hello, I really need help in this question. I find it very complicated. May you please present the answer in excel so I'm able to understand how it's supposed to be answered? Thank you so much I appreciate it. I have attached the question as pictures.

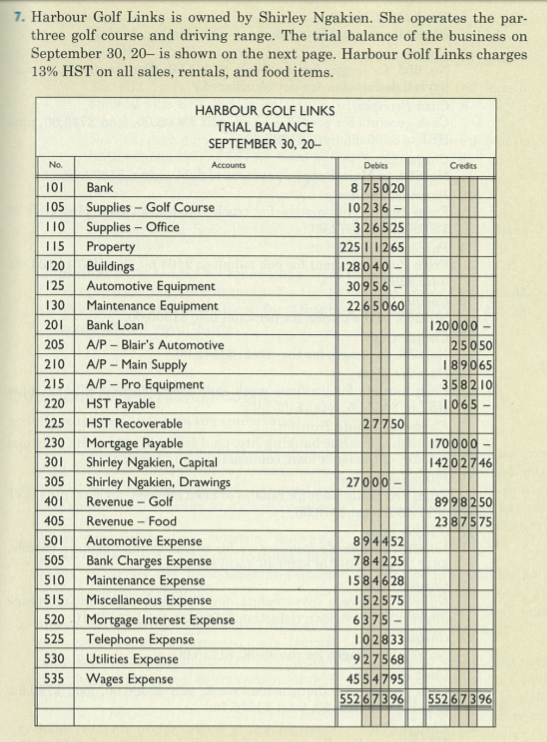

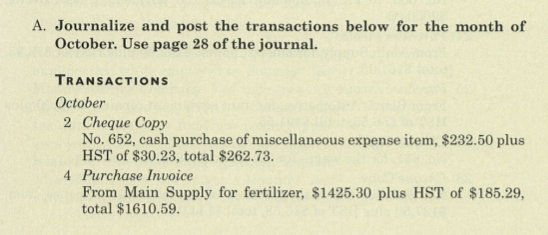

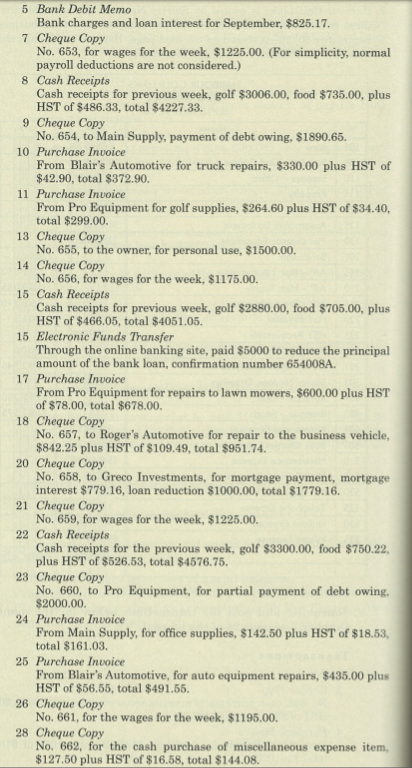

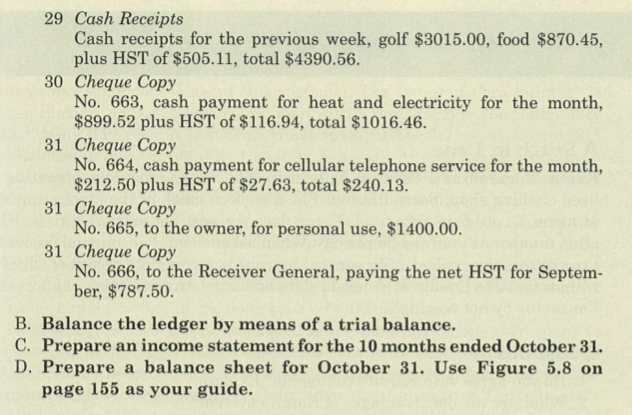

7. Harbour Golf Links is owned by Shirley Ngakien. She operates the par- three golf course and driving range. The trial balance of the business on September 30, 20- is shown on the next page. Harbour Golf Links charges 13% HST on all sales, rentals, and food items. HARBOUR GOLF LINKS TRIAL BALANCE SEPTEMBER 30, 20- No. Accounts Debies Credits 101 Bank 8 7 5 0 20 105 Supplies - Golf Course 10 2 3 6- 1 10 Supplies - Office 3 2 6 5 25 1 15 Property 225 1 1 2 65 120 Buildings 128 0 40 - 125 Automotive Equipment 30 9 5 6 130 Maintenance Equipment 22 6 5 0 60 201 Bank Loan 120 0 0 0 205 A/P - Blair's Automotive 2 5 0 50 210 A/P - Main Supply 1 8 9 0 65 215 A/P - Pro Equipment 3 5 8 2 10 220 HST Payable 10 65 - 225 HST Recoverable 2 7 7 50 230 Mortgage Payable 170 0 0 0 301 Shirley Ngakien, Capital 142 0 2 7 46 305 Shirley Ngakien, Drawings 27 0 0 0 401 Revenue - Golf 89 9 8 2 50 405 Revenue - Food 23 8 7 5 75 50 Automotive Expense 8 9 4 4 52 505 Bank Charges Expense 7 8 4 2 25 510 Maintenance Expense 15 8 4 6 28 515 Miscellaneous Expense 1 5 2 5 75 520 Mortgage Interest Expense 6 3 7 5 - 525 Telephone Expense 1 0 2 8 33 530 Utilities Expense 9 2 7 5 68 535 Wages Expense 45 5 4 7 95 552 6 7 3 96 552 6 7 3 96A. Journalize and post the transactions below for the month of October. Use page 28 of the journal. TRANSACTIONS October 2 Cheque Copy No. 652, cash purchase of miscellaneous expense item, $232.50 plus HST of $30.23, total $262.73. 4 Purchase Invoice From Main Supply for fertilizer, $1425.30 plus HST of $185.29, total $1610.59.5 Bank Debit Memo Bank charges and loan interest for September, $825.17. 7 Cheque Copy No. 653, for wages for the week, $1225.00. (For simplicity, normal payroll deductions are not considered.) 8 Cash Receipts Cash receipts for previous week, golf $3006.00, food $735.00, plus HST of $486.33, total $4227.33. 9 Cheque Copy No. 654, to Main Supply, payment of debt owing, $1890.65. 10 Purchase Invoice From Blair's Automotive for truck repairs, $330.00 plus HST of $42.90, total $372.90. 11 Purchase Invoice From Pro Equipment for golf supplies, $264.60 plus HST of $34.40, total $299.00. 13 Cheque Copy No. 655, to the owner, for personal use, $1500.00. 14 Cheque Copy No. 656, for wages for the week, $1175.00. 15 Cash Receipts Cash receipts for previous week, golf $2880.00, food $705.00, plus HST of $466.05, total $4051.05. 15 Electronic Funds Transfer Through the online banking site, paid $5000 to reduce the principal amount of the bank loan, confirmation number 654008A. 17 Purchase Invoice From Pro Equipment for repairs to lawn mowers, $600.00 plus HST of $78,00, total $678.00. 18 Cheque Copy No. 657, to Roger's Automotive for repair to the business vehicle, $842.25 plus HST of $109.49, total $951.74. 20 Cheque Copy No. 658, to Greco Investments, for mortgage payment, mortgage interest $779.16, loan reduction $1000,00, total $1779.16. 21 Cheque Copy No. 659, for wages for the week, $1225.00. 22 Cash Receipts Cash receipts for the previous week, golf $3300.00, food $750.22, plus HST of $526.53, total $4576.75. 23 Cheque Copy No. 660, to Pro Equipment, for partial payment of debt owing. $2000.00. 24 Purchase Invoice From Main Supply, for office supplies, $142.50 plus HST of $18.53, total $161.03. 25 Purchase Invoice From Blair's Automotive, for auto equipment repairs, $435.00 plus HST of $56.55, total $491.55. 26 Cheque Copy No. 661, for the wages for the week, $1195.00. 28 Cheque Copy No. 662, for the cash purchase of miscellaneous expense item, $127.50 plus HST of $16.58, total $144.08.29 Cash Receipts Cash receipts for the previous week, golf $3015.00, food $870.45, plus HST of $505.11, total $4390.56. 30 Cheque Copy No. 663, cash payment for heat and electricity for the month, $899.52 plus HST of $116.94, total $1016.46. 31 Cheque Copy No. 664, cash payment for cellular telephone service for the month, $212.50 plus HST of $27.63, total $240.13. 31 Cheque Copy No. 665, to the owner, for personal use, $1400.00. 31 Cheque Copy No. 666, to the Receiver General, paying the net HST for Septem- ber, $787.50. B. Balance the ledger by means of a trial balance. C. Prepare an income statement for the 10 months ended October 31. D. Prepare a balance sheet for October 31. Use Figure 5.8 on page 155 as your guide