Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. I would like the answer of these questions. I'm in a hurry, so quick response will be very appreciated. Thanks! Question 46 (1 point)

Hello. I would like the answer of these questions. I'm in a hurry, so quick response will be very appreciated. Thanks!

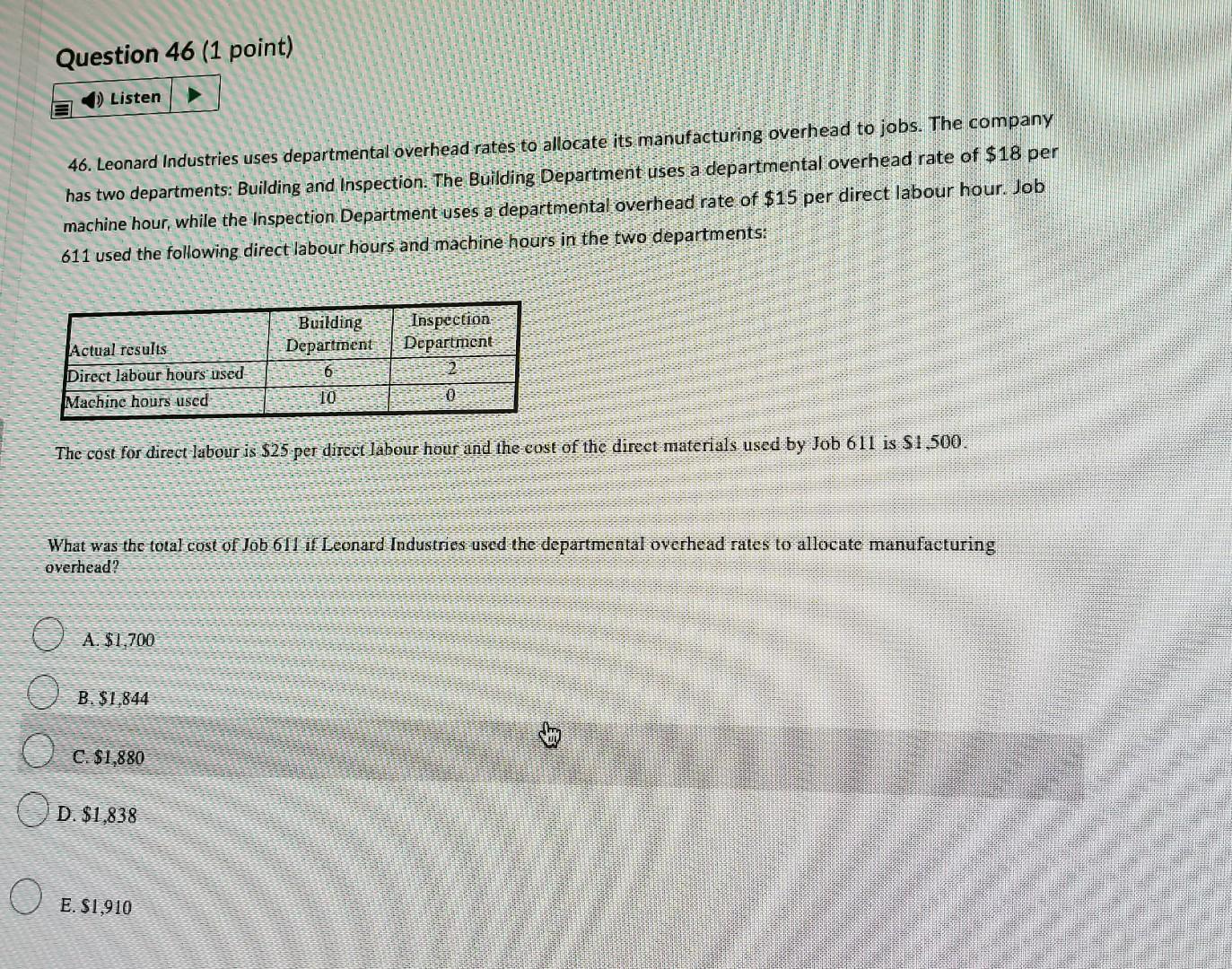

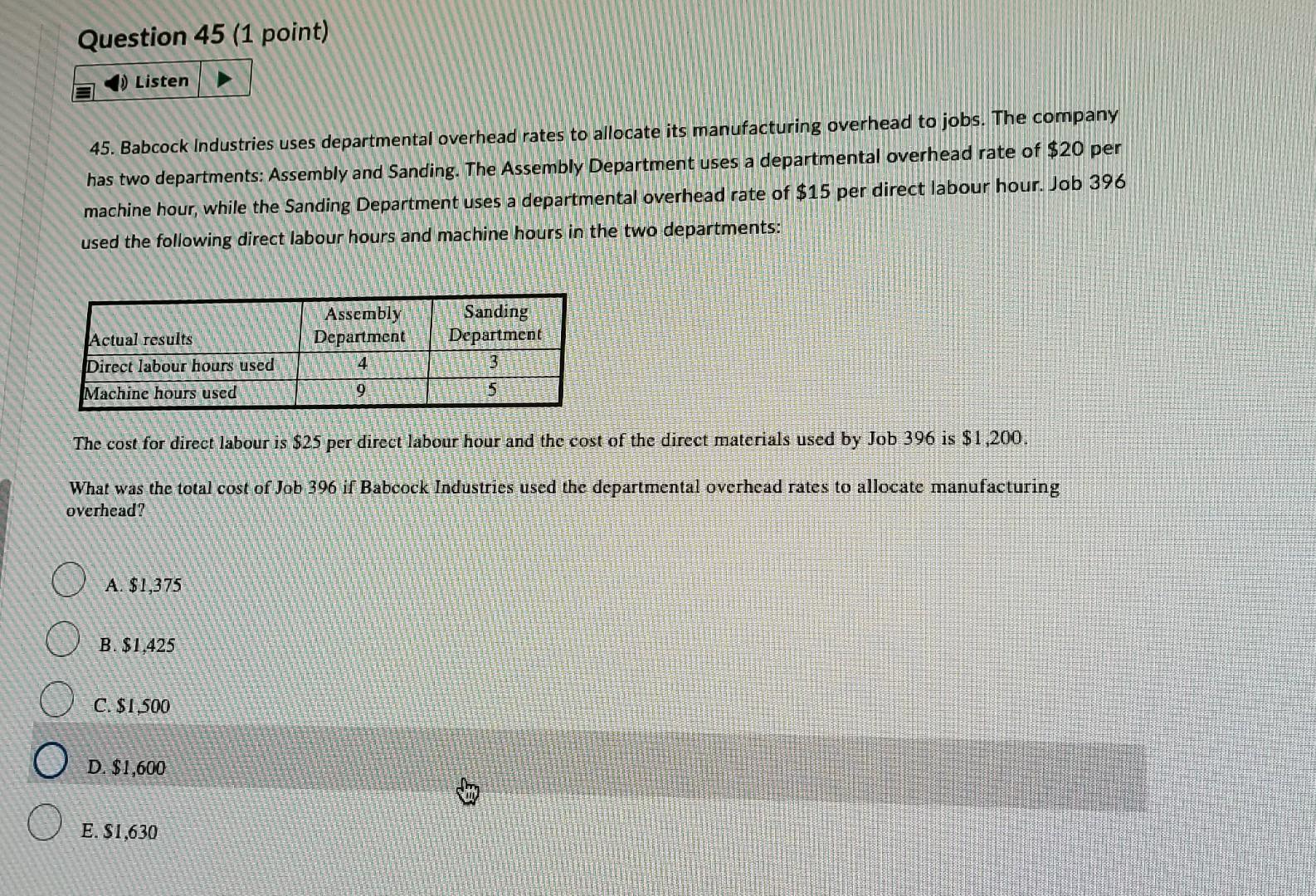

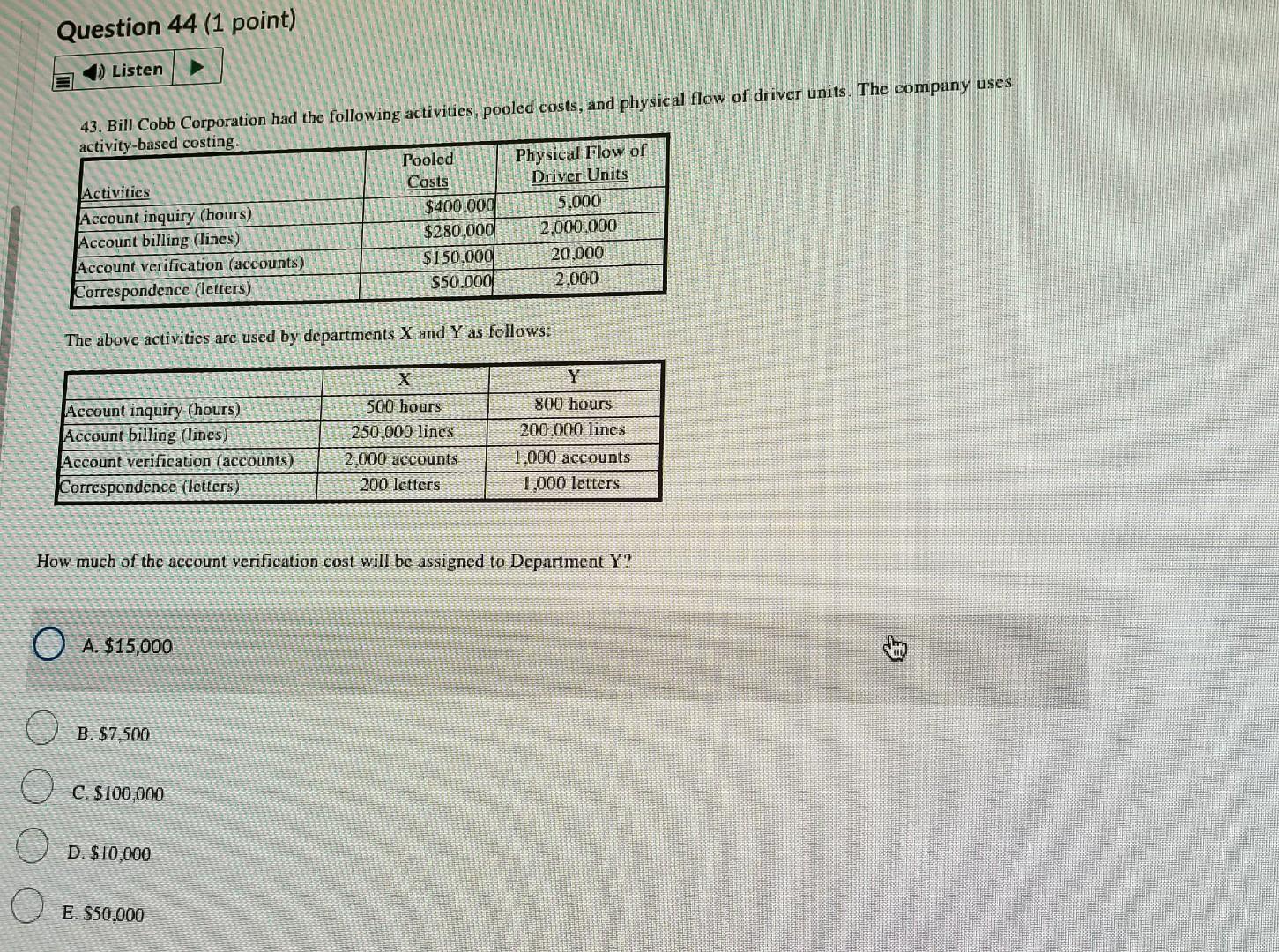

Question 46 (1 point) Listen 46. Leonard Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Building and Inspection. The Building Department uses a departmental overhead rate of $18 per machine hour, while the Inspection Department uses a departmental overhead rate of $15 per direct labour hour. Job 611 used the following direct labour hours and machine hours in the two departments: Building Department Inspection Department Actual results Direct labour hours used Machinc hours used TO The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 611 is $1,500. What was the total cost of Job 611 if Leonard Industries used the departmental overhead rates to allocate manufacturing overhead? O A. $1,700 B. $1.844 C. $1,880 D. $1,838 O E. $1,910 Question 45 (1 point) Listen 45. Babcock Industries uses departmental overhead rates to allocate its manufacturing overhead to jobs. The company has two departments: Assembly and Sanding. The Assembly Department uses a departmental overhead rate of $20 per machine hour, while the Sanding Department uses a departmental overhead rate of $15 per direct labour hour. Job 396 used the following direct labour hours and machine hours in the two departments: Actual results Direct labour hours used Machine hours used Assembly Department 4 Sanding Department 3 5 9 The cost for direct labour is $25 per direct labour hour and the cost of the direct materials used by Job 396 is $1,200. What was the total cost of Job 396 i Babcock Industries used the departmental overhead rates to allocate manufacturing overhead? A. $1,375 B. $1.425 O C. $1500 O D. $1,600 E. S1,630 Question 44 (1 point) Listen 43. Bill Cobb Corporation had the following activities, pooled costs, and physical flow of driver units. The company uses activity-based costing. Pooled Physical Flow of Activities Costs Driver Units Account inquiry (hours) $400.000 5.000 Account billing (lines) $280.000 2.000.000 Account verification (accounts) $150.000 20,000 Correspondence (letters) $50.000 2.000 The above activities arc used by departments X and Y as follows: X Y Account inquiry (hours) Account billing (lines) Account verification (accounts) Correspondence (letters) 500 hours 250.000 lincs 2,000 accounts 200 Ictters 800 hours 200.000 lines 1,000 accounts 1,000 letters How much of the account verification cost will be assigned to Dcpartment Y? O A. $15,000 TU B. $7.500 C. $100,000 D. $10,000 O E. $50.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started