Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello I was reviewing CFA Level I and had trouble understanding the mutual fund cash position indicator. Could you please explain to me why fund

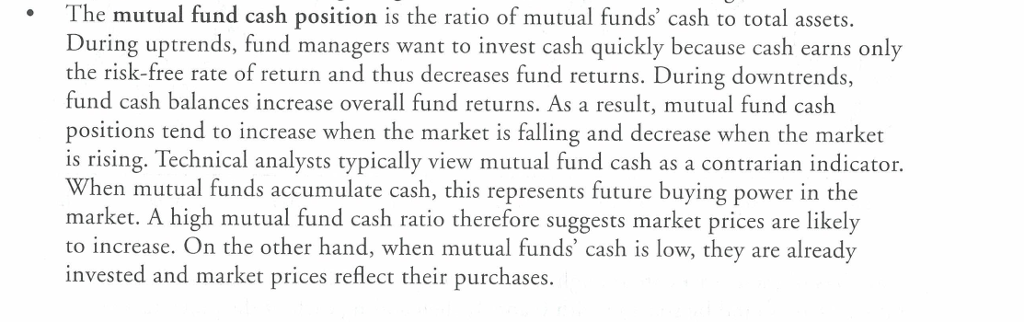

Hello I was reviewing CFA Level I and had trouble understanding the "mutual fund cash position" indicator. Could you please explain to me why "fund managers want to invest cash quickly because cash earns only the risk-free rate of return and thus decrease fund return?" Thank you!

The mutual fund cash position is the ratio of mutual funds' cash to total assets. During uptrends, fund managers want to invest cash quickly because cash earns only the risk-free rate of return and thus decreases fund returns. During downtrends, fund cash balances increase overall fund returns. As a result, mutual fund cash positions tend to increase when the market is falling and decrease when the market is rising. Technical analysts typically view mutual fund cash as a contrarian indicator. When mutual funds accumulate cash, this represents future buying power in the market. A high mutual fund cash ratio therefore suggests market prices are likely to increase. On the other hand, when mutual funds' cash is low, they are already invested and market prices reflect their purchases

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started