hello i need this case please can someone help?

tahnk you

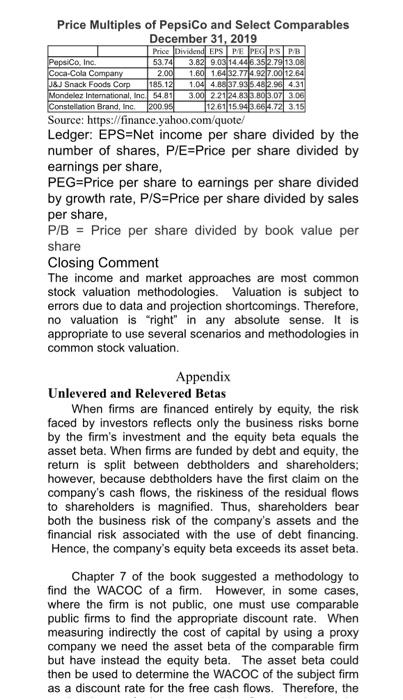

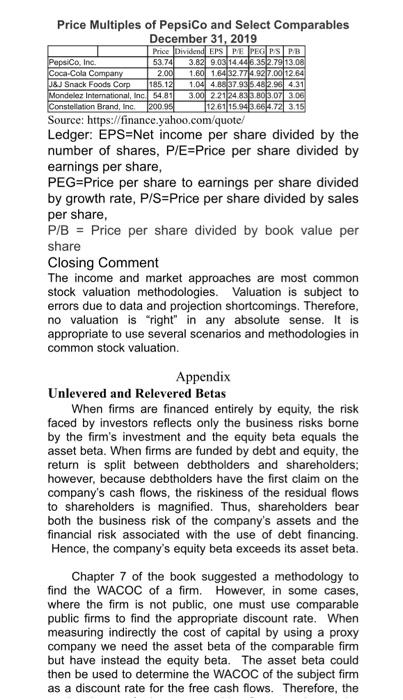

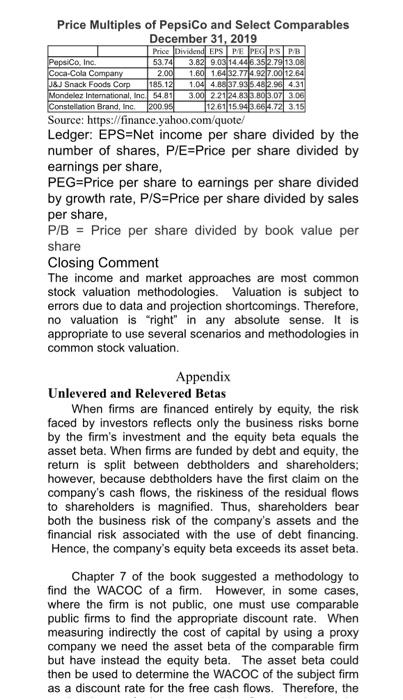

Price Multiples of PepsiCo and Select Comparables Naramhar 312019 Source: https://finance.yahoo.com/quote/ Ledger: EPS=Net income per share divided by the number of shares, P/E= Price per share divided by earnings per share, PEG=Price per share to earnings per share divided by growth rate, P/S= Price per share divided by sales per share, P/B= Price per share divided by book value per share Closing Comment The income and market approaches are most common stock valuation methodologies. Valuation is subject to errors due to data and projection shortcomings. Therefore, no valuation is "right" in any absolute sense. It is appropriate to use several scenarios and methodologies in common stock valuation. Appendix Unlevered and Relevered Betas When firms are financed entirely by equity, the risk faced by investors reflects only the business risks borne by the firm's investment and the equity beta equals the asset beta. When firms are funded by debt and equity, the return is split between debtholders and shareholders; however, because debtholders have the first claim on the company's cash flows, the riskiness of the residual flows to shareholders is magnified. Thus, shareholders bear both the business risk of the company's assets and the financial risk associated with the use of debt financing. Hence, the company's equity beta exceeds its asset beta. Chapter 7 of the book suggested a methodology to find the WACOC of a firm. However, in some cases. where the firm is not public, one must use comparable public firms to find the appropriate discount rate. When measuring indirectly the cost of capital by using a proxy company we need the asset beta of the comparable firm but have instead the equity beta. The asset beta could then be used to determine the WACOC of the subject firm as a discount rate for the free cash flows. Therefore, the public firms to find the appropriate discount rate. When measuring indirectly the cost of capital by using a proxy company we need the asset beta of the comparable firm but have instead the equity beta. The asset beta could then be used to determine the WACOC of the subject firm as a discount rate for the free cash flows. Therefore, the equity beta of the comparable firm needs to be transformed into asset beta through a process of unlevering and relevering the proxy beta. The proxy's asset beta could be stated as follows: Bassets = equity E/(E+D)+ debt D/(E+D) However, debt is relatively risk free and thus beta debt is zero, which modifies the above equation as follows: Bassets = equity E/(E+D) or Bassets = equity /(D+E)/E= Bequity= Bassets (1+D/E) Upon introduction of taxes, the above betas are stated as follows: An alternative formulation with taxes, define leveraged and unleveraged betas as follows: B1=Bu(1+(1t)(D/E))andBu=B1/(1+(1t)(D/E)) where t,D, and E are the tax rate, debt and equity, respectively. To derive the beta for a subject company, select comparable publicly listed companies from the same industry, with similar size and cyclicality, then unlevered their betas by application of the following model: Bu=B1/(1+(1t)(D/E)) The debt equity ratio is that of the comparable firm. Then reveler the betas using the (D/E) ratio of the subject private firm and marginal tax rate t of the subject firm whose levered beta (1) we seek to estimate by application of the following model: B1=Bu(1+(1t)(D/E)) Bassets is weighted average of the beta equity and debt. Alternatively, one can use 4 to estimate the cost of equity of the unlevered firm to be used in the APV methodology. Price Multiples of PepsiCo and Select Comparables Naramhar 312019 Source: https://finance.yahoo.com/quote/ Ledger: EPS=Net income per share divided by the number of shares, P/E= Price per share divided by earnings per share, PEG=Price per share to earnings per share divided by growth rate, P/S= Price per share divided by sales per share, P/B= Price per share divided by book value per share Closing Comment The income and market approaches are most common stock valuation methodologies. Valuation is subject to errors due to data and projection shortcomings. Therefore, no valuation is "right" in any absolute sense. It is appropriate to use several scenarios and methodologies in common stock valuation. Appendix Unlevered and Relevered Betas When firms are financed entirely by equity, the risk faced by investors reflects only the business risks borne by the firm's investment and the equity beta equals the asset beta. When firms are funded by debt and equity, the return is split between debtholders and shareholders; however, because debtholders have the first claim on the company's cash flows, the riskiness of the residual flows to shareholders is magnified. Thus, shareholders bear both the business risk of the company's assets and the financial risk associated with the use of debt financing. Hence, the company's equity beta exceeds its asset beta. Chapter 7 of the book suggested a methodology to find the WACOC of a firm. However, in some cases. where the firm is not public, one must use comparable public firms to find the appropriate discount rate. When measuring indirectly the cost of capital by using a proxy company we need the asset beta of the comparable firm but have instead the equity beta. The asset beta could then be used to determine the WACOC of the subject firm as a discount rate for the free cash flows. Therefore, the public firms to find the appropriate discount rate. When measuring indirectly the cost of capital by using a proxy company we need the asset beta of the comparable firm but have instead the equity beta. The asset beta could then be used to determine the WACOC of the subject firm as a discount rate for the free cash flows. Therefore, the equity beta of the comparable firm needs to be transformed into asset beta through a process of unlevering and relevering the proxy beta. The proxy's asset beta could be stated as follows: Bassets = equity E/(E+D)+ debt D/(E+D) However, debt is relatively risk free and thus beta debt is zero, which modifies the above equation as follows: Bassets = equity E/(E+D) or Bassets = equity /(D+E)/E= Bequity= Bassets (1+D/E) Upon introduction of taxes, the above betas are stated as follows: An alternative formulation with taxes, define leveraged and unleveraged betas as follows: B1=Bu(1+(1t)(D/E))andBu=B1/(1+(1t)(D/E)) where t,D, and E are the tax rate, debt and equity, respectively. To derive the beta for a subject company, select comparable publicly listed companies from the same industry, with similar size and cyclicality, then unlevered their betas by application of the following model: Bu=B1/(1+(1t)(D/E)) The debt equity ratio is that of the comparable firm. Then reveler the betas using the (D/E) ratio of the subject private firm and marginal tax rate t of the subject firm whose levered beta (1) we seek to estimate by application of the following model: B1=Bu(1+(1t)(D/E)) Bassets is weighted average of the beta equity and debt. Alternatively, one can use 4 to estimate the cost of equity of the unlevered firm to be used in the APV methodology