Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I need some help answering both parts A and B of this problem for accounting. I have attempted this problem many times but I

Hello, I need some help answering both parts A and B of this problem for accounting. I have attempted this problem many times but I am still not getting the correct answer. All I ask is for work to be shown so that I can refer back to this for similar problems in the future. Thank you!

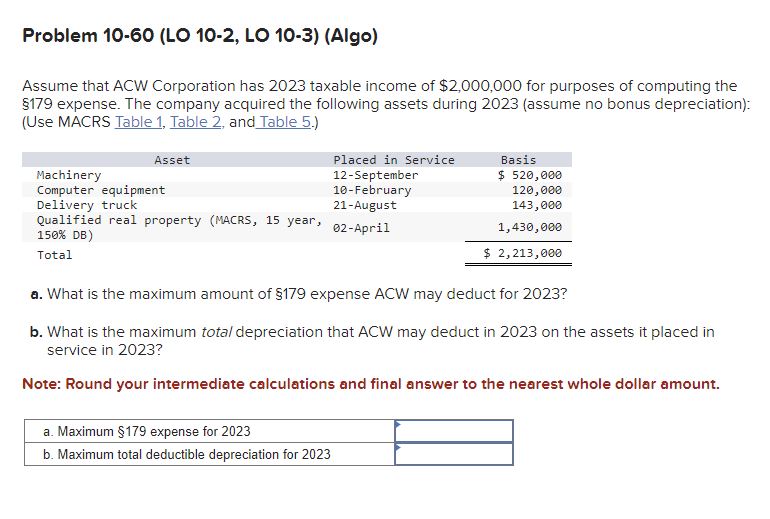

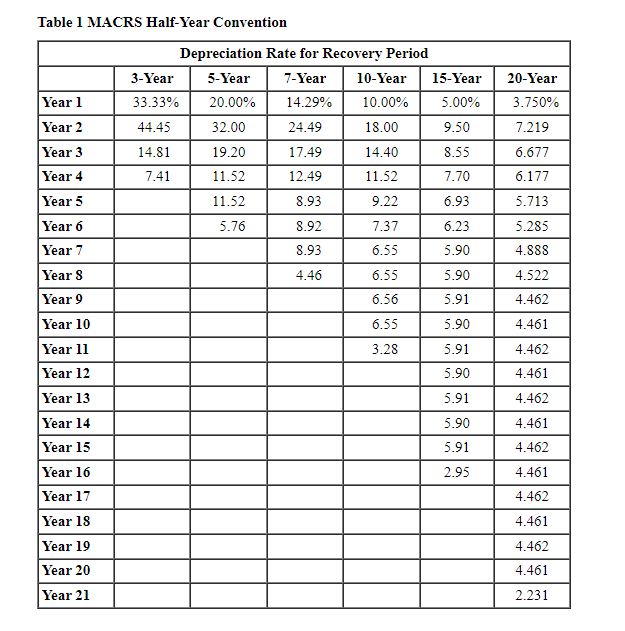

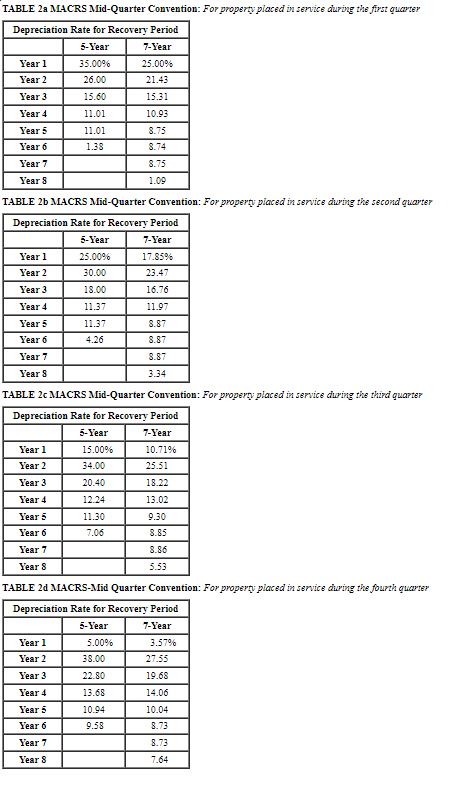

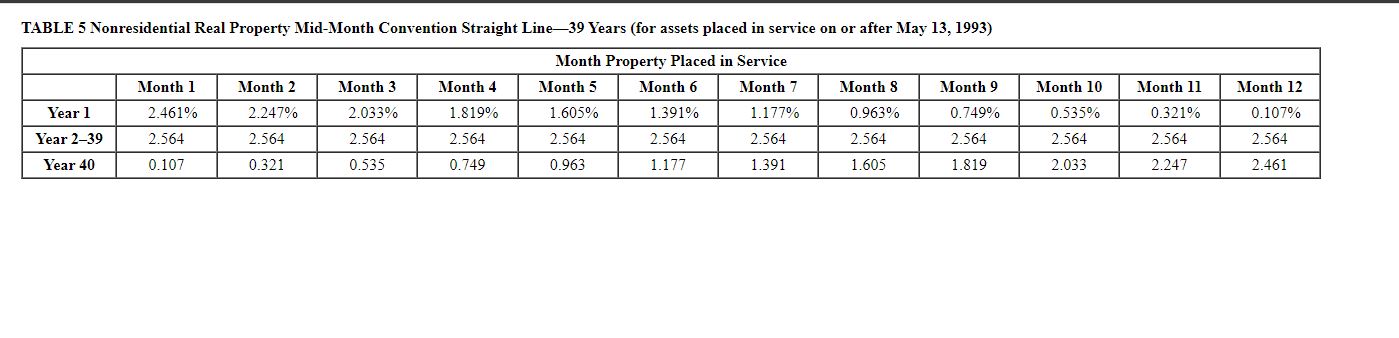

Assume that ACW Corporation has 2023 taxable income of $2,000,000 for purposes of computing the $179 expense. The company acquired the following assets during 2023 (assume no bonus depreciation): (Use MACRS Table 1, Table 2, and Table 5.) a. What is the maximum amount of $179 expense ACW may deduct for 2023 ? b. What is the maximum tota/ depreciation that ACW may deduct in 2023 on the assets it placed in service in 2023 ? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{13}{|c|}{ Month Property Placed in Service } \\ \hline & Month 1 & Month 2 & Month 3 & Month 4 & Month 5 & Month 6 & Month 7 & Month 8 & Month 9 & Month 10 & Month 11 & Month 12 \\ \hline Year 1 & 2.461% & 2.247% & 2.033% & 1.819% & 1.605% & 1.391% & 1.177% & 0.963% & 0.749% & 0.535% & 0.321% & 0.107% \\ \hline Year 2-39 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 \\ \hline Year 40 & 0.107 & 0.321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.819 & 2.033 & 2.247 & 2.461 \\ \hline \end{tabular} Table 1 MACRS Half-Year Convention \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Depreciation Rate for Recovery Period } \\ \hline & 3-Year & 5-Year & 7-Year & 10-Year & 15-Year & 20-Year \\ \hline Year 1 & 33.33% & 20.00% & 14.29% & 10.00% & 5.00% & 3.750% \\ \hline Year 2 & 44.45 & 32.00 & 24.49 & 18.00 & 9.50 & 7.219 \\ \hline Year 3 & 14.81 & 19.20 & 17.49 & 14.40 & 8.55 & 6.677 \\ \hline Year 4 & 7.41 & 11.52 & 12.49 & 11.52 & 7.70 & 6.177 \\ \hline Year 5 & & 11.52 & 8.93 & 9.22 & 6.93 & 5.713 \\ \hline Year 6 & & 5.76 & 8.92 & 7.37 & 6.23 & 5.285 \\ \hline Year 7 & & & 8.93 & 6.55 & 5.90 & 4.888 \\ \hline Year 8 & & & 4.46 & 6.55 & 5.90 & 4.522 \\ \hline Year 9 & & & & 6.56 & 5.91 & 4.462 \\ \hline Year 10 & & & & 6.55 & 5.90 & 4.461 \\ \hline Year 11 & & & & 3.28 & 5.91 & 4.462 \\ \hline Year 12 & & & & & 5.90 & 4.461 \\ \hline Year 13 & & & & & 5.91 & 4.462 \\ \hline Year 14 & & & & & 5.90 & 4.461 \\ \hline Year 15 & & & & & 5.91 & 4.462 \\ \hline Year 16 & & & & & 2.95 & 4.461 \\ \hline Year 17 & & & & & & 4.462 \\ \hline Year 18 & & & & & & 4.461 \\ \hline Year 19 & & & & & & 4.462 \\ \hline Year 20 & & & & & & 4.461 \\ \hline Year 21 & & & & & & 2.231 \\ \hline \end{tabular} Assume that ACW Corporation has 2023 taxable income of $2,000,000 for purposes of computing the $179 expense. The company acquired the following assets during 2023 (assume no bonus depreciation): (Use MACRS Table 1, Table 2, and Table 5.) a. What is the maximum amount of $179 expense ACW may deduct for 2023 ? b. What is the maximum tota/ depreciation that ACW may deduct in 2023 on the assets it placed in service in 2023 ? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{13}{|c|}{ Month Property Placed in Service } \\ \hline & Month 1 & Month 2 & Month 3 & Month 4 & Month 5 & Month 6 & Month 7 & Month 8 & Month 9 & Month 10 & Month 11 & Month 12 \\ \hline Year 1 & 2.461% & 2.247% & 2.033% & 1.819% & 1.605% & 1.391% & 1.177% & 0.963% & 0.749% & 0.535% & 0.321% & 0.107% \\ \hline Year 2-39 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 \\ \hline Year 40 & 0.107 & 0.321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.819 & 2.033 & 2.247 & 2.461 \\ \hline \end{tabular} Table 1 MACRS Half-Year Convention \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Depreciation Rate for Recovery Period } \\ \hline & 3-Year & 5-Year & 7-Year & 10-Year & 15-Year & 20-Year \\ \hline Year 1 & 33.33% & 20.00% & 14.29% & 10.00% & 5.00% & 3.750% \\ \hline Year 2 & 44.45 & 32.00 & 24.49 & 18.00 & 9.50 & 7.219 \\ \hline Year 3 & 14.81 & 19.20 & 17.49 & 14.40 & 8.55 & 6.677 \\ \hline Year 4 & 7.41 & 11.52 & 12.49 & 11.52 & 7.70 & 6.177 \\ \hline Year 5 & & 11.52 & 8.93 & 9.22 & 6.93 & 5.713 \\ \hline Year 6 & & 5.76 & 8.92 & 7.37 & 6.23 & 5.285 \\ \hline Year 7 & & & 8.93 & 6.55 & 5.90 & 4.888 \\ \hline Year 8 & & & 4.46 & 6.55 & 5.90 & 4.522 \\ \hline Year 9 & & & & 6.56 & 5.91 & 4.462 \\ \hline Year 10 & & & & 6.55 & 5.90 & 4.461 \\ \hline Year 11 & & & & 3.28 & 5.91 & 4.462 \\ \hline Year 12 & & & & & 5.90 & 4.461 \\ \hline Year 13 & & & & & 5.91 & 4.462 \\ \hline Year 14 & & & & & 5.90 & 4.461 \\ \hline Year 15 & & & & & 5.91 & 4.462 \\ \hline Year 16 & & & & & 2.95 & 4.461 \\ \hline Year 17 & & & & & & 4.462 \\ \hline Year 18 & & & & & & 4.461 \\ \hline Year 19 & & & & & & 4.462 \\ \hline Year 20 & & & & & & 4.461 \\ \hline Year 21 & & & & & & 2.231 \\ \hline \end{tabular}

Assume that ACW Corporation has 2023 taxable income of $2,000,000 for purposes of computing the $179 expense. The company acquired the following assets during 2023 (assume no bonus depreciation): (Use MACRS Table 1, Table 2, and Table 5.) a. What is the maximum amount of $179 expense ACW may deduct for 2023 ? b. What is the maximum tota/ depreciation that ACW may deduct in 2023 on the assets it placed in service in 2023 ? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{13}{|c|}{ Month Property Placed in Service } \\ \hline & Month 1 & Month 2 & Month 3 & Month 4 & Month 5 & Month 6 & Month 7 & Month 8 & Month 9 & Month 10 & Month 11 & Month 12 \\ \hline Year 1 & 2.461% & 2.247% & 2.033% & 1.819% & 1.605% & 1.391% & 1.177% & 0.963% & 0.749% & 0.535% & 0.321% & 0.107% \\ \hline Year 2-39 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 \\ \hline Year 40 & 0.107 & 0.321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.819 & 2.033 & 2.247 & 2.461 \\ \hline \end{tabular} Table 1 MACRS Half-Year Convention \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Depreciation Rate for Recovery Period } \\ \hline & 3-Year & 5-Year & 7-Year & 10-Year & 15-Year & 20-Year \\ \hline Year 1 & 33.33% & 20.00% & 14.29% & 10.00% & 5.00% & 3.750% \\ \hline Year 2 & 44.45 & 32.00 & 24.49 & 18.00 & 9.50 & 7.219 \\ \hline Year 3 & 14.81 & 19.20 & 17.49 & 14.40 & 8.55 & 6.677 \\ \hline Year 4 & 7.41 & 11.52 & 12.49 & 11.52 & 7.70 & 6.177 \\ \hline Year 5 & & 11.52 & 8.93 & 9.22 & 6.93 & 5.713 \\ \hline Year 6 & & 5.76 & 8.92 & 7.37 & 6.23 & 5.285 \\ \hline Year 7 & & & 8.93 & 6.55 & 5.90 & 4.888 \\ \hline Year 8 & & & 4.46 & 6.55 & 5.90 & 4.522 \\ \hline Year 9 & & & & 6.56 & 5.91 & 4.462 \\ \hline Year 10 & & & & 6.55 & 5.90 & 4.461 \\ \hline Year 11 & & & & 3.28 & 5.91 & 4.462 \\ \hline Year 12 & & & & & 5.90 & 4.461 \\ \hline Year 13 & & & & & 5.91 & 4.462 \\ \hline Year 14 & & & & & 5.90 & 4.461 \\ \hline Year 15 & & & & & 5.91 & 4.462 \\ \hline Year 16 & & & & & 2.95 & 4.461 \\ \hline Year 17 & & & & & & 4.462 \\ \hline Year 18 & & & & & & 4.461 \\ \hline Year 19 & & & & & & 4.462 \\ \hline Year 20 & & & & & & 4.461 \\ \hline Year 21 & & & & & & 2.231 \\ \hline \end{tabular} Assume that ACW Corporation has 2023 taxable income of $2,000,000 for purposes of computing the $179 expense. The company acquired the following assets during 2023 (assume no bonus depreciation): (Use MACRS Table 1, Table 2, and Table 5.) a. What is the maximum amount of $179 expense ACW may deduct for 2023 ? b. What is the maximum tota/ depreciation that ACW may deduct in 2023 on the assets it placed in service in 2023 ? Note: Round your intermediate calculations and final answer to the nearest whole dollar amount. TABLE 2d MACRS-Mid Quarter Convention: For property placed in service during the fourth quarter TABLE 5 Nonresidential Real Property Mid-Month Convention Straight Line-39 Years (for assets placed in service on or after May 13, 1993) \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline \multicolumn{13}{|c|}{ Month Property Placed in Service } \\ \hline & Month 1 & Month 2 & Month 3 & Month 4 & Month 5 & Month 6 & Month 7 & Month 8 & Month 9 & Month 10 & Month 11 & Month 12 \\ \hline Year 1 & 2.461% & 2.247% & 2.033% & 1.819% & 1.605% & 1.391% & 1.177% & 0.963% & 0.749% & 0.535% & 0.321% & 0.107% \\ \hline Year 2-39 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 & 2.564 \\ \hline Year 40 & 0.107 & 0.321 & 0.535 & 0.749 & 0.963 & 1.177 & 1.391 & 1.605 & 1.819 & 2.033 & 2.247 & 2.461 \\ \hline \end{tabular} Table 1 MACRS Half-Year Convention \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{7}{|c|}{ Depreciation Rate for Recovery Period } \\ \hline & 3-Year & 5-Year & 7-Year & 10-Year & 15-Year & 20-Year \\ \hline Year 1 & 33.33% & 20.00% & 14.29% & 10.00% & 5.00% & 3.750% \\ \hline Year 2 & 44.45 & 32.00 & 24.49 & 18.00 & 9.50 & 7.219 \\ \hline Year 3 & 14.81 & 19.20 & 17.49 & 14.40 & 8.55 & 6.677 \\ \hline Year 4 & 7.41 & 11.52 & 12.49 & 11.52 & 7.70 & 6.177 \\ \hline Year 5 & & 11.52 & 8.93 & 9.22 & 6.93 & 5.713 \\ \hline Year 6 & & 5.76 & 8.92 & 7.37 & 6.23 & 5.285 \\ \hline Year 7 & & & 8.93 & 6.55 & 5.90 & 4.888 \\ \hline Year 8 & & & 4.46 & 6.55 & 5.90 & 4.522 \\ \hline Year 9 & & & & 6.56 & 5.91 & 4.462 \\ \hline Year 10 & & & & 6.55 & 5.90 & 4.461 \\ \hline Year 11 & & & & 3.28 & 5.91 & 4.462 \\ \hline Year 12 & & & & & 5.90 & 4.461 \\ \hline Year 13 & & & & & 5.91 & 4.462 \\ \hline Year 14 & & & & & 5.90 & 4.461 \\ \hline Year 15 & & & & & 5.91 & 4.462 \\ \hline Year 16 & & & & & 2.95 & 4.461 \\ \hline Year 17 & & & & & & 4.462 \\ \hline Year 18 & & & & & & 4.461 \\ \hline Year 19 & & & & & & 4.462 \\ \hline Year 20 & & & & & & 4.461 \\ \hline Year 21 & & & & & & 2.231 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started