Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello! I want the solution to these questions. It would be really helpful if you could show how it's done in Excel too. Thank you!

Hello! I want the solution to these questions. It would be really helpful if you could show how it's done in Excel too. Thank you!

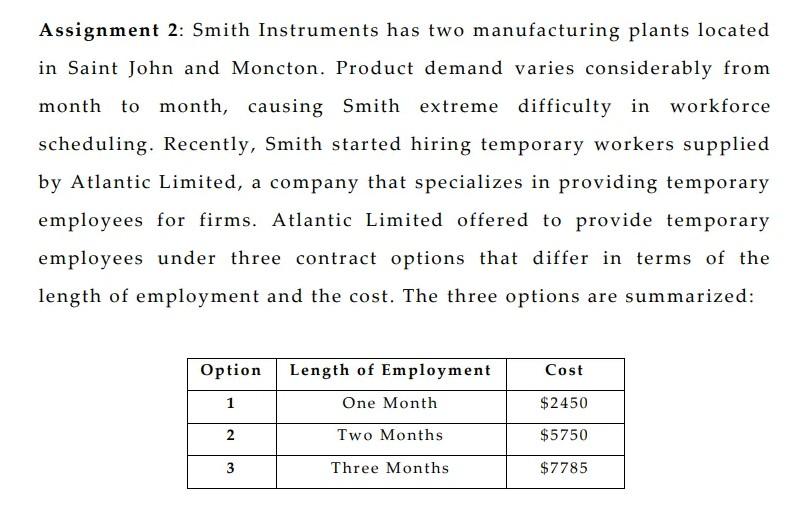

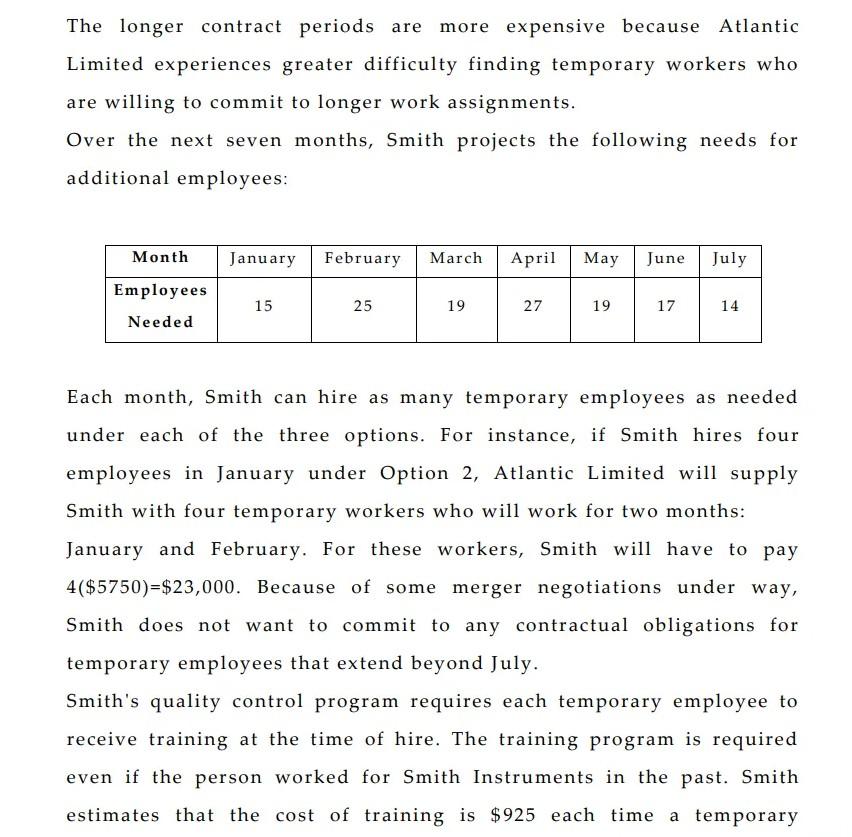

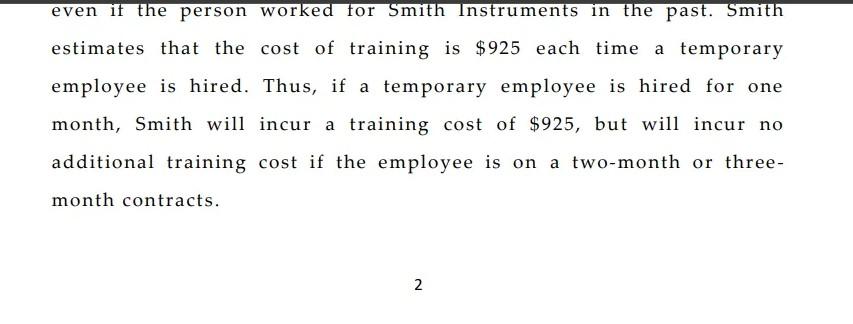

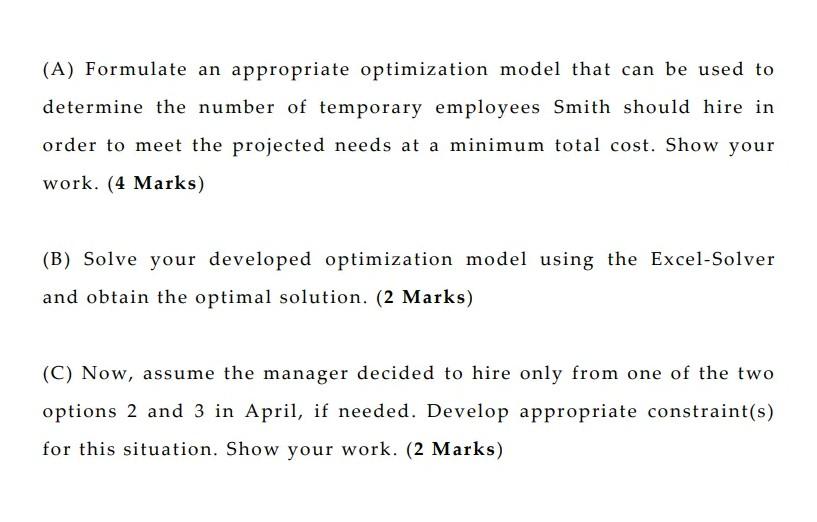

Assignment 2: Smith Instruments has two manufacturing plants located in Saint John and Moncton. Product demand varies considerably from month to month, causing Smith extreme difficulty in workforce scheduling. Recently, Smith started hiring temporary workers supplied by Atlantic Limited, a company that specializes in providing temporary employees for firms. Atlantic Limited offered to provide temporary employees under three contract options that differ in terms of the length of employment and the cost. The three options are summarized: Option Length of Employment Cost 1 One Month $2450 2 Two Months $5750 3 Three Months $7785 The longer contract periods are more expensive because Atlantic Limited experiences greater difficulty finding temporary workers who are willing to commit to longer work assignments. Over the next seven months, Smith projects the following needs for additional employees: Month January February March April May June July Employees Needed 15 25 19 27 19 17 14 Each month, Smith can hire as many temporary employees as needed under each of the three options. For instance, if Smith hires four employees in January under Option 2, Atlantic Limited will supply Smith with four temporary workers who will work for two months: January and February. For these workers, Smith will have to pay 4($5750)=$23,000. Because of some merger negotiations under way, Smith does not want to commit to any contractual obligations for temporary employees that extend beyond July. Smith's quality control program requires each temporary employee to receive training at the time of hire. The training program is required even if the person worked for Smith Instruments in the past. Smith estimates that the cost of training is $925 each time a temporary even if the person worked for Smith Instruments in the past. Smith estimates that the cost of training is $925 each time a temporary employee is hired. Thus, if a temporary employee is hired for one month, Smith will incur a training cost of $925, but will incur no additional training cost if the employee is on a two-month or three- month contracts. N (A) Formulate an appropriate optimization model that can be used to determine the number of temporary employees Smith should hire in order to meet the projected needs at a minimum total cost. Show your work. (4 Marks) (B) Solve your developed optimization model using the Excel-Solver and obtain the optimal solution. (2 Marks) (C) Now, assume the manager decided to hire only from one of the two options 2 and 3 in April, if needed. Develop appropriate constraint(s) for this situation. Show your work. (2 Marks) Assignment 2: Smith Instruments has two manufacturing plants located in Saint John and Moncton. Product demand varies considerably from month to month, causing Smith extreme difficulty in workforce scheduling. Recently, Smith started hiring temporary workers supplied by Atlantic Limited, a company that specializes in providing temporary employees for firms. Atlantic Limited offered to provide temporary employees under three contract options that differ in terms of the length of employment and the cost. The three options are summarized: Option Length of Employment Cost 1 One Month $2450 2 Two Months $5750 3 Three Months $7785 The longer contract periods are more expensive because Atlantic Limited experiences greater difficulty finding temporary workers who are willing to commit to longer work assignments. Over the next seven months, Smith projects the following needs for additional employees: Month January February March April May June July Employees Needed 15 25 19 27 19 17 14 Each month, Smith can hire as many temporary employees as needed under each of the three options. For instance, if Smith hires four employees in January under Option 2, Atlantic Limited will supply Smith with four temporary workers who will work for two months: January and February. For these workers, Smith will have to pay 4($5750)=$23,000. Because of some merger negotiations under way, Smith does not want to commit to any contractual obligations for temporary employees that extend beyond July. Smith's quality control program requires each temporary employee to receive training at the time of hire. The training program is required even if the person worked for Smith Instruments in the past. Smith estimates that the cost of training is $925 each time a temporary even if the person worked for Smith Instruments in the past. Smith estimates that the cost of training is $925 each time a temporary employee is hired. Thus, if a temporary employee is hired for one month, Smith will incur a training cost of $925, but will incur no additional training cost if the employee is on a two-month or three- month contracts. N (A) Formulate an appropriate optimization model that can be used to determine the number of temporary employees Smith should hire in order to meet the projected needs at a minimum total cost. Show your work. (4 Marks) (B) Solve your developed optimization model using the Excel-Solver and obtain the optimal solution. (2 Marks) (C) Now, assume the manager decided to hire only from one of the two options 2 and 3 in April, if needed. Develop appropriate constraint(s) for this situation. Show your work. (2 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started