Hello, I was just wondering if someone may solve this practice problem fully? I dont quite understand it. If you could show me the step by step with the solution at the end of the question(s) it would really help me understand the concept and how you reached the final result. Thank you in advance.

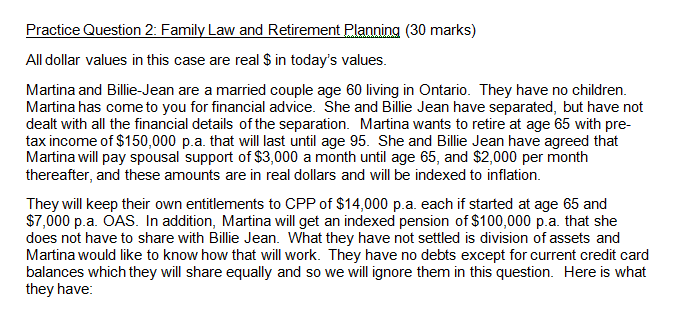

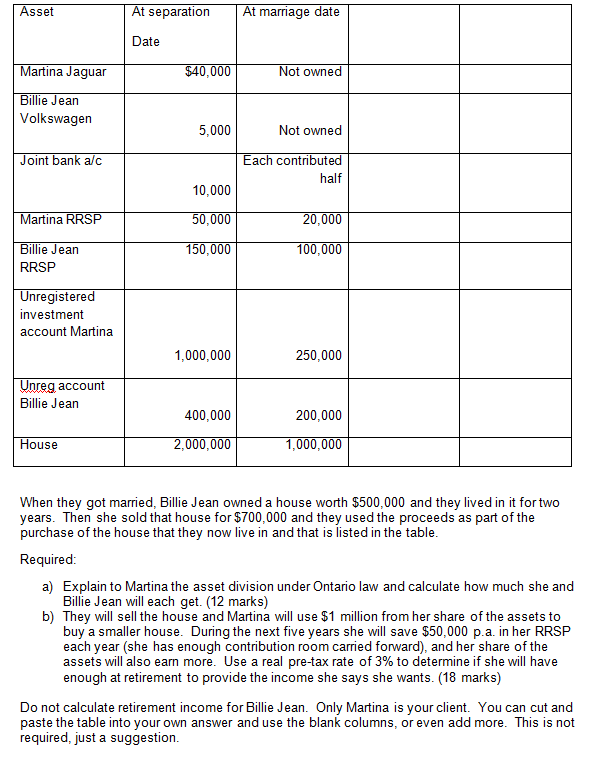

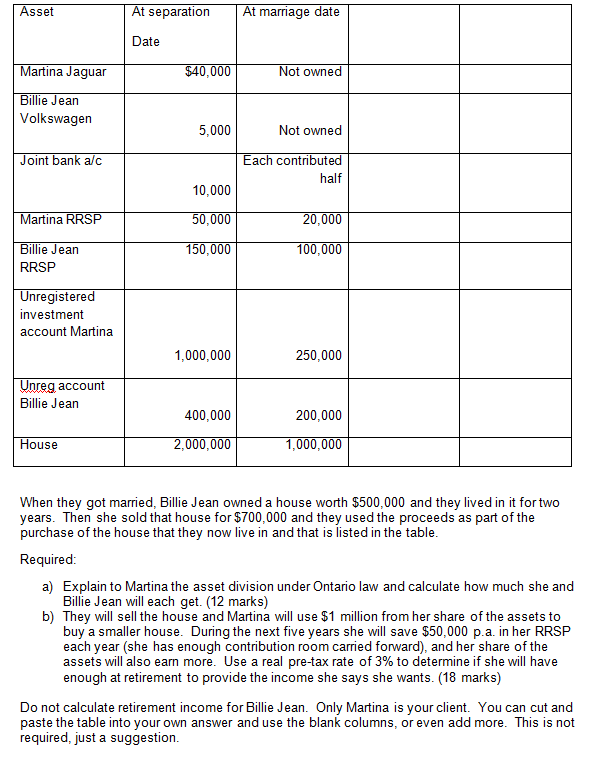

Practice Question 2: Family Law and Retirement Planning (30 marks) All dollar values in this case are real $ in today's values. Martina and Billie-Jean are a married couple age 60 living in Ontario. They have no children. Martina has come to you for financial advice. She and Billie Jean have separated, but have not dealt with all the financial details of the separation. Martina wants to retire at age 65 with pre- tax income of $150,000 p.a. that will last until age 95. She and Billie Jean have agreed that Martina will pay spousal support of $3,000 a month until age 65, and $2,000 per month thereafter, and these amounts are in real dollars and will be indexed to inflation. They will keep their own entitlements to CPP of $14,000 p.a. each if started at age 65 and $7,000 p.a. OAS. In addition, Martina will get an indexed pension of $100,000 p.a. that she does not have to share with Billie Jean. What they have not settled is division of assets and Martina would like to know how that will work. They have no debts except for current credit card balances which they will share equally and so we will ignore them in this question. Here is what they have Asset At separation At marriage date Date Martina Jaguar $40,000 Not owned Billie Jean Volkswagen 5,000 Not owned Joint bank a/c Each contributed half 10,000 Martina RRSP 50,000 20,000 150,000 100,000 Billie Jean RRSP Unregistered investment account Martina 1,000,000 250,000 Unreg account Billie Jean 400,000 200,000 House 2,000,000 1,000,000 When they got married, Billie Jean owned a house worth $500,000 and they lived in it for two years. Then she sold that house for $700,000 and they used the proceeds as part of the purchase of the house that they now live in and that is listed in the table. Required: a) Explain to Martina the asset division under Ontario law and calculate how much she and Billie Jean will each get. (12 marks) b) They will sell the house and Martina will use $1 million from her share of the assets to buy a smaller house. During the next five years she will save $50,000 p.a. in her RRSP each year (she has enough contribution room carried forward), and her share of the assets will also earn more. Use a real pre-tax rate of 3% to determine if she will have enough at retirement to provide the income she says she wants. (18 marks) Do not calculate retirement income for Billie Jean. Only Martina is your client. You can cut and paste the table into your own answer and use the blank columns, or even add more. This is not required, just a suggestion. Practice Question 2: Family Law and Retirement Planning (30 marks) All dollar values in this case are real $ in today's values. Martina and Billie-Jean are a married couple age 60 living in Ontario. They have no children. Martina has come to you for financial advice. She and Billie Jean have separated, but have not dealt with all the financial details of the separation. Martina wants to retire at age 65 with pre- tax income of $150,000 p.a. that will last until age 95. She and Billie Jean have agreed that Martina will pay spousal support of $3,000 a month until age 65, and $2,000 per month thereafter, and these amounts are in real dollars and will be indexed to inflation. They will keep their own entitlements to CPP of $14,000 p.a. each if started at age 65 and $7,000 p.a. OAS. In addition, Martina will get an indexed pension of $100,000 p.a. that she does not have to share with Billie Jean. What they have not settled is division of assets and Martina would like to know how that will work. They have no debts except for current credit card balances which they will share equally and so we will ignore them in this question. Here is what they have Asset At separation At marriage date Date Martina Jaguar $40,000 Not owned Billie Jean Volkswagen 5,000 Not owned Joint bank a/c Each contributed half 10,000 Martina RRSP 50,000 20,000 150,000 100,000 Billie Jean RRSP Unregistered investment account Martina 1,000,000 250,000 Unreg account Billie Jean 400,000 200,000 House 2,000,000 1,000,000 When they got married, Billie Jean owned a house worth $500,000 and they lived in it for two years. Then she sold that house for $700,000 and they used the proceeds as part of the purchase of the house that they now live in and that is listed in the table. Required: a) Explain to Martina the asset division under Ontario law and calculate how much she and Billie Jean will each get. (12 marks) b) They will sell the house and Martina will use $1 million from her share of the assets to buy a smaller house. During the next five years she will save $50,000 p.a. in her RRSP each year (she has enough contribution room carried forward), and her share of the assets will also earn more. Use a real pre-tax rate of 3% to determine if she will have enough at retirement to provide the income she says she wants. (18 marks) Do not calculate retirement income for Billie Jean. Only Martina is your client. You can cut and paste the table into your own answer and use the blank columns, or even add more. This is not required, just a suggestion