Hello, I would greatly appreciate explanations along with solutions. Thanks in advance!

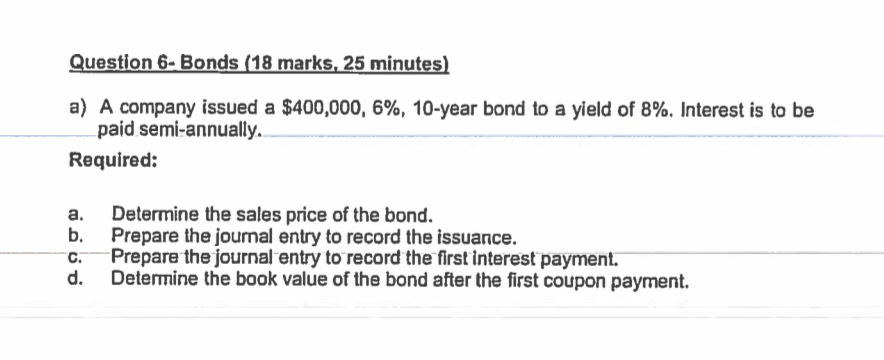

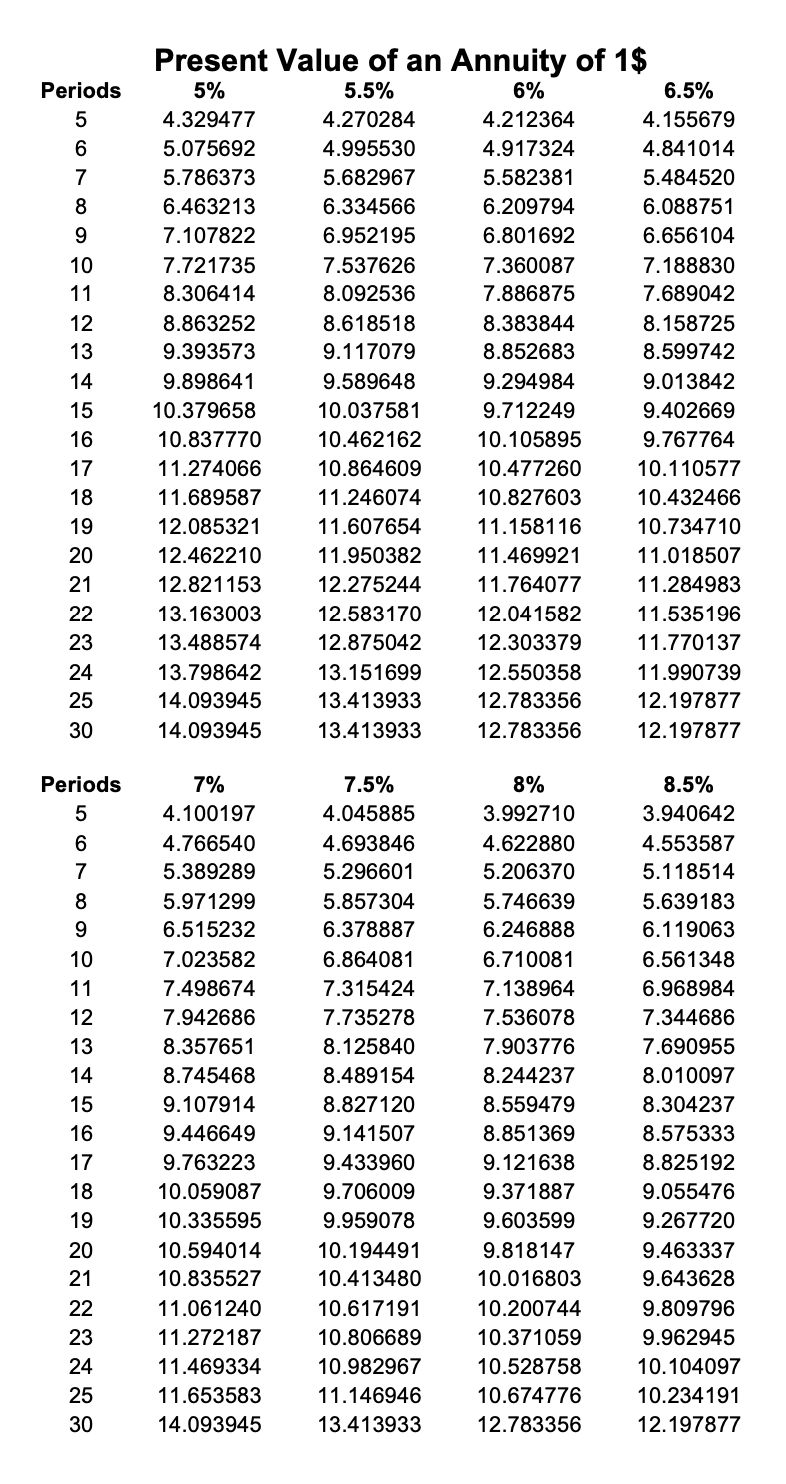

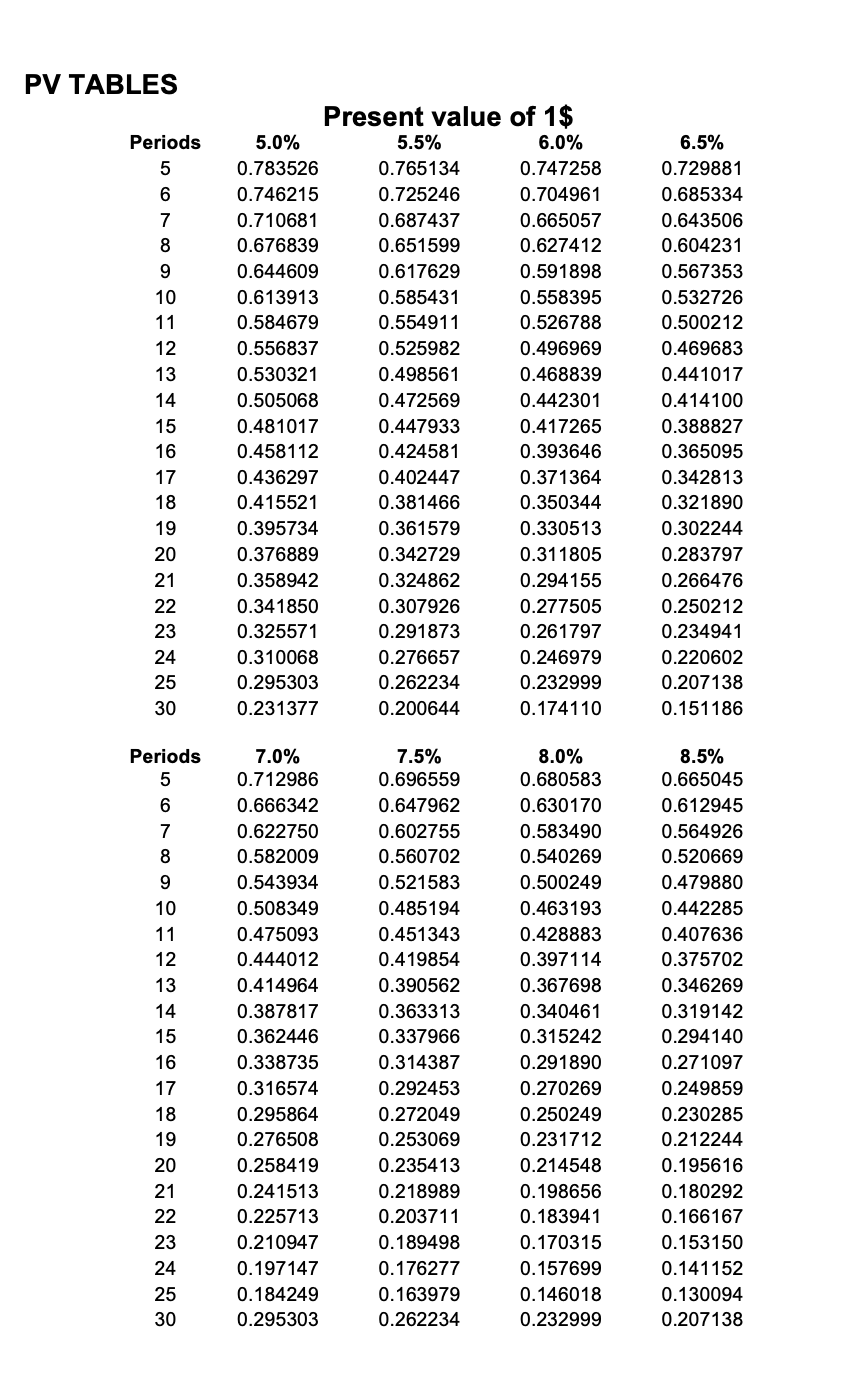

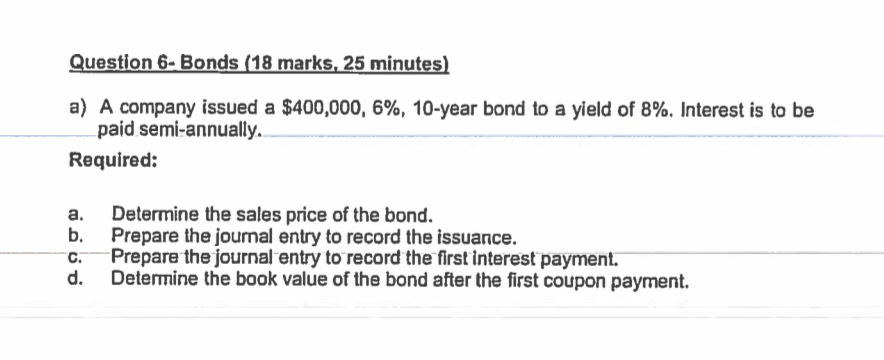

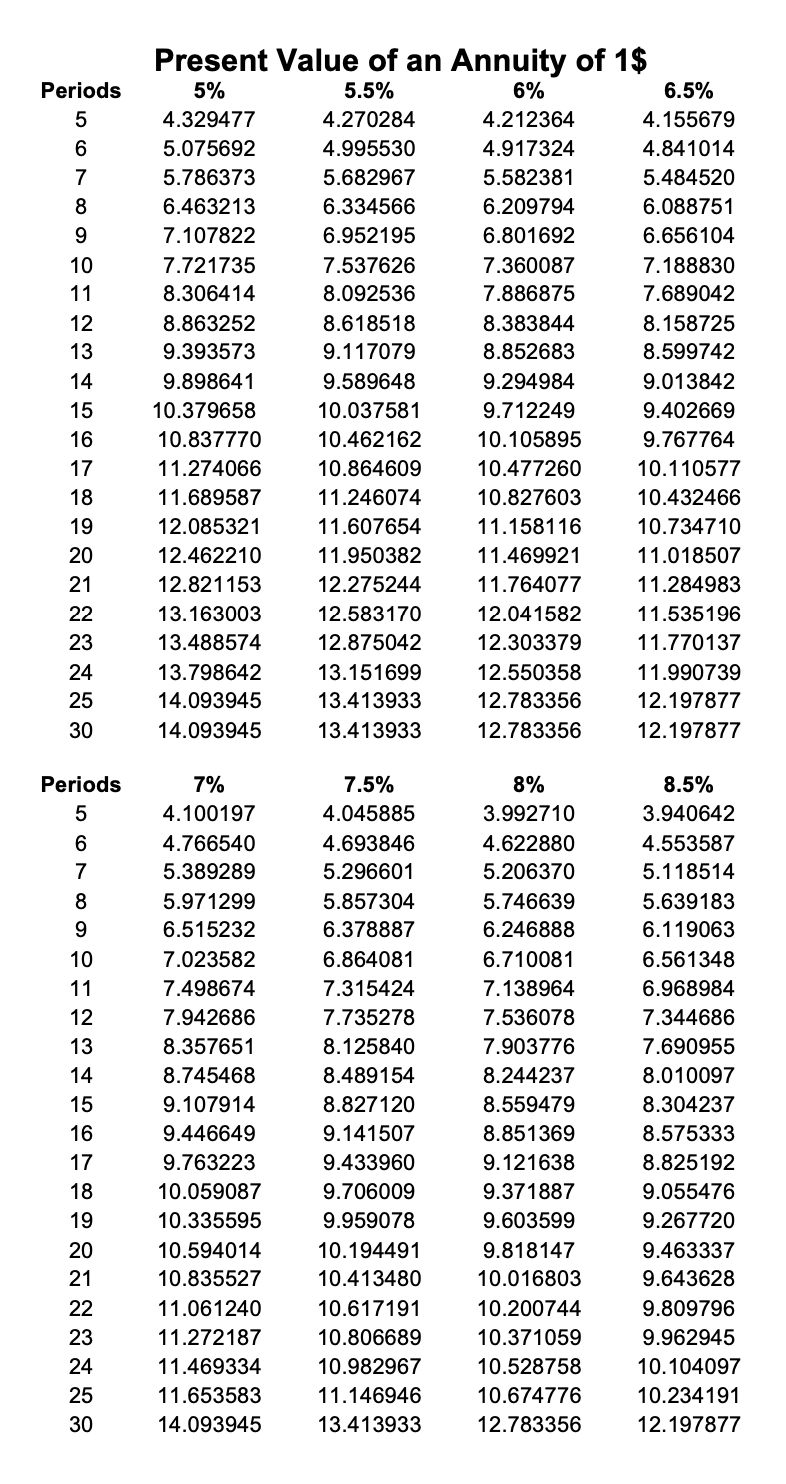

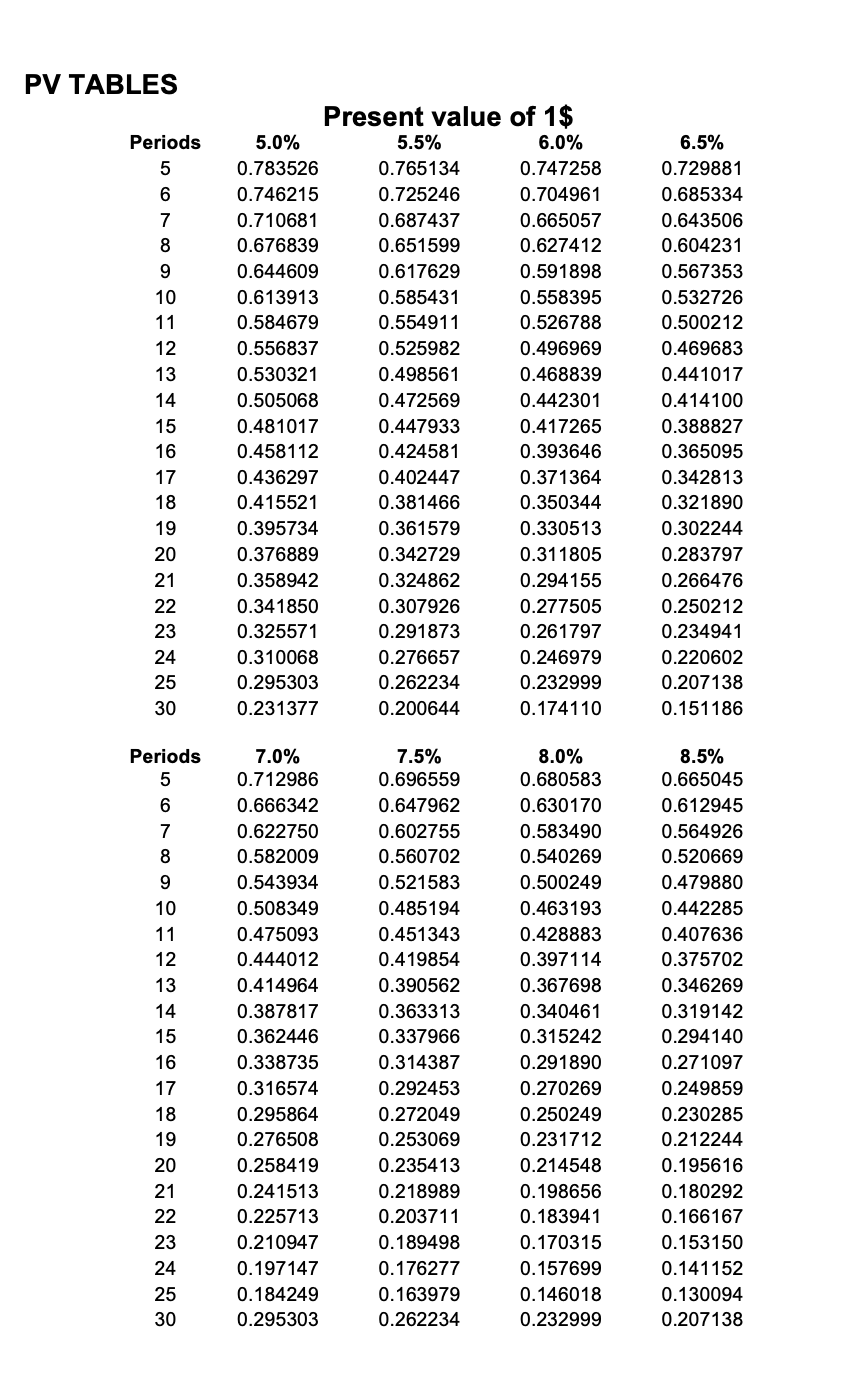

Question 6-Bonds (18 marks, 25 minutes) a) A company issued a $400,000, 6%, 10-year bond to a yield of 8%. Interest is to be paid semi-annually. Required: a. Determine the sales price of the bond. b. Prepare the journal entry to record the issuance. Prepare the journal entry to record the first interest payment. d. Determine the book value of the bond after the first coupon payment. Periods 14 Present Value of an Annuity of 1$ 5% 5.5% 6% 6.5% 4.329477 4.270284 4.212364 4.155679 5.075692 4.995530 4.917324 4.841014 5.786373 5.682967 5.582381 5.484520 6.463213 6.334566 6.209794 6.088751 7.107822 6.952195 6.801692 6.656104 7.721735 7.537626 7.360087 7.188830 8.306414 8.092536 7.886875 7.689042 8.863252 8.618518 8.383844 8.158725 9.393573 9.117079 8.852683 8.599742 9.898641 9.589648 9.294984 9.013842 10.379658 10.037581 9.712249 9.402669 10.837770 10.462162 10.105895 9.767764 11.274066 10.864609 10.477260 10.110577 11.689587 11.246074 10.827603 10.432466 12.085321 11.607654 11.158116 10.734710 12.462210 11.950382 11.469921 11.018507 12.821153 12.275244 11.764077 11.284983 13.163003 12.583170 12.041582 11.535196 13.488574 12.875042 12.303379 11.770137 13.798642 13.151699 12.550358 11.990739 14.093945 13.413933 12.783356 12.197877 14.093945 13.413933 12.783356 12.197877 16 17 25 30 Periods 7% 4.100197 4.766540 5.389289 5.971299 6.515232 7.023582 7.498674 7.942686 8.357651 8.745468 9.107914 9.446649 9.763223 10.059087 10.335595 10.594014 10.835527 11.061240 11.272187 11.469334 11.653583 14.093945 7.5% 4.045885 4.693846 5.296601 5.857304 6.378887 6.864081 7.315424 7.735278 8.125840 8.489154 8.827120 9.141507 9.433960 9.706009 9.959078 10.194491 10.413480 10.617191 10.806689 10.982967 11.146946 13.413933 8% 3.992710 4.622880 5.206370 5.746639 6.246888 6.710081 7.138964 7.536078 7.903776 8.244237 8.559479 8.851369 9.121638 9.371887 9.603599 9.818147 10.016803 10.200744 10.371059 10.528758 10.674776 12.783356 8.5% 3.940642 4.553587 5.118514 5.639183 6.119063 6.561348 6.968984 7.344686 7.690955 8.010097 8.304237 8.575333 8.825192 9.055476 9.267720 9.463337 9.643628 9.809796 9.962945 10.104097 10.234191 12.197877 PV TABLES Periods 6.0% Present value of 1$ 5.0% 5.5% 0.783526 0.765134 0.747258 0.746215 0.725246 0.704961 0.710681 0.687437 0.665057 0.676839 0.651599 0.627412 0.644609 0.617629 0.591898 0.613913 0.585431 0.558395 0.584679 0.554911 0.526788 0.556837 0.525982 0.496969 0.530321 0.498561 0.468839 0.505068 0.472569 0.442301 0.481017 0.447933 0.417265 0.458112 0.424581 0.393646 0.436297 0.402447 0.371364 0.415521 0.381466 0.350344 0.395734 0.361579 0.330513 0.376889 0.342729 0.311805 0.358942 0.324862 0.294155 0.341850 0.307926 0.277505 0.325571 0.291873 0.261797 0.310068 0.276657 0.246979 0.295303 0.262234 0.232999 0.231377 0.200644 0.174110 6.5% 0.729881 0.685334 0.643506 0.604231 0.567353 0.532726 0.500212 0.469683 0.441017 0.414100 0.388827 0.365095 0.342813 0.321890 0.302244 0.283797 0.266476 0.250212 0.234941 0.220602 0.207138 0.151186 Periods 7.0% 0.712986 0.666342 0.622750 0.582009 0.543934 0.508349 0.475093 0.444012 0.414964 0.387817 0.362446 0.338735 0.316574 0.295864 0.276508 0.258419 0.241513 0.225713 0.210947 0.197147 0.184249 0.295303 7.5% 0.696559 0.647962 0.602755 0.560702 0.521583 0.485194 0.451343 0.419854 0.390562 0.363313 0.337966 0.314387 0.292453 0.272049 0.253069 0.235413 0.218989 0.203711 0.189498 0.176277 0.163979 0.262234 8.0% 0.680583 0.630170 0.583490 0.540269 0.500249 0.463193 0.428883 0.397114 0.367698 0.340461 0.315242 0.291890 0.270269 0.250249 0.231712 0.214548 0.198656 0.183941 0.170315 0.157699 0.146018 0.232999 8.5% 0.665045 0.612945 0.564926 0.520669 0.479880 0.442285 0.407636 0.375702 0.346269 0.319142 0.294140 0.271097 0.249859 0.230285 0.212244 0.195616 0.180292 0.166167 0.153150 0.141152 0.130094 0.207138