Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. I just need the answer of this question. Not a solution. I'm in a hurry, so quick response will be appreciated! Thank you! Huten

Hello. I just need the answer of this question. Not a solution. I'm in a hurry, so quick response will be appreciated! Thank you!

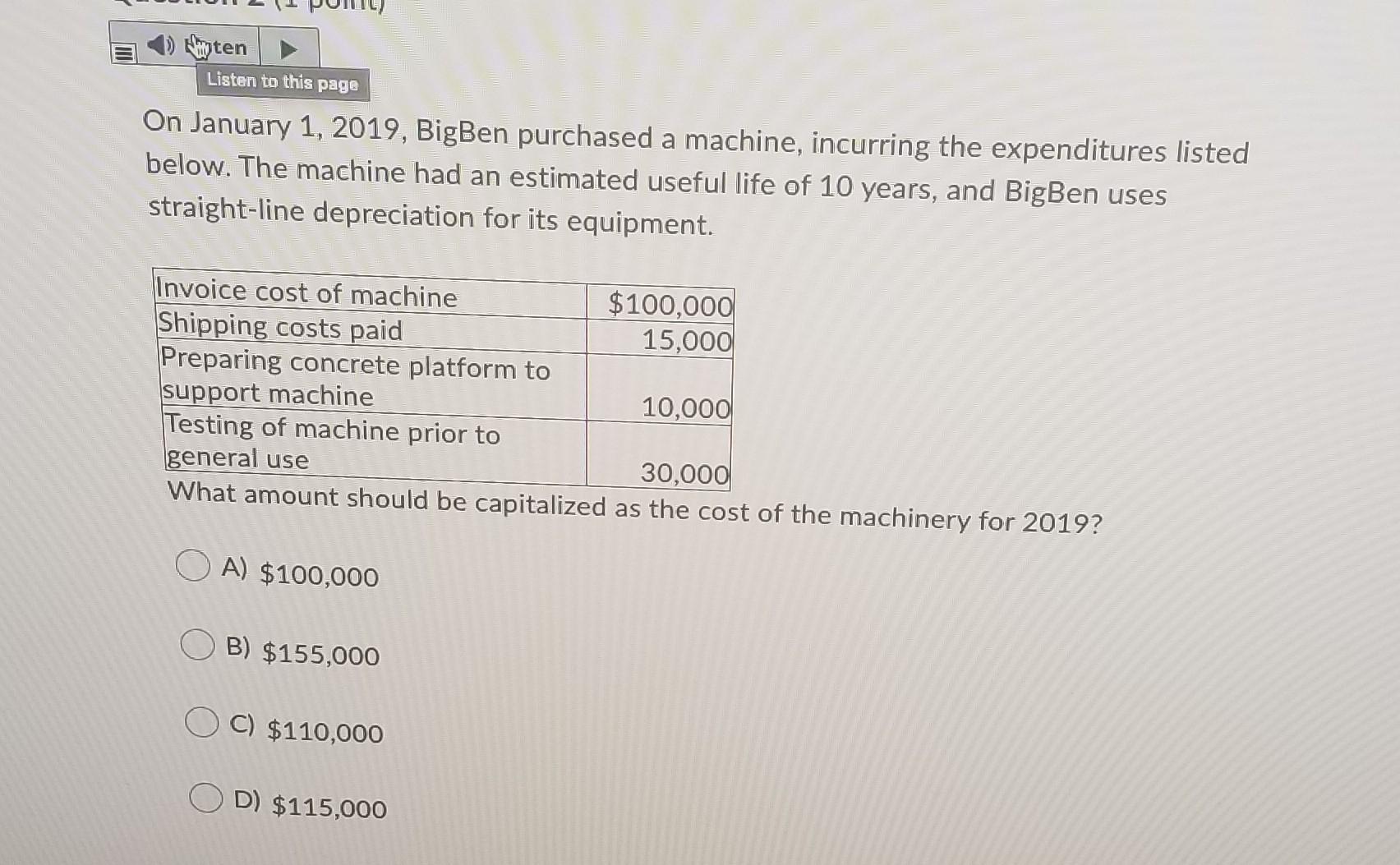

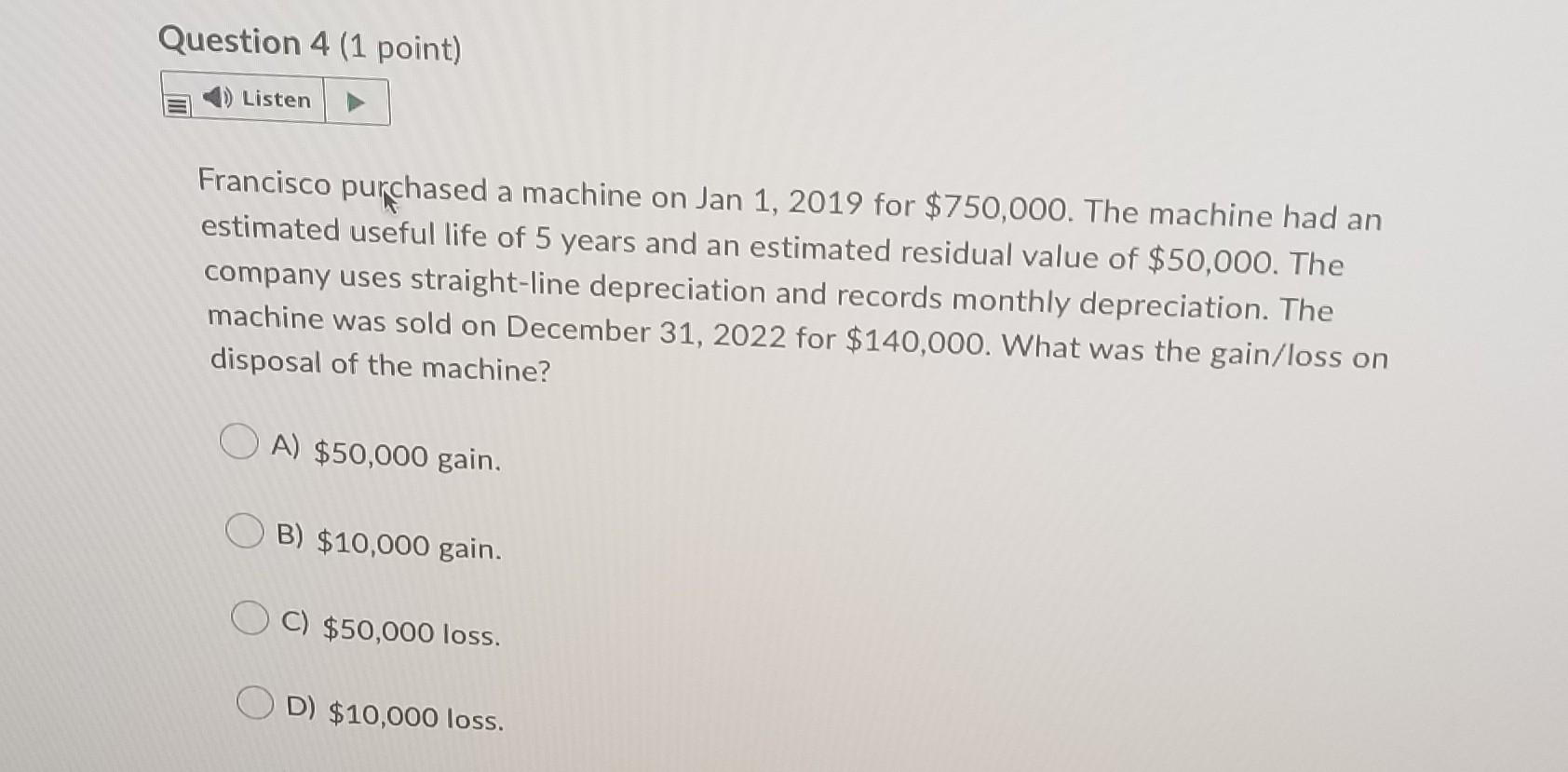

Huten Listen to this page On January 1, 2019, BigBen purchased a machine, incurring the expenditures listed below. The machine had an estimated useful life of 10 years, and BigBen uses straight-line depreciation for its equipment. Invoice cost of machine $100,000 Shipping costs paid 15,000 Preparing concrete platform to support machine 10,000 Testing of machine prior to general use 30,000 What amount should be capitalized as the cost of the machinery for 2019? A) $100,000 OB) $155,000 C) $110,000 D) $115,000 Question 4 (1 point) Listen Francisco purchased a machine on Jan 1, 2019 for $750,000. The machine had an estimated useful life of 5 years and an estimated residual value of $50,000. The company uses straight-line depreciation and records monthly depreciation. The machine was sold on December 31, 2022 for $140,000. What was the gain/loss on disposal of the machine? OA) $50,000 gain. B) $10,000 gain. OC) $50,000 loss. OD) $10,000 loss

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started