Answered step by step

Verified Expert Solution

Question

1 Approved Answer

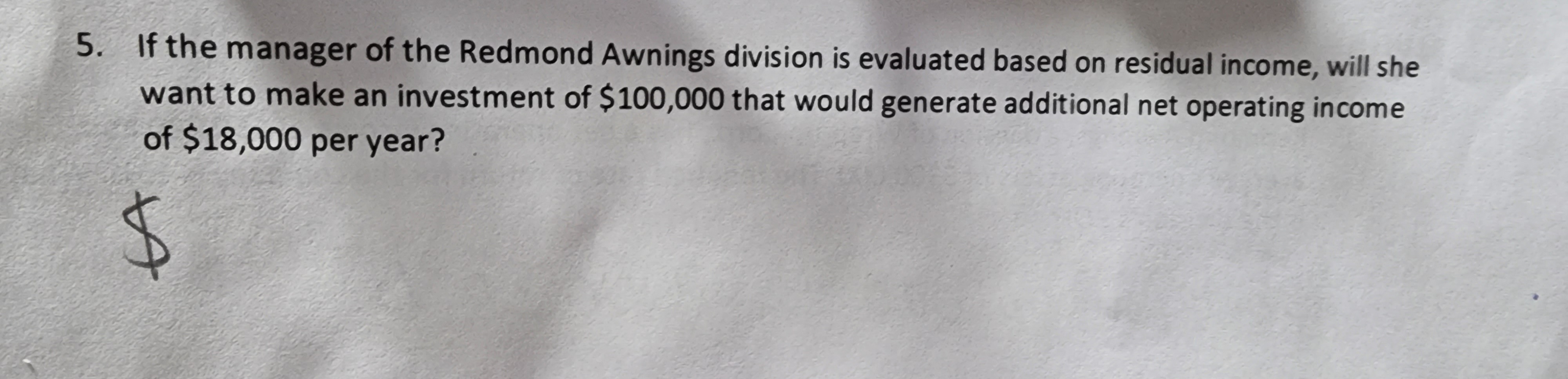

Hello, I need some help figure out question #5 for accounting. Please show all work/calculations as I would like to use this as a reference

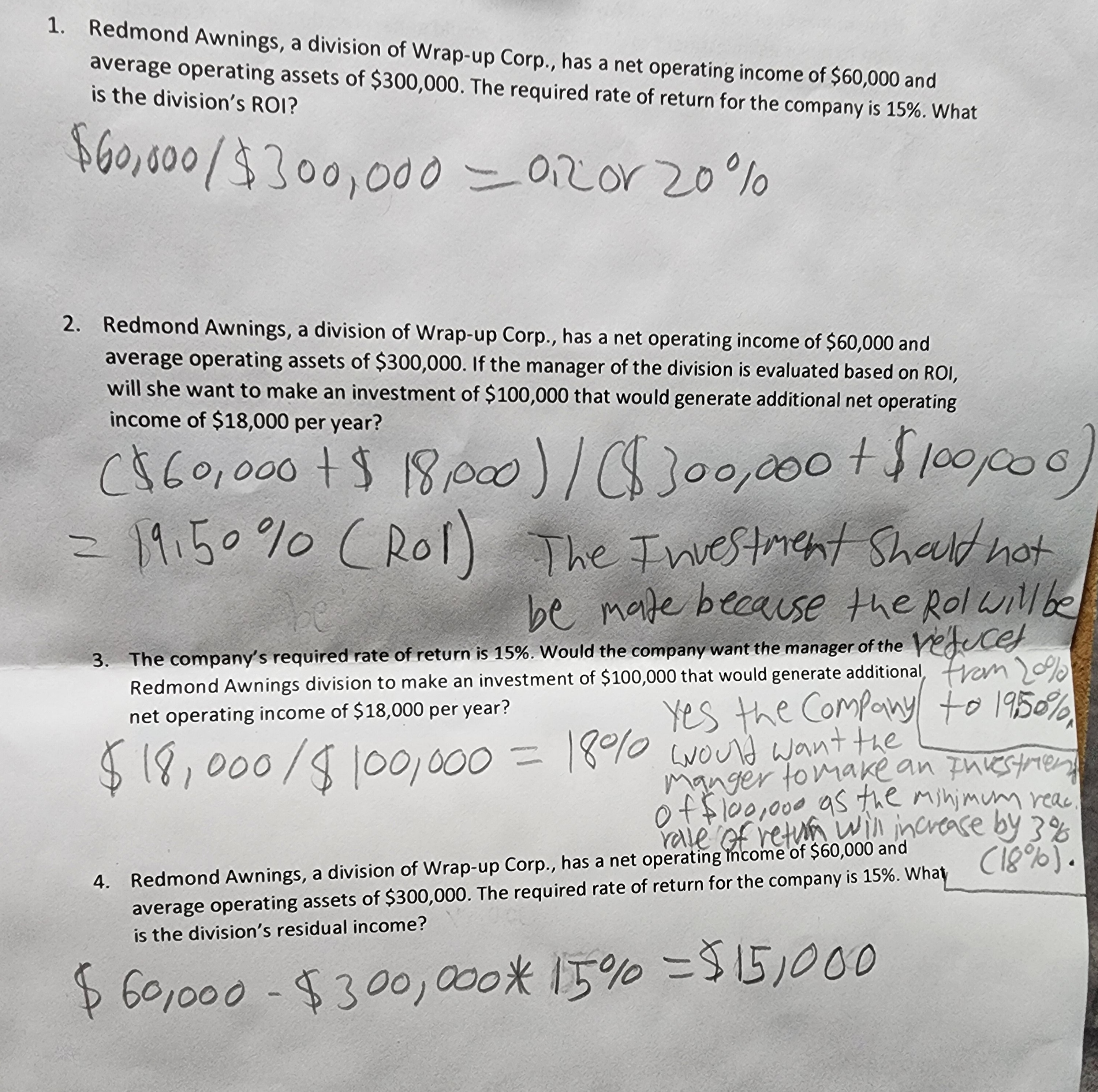

Hello, I need some help figure out question #5 for accounting. Please show all work/calculations as I would like to use this as a reference for similar problems in the future. Thank you! Also, I posted a screen shot with the previous parts (#1 through #4) as I am not sure if you might need information from any of those problems, so I posted them just in case. I am pretty much just stuck on #5.

1. Redmond Awnings, a division of Wrap-up Corp., has a net operating income of $60,000 and average operating assets of $300,000. The required rate of return for the company is 15%. What is the division's ROI? $60,000/$300,000=0,20r20% 2. Redmond Awnings, a division of Wrap-up Corp., has a net operating income of $60,000 and average operating assets of $300,000. If the manager of the division is evaluated based on ROI, will she want to make an investment of $100,000 that would generate additional net operating income of $18,000 per year? ($60,000+$18,000)/C300,000+$100,00 =19,50% (Rol) The Fhvestment shoul hat be mate beeause the Rol willt 3. The company's required rate of return is 15%. Would the company want the manager of the hefucef Redmond Awnings division to make an investment of $100,000 that would generate additional thom 209 net operating income of $18,000 per year? Yes the Company to 1950 $18,000/$100,000=180 would want the manger tomake an furestre off 100,000 as the minimum re rale of bethm win marese byy rale Of retum will increase by 3 4. Redmond Awnings, a division of Wrap-up Corp., has a net operating ?income of $60,000 and average operating assets of $300,000. The required rate of return for the company is 15%. What is the division's residual income? 5. If the manager of the Redmond Awnings division is evaluated based on residual income, will she want to make an investment of $100,000 that would generate additional net operating income of $18,000 per year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started