Hello, I truly need an experts help that is willing to extend their assitance with this accounting mini practice set 3. I know it seems long however, your help is truly appreciated; will someone please be kind and take the time to answer the question or at least half of it. Also, it may be helpful to see the flow of each section its asking about. I included the general ledgers at the bottom.

The Texas Company

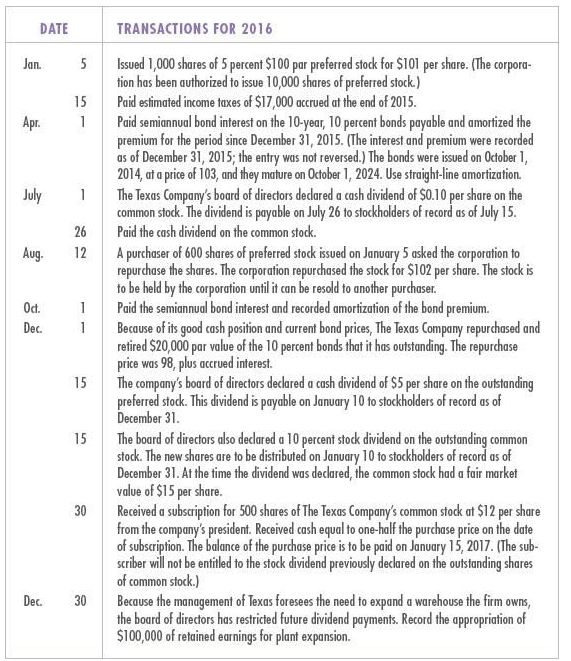

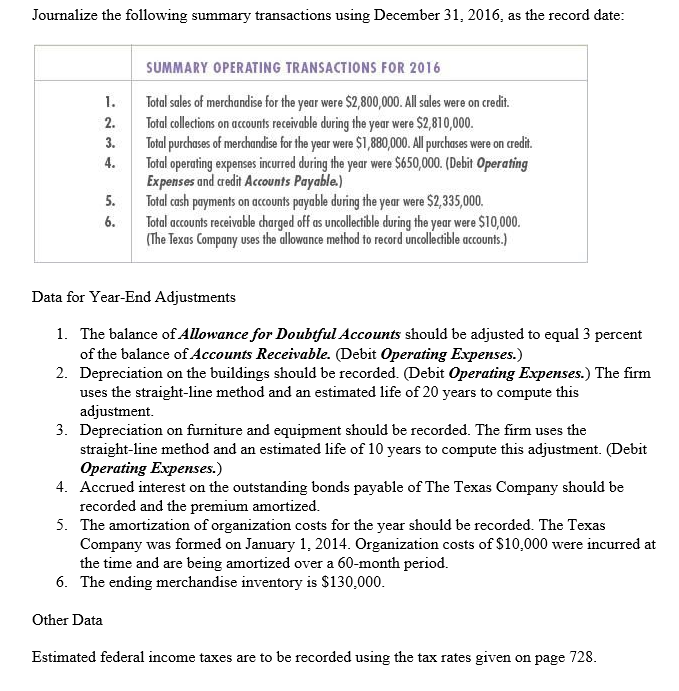

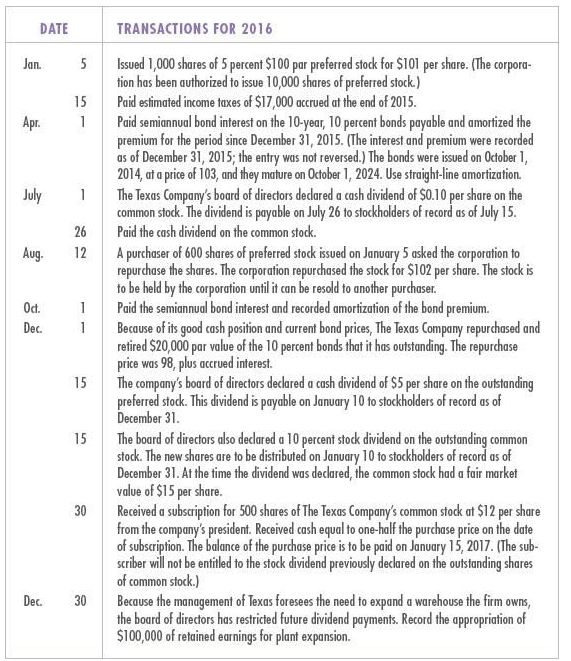

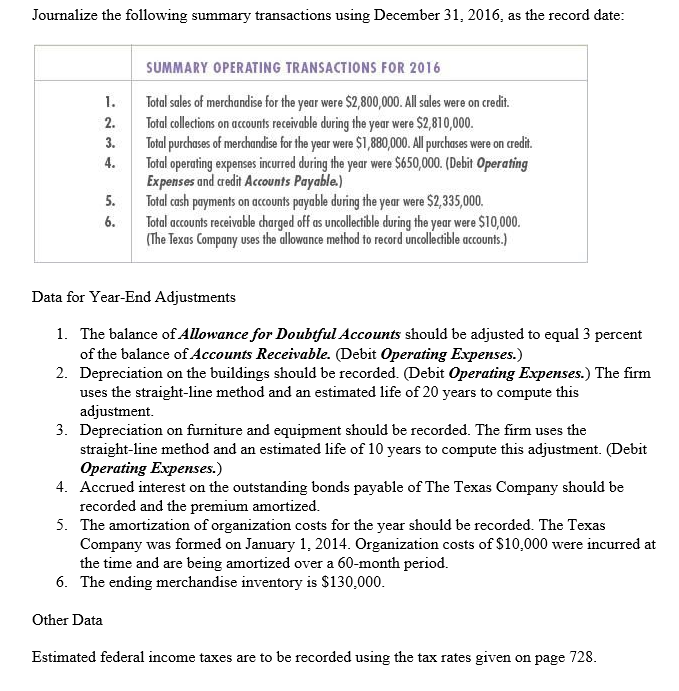

This project will give you an opportunity to apply your knowledge of accounting principles and procedures to a corporation. You will handle the accounting work of The Texas Company for 2016.

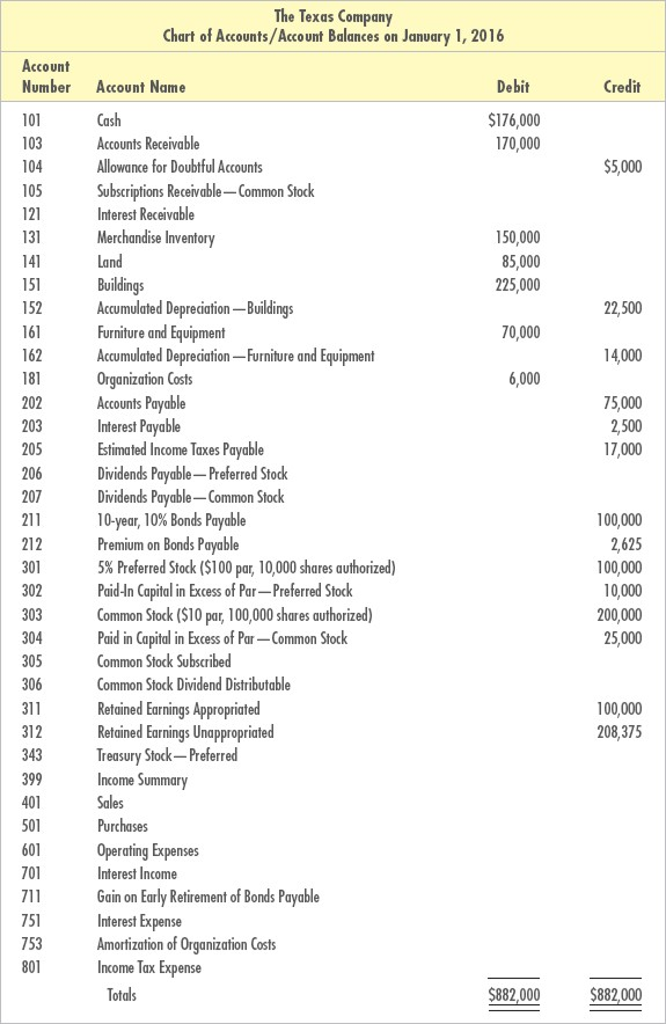

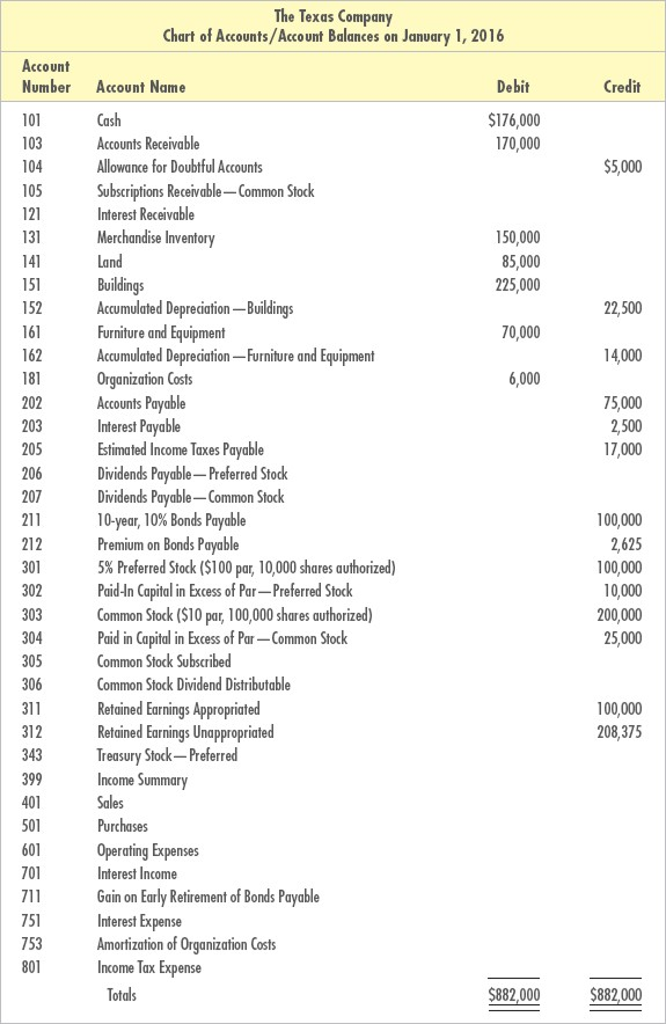

INTRODUCTION The chart of accounts and account balances of The Texas Company on January 1, 2016, are shown on the next page. Texas does not use reversing entries.

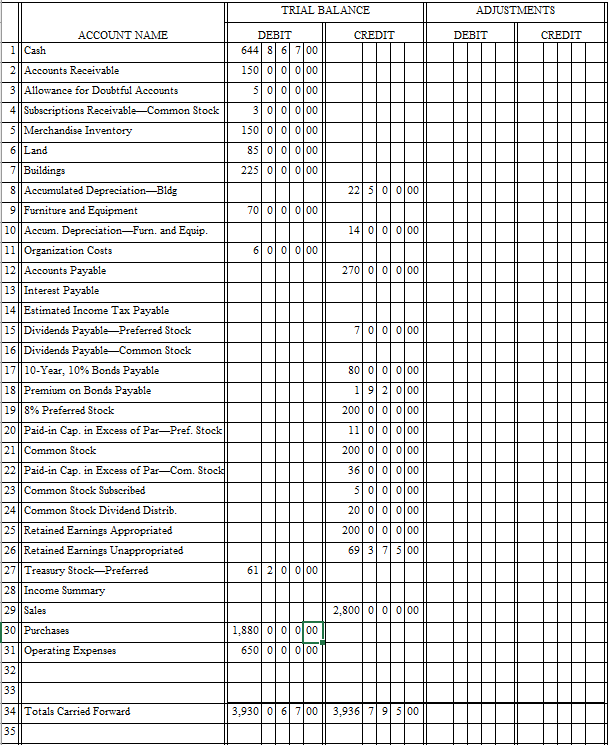

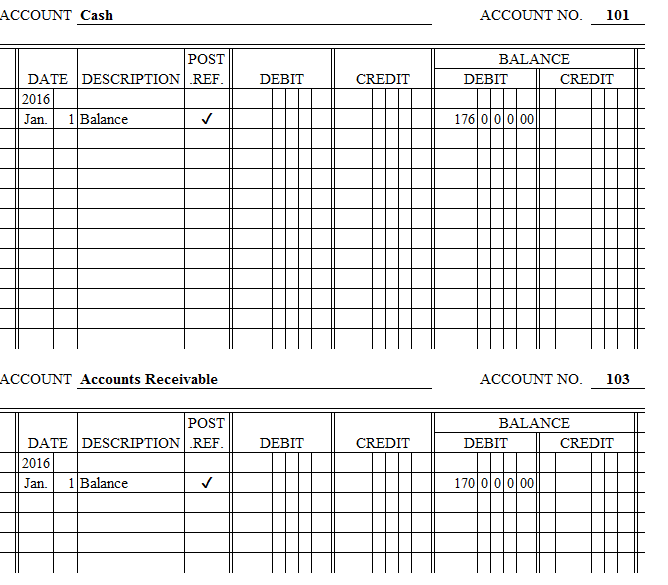

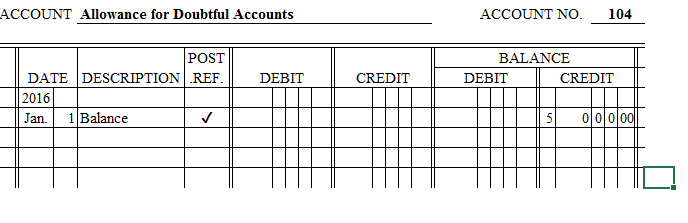

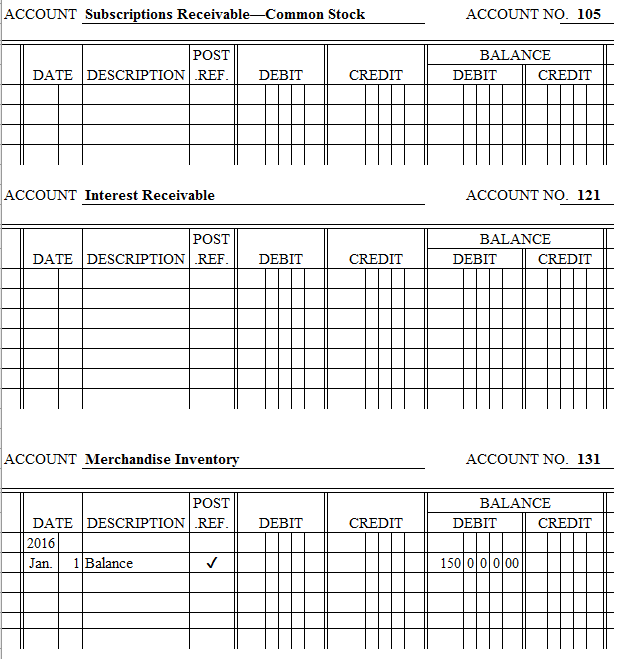

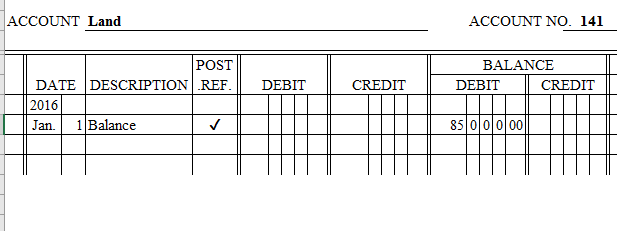

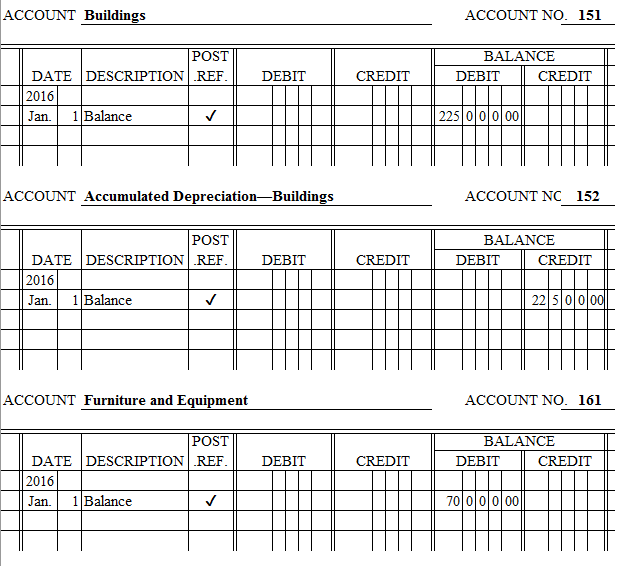

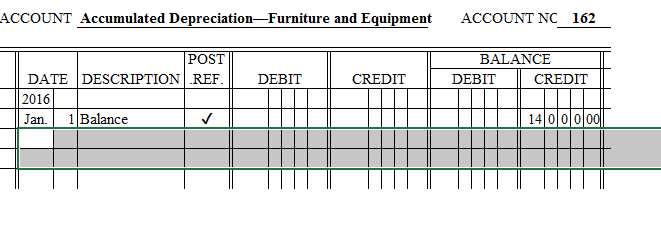

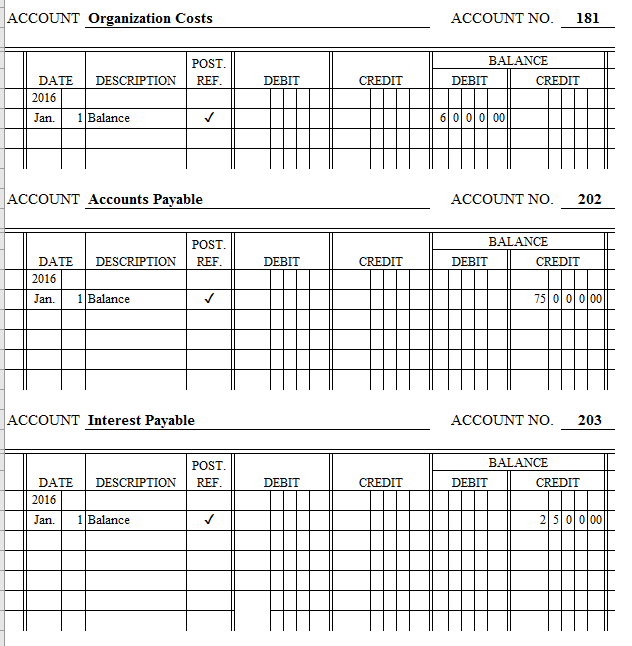

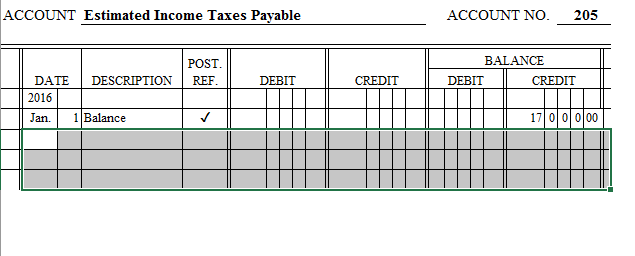

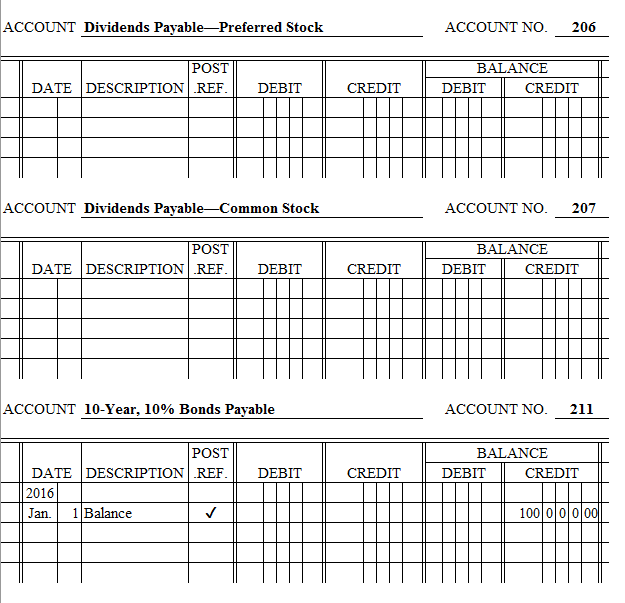

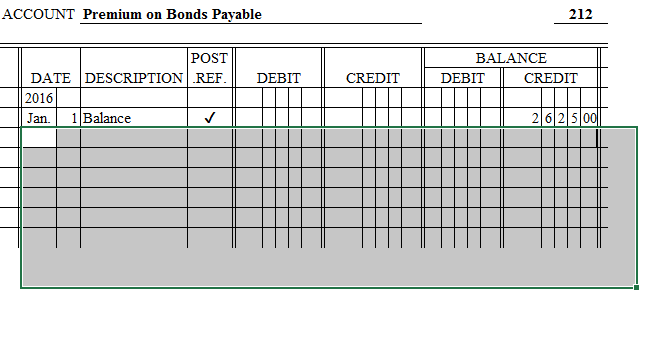

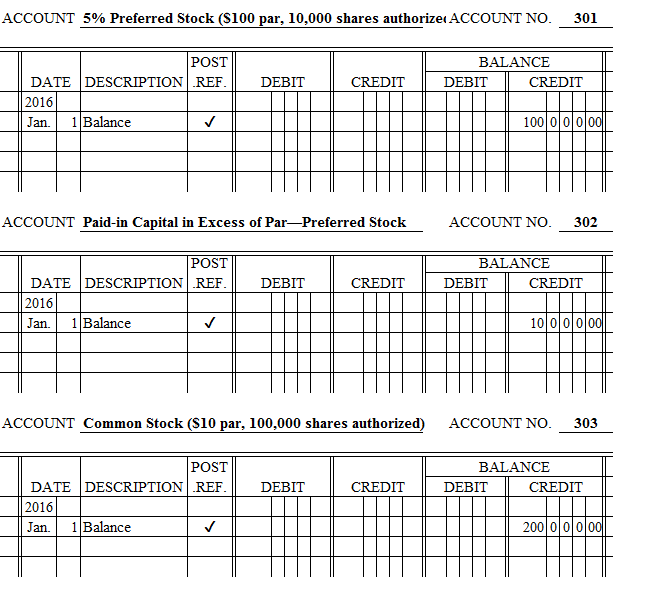

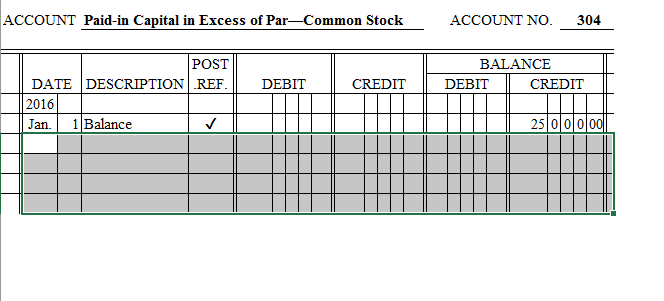

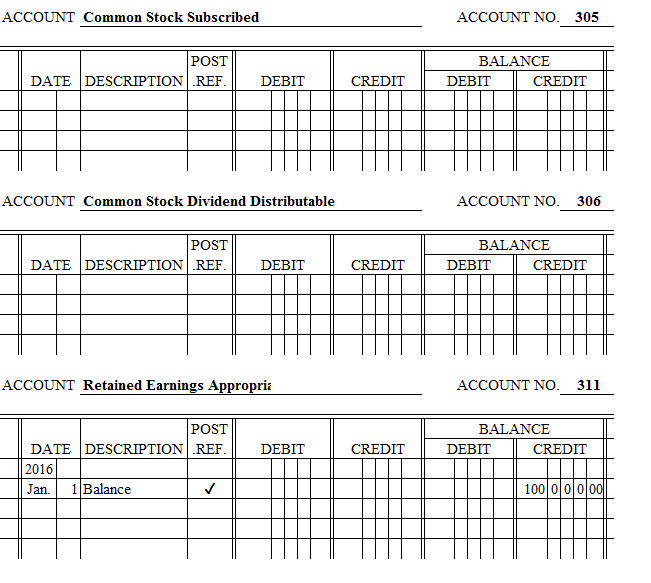

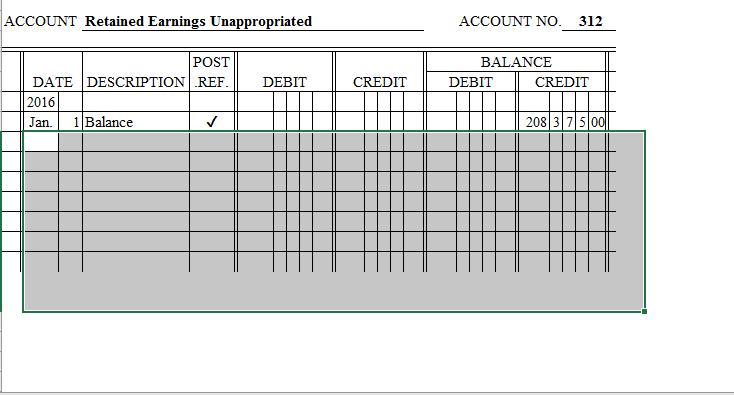

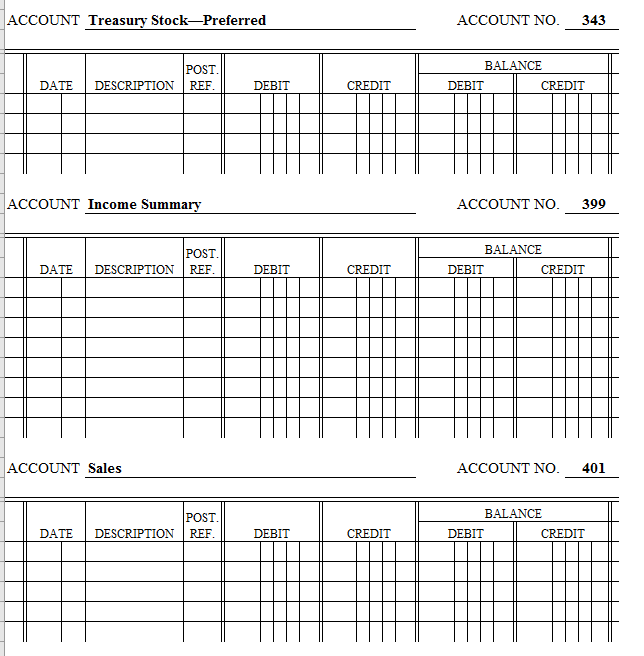

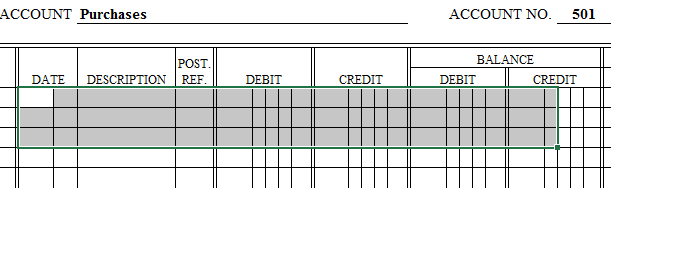

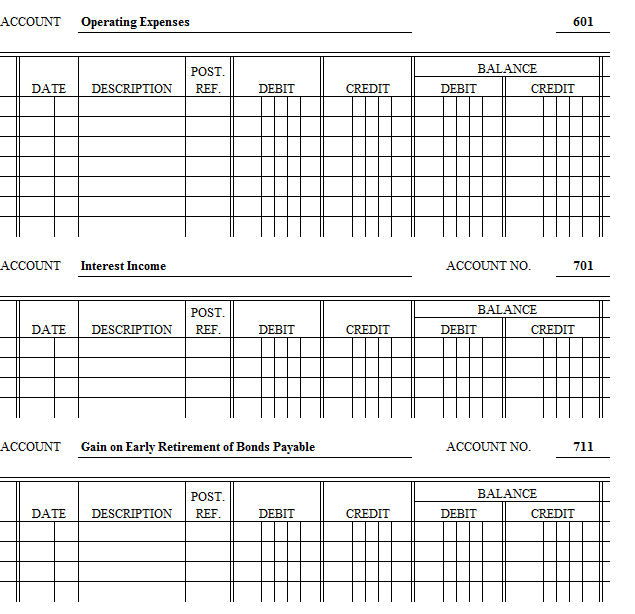

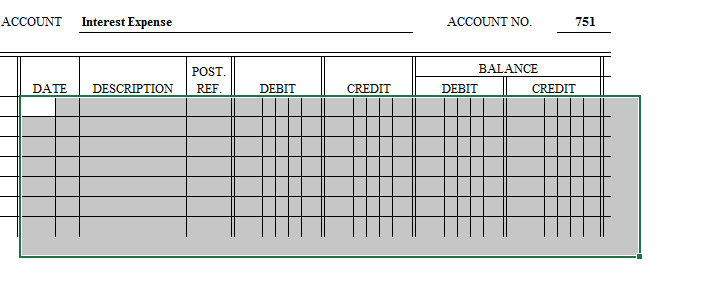

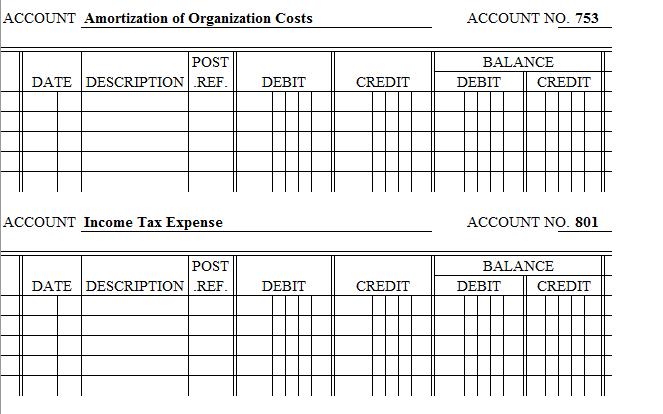

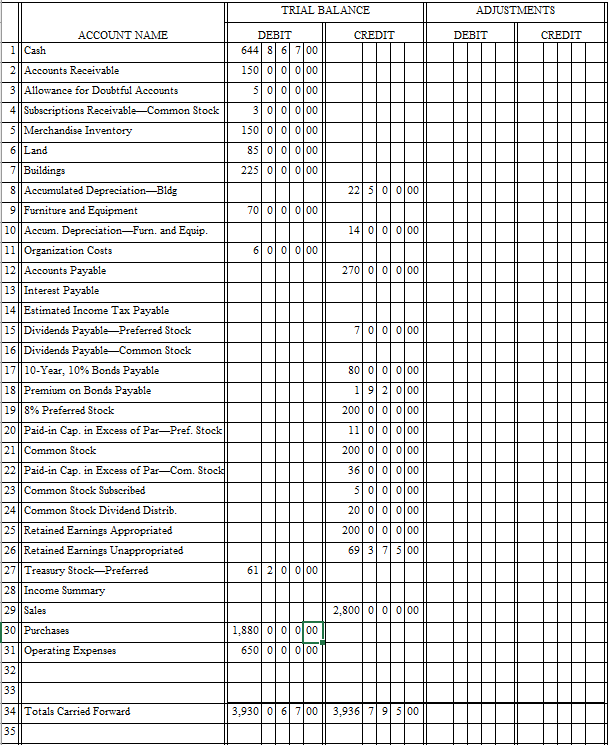

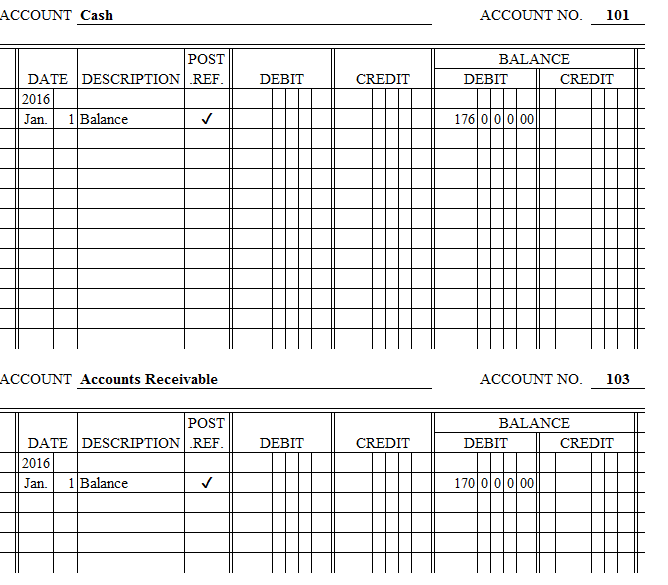

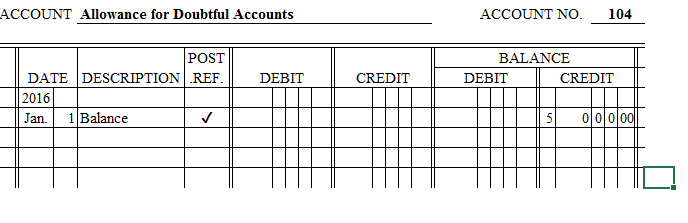

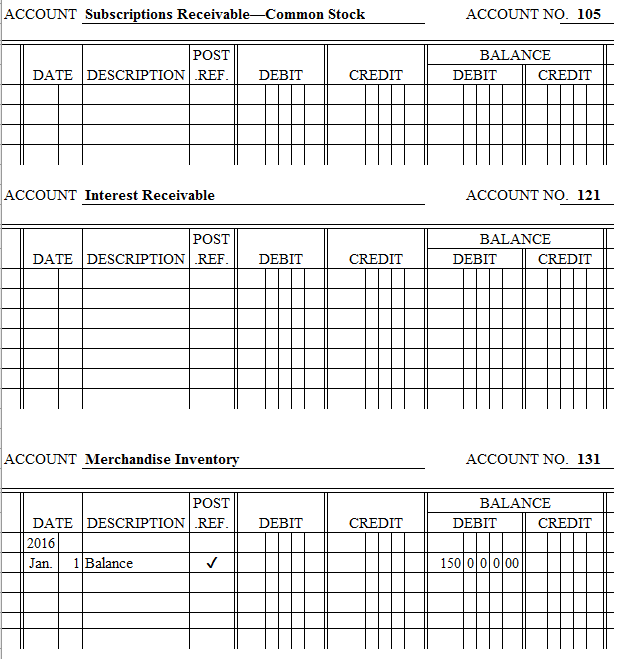

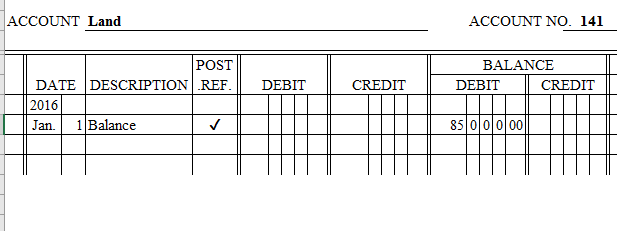

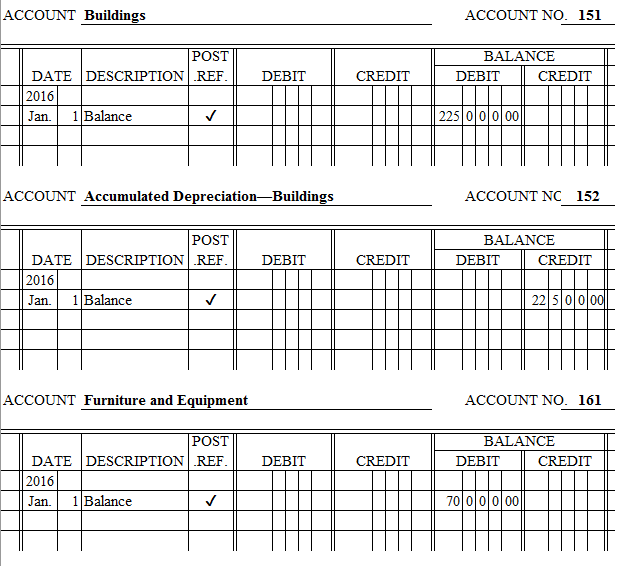

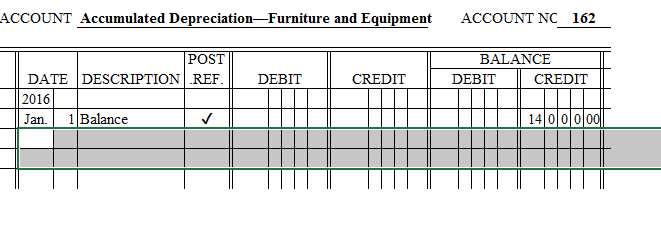

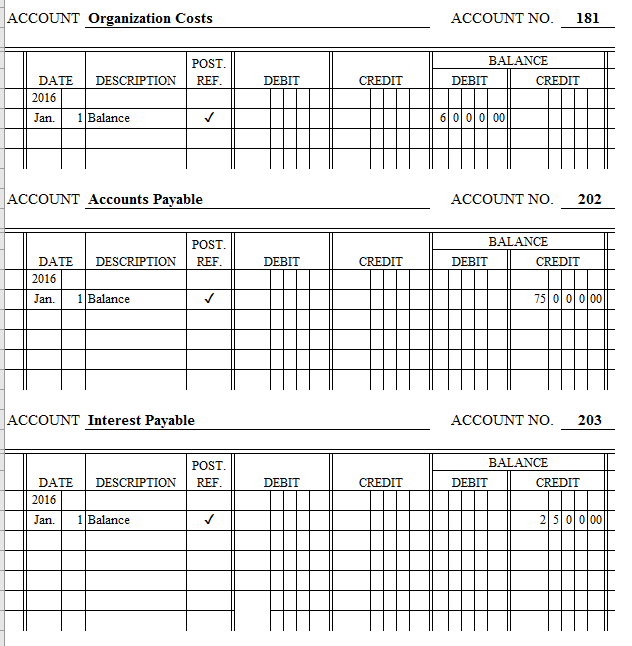

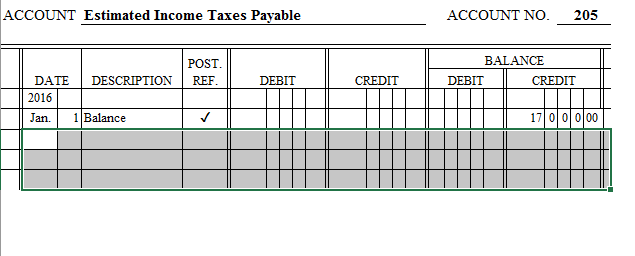

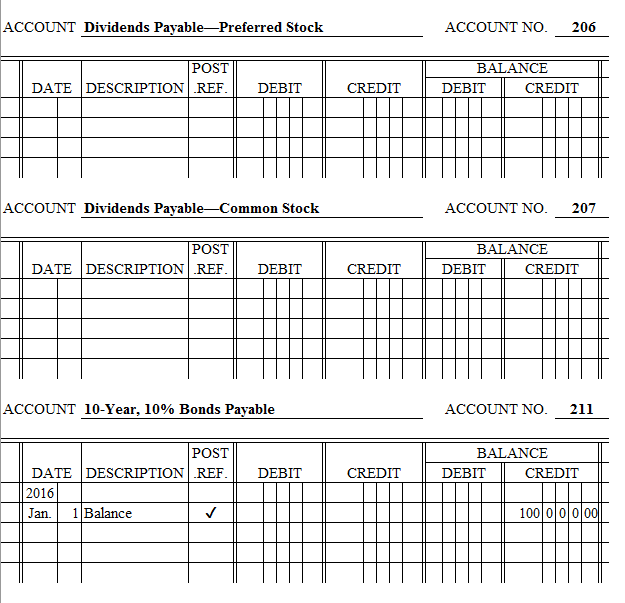

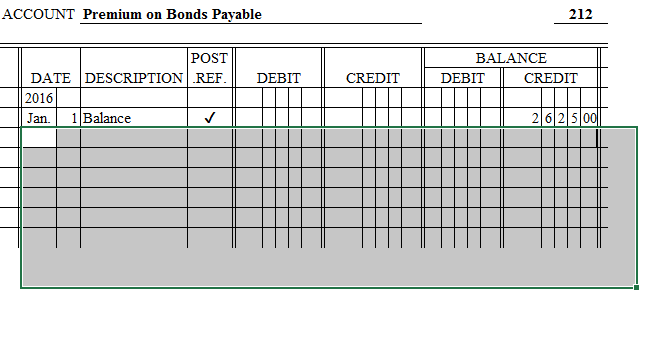

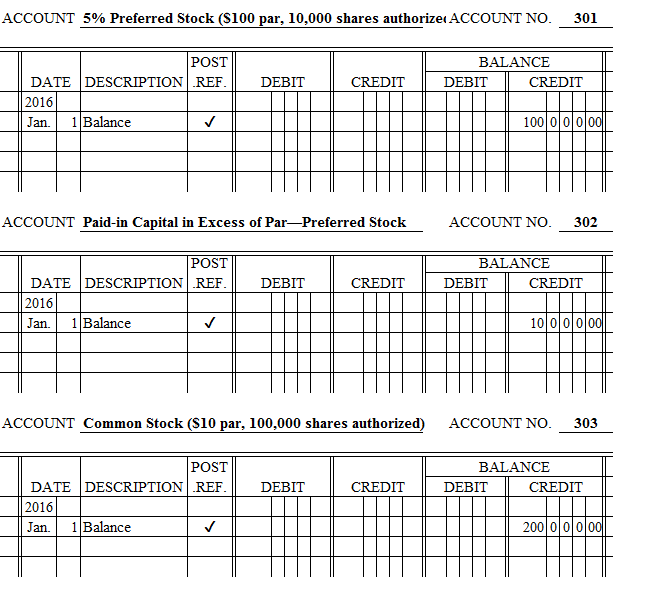

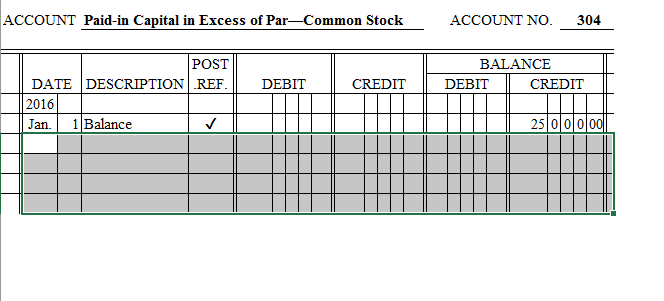

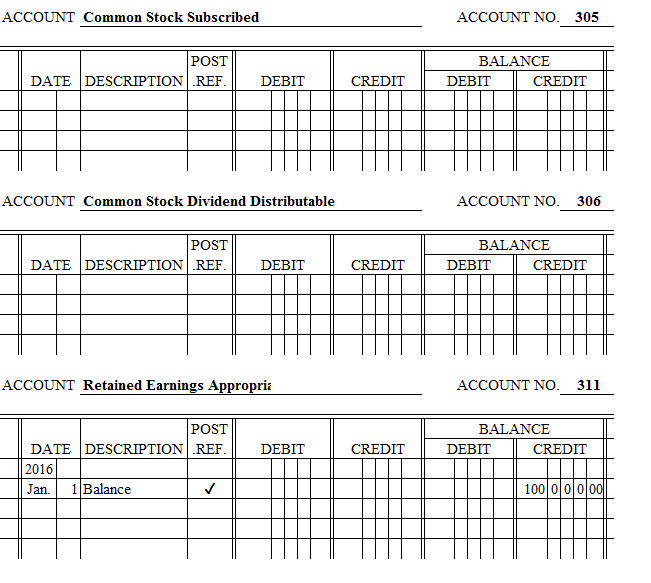

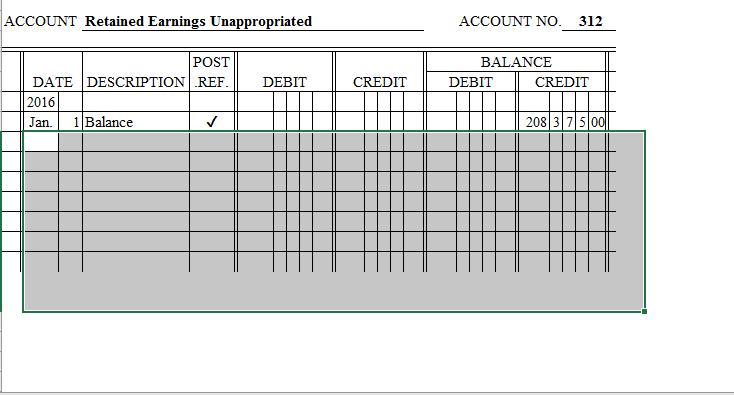

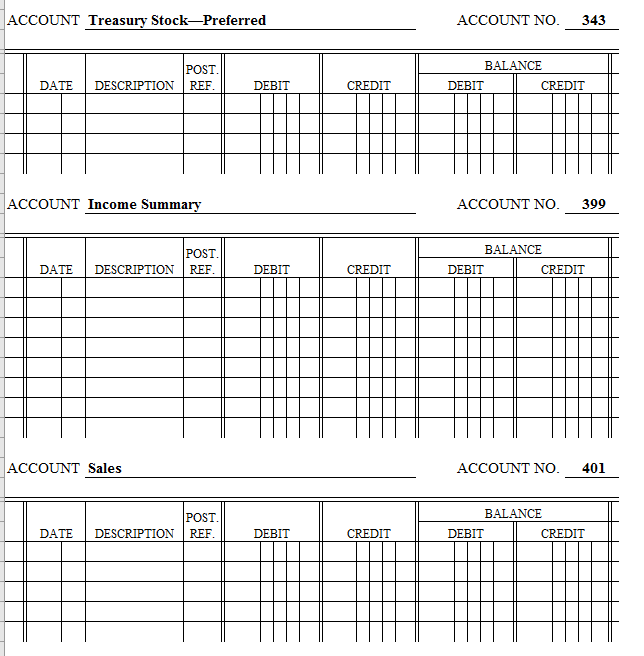

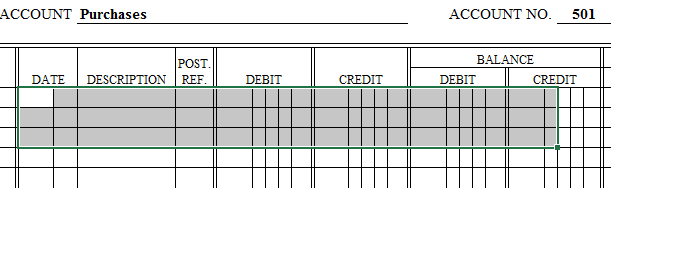

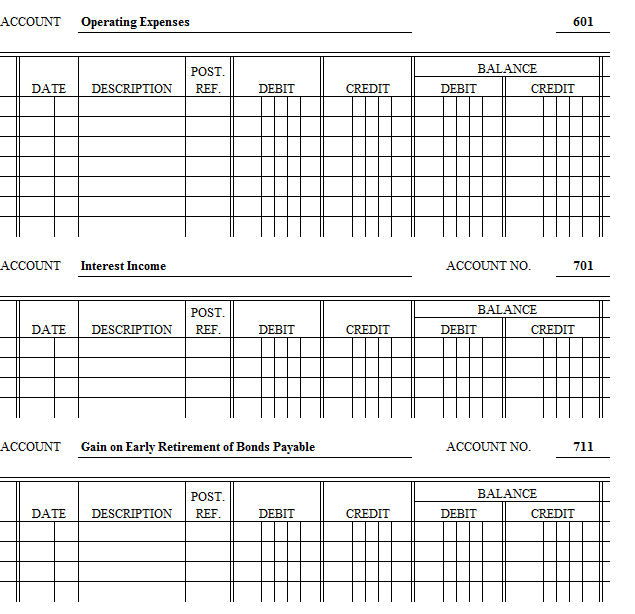

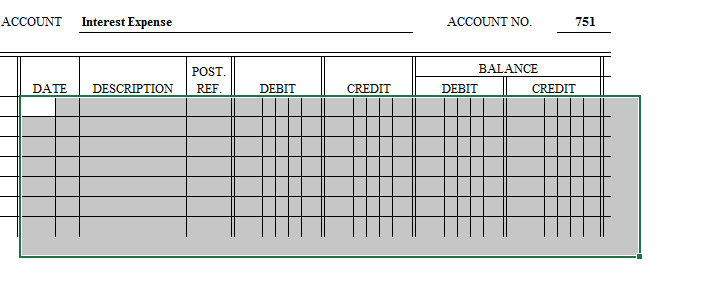

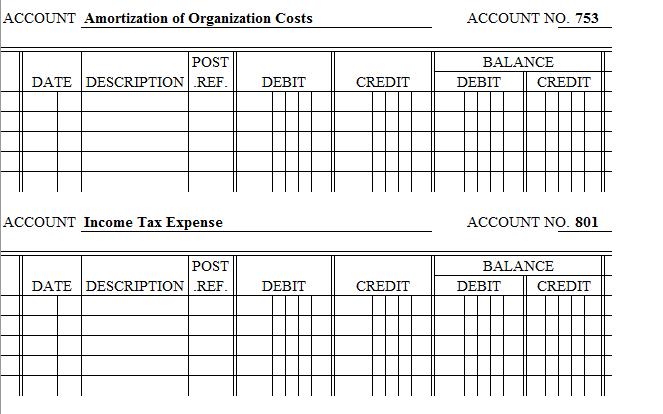

INSTRUCTIONS Round all computations to the nearest whole dollar. 1. Open the general ledger accounts and enter the balances for January 1, 2016. Obtain the necessary figures from the trial balance.

2. Analyze the transactions on the pages that follow, and record them in the general journal. Use 1 as the number of the first journal page.

3. Post the journal entries to the general ledger accounts.

Analyze: Assume that the firm declared and issued a 3:1 stock split of common stock in 2016. What is the effect on total par value?

The Texas Company Chart of Accounts/Account Balances on January 1, 2016 Account Number Account Name Debit Credit Cash $176,000 101 Accounts Receivable 103 170,000 $5,000 Allowance for Doubtful Accounts 104 105 Subscriptions Receivable-Common Stock Interest Receivable 121 Merchandise Inventory 131 150,000 Land 141 85,000 Buildings 151 225,000 Accumulated Depreciation-Buildings 152 22,500 161 Furniture and Equipment 70,000 162 Accumulated Depreciation-Furniture and Equipment 14000 181 Organization Costs 6,000 Accounts Payable 202 75,000 203 Interest Payable 2,500 205 Estimated Income Taxes Payable 17,000 206 Dividends Payable-Preferred Stock 207 Dividends Payable-Common Stock 211 10-year, 10% Bonds Payable 100,000 212 Premium on Bonds Payable 2,625 301 5% Preferred Stock ($100 par 10,000 shares authorized 100,000 Paid-n Capital in Excess of Par-Preferred Stock 302 10,000 303 Common Stock ($10 par, 100,000 shares authorized) 200,000 304 Paid in Capital in Excess of Par-Common Stock 25.000 Common Stock Subscribed 305 Common Stock Dividend Distributable 306 311 Retained Earnings Appropriated 100,000 312 Retained Earnings Unappropriated 208.375 343 Treasury Stock-Preferred 399 Income Summary 401 Sales Purchases 501 601 Operating Expenses 701 Interest Income Gain on Early Retirement of Bonds Payable Interest Expense 751 Amortization of Organization Costs 753 801 ncome Tax Exp ense Totals $882,000 $882.000 The Texas Company Chart of Accounts/Account Balances on January 1, 2016 Account Number Account Name Debit Credit Cash $176,000 101 Accounts Receivable 103 170,000 $5,000 Allowance for Doubtful Accounts 104 105 Subscriptions Receivable-Common Stock Interest Receivable 121 Merchandise Inventory 131 150,000 Land 141 85,000 Buildings 151 225,000 Accumulated Depreciation-Buildings 152 22,500 161 Furniture and Equipment 70,000 162 Accumulated Depreciation-Furniture and Equipment 14000 181 Organization Costs 6,000 Accounts Payable 202 75,000 203 Interest Payable 2,500 205 Estimated Income Taxes Payable 17,000 206 Dividends Payable-Preferred Stock 207 Dividends Payable-Common Stock 211 10-year, 10% Bonds Payable 100,000 212 Premium on Bonds Payable 2,625 301 5% Preferred Stock ($100 par 10,000 shares authorized 100,000 Paid-n Capital in Excess of Par-Preferred Stock 302 10,000 303 Common Stock ($10 par, 100,000 shares authorized) 200,000 304 Paid in Capital in Excess of Par-Common Stock 25.000 Common Stock Subscribed 305 Common Stock Dividend Distributable 306 311 Retained Earnings Appropriated 100,000 312 Retained Earnings Unappropriated 208.375 343 Treasury Stock-Preferred 399 Income Summary 401 Sales Purchases 501 601 Operating Expenses 701 Interest Income Gain on Early Retirement of Bonds Payable Interest Expense 751 Amortization of Organization Costs 753 801 ncome Tax Exp ense Totals $882,000 $882.000