Hello, I need help with questions 1,2 and 3.

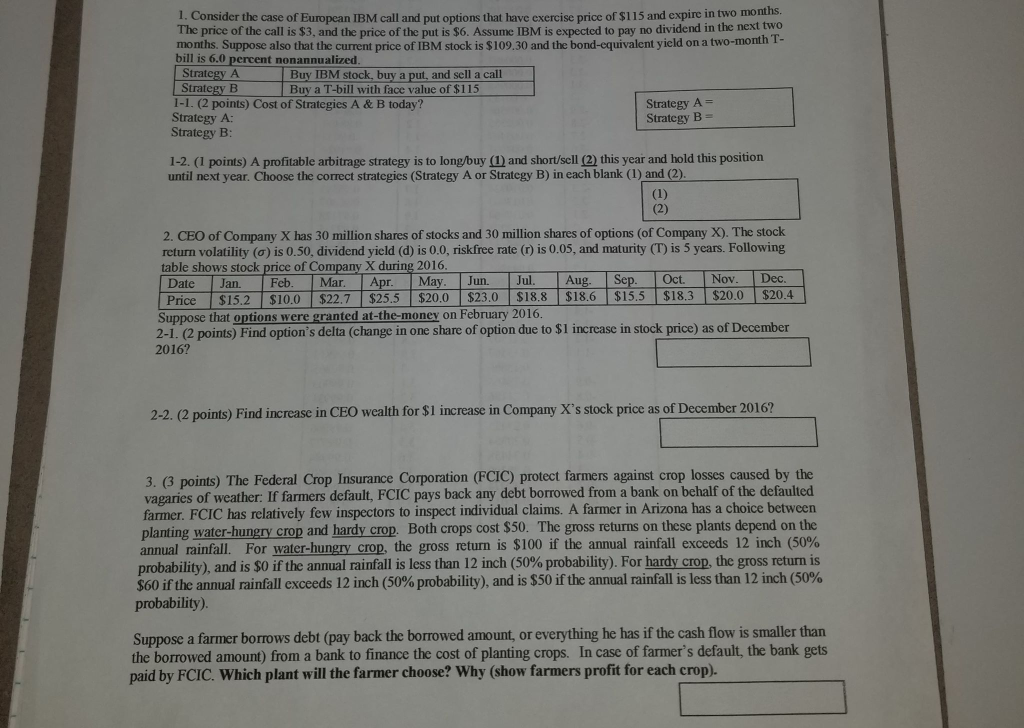

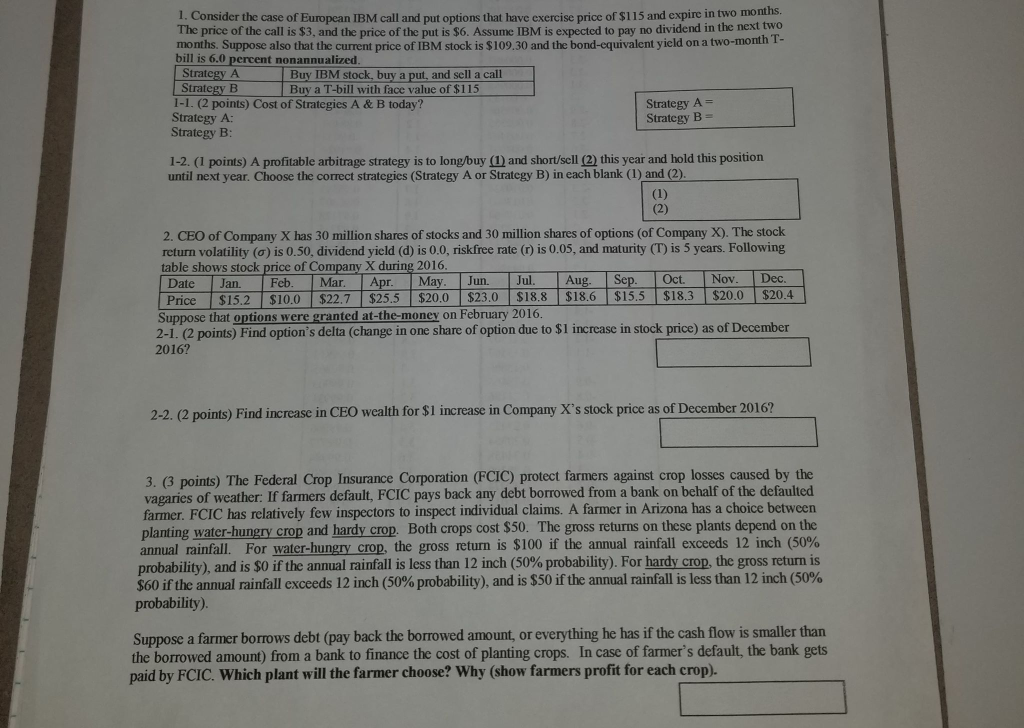

1. Consider the case of European IBM call and put options that have exercise price of $115 and expire in two months. The price of the call is $3, and the price of the put is $6. Assume IBM is expected to pay no dividend in the next two months. Suppose also that the current price of IBM stock is $109,30 and the bond-equivalent yield on a two-month 1- bill is 6.0 percent nonannualized. Strategy A Buy IBM stock, buy a put, and sell a call Strategy B Buy a T-bill with face value of $115 1-1. (2 points) Cost of Strategies A & B today? Strategy A= Strategy A: Strategy B = Strategy B: 1-2. (1 points) A profitable arbitrage strategy is to long/buy (1) and short/sell (2) this year and hold this position until next year. Choose the correct strategies (Strategy A or Strategy B) in each blank (1) and (2). ( (2) 2. CEO of Company X has 30 million shares of stocks and 30 million shares of options (of Company X). The stock return volatility () is 0.50, dividend yield (d) is 0.0, riskfree rate () is 0.05, and maturity (T) is 5 years. Following table shows stock price of Company X during 2016. Date Jan Feb Mar Apr May Jun Jul Aug Sep Oct. Nov. Dec. Price $15.2 S10.0 $22.7 $25.5 $20,0 $23.0 $18,8 $18.6 $15.5 $18.3 $20.0 $20.4 Suppose that options were granted at-the-money on February 2016. 2-1. (2 points) Find option's delta (change in one share of option due to $1 increase in stock price) as of December 2016? 2-2. (2 points) Find increase in CEO wealth for $l increase in Company X's stock price as of December 2016? 3. (3 points) The Federal Crop Insurance Corporation (FCIC) protect farmers against crop losses caused by the vagares of weather: If farmers default, FCIC pays back any debt borrowed from a bank on behalf of the defaulted farmer. FCIC has relatively few inspectors to inspect individual claims. A farmer in Arizona has a choice between planting water-hungry crop and hardy crop. Both crops cost $50. The gross returns on these plants depend on the annual rainfall. For water-hungry crop, the gross return is $100 if the annual rainfall exceeds 12 inch (50% probability), and is $0 if the annual rainfall is less than 12 inch (50% probability). For hardy crop, the gross return is $60 if the annual rainfall exceeds 12 inch (50% probability), and is $50 if the annual rainfall is less than 12 inch (50% probability). Suppose a farmer borrows debt (pay back the borrowed amount, or everything he has if the cash flow is smaller than the borrowed amount) from a bank to finance the cost of planting crops. In case of farmer's default, the bank gets paid by FCIC. Which plant will the farmer choose? Why (show farmers profit for each crop). 1. Consider the case of European IBM call and put options that have exercise price of $115 and expire in two months. The price of the call is $3, and the price of the put is $6. Assume IBM is expected to pay no dividend in the next two months. Suppose also that the current price of IBM stock is $109,30 and the bond-equivalent yield on a two-month 1- bill is 6.0 percent nonannualized. Strategy A Buy IBM stock, buy a put, and sell a call Strategy B Buy a T-bill with face value of $115 1-1. (2 points) Cost of Strategies A & B today? Strategy A= Strategy A: Strategy B = Strategy B: 1-2. (1 points) A profitable arbitrage strategy is to long/buy (1) and short/sell (2) this year and hold this position until next year. Choose the correct strategies (Strategy A or Strategy B) in each blank (1) and (2). ( (2) 2. CEO of Company X has 30 million shares of stocks and 30 million shares of options (of Company X). The stock return volatility () is 0.50, dividend yield (d) is 0.0, riskfree rate () is 0.05, and maturity (T) is 5 years. Following table shows stock price of Company X during 2016. Date Jan Feb Mar Apr May Jun Jul Aug Sep Oct. Nov. Dec. Price $15.2 S10.0 $22.7 $25.5 $20,0 $23.0 $18,8 $18.6 $15.5 $18.3 $20.0 $20.4 Suppose that options were granted at-the-money on February 2016. 2-1. (2 points) Find option's delta (change in one share of option due to $1 increase in stock price) as of December 2016? 2-2. (2 points) Find increase in CEO wealth for $l increase in Company X's stock price as of December 2016? 3. (3 points) The Federal Crop Insurance Corporation (FCIC) protect farmers against crop losses caused by the vagares of weather: If farmers default, FCIC pays back any debt borrowed from a bank on behalf of the defaulted farmer. FCIC has relatively few inspectors to inspect individual claims. A farmer in Arizona has a choice between planting water-hungry crop and hardy crop. Both crops cost $50. The gross returns on these plants depend on the annual rainfall. For water-hungry crop, the gross return is $100 if the annual rainfall exceeds 12 inch (50% probability), and is $0 if the annual rainfall is less than 12 inch (50% probability). For hardy crop, the gross return is $60 if the annual rainfall exceeds 12 inch (50% probability), and is $50 if the annual rainfall is less than 12 inch (50% probability). Suppose a farmer borrows debt (pay back the borrowed amount, or everything he has if the cash flow is smaller than the borrowed amount) from a bank to finance the cost of planting crops. In case of farmer's default, the bank gets paid by FCIC. Which plant will the farmer choose? Why (show farmers profit for each crop)