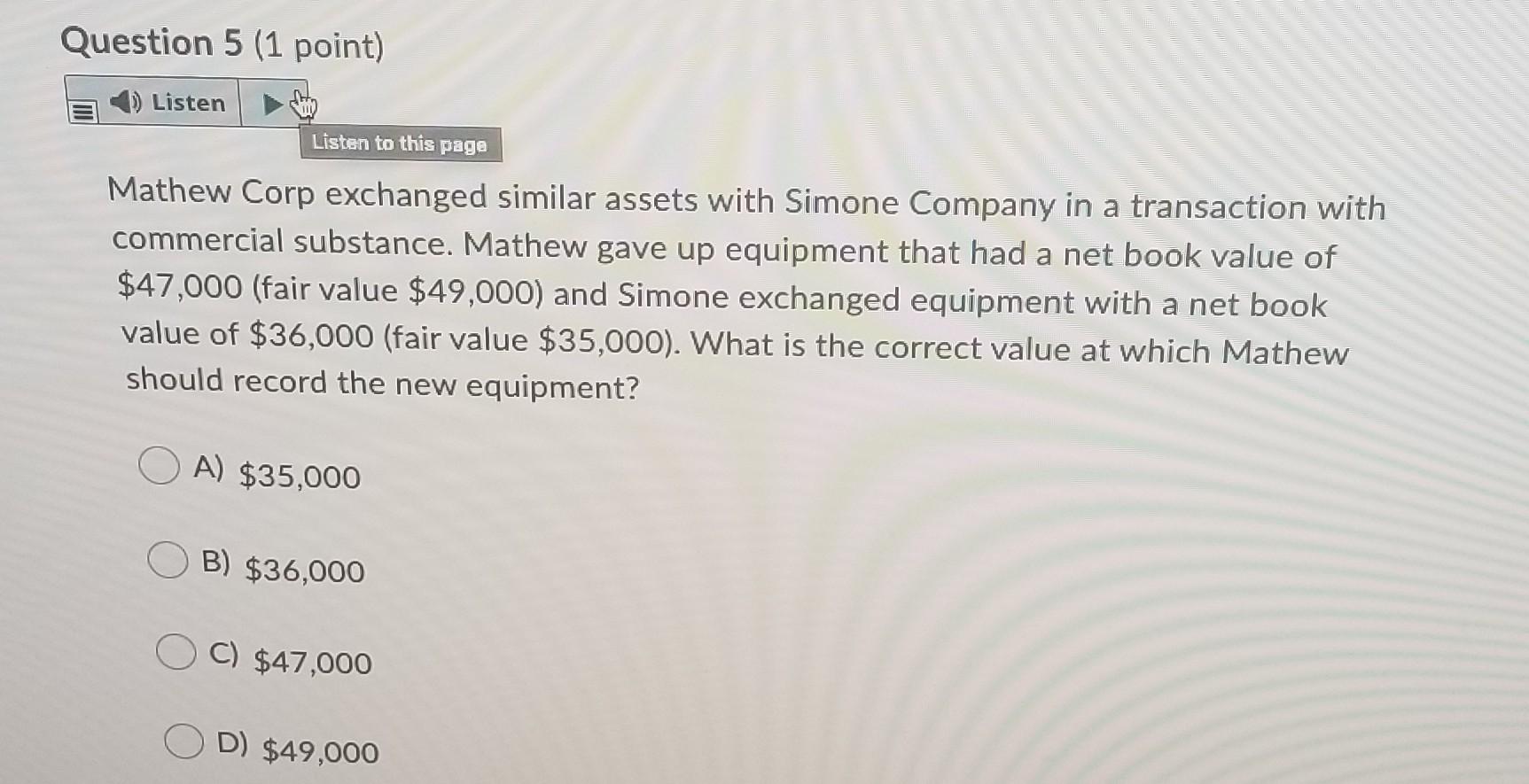

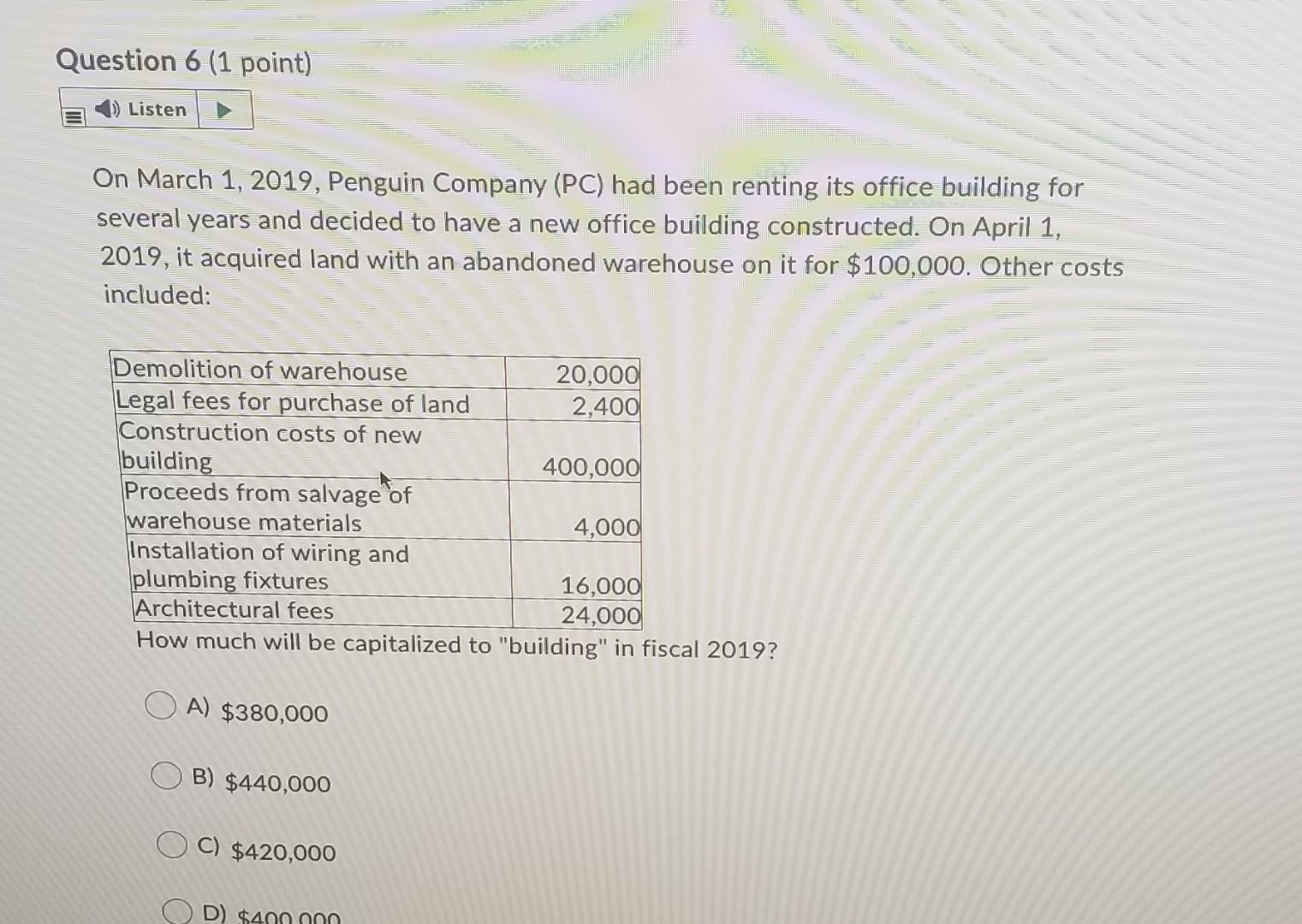

Question 5 (1 point) Listen Listen to this page Mathew Corp exchanged similar assets with Simone Company in a transaction with commercial substance. Mathew gave up equipment that had a net book value of $47,000 (fair value $49,000) and Simone exchanged equipment with a net book value of $36,000 (fair value $35,000). What is the correct value at which Mathew should record the new equipment? A) $35,000 B) $36,000 C) $47,000 D) $49,000 Question 6 (1 point) Listen On March 1, 2019, Penguin Company (PC) had been renting its office building for several years and decided to have a new office building constructed. On April 1, 2019, it acquired land with an abandoned warehouse on it for $100,000. Other costs included: Demolition of warehouse 20,000 Legal fees for purchase of land 2,400 Construction costs of new building 400,000 Proceeds from salvage of warehouse materials 4,000 Installation of wiring and plumbing fixtures 16,000 Architectural fees 24,000 How much will be capitalized to "building" in fiscal 2019? OA) $380,000 B) $440,000 C) $420,000 D) $400 non Under IFRS, what is the acceptable treatment for borrowing costs on a self constructed property, plant and equipment? A) Capitalize all indirectly attributable borrowing costs and expense the directly attributable costs. B) Capitalize costs that would have been avoided if the expenditure had not been made. C) Capitalize costs of any internal debt incurred within the corporation. D) A company can make a policy choice on the treatment of borrowing costs. Question 8 (1 Aoint) ) Listen What is the meaning of "useful life"? A) The estimated period of time over which an asset is expected to be available for use by an entity. B) The systematic allocation of an asset's depreciable amount over its estimated useful life. C) The total amount to be expensed through depreciation. D) The estimated amount that an entity would currently obtain from disposal of the asset, after deducting disposal costs, for an asset of similar age and condition expected at the end of its useful life

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started