Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. I would like the solution of this question in Excel format. I'm in a hurry, so quick response will be very appreciated. Thanks! Listen

Hello. I would like the solution of this question in Excel format. I'm in a hurry, so quick response will be very appreciated. Thanks!

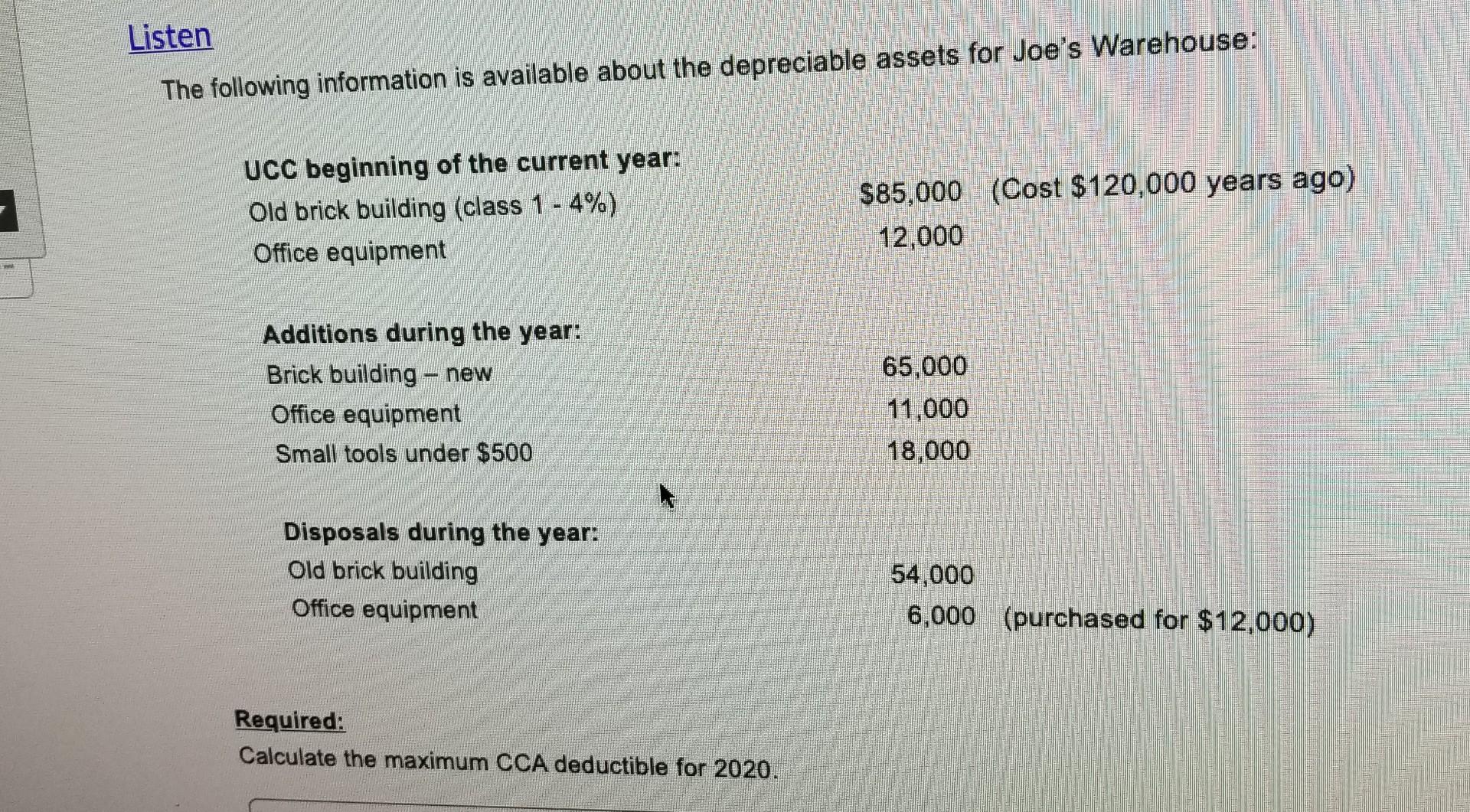

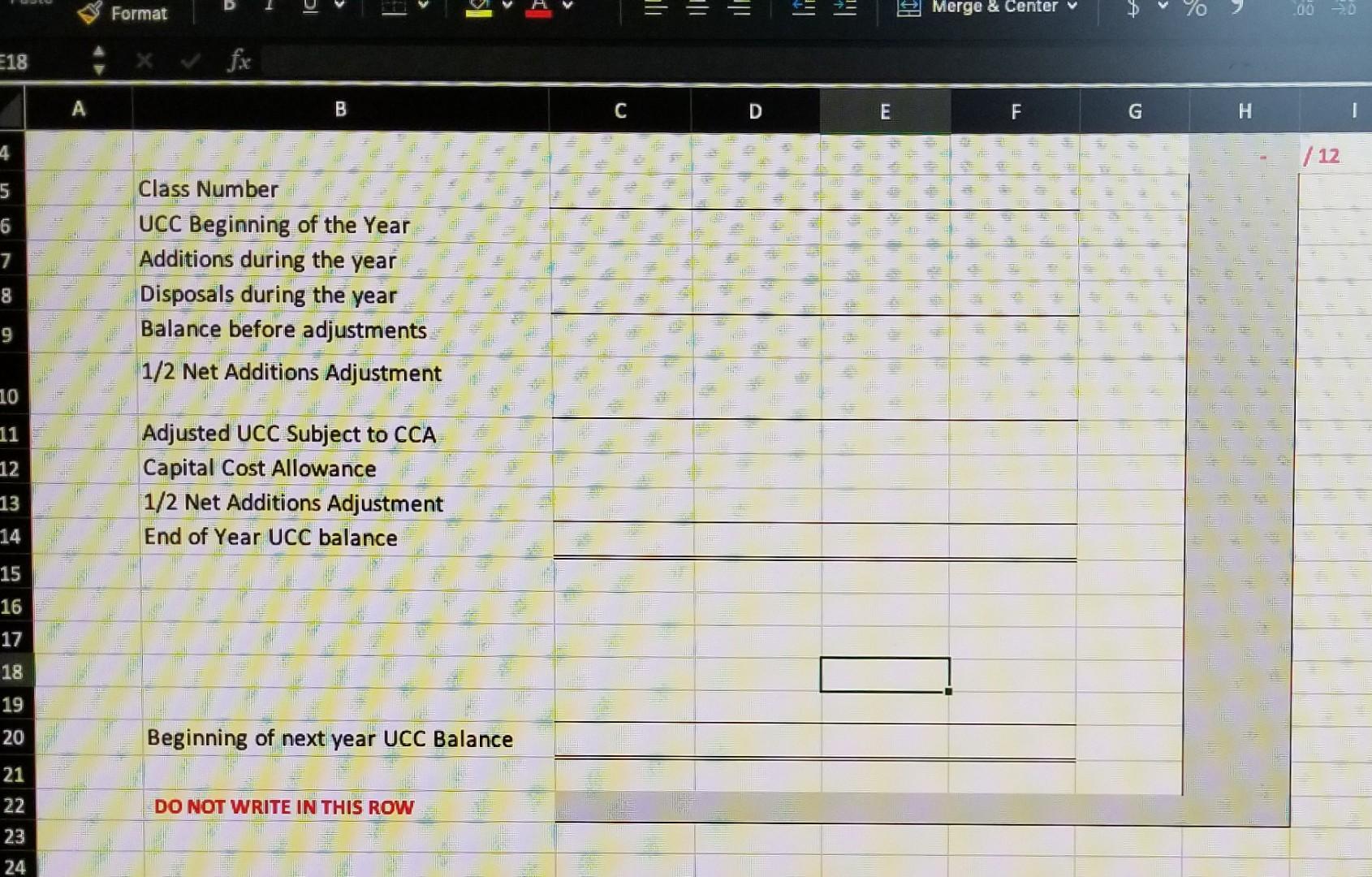

Listen The following information is available about the depreciable assets for Joe's Warehouse: UCC beginning of the current year: Old brick building (class 1 - 4%) Office equipment $85,000 (Cost $120,000 years ago) 12,000 Additions during the year: Brick building - new Office equipment Small tools under $500 65,000 11,000 18,000 Disposals during the year: Old brick building Office equipment 54,000 6,000 (purchased for $12,000) Required: Calculate the maximum CCA deductible for 2020. = = lit Format Merge & Center 70 E18 D E LL H 4 / 12 5 6 7 Class Number UCC Beginning of the Year Additions during the year Disposals during the year Balance before adjustments 1/2 Net Additions Adjustment 8 9 10 11 12 Adjusted UCC Subject to CCA Capital Cost Allowance 1/2 Net Additions Adjustment End of Year UCC balance 13 14 15 16 17 18 19 20 Beginning of next year UCC Balance 21 DO NOT WRITE IN THIS ROW 22 23 24 Listen The following information is available about the depreciable assets for Joe's Warehouse: UCC beginning of the current year: Old brick building (class 1 - 4%) Office equipment $85,000 (Cost $120,000 years ago) 12,000 Additions during the year: Brick building - new Office equipment Small tools under $500 65,000 11,000 18,000 Disposals during the year: Old brick building Office equipment 54,000 6,000 (purchased for $12,000) Required: Calculate the maximum CCA deductible for 2020. = = lit Format Merge & Center 70 E18 D E LL H 4 / 12 5 6 7 Class Number UCC Beginning of the Year Additions during the year Disposals during the year Balance before adjustments 1/2 Net Additions Adjustment 8 9 10 11 12 Adjusted UCC Subject to CCA Capital Cost Allowance 1/2 Net Additions Adjustment End of Year UCC balance 13 14 15 16 17 18 19 20 Beginning of next year UCC Balance 21 DO NOT WRITE IN THIS ROW 22 23 24

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started