Answered step by step

Verified Expert Solution

Question

1 Approved Answer

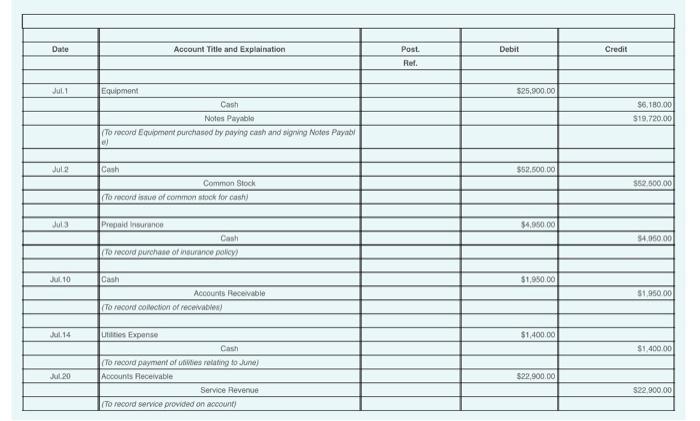

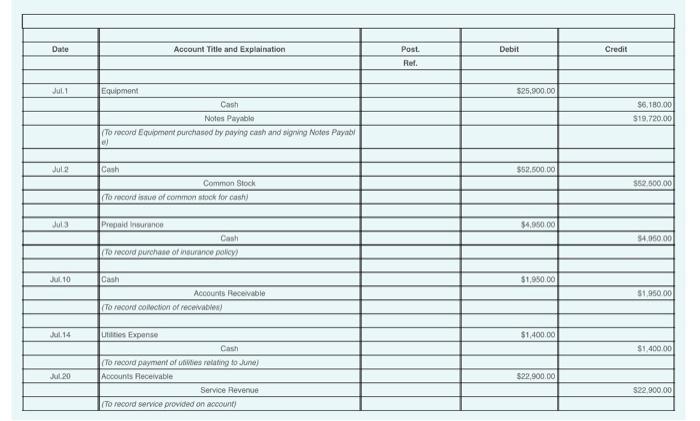

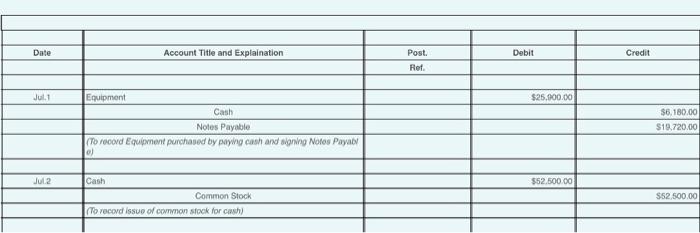

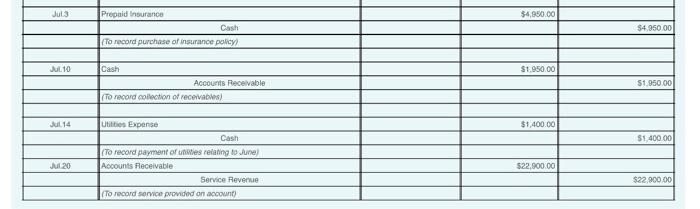

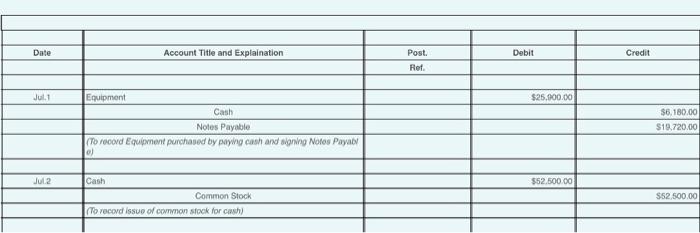

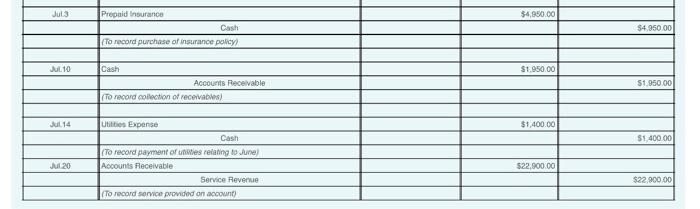

hello, i need help filling iut the rest of this journal entry, I've started on it, but my professor is telling me that thats not

hello, i need help filling iut the rest of this journal entry, I've started on it, but my professor is telling me that thats not all the journal entry there is so i just need help filling out the rest of the sheet. thank you

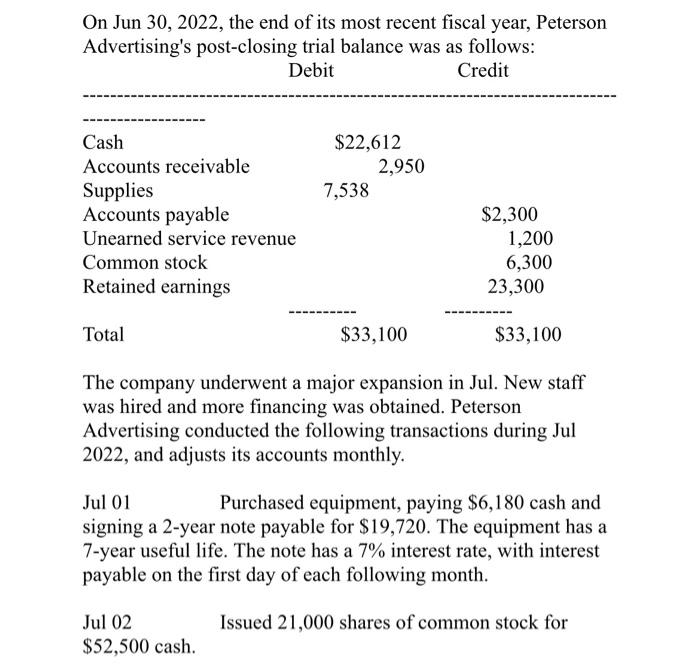

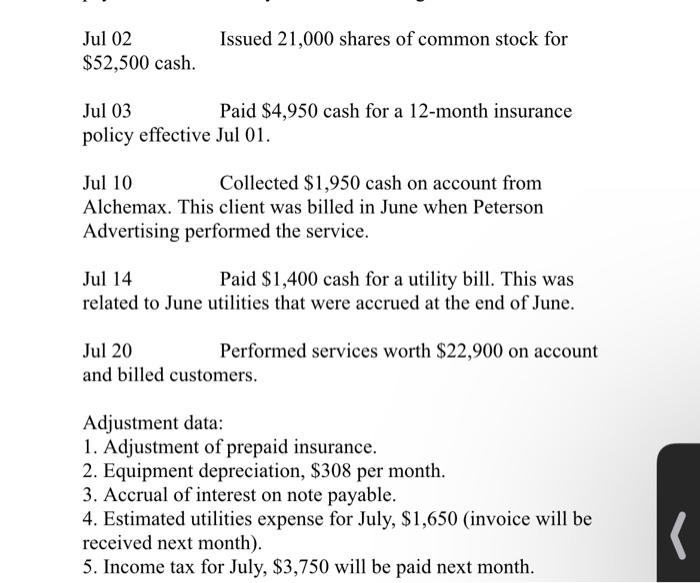

here is s clearer version of the questions!

hi i hope this is clear enough i think the picture was too bug but here i broke it down. i need help journalzing these transactions. as you can see from my first post i have already started and ive posted what i done below again. thank you!

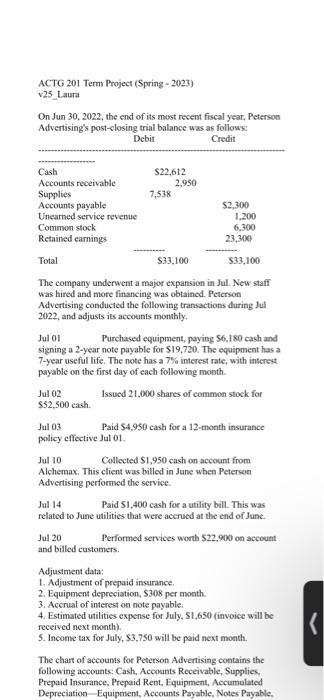

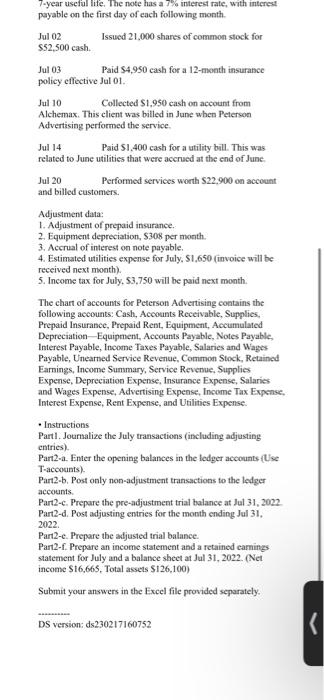

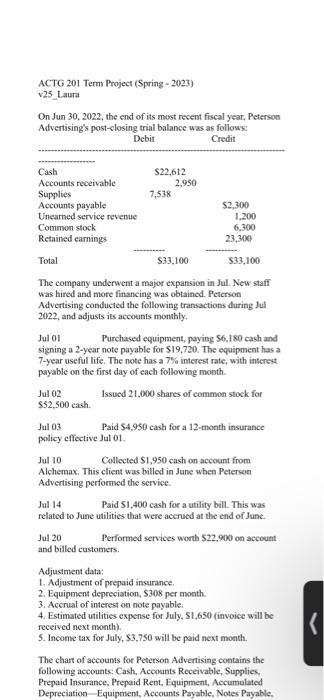

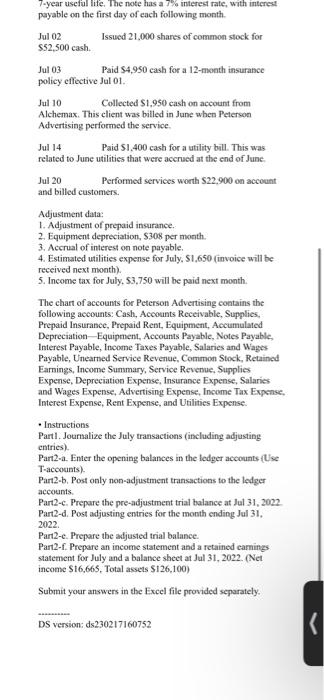

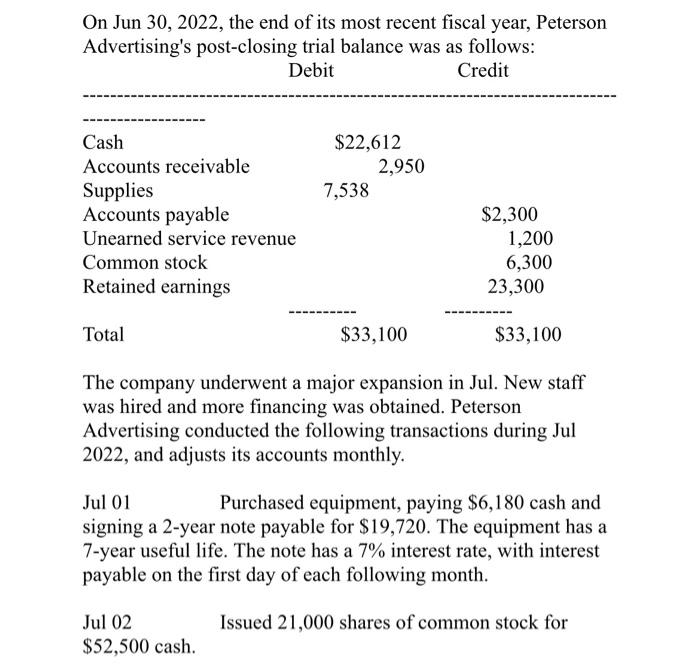

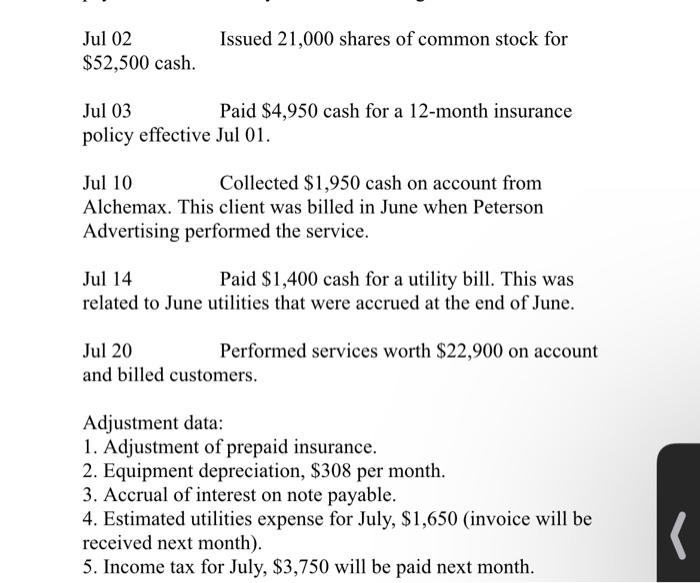

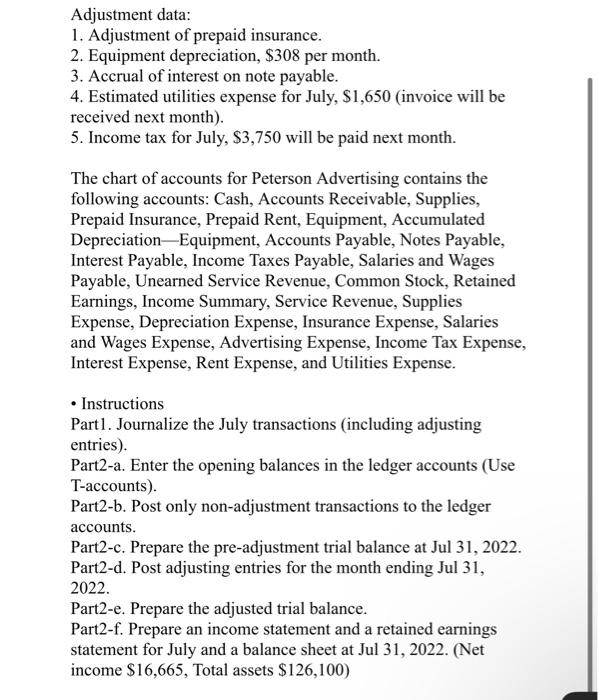

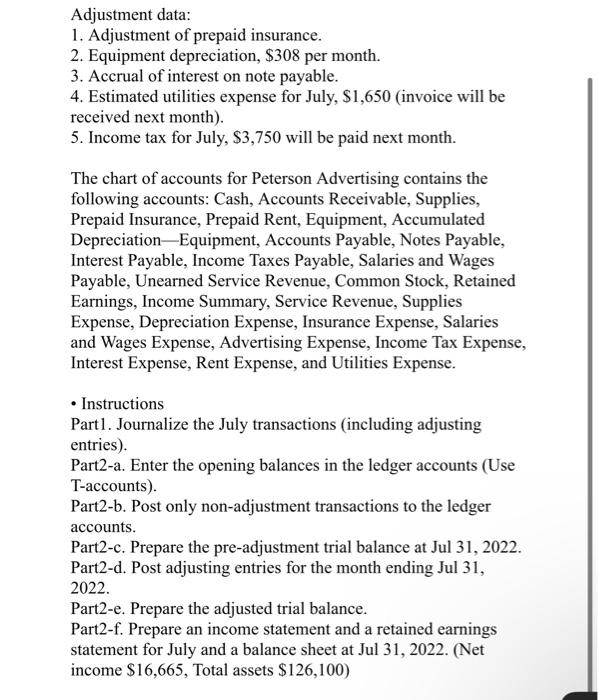

On Jan 30, 2022, the end of its most recent fiseal vear, Petersen Advertising's postclesing trial balance was as tollows. Debit Credt Cash \$22,612 Accounts recelvatie 2,950 Supples 7.53s Accounts payable $2,300 Uneared senvice revenue 1,200 Cammon stock 6,300 Aetained earnings 23,300 Total \$33,100 $33,100 The company underwent a major expansion in de. New staff was hired and more firancing was obtained. Peterson Advertising conducted the folowing transkefions daring Jul 2022, and adfusts its accounts monthly. Jud of Purchssed equipment, paying $5,180 cash and signing a 2-year note payable for $19720. The equipment has al 7 -year useful Me. The note has a 7% interest rase, with linterest puyable on the first day of each following month. Mai 02 lssued 22000 shares of common stock for $57,500 eash. Jul 03 Paid 54,950 cash tor a 12 -meonth insurance policy effective Jul o1. Jul 10 Collected 51,960 cash on accovint from Alchemax. This client was tilled in June when Peterson Advertising performed the service. Jal 14 Paid 51,400 carsh for a utility bie. This was relsted to June utlities that were accrued at the end of June. dul 20 Performed services worth $22,900 on account aed biled custenter. Ad istment data. 1. Adlustment of prepsid insurance. 2. Equipment depreciation, 530 per month. 3. Acerual of intecest en note oalyable. 4. Estimated uailites eipense fer Mly. 51,660 Ginvoice will be recoived next month). 5 . Income tax for July, $3,750 will be paid next month. The chart of accounts for Peterwon Advertising coetains the folswing asecunts: Cash, Accounts Heceivable, Supplies, Prepaid insurance. Prepaid Rent, Equipment, Accumulated Derreciation- Equipment, Accounts Payable. Notes Payable. kterest Payabit, incame Taxrs Payable. Sataries and Wages Payable, Unearned Service Pevenue. Common SAock, Hetained Iarnings, Income Sumthary. Service Revenue, Supplies Fxpense, Depreciation Expense, lnsurance Expense. Salaries and Wages Fxpense, Advertiting Expense, lnceme Fara Exponse, Intorest Expensie, Phent Expense, and Utilities. Expense - Instructions Part1. Journaife the dely transwetions fincluding adjasting entries?). For now I just need help journalizing these transacfiers, inchuding the dates, accesint tiths, and is debit or eredit thank youtti ACTG 201 Term Project (Spring - 2023) v25 Laura On Jun 30, 2022, the end of its most recent fiscal year, Peterson Advertising's post-closing trial balance was as follows: The company underwent a major expansion in Jul. New staff was hired and more financing was obtained. Peterson Advertising conducted the following transactions during Jul 2022 , and adjusts its accounts monthly. Jul 01 Purchased equipment, paying 56,180 cash and signing a 2-year note payable for $19,720. The equipment has a 7 -year useful life. The note has a 7% interest rate, with interest payable on the first day of each following month. Jul 02 Issued 21,000 shares of common stock for $52,500cash. Jul 03 Paid 44,950 cash for a 12-month insurance policy effective Jul 01 . Jul 10 Collected $1,950 cash on account from Alchemax. This client was billed in June when Peterson Advertising performed the service. Jal 14 Paid $1,400 cash for a utility bill. This was related to June utilities that were acereed at the end of June. Jul 20 Performed services worth $22,900 on acceunt and billed customers. Adjustment data: 1. Adjustment of prepaid insurance. 2. Equipment depreciation, $308 per month. 3. Acerual of interest on note payable. 4. Estimated utilities expense for July, S1,650 (invoice will be received next month). 5. Income tax for July, $3,750 will be paid next month. The chart of accounts for Peterson Advertising contains the following accounts: Cash, Accoants Receivable, Supplies, Prepaid Insurance, Prepaid Rent, Equipment, Accumulated Depreciation-Equipment, Accounts Payable, Notes Payable. 7 year usefal life. The note has a 7% interest rate, with interest payable on the first day of each following month. Jul 02 Issued 21,000 shares of common stock for $52,500 cash. Jul 03 Paid 54,950 cash for a 12 -month insurance policy effective Jul 01 . Jul 10 Collected $1,950 cash on account from Alchemax. This client was billed in June when Petersoa Advertising performed the service. Jul 14 Paid $1,400 cash for a utility bill. This was related to June utilities that were acerued at the end of June Jul 20 Performed services worth $22,900 on account and billed customers. Adjustment data: 1. Adjustment of prepaid insurance. 2. Equipment depreciation, $308 per month. 3. Accrual of interest on note payable. 4. Estimated utilities expense for July, $1,650 (invoice will be received next month). 5. Income tax for July, 53,750 will be paid next month. The chart of accounts for Peterson Advertising contains the following aceounts: Cash, Accotnts Receivable, Supplies, Prepaid Insurance, Prepaid Rent, Equipment, Accumulated Depreciation - Equipment, Accounts Payable, Notes Payable, Interest Payable, Income Taxes Payable, Salaries and Wages Payable, Unearned Service Revenue, Common Stock, Retained Earnings, Income Summary, Service Revenue, Supplies Expense, Depreciation Expense, Insurance Expense, Salaries and Wages Expense, Advertising Expense, Income Tax Expense, Interest Expense, Rent Expense, and Utilities Expense. - Instrections Part1. Joursalize the July transactions (including adjusting entries). Partz-a. Enter the opening balances in the ledger accounts (Use T-accounts). Part2-b. Post only non-adjustment transactions to the ledger accounts. Part2-c. Prepare the pre-adjustment trial balance at Jul 31, 2022 Part2-d. Post adjusting entries for the month ending Jul 31. 2022. Part2-e. Prepare the adjusied trial balance. Part2-f. Prepare an income statement and a retained carnings statement for July and a balance sheet at Jul 31, 2022. (Net income $16,665. Total assets $126,100 ) Submit your answers in the Exeel file provided separately. DS version: ds230217160752 On Jun 30, 2022, the end of its most recent fiscal year, Peterson Advertising's post-closing trial balance was as follows: Debit Credit The company underwent a major expansion in Jul. New staff was hired and more financing was obtained. Peterson Advertising conducted the following transactions during Jul 2022 , and adjusts its accounts monthly. Jul 01 Purchased equipment, paying $6,180 cash and signing a 2 -year note payable for $19,720. The equipment has a 7 -year useful life. The note has a 7% interest rate, with interest payable on the first day of each following month. Jul 02 Issued 21,000 shares of common stock for $52,500 cash. Jul 02 Issued 21,000 shares of common stock for $52,500 cash. Jul 03 Paid $4,950 cash for a 12-month insurance policy effective Jul 01. Jul 10 Collected $1,950 cash on account from Alchemax. This client was billed in June when Peterson Advertising performed the service. Jul 14 Paid $1,400 cash for a utility bill. This was related to June utilities that were accrued at the end of June. Jul 20 Performed services worth $22,900 on account and billed customers. Adjustment data: 1. Adjustment of prepaid insurance. 2. Equipment depreciation, $308 per month. 3. Accrual of interest on note payable. 4. Estimated utilities expense for July, $1,650 (invoice will be received next month). Adjustment data: 1. Adjustment of prepaid insurance. 2. Equipment depreciation, $308 per month. 3. Accrual of interest on note payable. 4. Estimated utilities expense for July, $1,650 (invoice will be received next month). 5. Income tax for July, $3,750 will be paid next month. The chart of accounts for Peterson Advertising contains the following accounts: Cash, Accounts Receivable, Supplies, Prepaid Insurance, Prepaid Rent, Equipment, Accumulated Depreciation-Equipment, Accounts Payable, Notes Payable, Interest Payable, Income Taxes Payable, Salaries and Wages Payable, Unearned Service Revenue, Common Stock, Retained Earnings, Income Summary, Service Revenue, Supplies Expense, Depreciation Expense, Insurance Expense, Salaries and Wages Expense, Advertising Expense, Income Tax Expense, Interest Expense, Rent Expense, and Utilities Expense. - Instructions Part1. Journalize the July transactions (including adjusting entries). Part2-a. Enter the opening balances in the ledger accounts (Use T-accounts). Part2-b. Post only non-adjustment transactions to the ledger accounts. Part2-c. Prepare the pre-adjustment trial balance at Jul 31, 2022. Part2-d. Post adjusting entries for the month ending Jul 31, 2022. Part2-e. Prepare the adjusted trial balance. Part2-f. Prepare an income statement and a retained earnings statement for July and a balance sheet at Jul 31, 2022. (Net income $16,665, Total assets $126,100 )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started