Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I would appreciate it if you could solve it in a simple and understandable way. Best, 1.Crackling Fried Chicken bought equipment on January 2,2016

Hello, I would appreciate it if you could solve it in a simple and understandable way. Best,

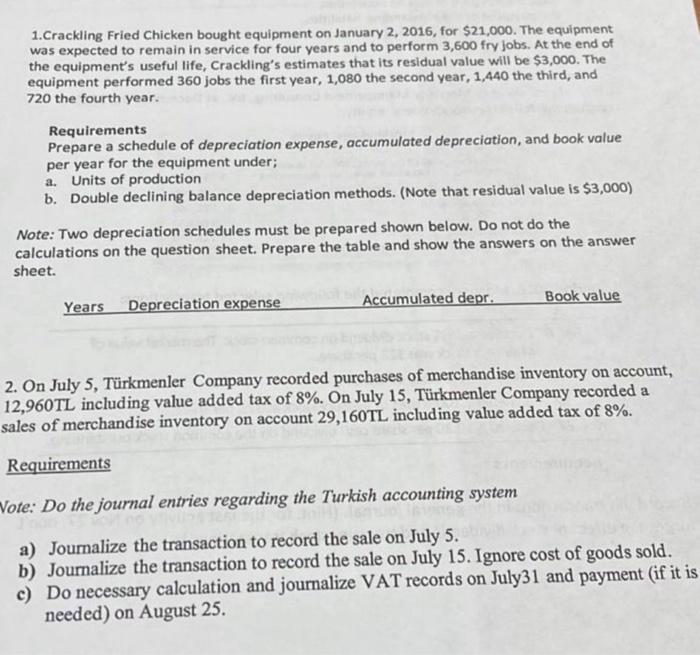

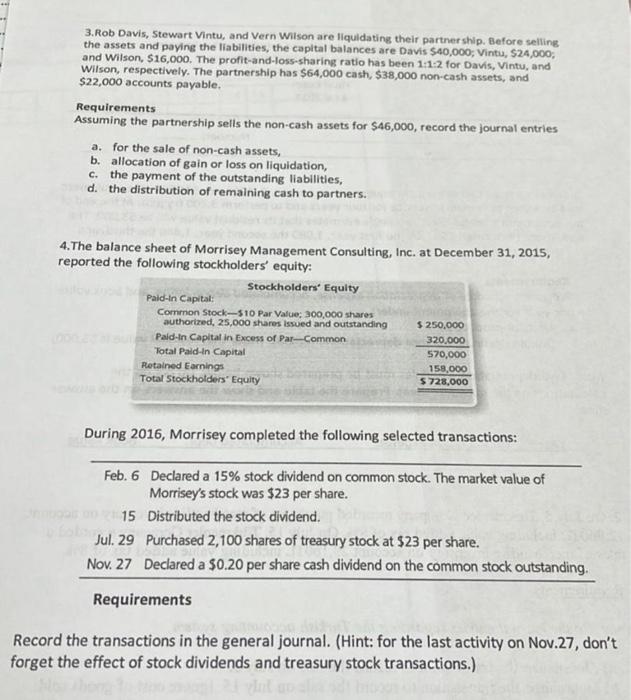

1.Crackling Fried Chicken bought equipment on January 2,2016 , for $21,000. The equipment was expected to remain in service for four years and to perform 3,600 fry jobs. At the end of the equipment's useful life, Crackling's estimates that its residual value will be $3,000. The equipment performed 360 jobs the first year, 1,080 the second year, 1,440 the third, and 720 the fourth year. Requirements Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under; a. Units of production b. Double declining balance depreciation methods. (Note that residual value is $3,000 ) Note: Two depreciation schedules must be prepared shown below. Do not do the calculations on the question sheet. Prepare the table and show the answers on the answer sheet. 2. On July 5, Trkmenler Company recorded purchases of merchandise inventory on account, 12,960TL including value added tax of 8%. On July 15 , Trkmenler Company recorded a sales of merchandise inventory on account 29,160TL including value added tax of 8%. Requirements Vote: Do the journal entries regarding the Turkish accounting system a) Joumalize the transaction to record the sale on July 5 . b) Journalize the transaction to record the sale on July 15. Ignore cost of goods sold. c) Do necessary calculation and journalize VAT records on July 31 and payment (if it is needed) on August 25. 3.Rob Davis, Stewart Vintu, and Vern Wison are liquidating their partnership. Before selling the assets and paying the liabilities, the capital balances are Davis $40,000; Vintu, $24,000; and Wilson, $16,000. The profit-and-Ioss-sharing ratio has been 1:1:2 for Davis, Vintu, and Wilson, respectively. The partnership has $64,000 cash, $38,000 non-cash assets, and $22,000 accounts payable. Requirements Assuming the partnership sells the non-cash assets for $46,000, record the journal entries a. for the sale of non-cash assets, b. allocation of gain or loss on liquidation, c. the payment of the outstanding liabilities, d. the distribution of remaining cash to partners. 4.The balance sheet of Morrisey Management Consulting, Inc. at December 31, 2015, reported the following stockholders' equity: During 2016, Morrisey completed the following selected transactions: Requirements Record the transactions in the general journal. (Hint: for the last activity on Nov.27, don't forget the effect of stock dividends and treasury stock transactions.)

1.Crackling Fried Chicken bought equipment on January 2,2016 , for $21,000. The equipment was expected to remain in service for four years and to perform 3,600 fry jobs. At the end of the equipment's useful life, Crackling's estimates that its residual value will be $3,000. The equipment performed 360 jobs the first year, 1,080 the second year, 1,440 the third, and 720 the fourth year. Requirements Prepare a schedule of depreciation expense, accumulated depreciation, and book value per year for the equipment under; a. Units of production b. Double declining balance depreciation methods. (Note that residual value is $3,000 ) Note: Two depreciation schedules must be prepared shown below. Do not do the calculations on the question sheet. Prepare the table and show the answers on the answer sheet. 2. On July 5, Trkmenler Company recorded purchases of merchandise inventory on account, 12,960TL including value added tax of 8%. On July 15 , Trkmenler Company recorded a sales of merchandise inventory on account 29,160TL including value added tax of 8%. Requirements Vote: Do the journal entries regarding the Turkish accounting system a) Joumalize the transaction to record the sale on July 5 . b) Journalize the transaction to record the sale on July 15. Ignore cost of goods sold. c) Do necessary calculation and journalize VAT records on July 31 and payment (if it is needed) on August 25. 3.Rob Davis, Stewart Vintu, and Vern Wison are liquidating their partnership. Before selling the assets and paying the liabilities, the capital balances are Davis $40,000; Vintu, $24,000; and Wilson, $16,000. The profit-and-Ioss-sharing ratio has been 1:1:2 for Davis, Vintu, and Wilson, respectively. The partnership has $64,000 cash, $38,000 non-cash assets, and $22,000 accounts payable. Requirements Assuming the partnership sells the non-cash assets for $46,000, record the journal entries a. for the sale of non-cash assets, b. allocation of gain or loss on liquidation, c. the payment of the outstanding liabilities, d. the distribution of remaining cash to partners. 4.The balance sheet of Morrisey Management Consulting, Inc. at December 31, 2015, reported the following stockholders' equity: During 2016, Morrisey completed the following selected transactions: Requirements Record the transactions in the general journal. (Hint: for the last activity on Nov.27, don't forget the effect of stock dividends and treasury stock transactions.)

Hello,

I would appreciate it if you could solve it in a simple and understandable way.

Best,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started