Answered step by step

Verified Expert Solution

Question

1 Approved Answer

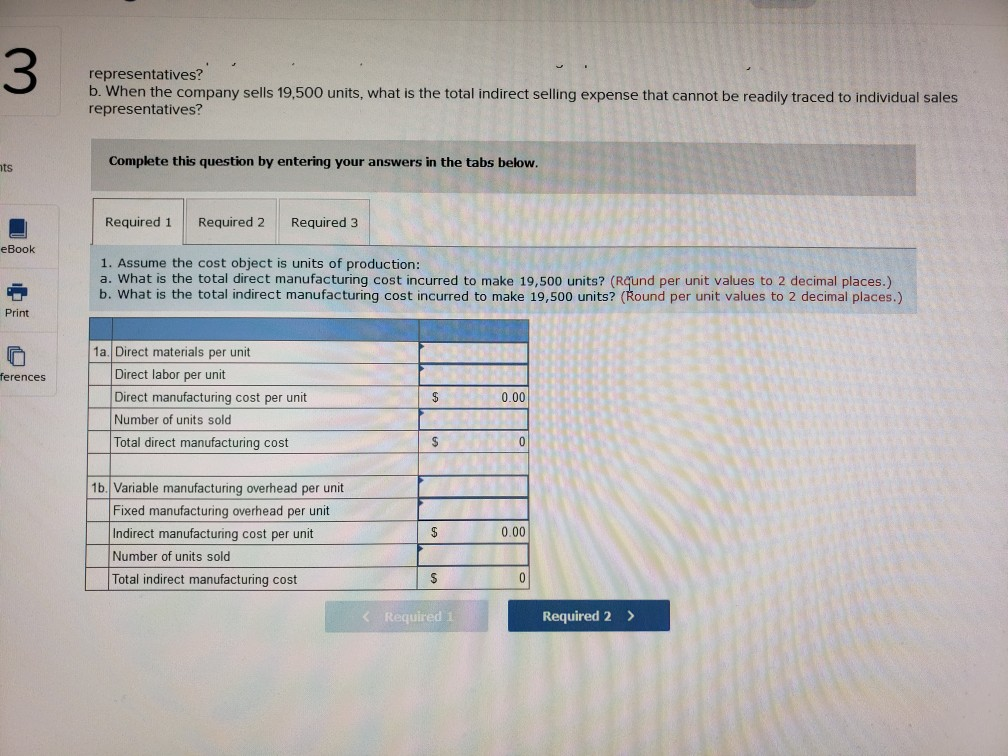

Hello, I need help on solving this. Thank you 3 representatives? b. When the company sells 19,500 units, what is the total indirect selling expense

Hello, I need help on solving this. Thank you

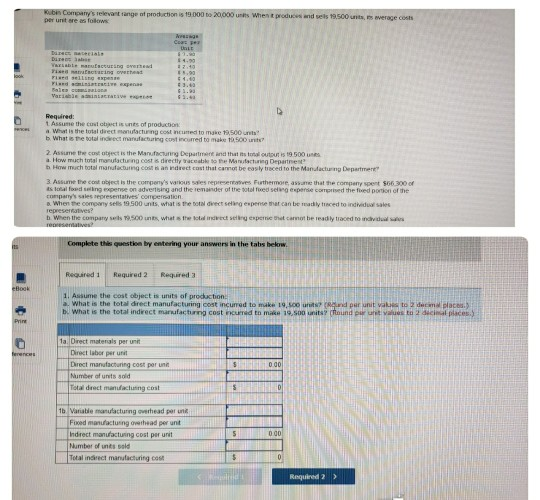

3 representatives? b. When the company sells 19,500 units, what is the total indirect selling expense that cannot be readily traced to individual sales representatives? its Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 eBook 1. Assume the cost object is units of production: a. What is the total direct manufacturing cost incurred to make 19,500 units? (Rqund per unit values to 2 decimal places.) b. What is the total indirect manufacturing cost incurred to make 19,500 units? (Round per unit values to 2 decimal places.) Print ferences 1a. Direct materials per unit Direct labor per unit Direct manufacturing cost per unit Number of units sold Total direct manufacturing cost $ 0.00 $ 0 1b. Variable manufacturing overhead per unit Fixed manufacturing overhead per unit Indirect manufacturing cost per unit Number of units sold Total indirect manufacturing cost $ 0.00 $ 0 Kubin Company's relevant range of production is 19.000 to 20,000 units When it produce and sels 19.500 units werage costs per untere as fotos Descate Direct Vezi maructuring in het Fixed selle spese Videa Course UE 8. 12.10 E. 14.00 3. 1. Var Required: t. Assume the colorisnes of production What is the total direct mutacturing cost incurred to make 19,500 b. What is the wool indeed manufacturing cost incurred to make 19,500 2. Assume the cost object is the Manufacturing Department and that solutis 19 500 S a. How much totalmorutacturing costs directly traces to the Manufacturing Department How much total manufacturing com an drect cost that cannot be easily traced to the Manufacturing Department 3. Assume the cost object in the company's various sales representatives Puthermore, and that the company spent $66.300 of Is Total dating expere on advertising and the remainder of the total for selge pense corried the feed portion of the company's sales representatives compensation a. When the company sells 19 500 units what is the total direct seling expense that can be madly traced to individuale representatives? b. When the company was 9.500 units what the old direct selling experie the camothe leadily traced to individual resentatives? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required eBook 1. Assume the cost object is units of production What is the total direct manufacturing cost incurred to make 19.00 und per unit values to decid lacus. bu What is the total indirect manufacturing cost incurred to make 10,500 units? (found our une values to 2 decimal places.) Print ferences 1a. Direct materials per unit Direct labor per un Direct manufacturing cost per un Number of units sold Total direct manufacturing cost 5 000 $ 1b Variable manufacturing overhead porn Fixed manufacturing whead perunt Indirect manufacturing cost per unit Number of uns sold Total indirect manufacturing con 000 0 Required 2 > 3 representatives? b. When the company sells 19,500 units, what is the total indirect selling expense that cannot be readily traced to individual sales representatives? its Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 eBook 1. Assume the cost object is units of production: a. What is the total direct manufacturing cost incurred to make 19,500 units? (Rqund per unit values to 2 decimal places.) b. What is the total indirect manufacturing cost incurred to make 19,500 units? (Round per unit values to 2 decimal places.) Print ferences 1a. Direct materials per unit Direct labor per unit Direct manufacturing cost per unit Number of units sold Total direct manufacturing cost $ 0.00 $ 0 1b. Variable manufacturing overhead per unit Fixed manufacturing overhead per unit Indirect manufacturing cost per unit Number of units sold Total indirect manufacturing cost $ 0.00 $ 0 Kubin Company's relevant range of production is 19.000 to 20,000 units When it produce and sels 19.500 units werage costs per untere as fotos Descate Direct Vezi maructuring in het Fixed selle spese Videa Course UE 8. 12.10 E. 14.00 3. 1. Var Required: t. Assume the colorisnes of production What is the total direct mutacturing cost incurred to make 19,500 b. What is the wool indeed manufacturing cost incurred to make 19,500 2. Assume the cost object is the Manufacturing Department and that solutis 19 500 S a. How much totalmorutacturing costs directly traces to the Manufacturing Department How much total manufacturing com an drect cost that cannot be easily traced to the Manufacturing Department 3. Assume the cost object in the company's various sales representatives Puthermore, and that the company spent $66.300 of Is Total dating expere on advertising and the remainder of the total for selge pense corried the feed portion of the company's sales representatives compensation a. When the company sells 19 500 units what is the total direct seling expense that can be madly traced to individuale representatives? b. When the company was 9.500 units what the old direct selling experie the camothe leadily traced to individual resentatives? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required eBook 1. Assume the cost object is units of production What is the total direct manufacturing cost incurred to make 19.00 und per unit values to decid lacus. bu What is the total indirect manufacturing cost incurred to make 10,500 units? (found our une values to 2 decimal places.) Print ferences 1a. Direct materials per unit Direct labor per un Direct manufacturing cost per un Number of units sold Total direct manufacturing cost 5 000 $ 1b Variable manufacturing overhead porn Fixed manufacturing whead perunt Indirect manufacturing cost per unit Number of uns sold Total indirect manufacturing con 000 0 Required 2 >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started