Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello! I want help with this question. The submission deadline is an hour. Our client, Tekedan, has the following hedges in place in cad/GJ: Tekedan

Hello! I want help with this question. The submission deadline is an hour.

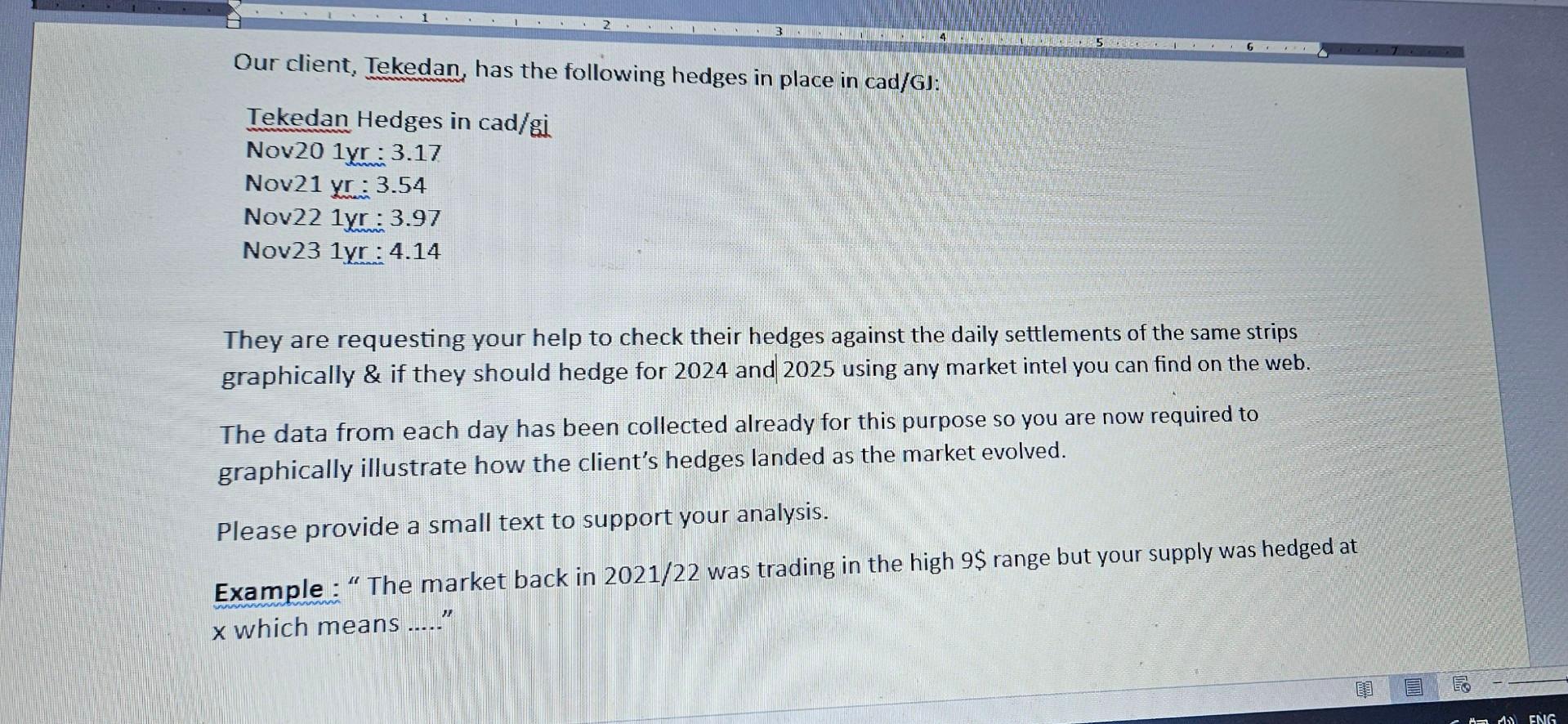

Our client, Tekedan, has the following hedges in place in cad/GJ: Tekedan Hedges in cad/gj Nov20 1yr:3.17 Nov21 yr: 3.54 Nov22 1yr: 3.97 Nov23 1yr:4.14 They are requesting your help to check their hedges against the daily settlements of the same strips graphically \& if they should hedge for 2024 and 2025 using any market intel you can find on the web. The data from each day has been collected already for this purpose so you are now required to graphically illustrate how the client's hedges landed as the market evolved. Please provide a small text to support your analysis. Example : "The market back in 2021/22 was trading in the high 9$ range but your supply was hedged at x which means ....." Our client, Tekedan, has the following hedges in place in cad/GJ: Tekedan Hedges in cad/gj Nov20 1yr:3.17 Nov21 yr: 3.54 Nov22 1yr: 3.97 Nov23 1yr:4.14 They are requesting your help to check their hedges against the daily settlements of the same strips graphically \& if they should hedge for 2024 and 2025 using any market intel you can find on the web. The data from each day has been collected already for this purpose so you are now required to graphically illustrate how the client's hedges landed as the market evolved. Please provide a small text to support your analysis. Example : "The market back in 2021/22 was trading in the high 9$ range but your supply was hedged at x which meansStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started