Answered step by step

Verified Expert Solution

Question

1 Approved Answer

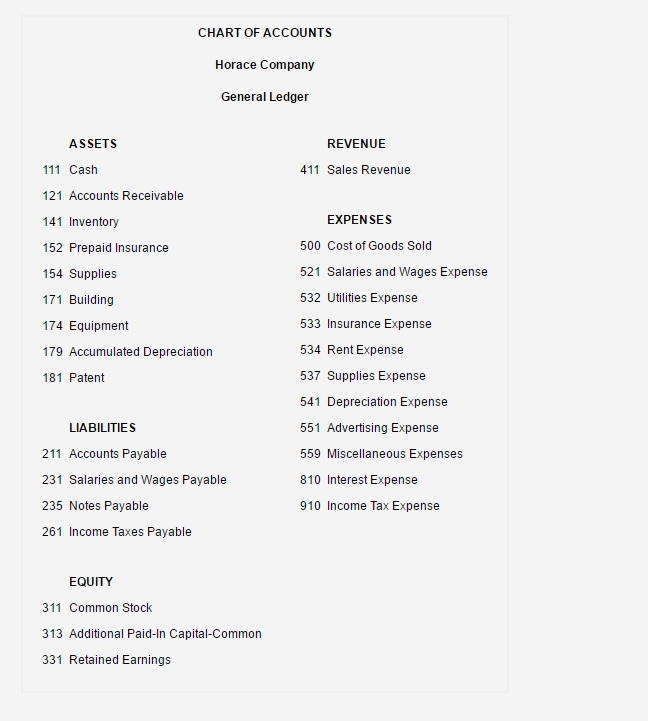

Hello i need help filling out this journal entry. I have attached the chart of accounts so please use the terms listed in there...any other

Hello i need help filling out this journal entry. I have attached the chart of accounts so please use the terms listed in there...any other terms will not be counted as correct by the grading system. Thanks!

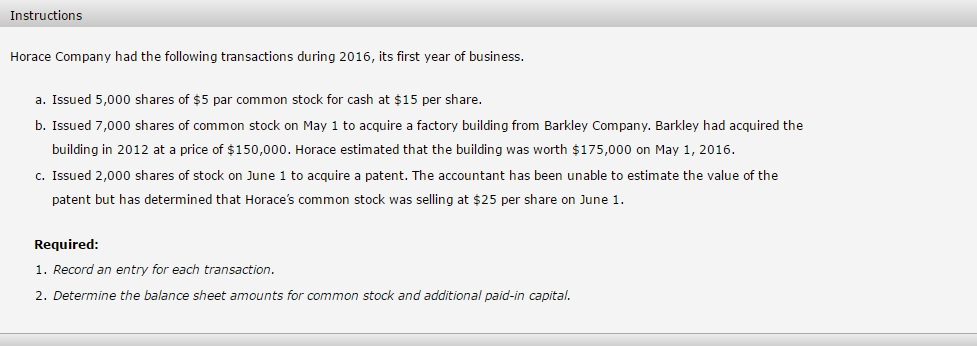

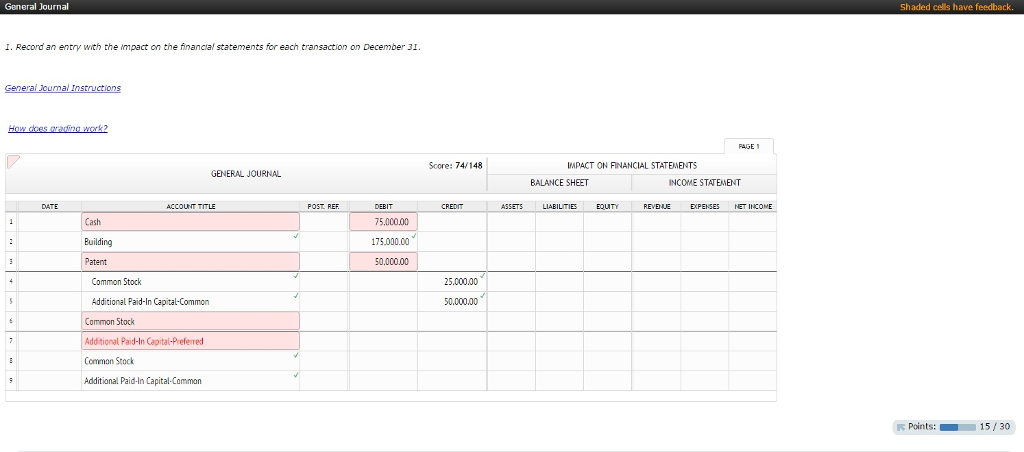

Instructions Horace Company had the following transactions during 2016, its first year of business. a. Issued 5,000 shares of $5 par common stock for cash at $15 per share. b. Issued 7,000 shares of common stock on May 1 to acquire a factory building from Barkley Company. Barkley had acquired the building in 2012 at a price of $150,000. Horace estimated that the building was worth $175,000 on May 1, 2016. c. Issued 2,000 shares of stock on June 1 to acquire a patent. The accountant has been unable to estimate the value of the patent but has determined that Horace's common stock was selling at $25 per share on June 1. Required: 1. Record an entry for each transaction. 2. Determine the balance sheet amounts for common stock and additional paid-in capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started