Question

Hello, I just need the Income Statement for this problem. Info is down below Write down all of your personal assets and liabilities. These may

Hello, I just need the Income Statement for this problem. Info is down below

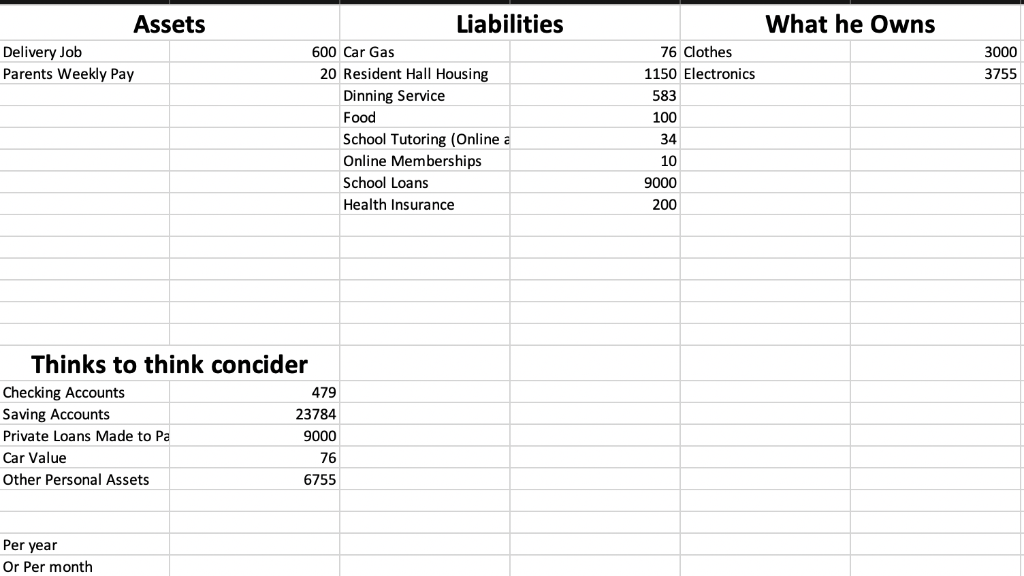

Write down all of your personal assets and liabilities. These may not include assets which are your parents, they will include loans your parents expect you to pay back (i.e. tuition loans). Same for grandparents, siblings, et al. When in doubt leave off the asset, put on the liability (assume you owe, but not own). Inheritance is not an asset (yet)---it does not get included.

A full list of items to check for will be provided. Then write down your current income streams (if any) and write down your current outflow streams (they definitely exist). Form a zero-balance budget. Write down your assets and liabilities as a balance sheet (net worth is the same as equity). Write down your income and expenses as an income statement. Make the statements (balance sheet and income statement) common size. Note: to common size for income statement divide it by sales/wages, to common size for balance sheet divide it by total assets or total liabilities and net worth (together).

Submit ONE excel document with Balance sheet on one tab and income statement on the other.

Analyze your current financial situation. Are you appropriately insured for health insurance, car insurance, disability insurance, life insurance, etc.. Are you underwater/fiscally bankrupt (owe more than you have)?---this is the case for the majority of you: do not fret. What do you plan to do about it? Was this project eye-opening? Submit a copy of your COMMON SIZE ONLY (%) Balance sheet and Income Statement. You will receive a 25% reduction in your final grade for this quiz if you submit dollar ($) figure numbers for your statements.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started