Hello, I need to help to solve the following questions

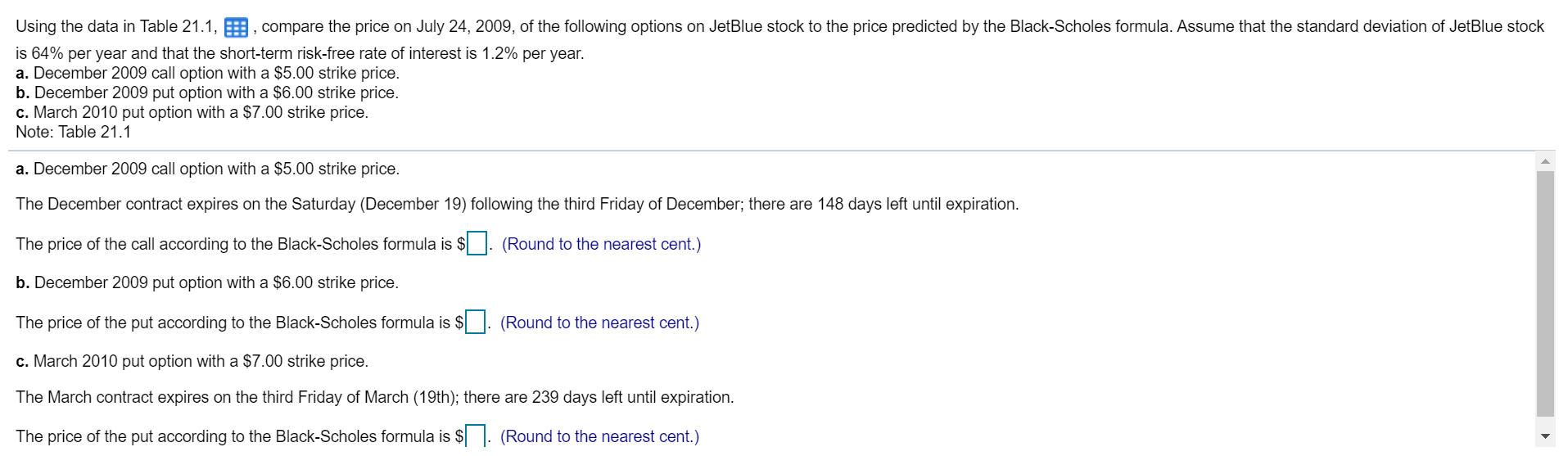

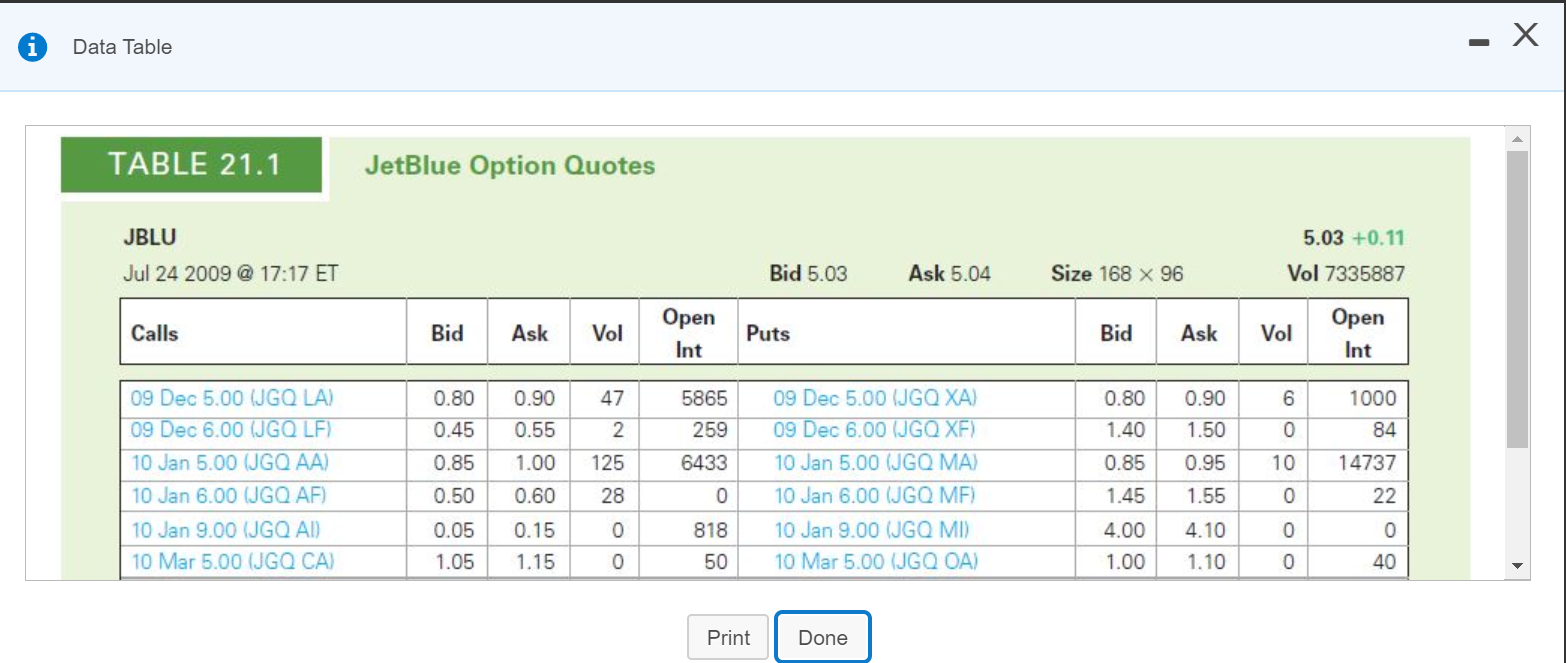

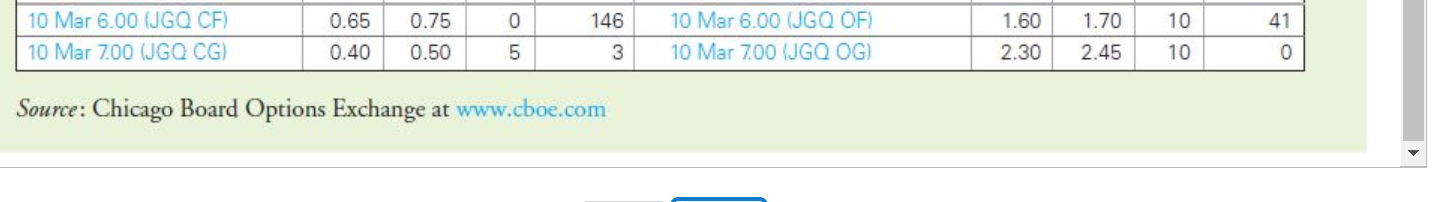

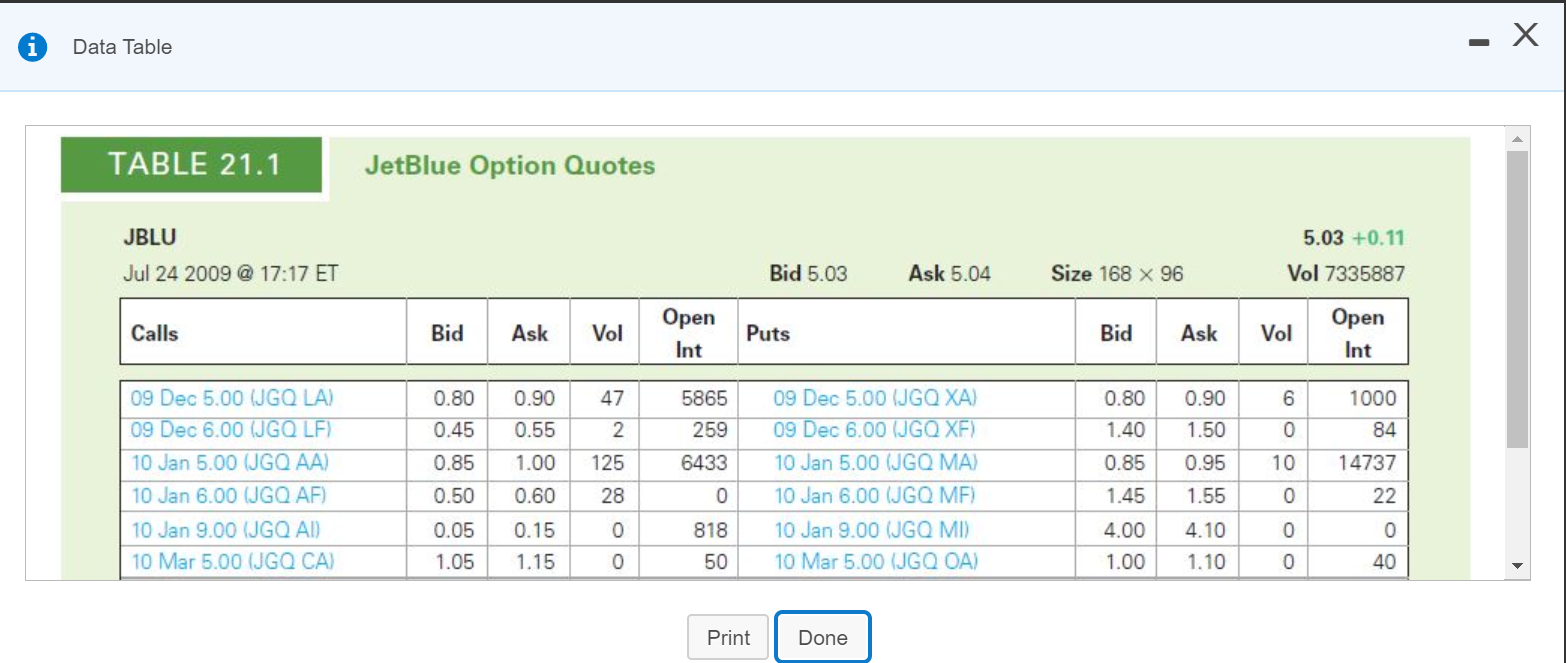

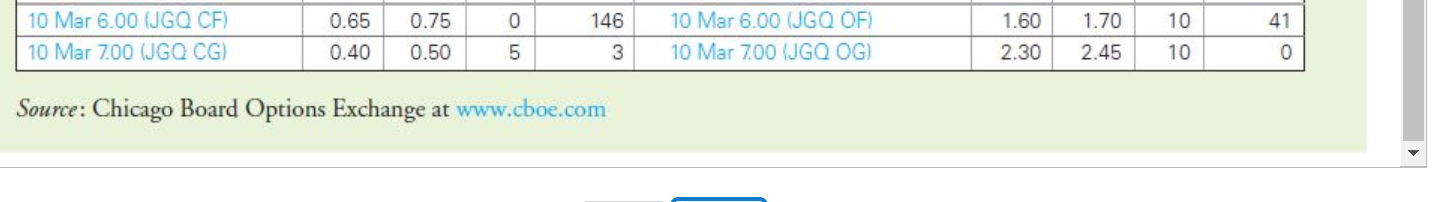

Using the data in Table 21.1, B, compare the price on July 24, 2009, of the following options on JetBlue stock to the price predicted by the Black-Scholes formula. Assume that the standard deviation of JetBlue stock is 64% per year and that the short-term risk-free rate of interest is 1.2% per year. a. December 2009 call option with a $5.00 strike price. b. December 2009 put option with a $6.00 strike price. c. March 2010 put option with a $7.00 strike price. Note: Table 21.1 a. December 2009 call option with a $5.00 strike price. The December contract expires on the Saturday (December 19) following the third Friday of December; there are 148 days left until expiration. The price of the call according to the Black-Scholes formula is $ . (Round to the nearest cent.) b. December 2009 put option with a $6.00 strike price. The price of the put according to the Black-Scholes formula is $ U. (Round to the nearest cent.) c. March 2010 put option with a $7.00 strike price. The March contract expires on the third Friday of March (19th); there are 239 days left until expiration. The price of the put according to the Black-Scholes formul ound to the nearest cent.) A Data Table - X TABLE 21.1 JetBlue Option Quotes JBLU Jul 24 2009 @ 17:17 ET 5.03 +0.11 Vol 7335887 Bid 5.03 Ask 5.04 Size 168 x 96 Calls Bid Ask Open Int Puts Bid Ask Vol Open Int 5865 6 o 259 6433 09 Dec 5.00 (JGQ LA) 09 Dec 6.00 (JGQ LF) 10 Jan 5.00 (JGQ AA) 10 Jan 6.00 (JGQ AF) 10 Jan 9.00 (JGQ AI) 10 Mar 5.00 (JGQ CA 0.80 0.45 0.85 0.50 0.05 1.05 47 2 125 28 0 10 0.90 0.55 1.00 0.60 0.15 1.15 09 Dec 5.00 (JGO XA) 09 Dec 6.00 (JGQ XF) 10 Jan 5.00 (JGQ MA 10 Jan 6.00 (JGO MF) 10 Jan 9.00 (JGQ MI) 10 Mar 5.00 (JGQ OA) 0.80 1.40 0.85 1.45 4.00 1.00 0.90 1.50 0.95 1.55 4.10 1.10 1000 84 14737 22 0 818 50 Print Done 10 Mar 6.00 (JGO CF) 10 Mar 700 (JGQ CG) 0.65 0.40 0.75 0.50 0 5 146 3 10 Mar 6.00 (JGQ OF) 10 Mar 700 (JGQ OG) 1.60 2.30 1.70 2.45 10 10 4 1 Source: Chicago Board Options Exchange at www.cboe.com Using the data in Table 21.1, B, compare the price on July 24, 2009, of the following options on JetBlue stock to the price predicted by the Black-Scholes formula. Assume that the standard deviation of JetBlue stock is 64% per year and that the short-term risk-free rate of interest is 1.2% per year. a. December 2009 call option with a $5.00 strike price. b. December 2009 put option with a $6.00 strike price. c. March 2010 put option with a $7.00 strike price. Note: Table 21.1 a. December 2009 call option with a $5.00 strike price. The December contract expires on the Saturday (December 19) following the third Friday of December; there are 148 days left until expiration. The price of the call according to the Black-Scholes formula is $ . (Round to the nearest cent.) b. December 2009 put option with a $6.00 strike price. The price of the put according to the Black-Scholes formula is $ U. (Round to the nearest cent.) c. March 2010 put option with a $7.00 strike price. The March contract expires on the third Friday of March (19th); there are 239 days left until expiration. The price of the put according to the Black-Scholes formul ound to the nearest cent.) A Data Table - X TABLE 21.1 JetBlue Option Quotes JBLU Jul 24 2009 @ 17:17 ET 5.03 +0.11 Vol 7335887 Bid 5.03 Ask 5.04 Size 168 x 96 Calls Bid Ask Open Int Puts Bid Ask Vol Open Int 5865 6 o 259 6433 09 Dec 5.00 (JGQ LA) 09 Dec 6.00 (JGQ LF) 10 Jan 5.00 (JGQ AA) 10 Jan 6.00 (JGQ AF) 10 Jan 9.00 (JGQ AI) 10 Mar 5.00 (JGQ CA 0.80 0.45 0.85 0.50 0.05 1.05 47 2 125 28 0 10 0.90 0.55 1.00 0.60 0.15 1.15 09 Dec 5.00 (JGO XA) 09 Dec 6.00 (JGQ XF) 10 Jan 5.00 (JGQ MA 10 Jan 6.00 (JGO MF) 10 Jan 9.00 (JGQ MI) 10 Mar 5.00 (JGQ OA) 0.80 1.40 0.85 1.45 4.00 1.00 0.90 1.50 0.95 1.55 4.10 1.10 1000 84 14737 22 0 818 50 Print Done 10 Mar 6.00 (JGO CF) 10 Mar 700 (JGQ CG) 0.65 0.40 0.75 0.50 0 5 146 3 10 Mar 6.00 (JGQ OF) 10 Mar 700 (JGQ OG) 1.60 2.30 1.70 2.45 10 10 4 1 Source: Chicago Board Options Exchange at www.cboe.com