Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I need help with the following correcting entries: Step 1 requires two entries: A) Record the entry to correct the error in recording equipment.

Hello, I need help with the following correcting entries:

Step 1 requires two entries: A) Record the entry to correct the error in recording equipment. B) Record the entry to correct the error in land improvements.

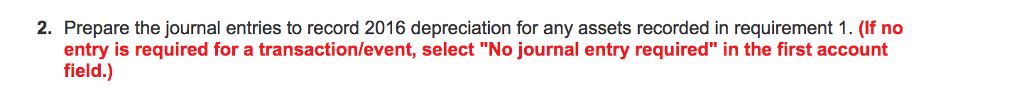

Step 2 requires one entry: Record the entry for the depreciation of the assets in requirement 1 for 2016.

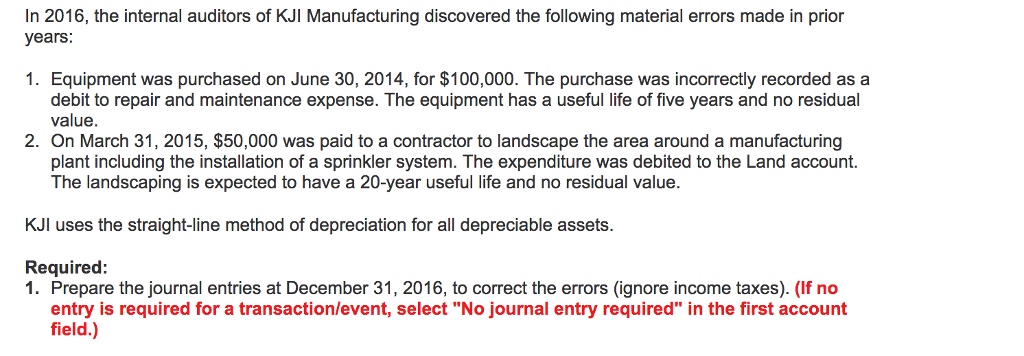

n 2016, the internal auditors of KJl Manufacturing discovered the following material errors made in prior years: 1. Equipment was purchased on June 30, 2014, for $100,000. The purchase was incorrectly recorded as a debit to repair and maintenance expense. The equipment has a useful life of five years and no residual value. 2. On March 31, 2015, $50,000 was paid to a contractor to landscape the area around a manufacturing plant including the installation of a sprinkler system. The expenditure was debited to the Land account. The landscaping is expected to have a 20-year useful life and no residual value. KJl uses the straight-line method of depreciation for all depreciable assets. Required: 1. Prepare the journal entries at December 31, 2016, to correct the errors (ignore income taxes). (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started