hello i posted this question yesterday but i forgot to post up the questions (1-27) . can someone please answer it for me ?

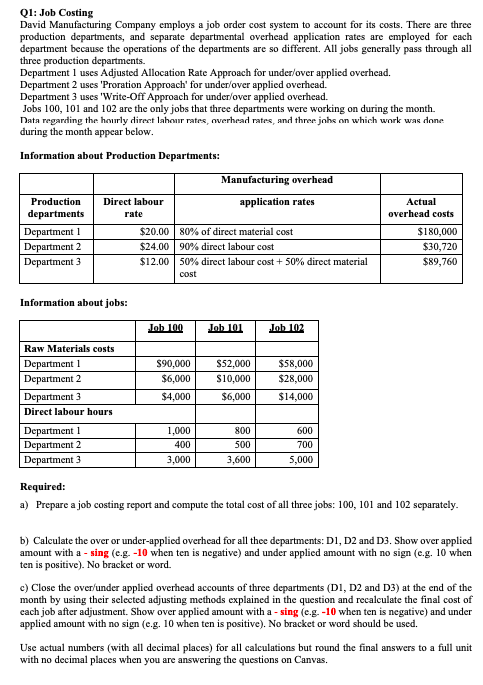

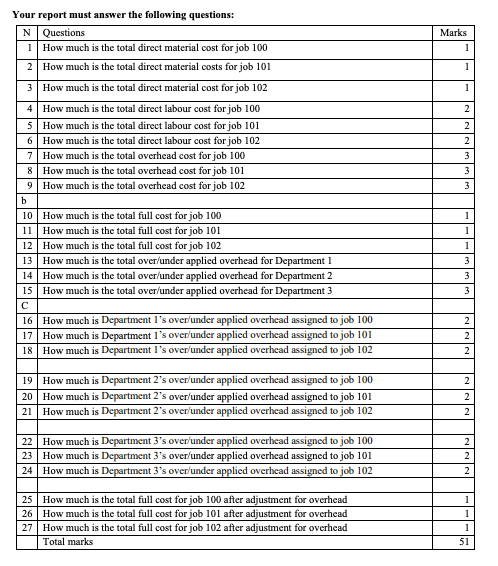

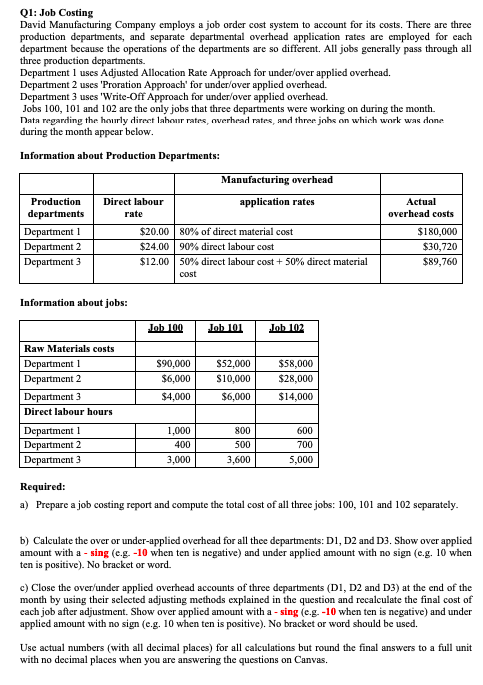

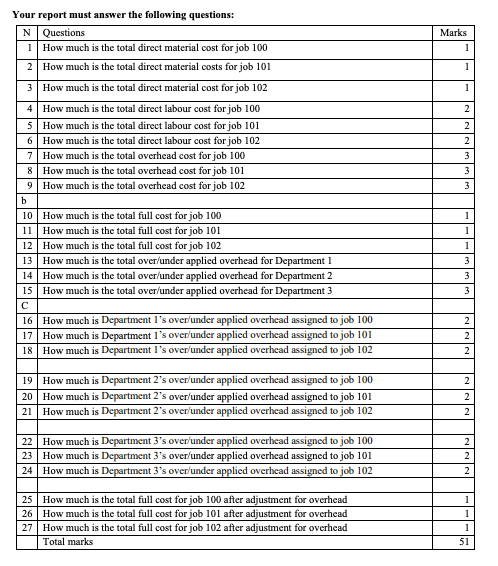

Q1: Job Costing David Manufacturing Company employs a job order cost system to account for its costs. There are three production departments, and separate departmental overhead application rates are employed for each department because the operations of the departments are so different. All jobs generally pass through all three production departments. Department 1 uses Adjusted Allocation Rate Approach for under/over applied overhead. Department 2 uses 'Proration Approach' for under/over applied overhead. Department 3 uses 'Write-Off Approach for under over applied overhead. Jobs 100, 101 and 102 are the only jobs that three departments were working on during the month. Data regarding the hourly direct labour rates, overhead rates, and three jobs on which work was done during the month appear below. Information about Production Departments: Manufacturing overhead application rates Direct labour rate Production departments Department 1 Department 2 Department 3 $20.00 80% of direct material cost $24.00 90% direct labour cost $12.00 50% direct labour cost + 50% direct material cost Actual overhead costs $180,000 $30,720 $89,760 Information about jobs: Lob 100 Job 101 Job 102 Raw Materials costs Department 1 Department 2 Department 3 Direct labour hours $90,000 $6,000 $4,000 $52,000 $10,000 $6,000 $58,000 $28,000 $14,000 Department 1 Department 2 Department 3 1.000 400 3,000 800 500 3,600 600 700 5,000 Required: a) Prepare a job costing report and compute the total cost of all three jobs: 100, 101 and 102 separately. b) Calculate the over or under-applied overhead for all the departments: D1, D2 and D3. Show over applied amount with a - sing (e.g.-10 when ten is negative) and under applied amount with no sign (e.g. 10 when ten is positive). No bracket or word. c) Close the over/under applied overhead accounts of three departments (D1, D2 and D3) at the end of the month by using their selected adjusting methods explained in the question and recalculate the final cost of cach job after adjustment. Show over applied amount with a sing (e.g.-10 when ten is negative) and under applied amount with no sign (c.g. 10 when ten is positive). No bracket or word should be used. Use actual numbers (with all decimal places) for all calculations but round the final answers to a full unit with no decimal places when you are answering the questions on Canvas. Marks 2 2 2 3 Your report must answer the following questions: N Questions 1 How much is the total direct material cost for job 100 2 How much is the total direct material costs for job 101 3 How much is the total direct material cost for job 102 4 How much is the total direct labour cost for job 100 5 How much is the total direct labour cost for job 101 6 How much is the total direct labour cost for job 102 7 How much is the total overhead cost for job 100 & How much is the total overhead cost for job 101 9 How much is the total overhead cost for job 102 b 10 How much is the total full cost for job 100 11 How much is the total full cost for job 101 12 How much is the total full cost for job 102 13 How much is the total over/under applied overhead for Department 1 14 How much is the total over/under applied overhead for Department 2 15 How much is the total over/under applied overhead for Department 3 16 How much is Department l's over/under applied overhead assigned to job 100 17 How much is Department l's over/under applied overhead assigned to job 101 18 How much is Department I's over under applied overhead assigned to job 102 3 3 1 1 3 3 3 2 2 2 2 19 How much is Department 2's over under applied overhead assigned to job 100 20 How much is Department 2's over/under applied overhead assigned to job 101 21 How much is Department 2's over/under applied overhead assigned to job 102 2 2 22 How much is Department 3's over/under applied overhead assigned to job 100 23 How much is Department 3's over/under applied overhead assigned to job 101 24 How much is Department 3's over/under applied overhead assigned to job 102 2 2 2 1 25 How much is the total full cost for job 100 after adjustment for overhead 26 How much is the total full cost for job 101 after adjustment for overhead 27 How much is the total full cost for job 102 after adjustment for overhead Total marks 1 51