Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I would like clear step by step working out of each of these questions instead of just the answers. I want to know how

Hello, I would like clear step by step working out of each of these questions instead of just the answers. I want to know how you got the answer for each step. if you added then multipled etc. I want to be able to do it on my own. I would also like a space in between the questions and numbered clearly which solution is for which question. Thank you

let me know if it's still not clear

let me know if its still not clear

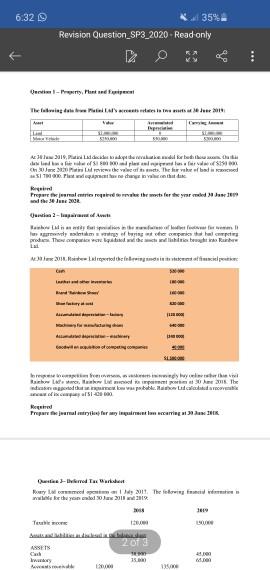

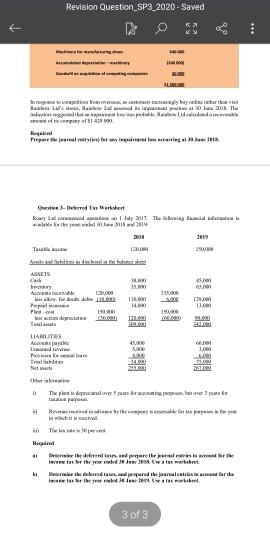

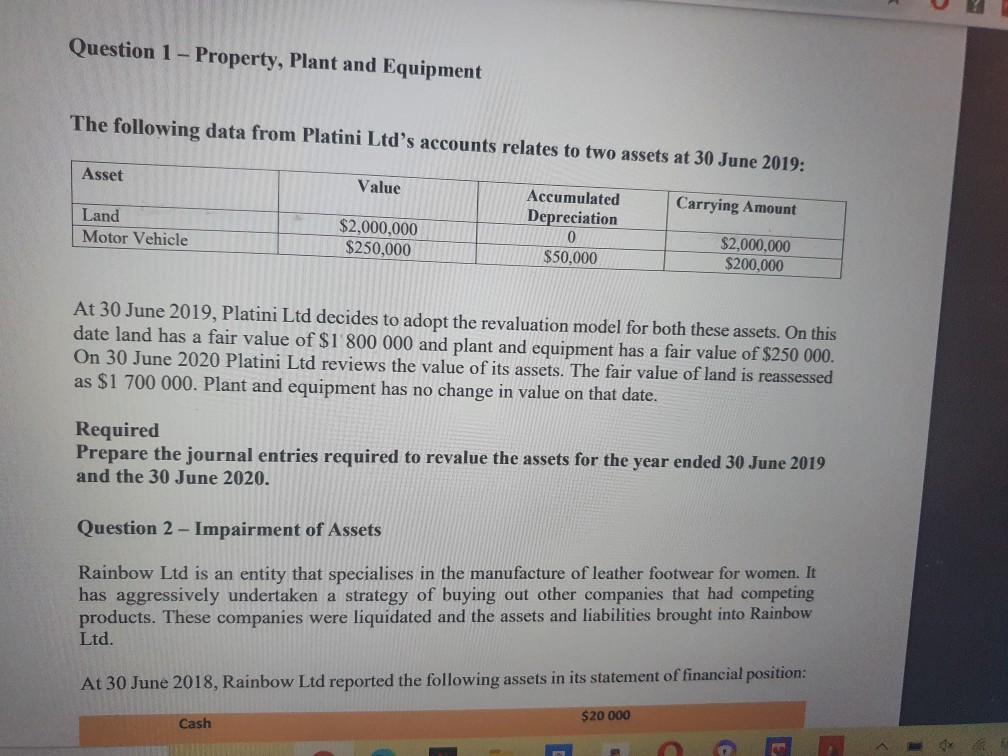

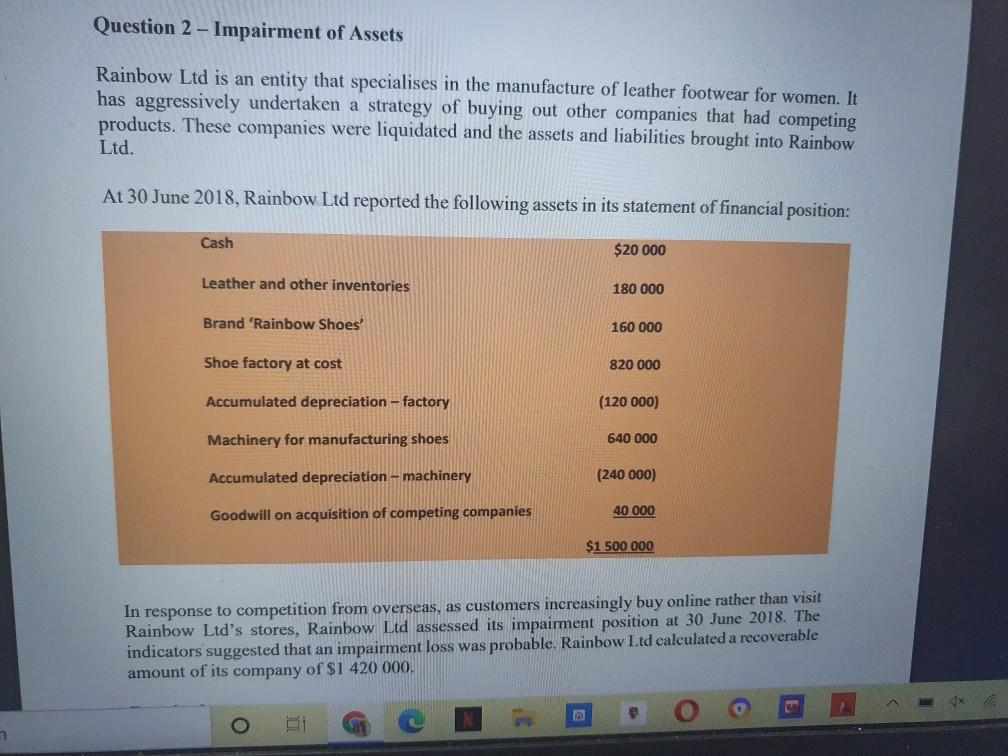

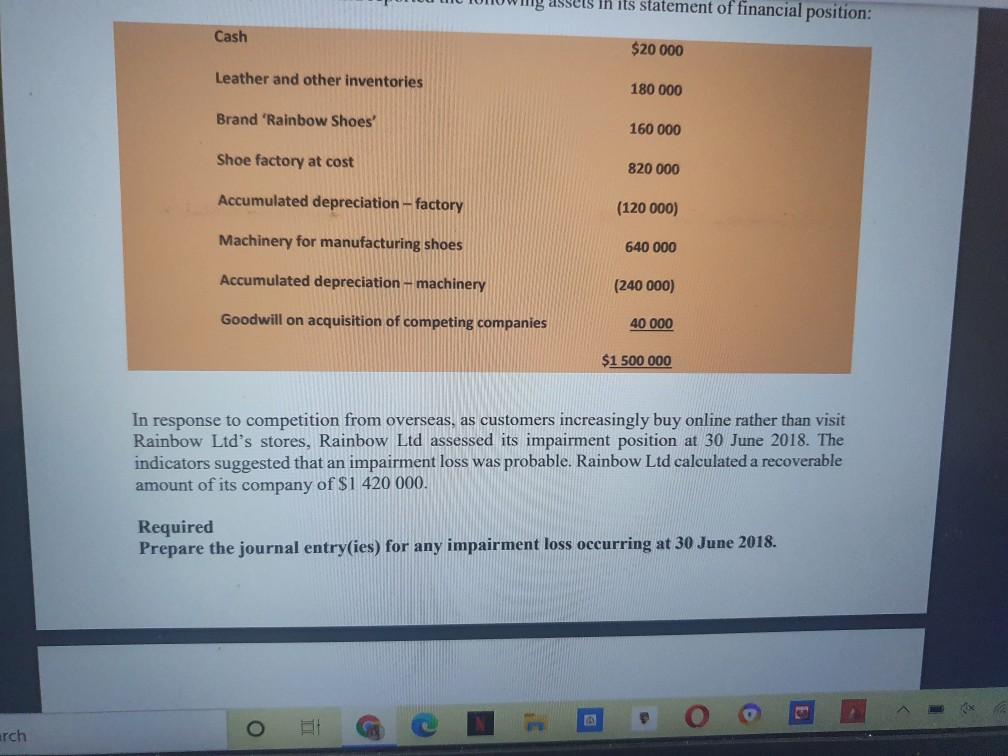

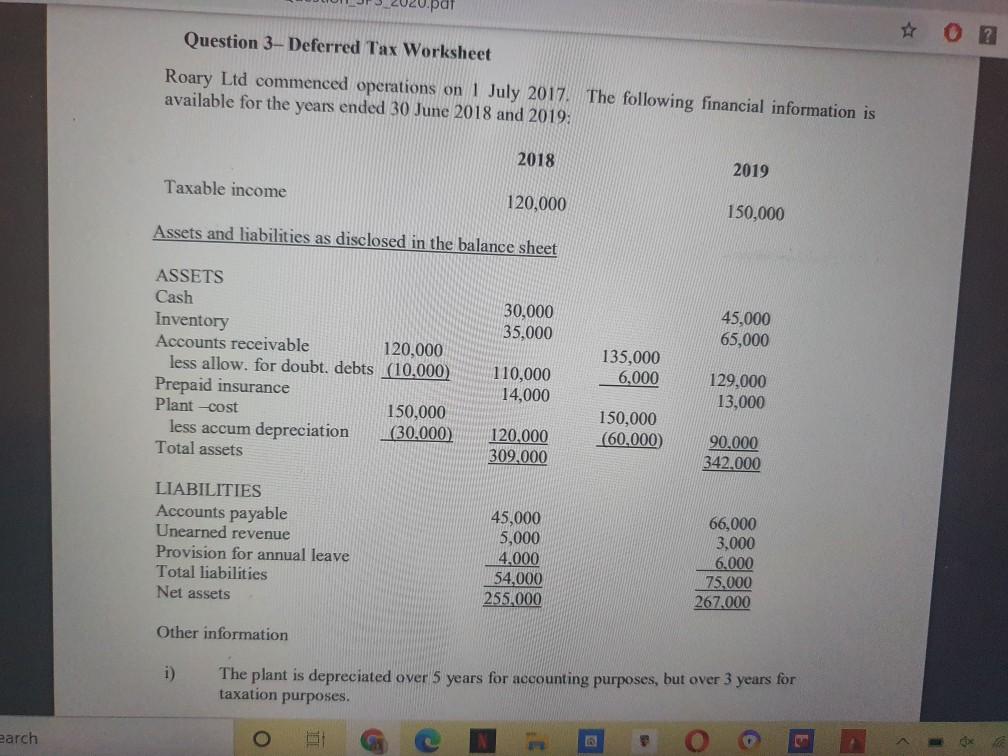

6.32 35% Revision Question SP3 2020 Read only Descriere The bring deur die met de de libre 510 w the heat. The herokee had in med ST. Platdan change in the Prepare for sale Fored the meter the yard be these lune 2- per il samboristekas in Thena tire breasts 2018. Melodhenicile - och penge Rochester United. The www incl. 2 d.wbl.ac. Free fjermal try for any inquirenti carring Dhe Tax werthu yon todas 2012 Newry Luma 2011. The following 3019 2019 ASSETS 1 13 werd Revision Question SP3 2020 Saved V toronto, bayar Bachels www. port Rigol Preprimante Ted Trstent Raya 2017 The boy was wel below 2008 Antecedente 13 Carl wy Aceh b. Bu debe Pipe sondere 11. AS HO 19 1910 LARUTE 15, 1.00 Trao 9 The pecados Beloven & Hig 1 Die eerste ir ihr your sett fibry well 3 of 3 Question 1 - Property, Plant and Equipment The following data from Platini Ltd's accounts relates to two assets at 30 June 2019: Asset Value Accumulated Depreciation Carrying Amount Land Motor Vehicle $2,000,000 $250,000 $50,000 $2,000,000 $200,000 At 30 June 2019, Platini Ltd decides to adopt the revaluation model for both these assets. On this date land has a fair value of $1 800 000 and plant and equipment has a fair value of $250 000. On 30 June 2020 Platini Ltd reviews the value of its assets. The fair value of land is reassessed as $1 700 000. Plant and equipment has no change in value on that date. Required Prepare the journal entries required to revalue the assets for the year ended 30 June 2019 and the 30 June 2020. Question 2 - Impairment of Assets Rainbow Ltd is an entity that specialises in the manufacture of leather footwear for women. It has aggressively undertaken a strategy of buying out other companies that had competing products. These companies were liquidated and the assets and liabilities brought into Rainbow Ltd. At 30 June 2018, Rainbow Ltd reported the following assets in its statement of financial position: $20 000 Cash G Question 2 - Impairment of Assets Rainbow Ltd is an entity that specialises in the manufacture of leather footwear for women. It has aggressively undertaken a strategy of buying out other companies that had competing products. These companies were liquidated and the assets and liabilities brought into Rainbow Ltd. At 30 June 2018, Rainbow Ltd reported the following assets in its statement of financial position: Cash $20 000 Leather and other inventories 180 000 Brand 'Rainbow Shoes' 160 000 Shoe factory at cost 820 000 Accumulated depreciation - factory (120 000) Machinery for manufacturing shoes 640 000 Accumulated depreciation - machinery (240 000) Goodwill on acquisition of competing companies 40 000 $1 500 000 In response to competition from overseas, as customers increasingly buy online rather than visit Rainbow Ltd's stores, Rainbow Ltd assessed its impairment position at 30 June 2018. The indicators suggested that an impairment loss was probable. Rainbow Ltd calculated a recoverable amount of its company of $1 420 000. asses in its statement of financial position: Cash $20 000 Leather and other inventories 180 000 Brand 'Rainbow Shoes' 160 000 Shoe factory at cost 820 000 Accumulated depreciation - factory (120 000) Machinery for manufacturing shoes 640 000 Accumulated depreciation - machinery (240 000) Goodwill on acquisition of competing companies 40 000 $1 500 000 In response to competition from overseas, as customers increasingly buy online rather than visit Rainbow Ltd's stores, Rainbow Ltd assessed its impairment position at 30 June 2018. The indicators suggested that an impairment loss was probable. Rainbow Ltd calculated a recoverable amount of its company of $1 420 000. Required Prepare the journal entry(ies) for any impairment loss occurring at 30 June 2018. o arch Question 3- Deferred Tax Worksheet Roary Ltd commenced operations on 1 July 2017. The following financial information is available for the years ended 30 June 2018 and 2019: 2018 2019 Taxable income 120,000 150,000 Assets and liabilities as disclosed in the balance sheet 30,000 35.000 45,000 65,000 ASSETS Cash Inventory Accounts receivable 120,000 less allow. for doubt. debts (10,000) Prepaid insurance Plant -cost 150,000 less accum depreciation (30,000) Total assets 110,000 14,000 135,000 6,000 129,000 13,000 120.000 309.000 150,000 (60,000) 90.000 2.000 LIABILITIES Accounts payable Unearned revenue Provision for annual leave Total liabilities Net assets 45,000 5,000 4.000 54,000 255,000 66,000 3,000 6,000 75,000 267.000 Other information i) The plant is depreciated over 5 years for accounting purposes, but over 3 years for taxation purposes. N earch o VISION%20Question SP3_2020.pdf LIABILITIES Accounts payable Unearned revenue Provision for annual leave Total liabilities Net assets 45,000 5,000 4.000 66,000 3.000 6.000 75,000 267,000 54,000 255,000 Other information 1) The plant is depreciated over 5 years for accounting purposes, but over 3 years for taxation purposes. in Revenue received in advance by the company is assessable for tax purposes in the year in which it is received. The tax rate is 30 per cent. Required a) Determine the deferred taxes, and prepare the journal entries to account for the income tax for the year ended 30 June 2018. Use a tax worksheet. b) Determine the deferred taxes, and prepared the journal entries to account for the income tax for the year ended 30 June 2019. Use a tax worksheet. Type here to search O GO 080Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started