Hello, I was wondering if you could help me with Cumulative Comprehension Problem from Chapter 5: Echo Systems. Can you help with the ledger and trail balance?

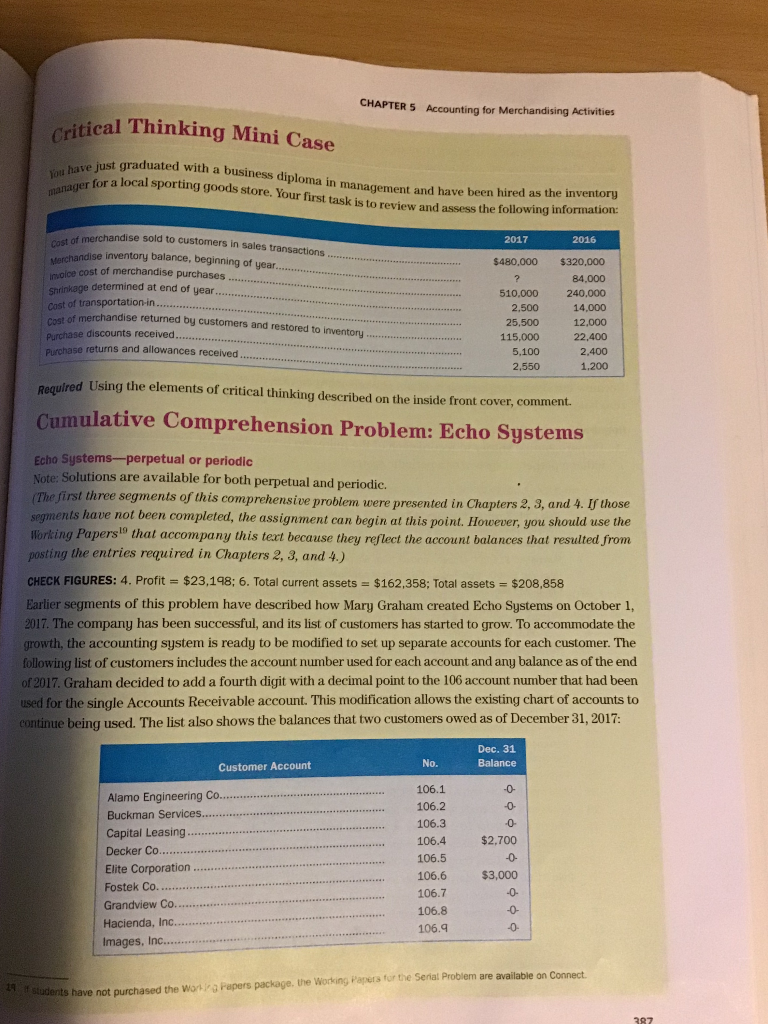

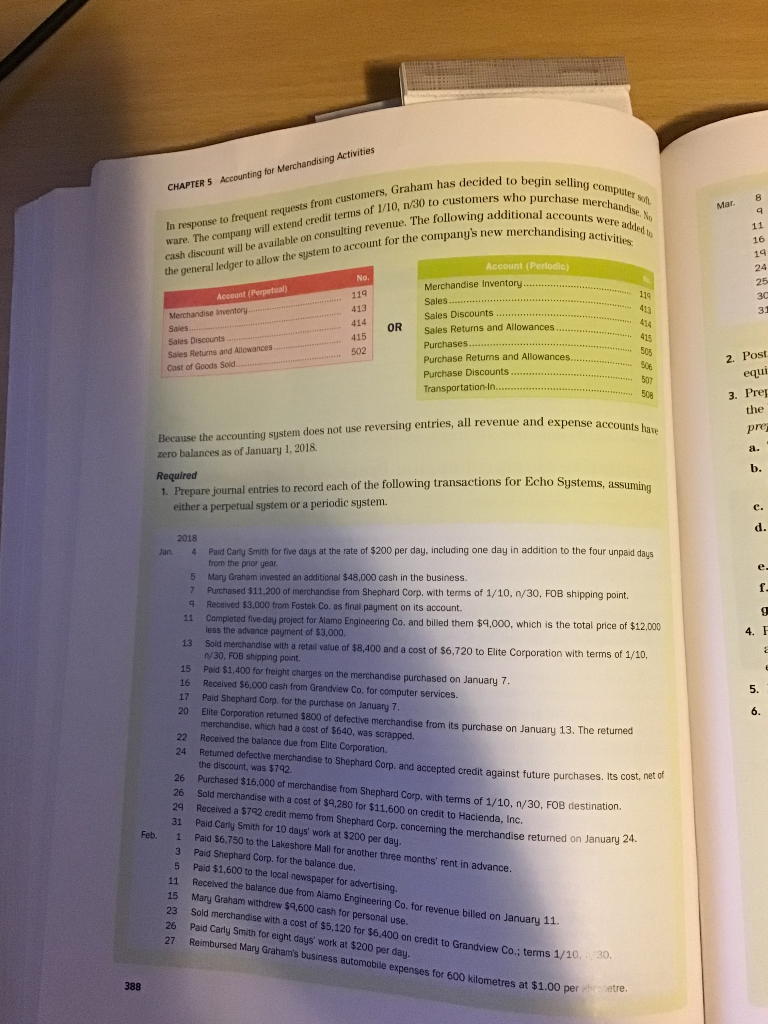

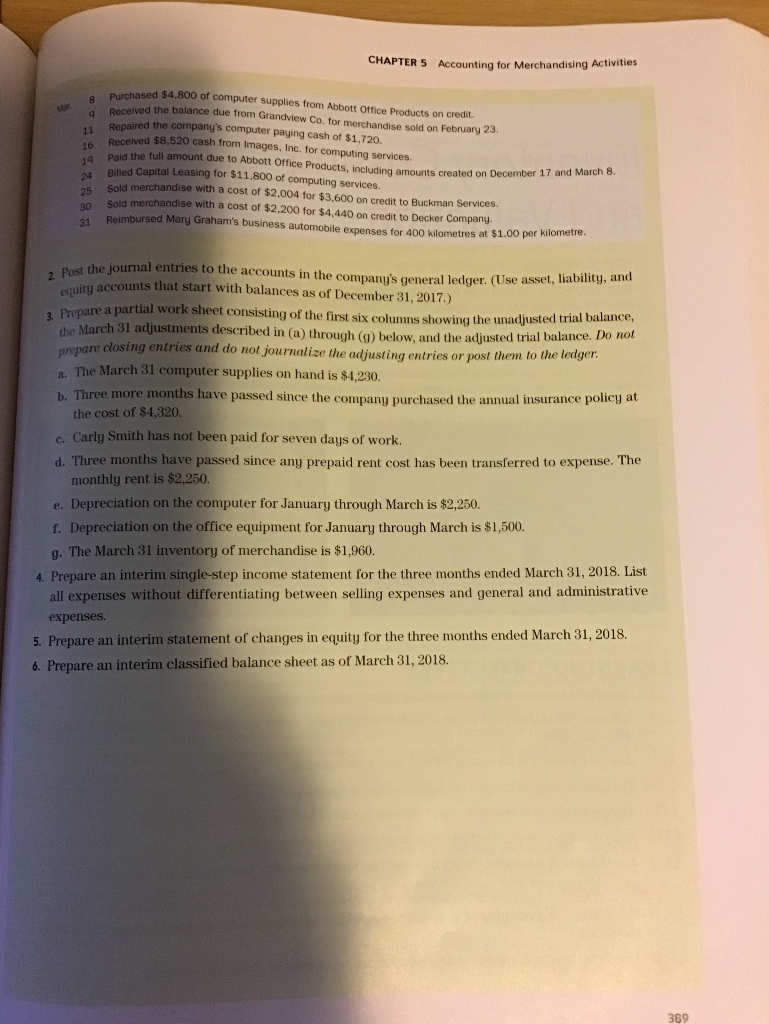

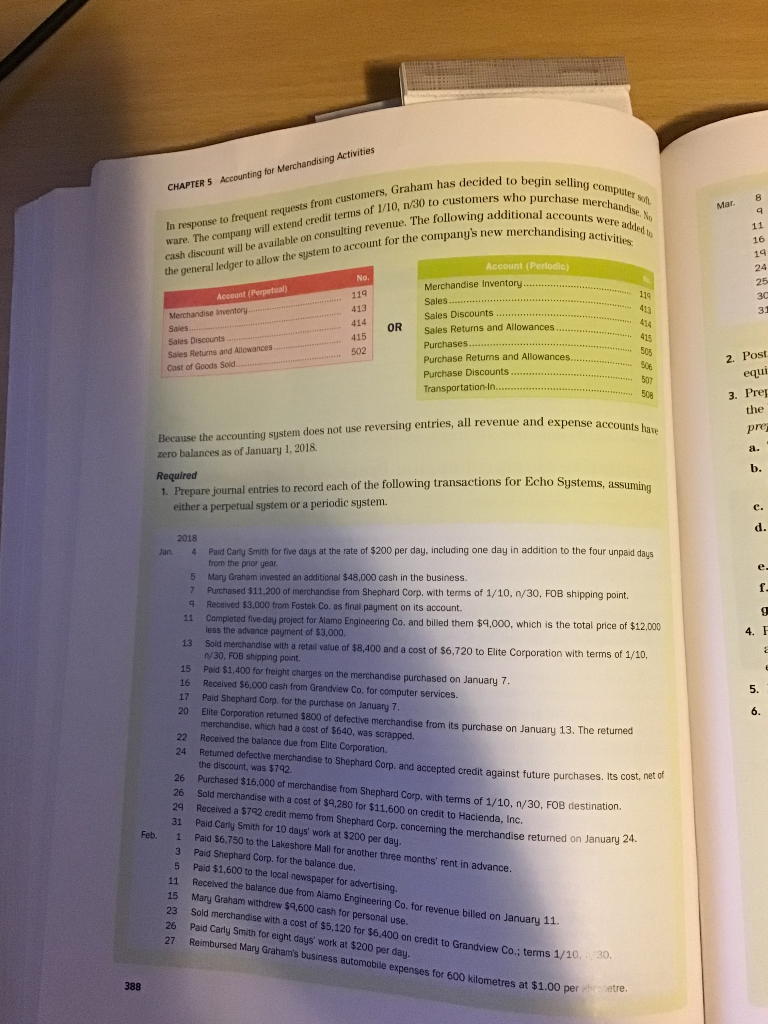

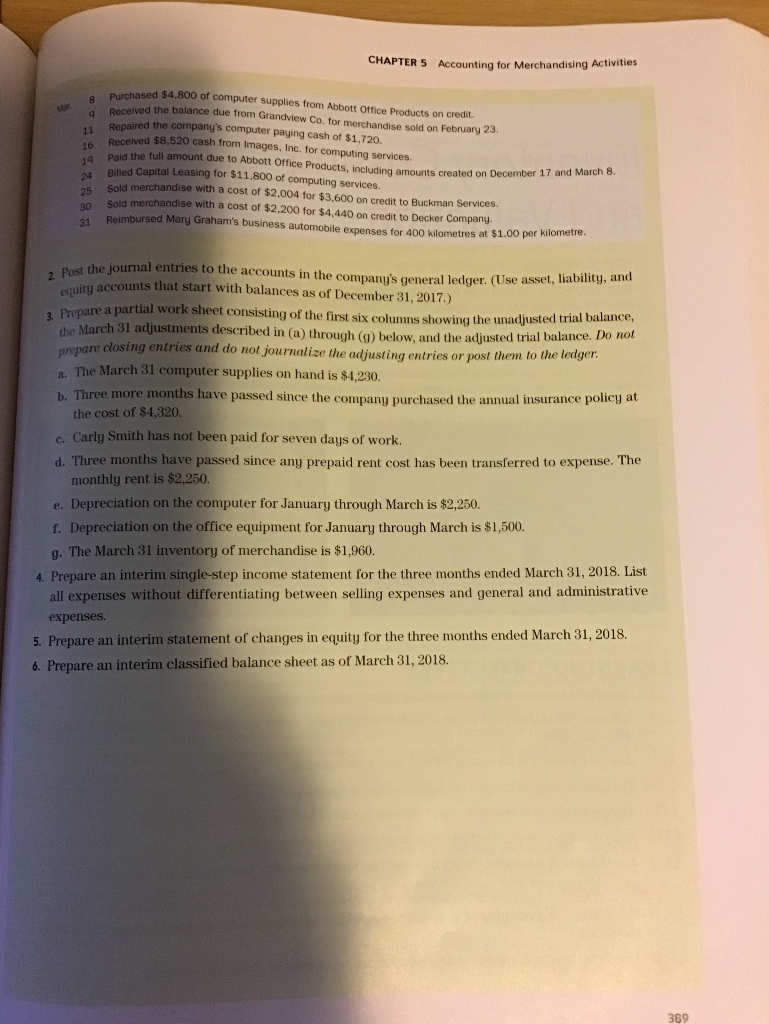

CHAPTER 5 Accounting for Merchandising Activities critical Thinking Mini Case ve just graduated with a business diploma in management and have been hired as the inven r for a local sporting goods store. Your first task is to review and assess the following information: of merchandise sold to customers in sales transactions 2017 2016 e inventory balance, beginning of year. $480,000 $320,000 84,000 510,000 240,000 2.500 14,000 25,500 12,000 115,000 2.400 ice cost of merchandise purchases sninkage determined at end of year Cost of transportation-in merchandise returned by customers and restored to inventory Cost of Purchase discounts received Purchase returns and allowances rece 5,100 2,550 1,200 Required Using the elements of critical thinking described on the inside front cover, comment. Cumulative Comprehension Problem: Echo Systems Echo Systems-perpetual or periodic Note: Solutions are available for both perpetual and periodic. The first three segments of this comprehensive problem were p segments have not been completed, the assignment can begin at this point. However, you should use the Working Papers1 that accompany this text because they reflect the account balances that resulted from posting the entries required in Chapters 2, 3, and 4) resented in Chapters 2, 3, and 4. If those CHECK FIGURES: 4. Profit $23,198: 6. Total current assets $162,358: Total assets $208,858 Earlier segments of this problem have described how Mary Graham created Echo Systems on October 1 2017. The company has been successful, and its list of customers has started to grow. To accommodate the growth, the accounting system is ready to be modified to set up separate accounts for each customer. The following list of customers includes the account number used for each account and any balance as of the end of 2017. Graham decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This modification allows the existing chart of accounts to continue being used. The list also shows the balances that two customers owed as of December 31, 2017: Dec. 31 Balance No. Customer Account 106.1 106.2 106.3 Alamo Engineering Co Buckman Services. Capital Leasing 0- 106.5 $2,700 Elite Corporation. Fostek Co.... 106.6 106.7 106.8 106.q $3,000 Images, Inc udlents have not purchased the Wor a Papers package. the Working Papers fur the Serial Problem are available on Connect 387 In response to frequent requests from customers, Graham has d ware. The company will extend credit terms of 1/10, n/30 to cus has decided to begin sell CHAPTER 5 Accounting for Merchandising Activities Mar. 8 cash discount will be available on consulting revenue. The follow the additional accounts were company's new merchandising a 16 general ledger to allow the system to account for the com Merchandise Inventory 119 413 Sales. Sales Discounts OR Sales Returns and Allowances.. 415 Sales Discounts Sales Retums and Allowances Cost of Goods Sold.. Returns and Allowances 2. Post Purchase Discounts Transportation-In 3. Pre Because the accounting sustem does not use reversing entries, all revenue and expense acct zero balances as of January 1,2018 pre al. 1. Prepare journal entries to record each of the following transactions for Echo S either a perpetual system or a periodic system. d. Jan. 4 Paid Carly Smith for fihe days at the rate of $200 per day, including one day in addition to the four unpaid days from the prior year 5 Many Graham invested an additional $48,000 cash in the business. 7 Purchased $11.200 of merchandise from Shephard Corp. with terms of 1/10, n/30, FOB shipping point. 9 Received $3,000 from Fostek Co. as final payment on its account. 11 Completed five day project for Alamo Engineering Co. and billed them $9,000, which is the total price of $12.000 13 Sold merchandise with a retail value of $8,400 and a cost of $6,720 to Elite Corporation with terms of 1/10 less the advance payment of $3,000. n/30, FOB shipping point. 15 Paid $1,400 for freight charges on the merchandise purchased on January 7 16 Received $6,000 cash from Grandview Co. for computer services. 17 Paid Shephard Corp. for the purchase on January 7 20 Elite Corporation returned $800 of defective merchandise from its purchase on January 13. The returned 5. merchandise, which had a cost of $640, was scrapped 22 Received the balance due from Elite Corporation. 24 Returned defective merchandise to Shephard Corp, and accepted credit against future purchases. the discount, was $792. 26 Purchased $16,000 of merchandise from Shephard Corp. with terms of 1/10, n/30, FOB destination. 26 Sold merchandise with a cost of $q,280 for $11.,600 on credit to Hacienda, Inc. Its cost, net of 29 Received a $792 credit memo from Shephard Corp. concerming the merchandise returned on January 2 31 Paid Carly Smith for 10 days' work at $200 per day 1 Feb. Paid $6.750 to the Lakeshore Mall for another three months' rent in advance. 24. 3 Paid Shephard Corp. for the balance due, 5 11 15 Paid $1,600 to the local newspaper for advertising. Received the balance due from Alamo Engineering Co. for revenue billed on Ja Mary Graham withdrew $4,600 cash for personal use. 23 Sold merchandise with a cost of $5,120 for $6.400 orn 26 Paid Carly Smith for eight days' work at $200 per day. nuary 11. 27 Reimbursed Mary Graham's business automobile credit to Grandview Co.; terms 1/10, 30 l expenses for 600 kilometres at $1.00 peretre 388 CHAPTER 5 Accounting for Merchandising Activities $4,800 of computer supplies from Abbott Office Products on credit. 8 Purchased 4 Received d the balance due from Grandview Co. for merchandise sold on February 23 the company's computer paying cash of $1,720 $8.520 cash from Images, Inc. for computing services the full amount due to Abbott Office Products, including amounts o 14 Billed Capital Leasing for $11,800 of computing services. reated on December 17 and March 8 Sold merchandise with a cost of $2,004 for $3,600 on credit to Buckman Services. Sold merchandise with a cost of $2,200 for $4,440 on credit to Decker Company. 25 d Mary Graham's business automobile expenses for 4 31 Reimburse 00 kilometres at $1.00 per kilometre. the journal entries to the accounts in the company's general ledger. (Use asset, liability, and accounts that start with balances as of December 31, 2017.) 2 Post are a partial work sheet consisting of the first six columns showing the unadjusted tria the March 31 adjustments described in (a) through (g) below, and the adjusted trial 3. Pre l balance, Do not balance are closing entries and do not journalize the adjusting entries or post them to prep The March 31 computer supplies on hand is $4,230. b. Three more months have passed since the company purchased the annual insurance policy at the cost of $4,320. Carly Smith has not been paid for seven days of work d. Three months have passed since any prepaid rent cost has been transferred to expense. The monthly rent is $2,250. e. Depreciation on the computer for January through March is $2,250. t. Depreciation on the office equipment for January through March is $1,500. g. The March 31 inventory of merchandise is $1,960. 4. Prepare an interim single-step income statement for the three months ended March 31, 2018. List all expenses without differentiating between selling expenses and general and administrative expenses. 5. Prepare an interim statement of changes in equity for the three months ended March 31, 2018. 6. Prepare an interim classified balance sheet as of March 31, 2018. 389 CHAPTER 5 Accounting for Merchandising Activities critical Thinking Mini Case ve just graduated with a business diploma in management and have been hired as the inven r for a local sporting goods store. Your first task is to review and assess the following information: of merchandise sold to customers in sales transactions 2017 2016 e inventory balance, beginning of year. $480,000 $320,000 84,000 510,000 240,000 2.500 14,000 25,500 12,000 115,000 2.400 ice cost of merchandise purchases sninkage determined at end of year Cost of transportation-in merchandise returned by customers and restored to inventory Cost of Purchase discounts received Purchase returns and allowances rece 5,100 2,550 1,200 Required Using the elements of critical thinking described on the inside front cover, comment. Cumulative Comprehension Problem: Echo Systems Echo Systems-perpetual or periodic Note: Solutions are available for both perpetual and periodic. The first three segments of this comprehensive problem were p segments have not been completed, the assignment can begin at this point. However, you should use the Working Papers1 that accompany this text because they reflect the account balances that resulted from posting the entries required in Chapters 2, 3, and 4) resented in Chapters 2, 3, and 4. If those CHECK FIGURES: 4. Profit $23,198: 6. Total current assets $162,358: Total assets $208,858 Earlier segments of this problem have described how Mary Graham created Echo Systems on October 1 2017. The company has been successful, and its list of customers has started to grow. To accommodate the growth, the accounting system is ready to be modified to set up separate accounts for each customer. The following list of customers includes the account number used for each account and any balance as of the end of 2017. Graham decided to add a fourth digit with a decimal point to the 106 account number that had been used for the single Accounts Receivable account. This modification allows the existing chart of accounts to continue being used. The list also shows the balances that two customers owed as of December 31, 2017: Dec. 31 Balance No. Customer Account 106.1 106.2 106.3 Alamo Engineering Co Buckman Services. Capital Leasing 0- 106.5 $2,700 Elite Corporation. Fostek Co.... 106.6 106.7 106.8 106.q $3,000 Images, Inc udlents have not purchased the Wor a Papers package. the Working Papers fur the Serial Problem are available on Connect 387 In response to frequent requests from customers, Graham has d ware. The company will extend credit terms of 1/10, n/30 to cus has decided to begin sell CHAPTER 5 Accounting for Merchandising Activities Mar. 8 cash discount will be available on consulting revenue. The follow the additional accounts were company's new merchandising a 16 general ledger to allow the system to account for the com Merchandise Inventory 119 413 Sales. Sales Discounts OR Sales Returns and Allowances.. 415 Sales Discounts Sales Retums and Allowances Cost of Goods Sold.. Returns and Allowances 2. Post Purchase Discounts Transportation-In 3. Pre Because the accounting sustem does not use reversing entries, all revenue and expense acct zero balances as of January 1,2018 pre al. 1. Prepare journal entries to record each of the following transactions for Echo S either a perpetual system or a periodic system. d. Jan. 4 Paid Carly Smith for fihe days at the rate of $200 per day, including one day in addition to the four unpaid days from the prior year 5 Many Graham invested an additional $48,000 cash in the business. 7 Purchased $11.200 of merchandise from Shephard Corp. with terms of 1/10, n/30, FOB shipping point. 9 Received $3,000 from Fostek Co. as final payment on its account. 11 Completed five day project for Alamo Engineering Co. and billed them $9,000, which is the total price of $12.000 13 Sold merchandise with a retail value of $8,400 and a cost of $6,720 to Elite Corporation with terms of 1/10 less the advance payment of $3,000. n/30, FOB shipping point. 15 Paid $1,400 for freight charges on the merchandise purchased on January 7 16 Received $6,000 cash from Grandview Co. for computer services. 17 Paid Shephard Corp. for the purchase on January 7 20 Elite Corporation returned $800 of defective merchandise from its purchase on January 13. The returned 5. merchandise, which had a cost of $640, was scrapped 22 Received the balance due from Elite Corporation. 24 Returned defective merchandise to Shephard Corp, and accepted credit against future purchases. the discount, was $792. 26 Purchased $16,000 of merchandise from Shephard Corp. with terms of 1/10, n/30, FOB destination. 26 Sold merchandise with a cost of $q,280 for $11.,600 on credit to Hacienda, Inc. Its cost, net of 29 Received a $792 credit memo from Shephard Corp. concerming the merchandise returned on January 2 31 Paid Carly Smith for 10 days' work at $200 per day 1 Feb. Paid $6.750 to the Lakeshore Mall for another three months' rent in advance. 24. 3 Paid Shephard Corp. for the balance due, 5 11 15 Paid $1,600 to the local newspaper for advertising. Received the balance due from Alamo Engineering Co. for revenue billed on Ja Mary Graham withdrew $4,600 cash for personal use. 23 Sold merchandise with a cost of $5,120 for $6.400 orn 26 Paid Carly Smith for eight days' work at $200 per day. nuary 11. 27 Reimbursed Mary Graham's business automobile credit to Grandview Co.; terms 1/10, 30 l expenses for 600 kilometres at $1.00 peretre 388 CHAPTER 5 Accounting for Merchandising Activities $4,800 of computer supplies from Abbott Office Products on credit. 8 Purchased 4 Received d the balance due from Grandview Co. for merchandise sold on February 23 the company's computer paying cash of $1,720 $8.520 cash from Images, Inc. for computing services the full amount due to Abbott Office Products, including amounts o 14 Billed Capital Leasing for $11,800 of computing services. reated on December 17 and March 8 Sold merchandise with a cost of $2,004 for $3,600 on credit to Buckman Services. Sold merchandise with a cost of $2,200 for $4,440 on credit to Decker Company. 25 d Mary Graham's business automobile expenses for 4 31 Reimburse 00 kilometres at $1.00 per kilometre. the journal entries to the accounts in the company's general ledger. (Use asset, liability, and accounts that start with balances as of December 31, 2017.) 2 Post are a partial work sheet consisting of the first six columns showing the unadjusted tria the March 31 adjustments described in (a) through (g) below, and the adjusted trial 3. Pre l balance, Do not balance are closing entries and do not journalize the adjusting entries or post them to prep The March 31 computer supplies on hand is $4,230. b. Three more months have passed since the company purchased the annual insurance policy at the cost of $4,320. Carly Smith has not been paid for seven days of work d. Three months have passed since any prepaid rent cost has been transferred to expense. The monthly rent is $2,250. e. Depreciation on the computer for January through March is $2,250. t. Depreciation on the office equipment for January through March is $1,500. g. The March 31 inventory of merchandise is $1,960. 4. Prepare an interim single-step income statement for the three months ended March 31, 2018. List all expenses without differentiating between selling expenses and general and administrative expenses. 5. Prepare an interim statement of changes in equity for the three months ended March 31, 2018. 6. Prepare an interim classified balance sheet as of March 31, 2018. 389