Answered step by step

Verified Expert Solution

Question

1 Approved Answer

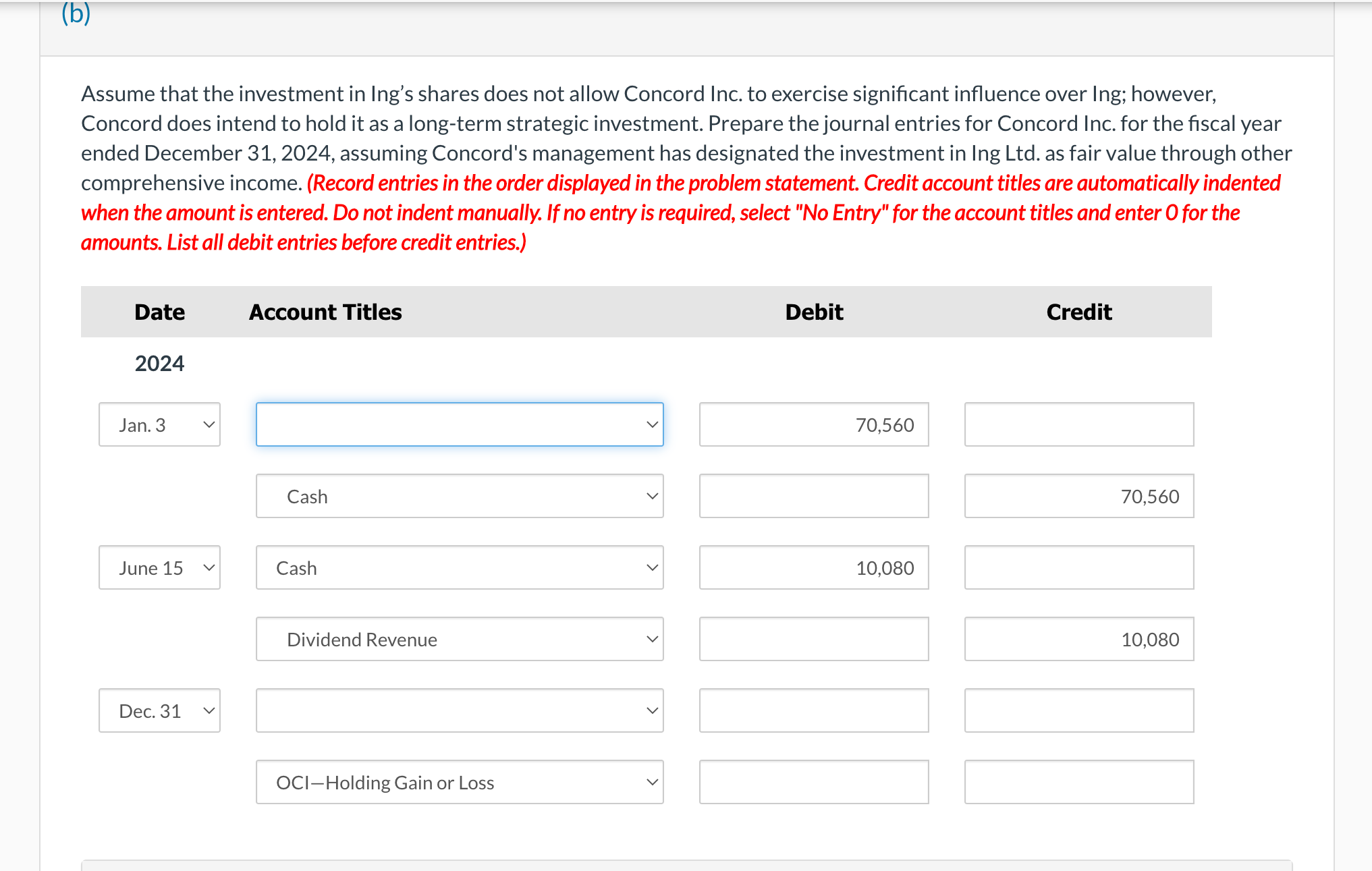

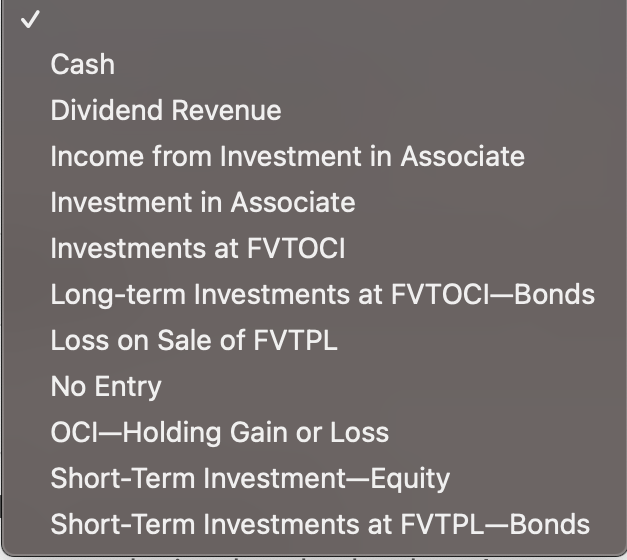

hello i need help on the last part and the last picture shows the titles that should be put in the entries Assume that the

hello i need help on the last part and the last picture shows the titles that should be put in the entries

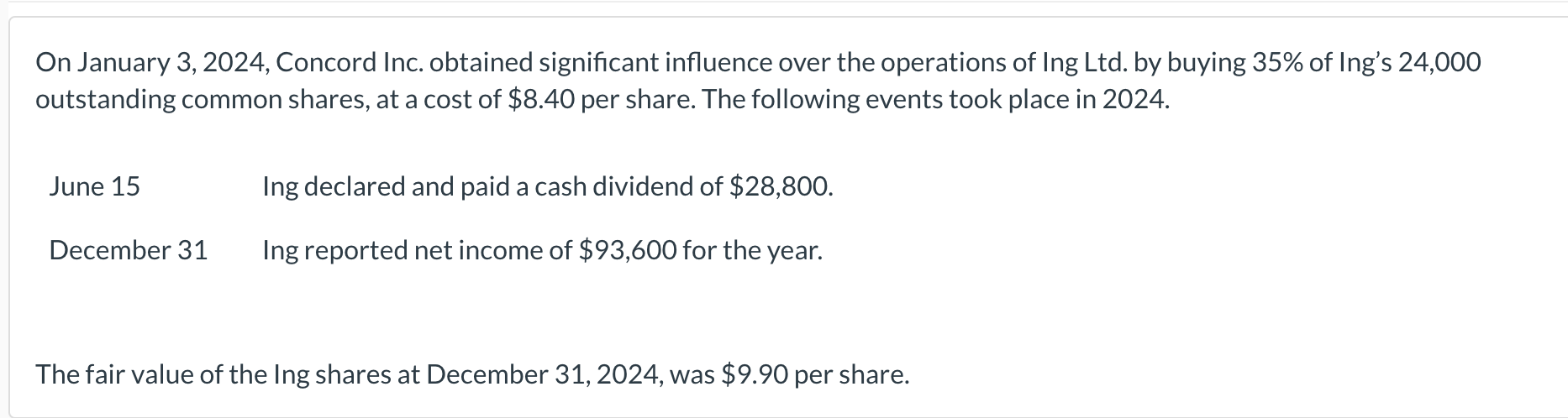

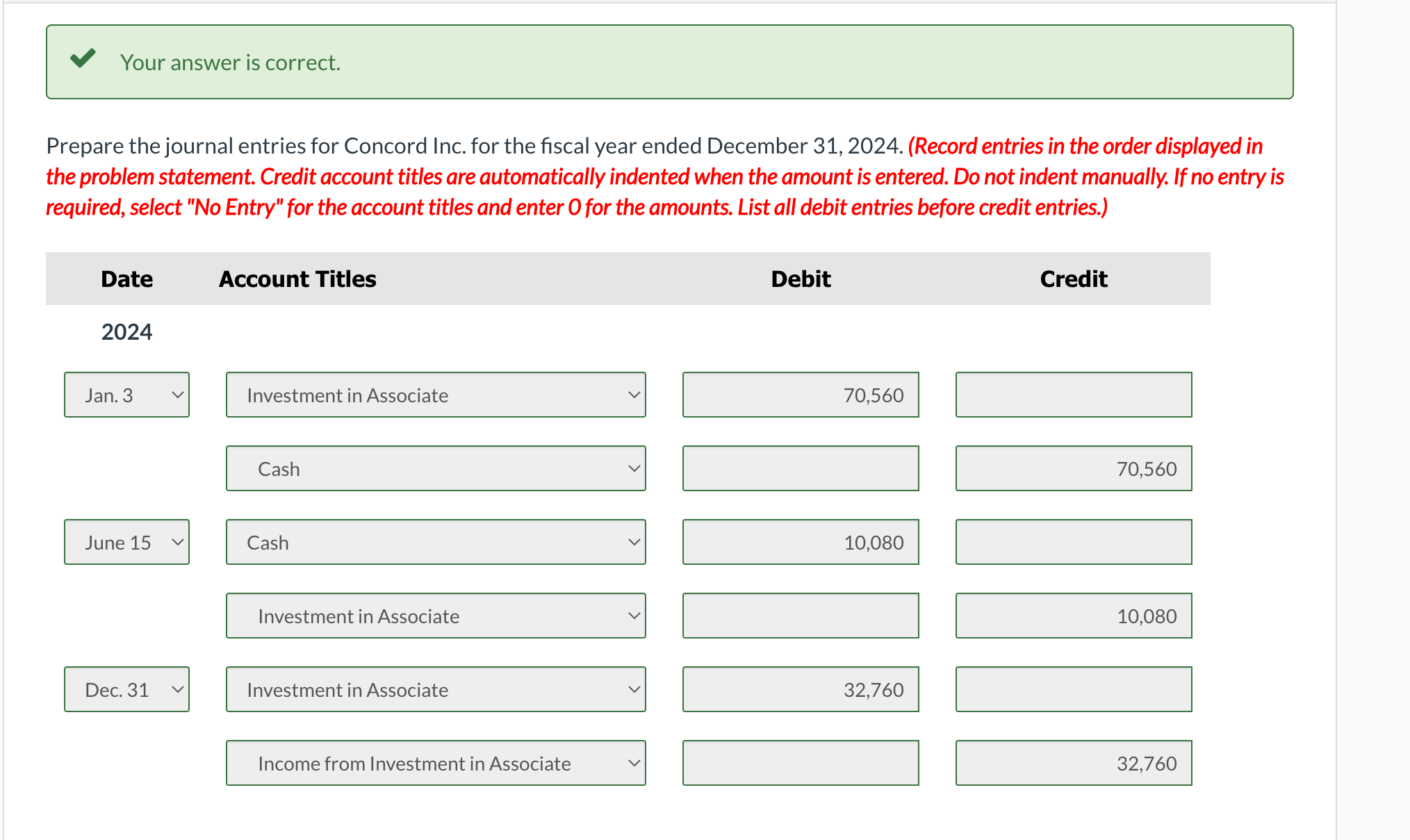

Assume that the investment in Ing's shares does not allow Concord Inc. to exercise significant influence over Ing; however, Concord does intend to hold it as a long-term strategic investment. Prepare the journal entries for Concord Inc. for the fiscal year ended December 31, 2024, assuming Concord's management has designated the investment in Ing Ltd. as fair value through other comprehensive income. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Your answer is correct. Prepare the journal entries for Concord Inc. for the fiscal year ended December 31, 2024. (Record entries in the order displayed in the problem statement. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) On January 3, 2024, Concord Inc. obtained significant influence over the operations of Ing Ltd. by buying 35\% of Ing's 24,000 outstanding common shares, at a cost of $8.40 per share. The following events took place in 2024 . June 15 Ing declared and paid a cash dividend of $28,800. December 31 Ing reported net income of $93,600 for the year. The fair value of the Ing shares at December 31,2024 , was $9.90 per share. Cash Dividend Revenue Income from Investment in Associate Investment in Associate Investments at FVTOCI Long-term Investments at FVTOCl-Bonds Loss on Sale of FVTPL No Entry OCl-Holding Gain or Loss Short-Term Investment-Equity Short-Term Investments at FVTPL-BondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started