Answered step by step

Verified Expert Solution

Question

1 Approved Answer

hello, i need help with 1-4, and number 6 please. Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and

hello, i need help with 1-4, and number 6 please.

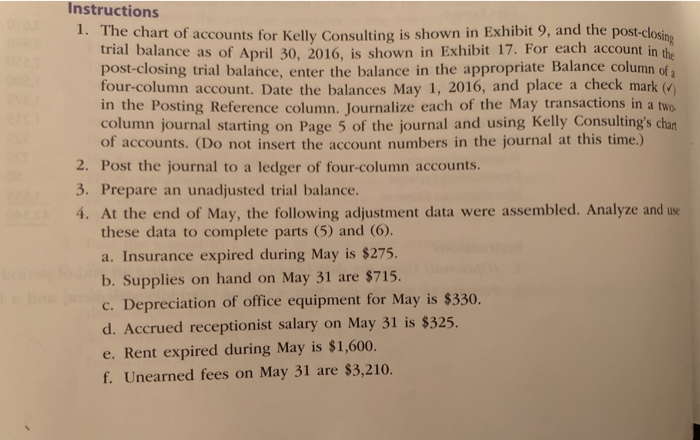

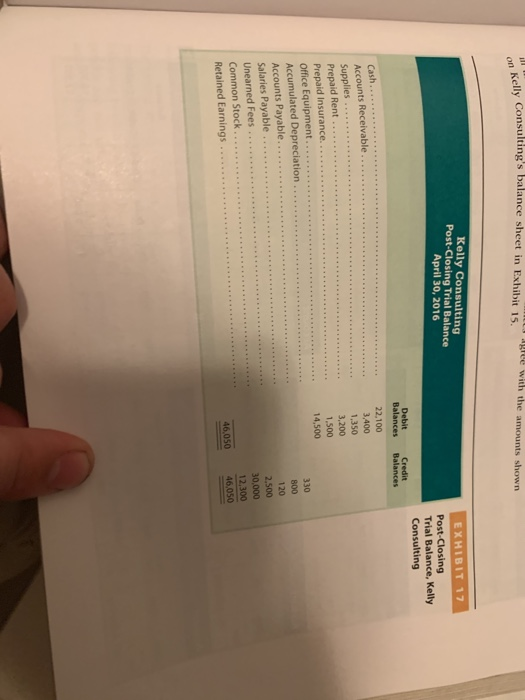

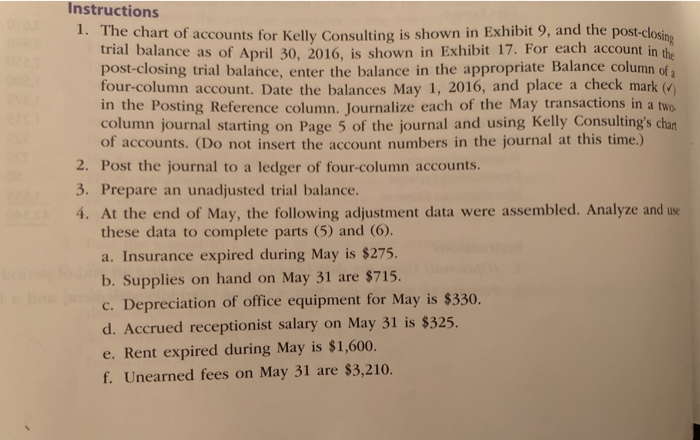

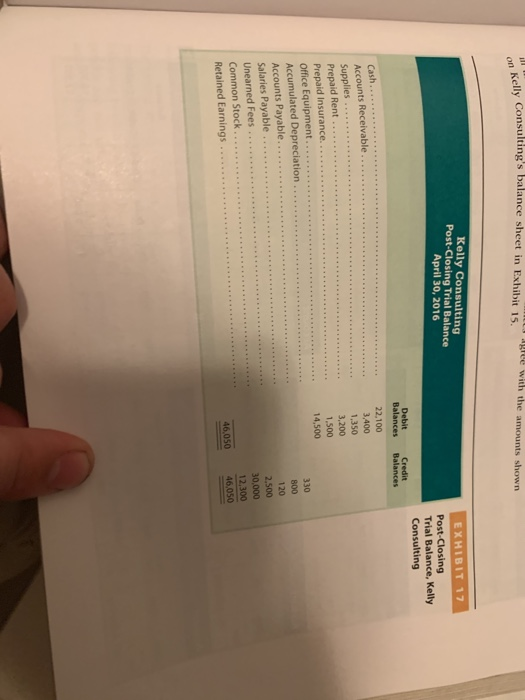

Instructions 1. The chart of accounts for Kelly Consulting is shown in Exhibit 9, and the post-closing trial balance as of April 30, 2016, is shown in Exhibit 17. For each account in the post-closing trial balahce, enter the balance in the appropriate Balance column of four-column account. Date the balances May 1, 2016, and place a check mark ( in the Posting Reference column. Journalize each of the May transactions in a two column journal starting on Page 5 of the journal and using Kelly Consulting's chan of accounts. (Do not insert the account numbers in the journal at this time.) 2. Post the journal to a ledger of four-column accounts. 3. Prepare an unadjusted trial balance. 4. At the end of May, the following adjustment data were assembled. Analyze and use these data to complete parts (5) and (6) a. Insurance expired during May is $275 b. Supplies on hand on May 31 are $715. c. Depreciation of office equipment for May is $330. d. Accrued receptionist salary on May 31 is $325. e. Rent expired during May is $1,600. f. Unearned fees on May 31 are $3,210. Younalie and gpos the adjusting entries Record the adjusting entries on Page 7 of the jpurnal on Kelly Kelly Consulting's balance sheet in Exhibit 15. Kelly Consulting Post-Closing Trial Balance April 30, 2016 EXHIBIT 17 Post-Closing Trial Balance, Kelly Consulting Debit Credit Balances Balances Cash 22,100 3,400 1,350 3,200 1,500 14,500 ccounts Receivable.... Supplies . Accum ulated Depreciation . 120 30,000 12,300 46,050 46.050

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started