Answered step by step

Verified Expert Solution

Question

1 Approved Answer

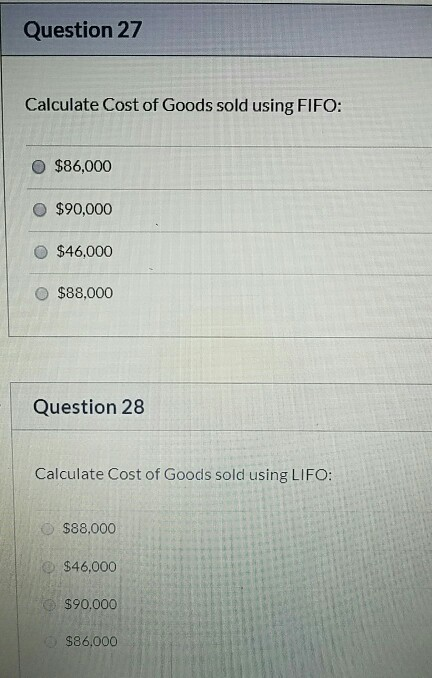

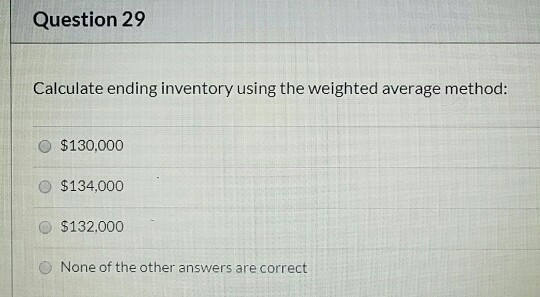

hello, I need help with 27, 28, 29, and 30 please and thank you :) is his enough information? Question 27 Calculate Cost of Goods

hello, I need help with 27, 28, 29, and 30 please and thank you :)

is his enough information?

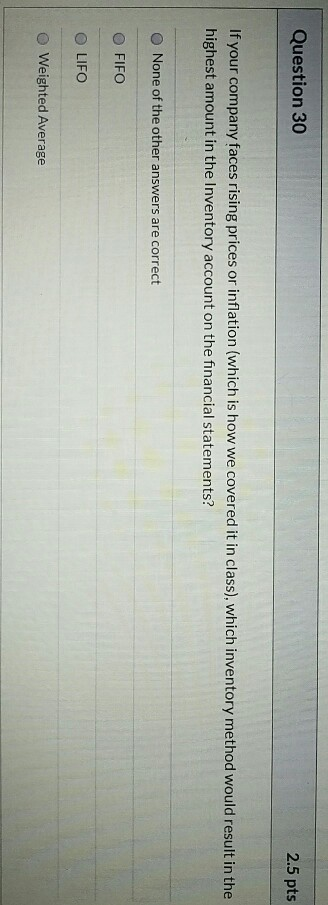

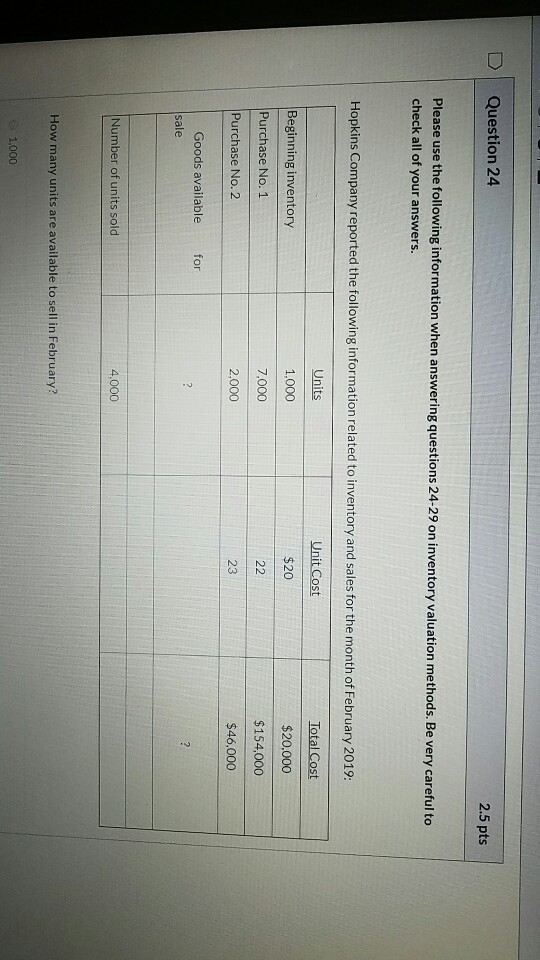

Question 27 Calculate Cost of Goods sold using FIFO: $86,000 $90,000 $46.000 $88,000 Question 28 Calculate Cost of Goods sold using LIFO: $88.000 $46,000 $90.000 $86,000 Question 29 Calculate ending inventory using the weighted average method: $130,000 $134,000 $132.000 None of the other answers are correct Question 30 2.5 pts If your company faces rising prices or inflation (which is how we covered it in class), which inventory method would result in the highest amount in the Inventory account on the financial statements? None of the other answers are correct FIFO LIFO Weighted Average Question 24 2.5 pts Please use the following information when answering questions 24-29 on inventory valuation methods. Be very careful to check all of your answers. Hopkins Company reported the following information related to inventory and sales for the month of February 2019: Units Unit Cost Total Cost Beginning inventory 1,000 $20 $20.000 Purchase No. 1 7,000 22 $154,000 Purchase No. 2 2.000 23 $46,000 for Goods available sale ? Number of units sold 4,000 How many units are available to sell in February? 1,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started