hello,

i need help with the rest of requirement 4 through six. i have provided all previous information and work. please help. thanks so much

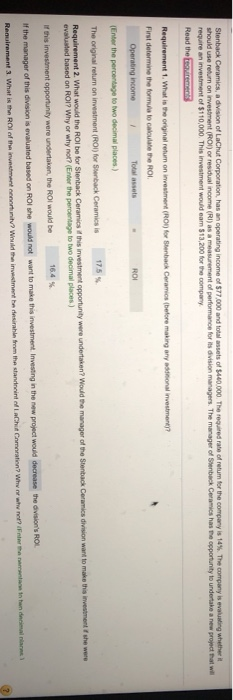

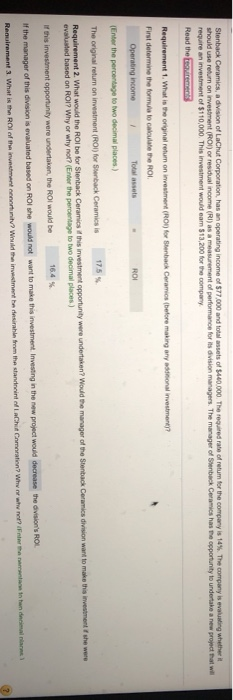

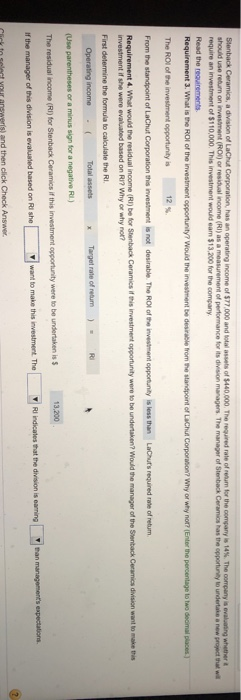

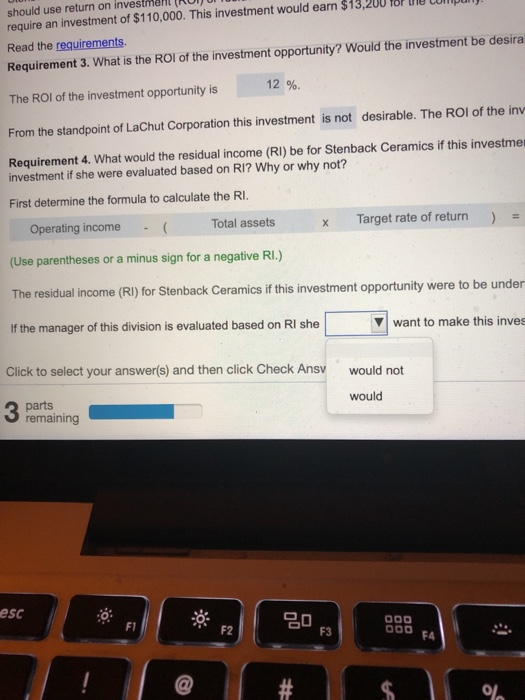

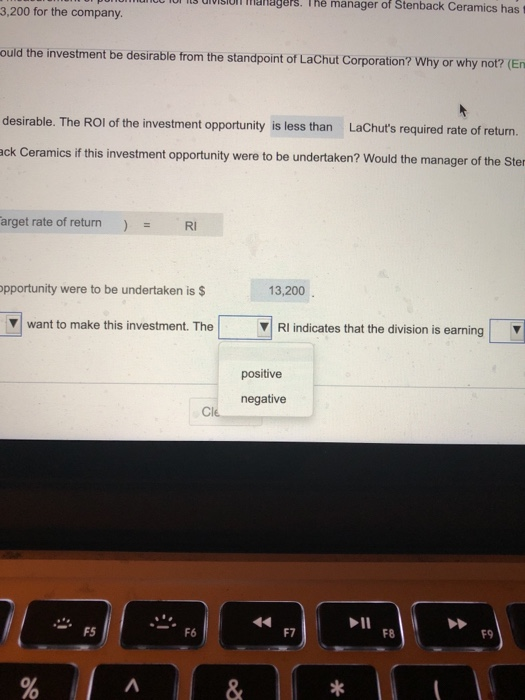

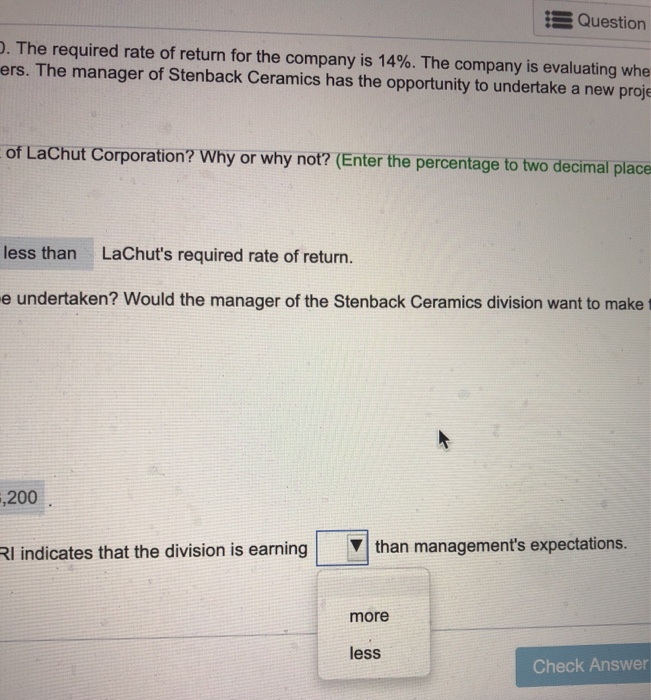

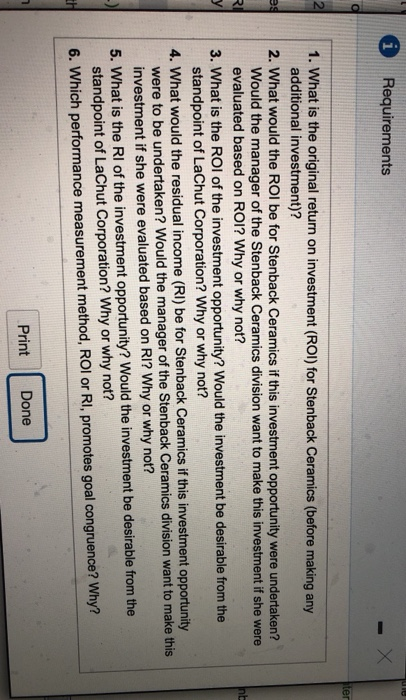

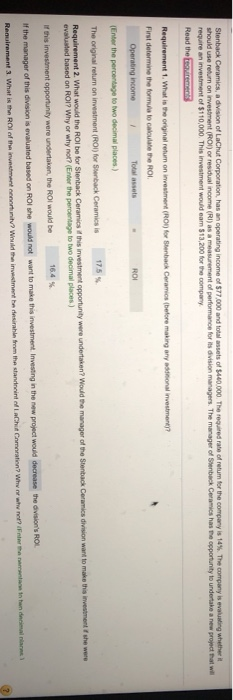

Stenback Ceramics, a division of LaChut Corporation, has an operating income of $77.000 and total assets of $440.000 The required rate of retum for the company is 14 % The company is evaluating whether it should use return on investment (RO) or residual income (RI) as a measurement of performance for its division managers. The manager of Stenback Ceramics has the opportunity to undertake a new project that will require an investment of $110,000. This imvestment would eam $13,200 for the company Read the teairements Requirement 1. What is the original retum on investment (RO) for Stenback Ceramics (before making any addinional investmenty? First determine the formula to caloulate the ROI Operabing income Total assets ROI (Enter the percentage to two decimal places) The original return on investment (ROI) for Stenback Ceramics is 17.5% Requirement 2. What would the ROI be for Stenback Ceramics this investment opportunity were undertaken? Would the manager of the Stenback Ceramics division want to make this investment f she were evaluated based on ROI? Why or why not? (Enter the percentage to two decimal places) 16.4 % If this investment opportunity were undertaken, the ROI would be f the manager of this division is evaluated based on ROI she would not want to make this investment. Investing in the new project would decrease the division's ROL Renuirement 3. What is the ROl ef the inunstment cenortunitv? Wnuld the imvestment he desirahle frem the standnnint of LaChit Comoration? Why or whw net? (Fnter the nementane tn hen decimal nlarns Stenback Ceramics, a division of LaChut Corporation, has an operating income of 577.000 and total assets of $440,000 The required rate of reum for the company is 14%. The company is evaluating whether t should use return on investment (RO) or residual income (RI) as a measurement of performancee for its division managers The manager of Stenback Ceramics has the opportunity to undertake a new project that will require an investment of $110,000. This investment would eam $13,200 for the company Read the reauirements Requirement 3. What is the ROI of the investment opportunity? Would the investment be desirable from the standpoint of LaChut Corporation? Why or why not? (Enter the percentage to two decimal places) The ROl of the investment opportunity is 12% From the standpoint of LaChut Corporation this investment is not desirable. The ROI of the investment opportunity is less than LaChut's required rate of retum Requirement 4. What would the residual income (RI) be for Stenback Ceramics if this investment opportunity were to be undertaken? Would the manager of the Stenback Ceramics division want to make this investment if she were evaluated based on RI? Why or why not? First determine the formula to calculate the R Operating income Total assets Target rate of retum ) = RI (Use parentheses or a minus sign for a negative RI) 13.200 The residual income (RI) for Stenback Ceramics if this investment opportunity were to be undertaken is $P RI indicates that the division is earnings an managements expectations want to make this investment. The If the manager of this division is evaluated based on RI she answeris) and then click Check Answer should use return on investmenL require an investment of $110,000. This investment would earn $13 Read the requirements Requirement 3. What is the ROI of the investment opportunity? Would the investment be desira 12 %. The ROI of the investment opportunity is From the standpoint of LaChut Corporation this investment is not desirable. The ROI of the inv Requirement 4. What would the residual income (RI) be for Stenback Ceramics if this investme investment if she were evaluated based on RI? Why or why not? First determine the formula to calculate the RI. Target rate of return Total assets Operating income X (Use parentheses or a minus sign for a negative RI.) The residual income (RI) for Stenback Ceramics if this investment opportunity were to be under If the manager of this division is evaluated based on RI she want to make this inves Click to select your answer(s) and then click Check Ansv would not would parts remaining esc F1 F2 F3 # $ nagers. The manager of Stenback Ceramics has 3.200 for the company. ould the investment be desirable from the standpoint of LaChut Corporation? Why or why not? (En desirable. The ROI of the investment opportunity is less than LaChut's required rate of return. ack Ceramics if this investment opportunity were to be undertaken? Would the manager of the Ster arget rate of return ) = RI opportunity were to be undertaken is $ 13,200 want to make this investment. The RI indicates that the division is earning positive negative Cle F5 F6 F7 F8 F9 & 3S 96 Question D. The required rate of return for the company is 14%. The company is evaluating whe ers. The manager of Stenback Ceramics has the opportunity to undertake a new proje of LaChut Corporation? Why or why not? (Enter the percentage to two decimal place less than LaChut's required rate of return. e undertaken? Would the manager of the Stenback Ceramics division want to make ,200 than management's expectations. RI indicates that the division is earning more less Check Answer Requirements ter 1. What is the original return on investment (ROI) for Stenback Ceramics (before making any additional investment)? 2. What would the ROI be for Stenback Ceramics if this investment opportunity Would the manager of the Stenback Ceramics division want to make this investment if she were evaluated based on ROI? Why or why not? es were undertaken? RI y 3. What is the ROI of the investment opportunity? Would the investment be desirable from the standpoint of LaChut Corporation? Why or why not? 4. What would the residual income (RI) be for Stenback Ceramics if this investment opportunity were to be undertaken? Would the manager of the Stenback Ceramics division want to make this investment if she were evaluated based on RI? Why or why not? 5. What is the RI of the investment opportunity? Would the investment be desirable from the standpoint of LaChut Corporation? Why or why not? 6. Which performance measurement method, ROI or RI, promotes goal congruence? Why? th Print Done