Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. I would like the solution of this question in Excel format. I'm in a hurry, so quick response will be very appreciated. Thanks! Julie

Hello. I would like the solution of this question in Excel format. I'm in a hurry, so quick response will be very appreciated. Thanks!

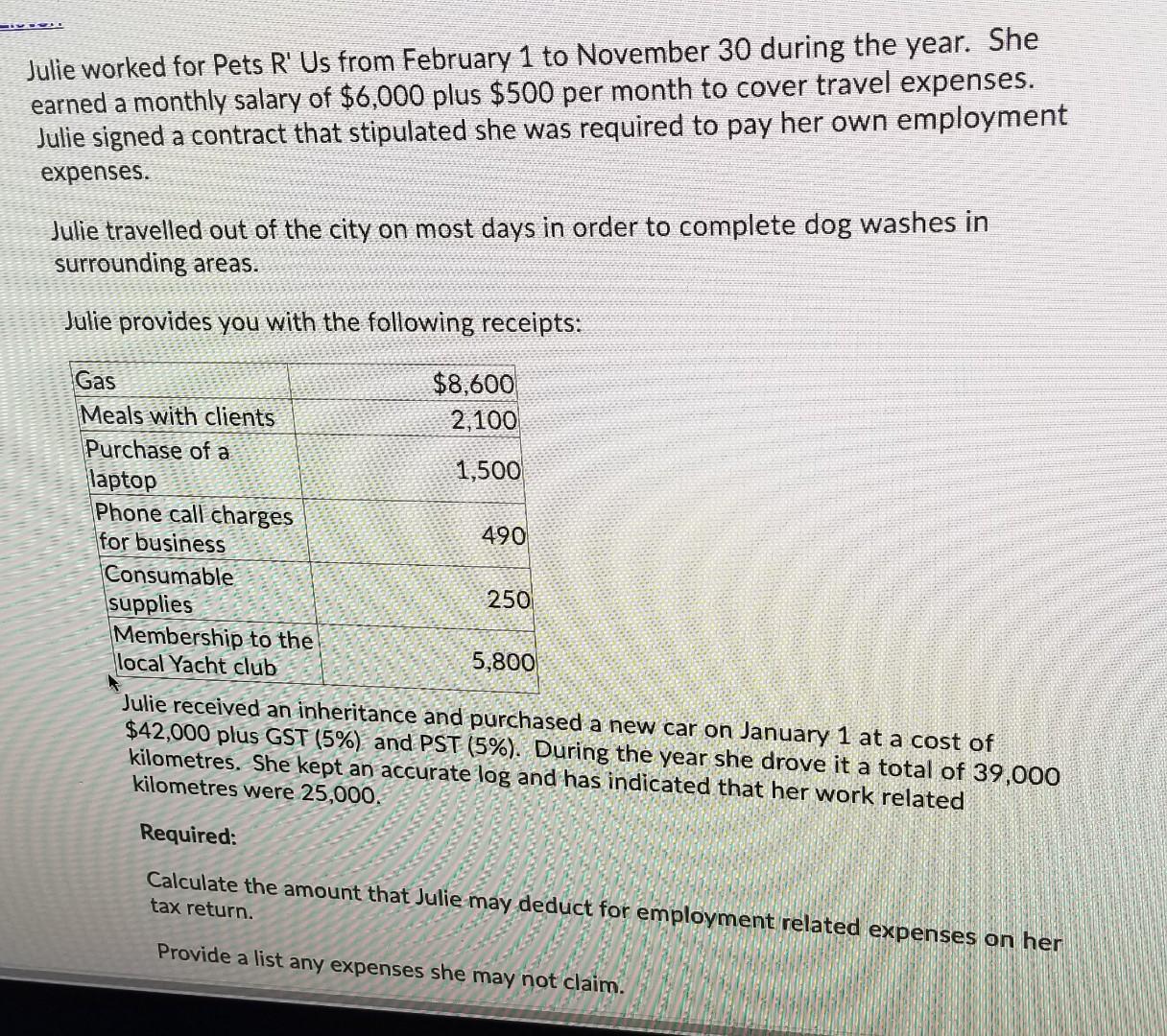

Julie worked for Pets R' Us from February 1 to November 30 during the year. She earned a monthly salary of $6,000 plus $500 per month to cover travel expenses. Julie signed a contract that stipulated she was required to pay her own employment expenses. Julie travelled out of the city on most days in order to complete dog washes in surrounding areas. Julie provides you with the following receipts: $8,600 2,100 1,500 Gas Meals with clients Purchase of a laptop Phone call charges for business Consumable supplies Membership to the local Yacht club 490 250 5,800 Julie received an inheritance and purchased a new car on January 1 at a cost of $42,000 plus GST (5%) and PST (5%). During the year she drove it a total of 39,000 kilometres. She kept an accurate log and has indicated that her work related kilometres were 25,000. Required: Calculate the amount that Julie may deduct for employment related expenses on her tax return. Provide a list any expenses she may not claim. Julie worked for Pets R' Us from February 1 to November 30 during the year. She earned a monthly salary of $6,000 plus $500 per month to cover travel expenses. Julie signed a contract that stipulated she was required to pay her own employment expenses. Julie travelled out of the city on most days in order to complete dog washes in surrounding areas. Julie provides you with the following receipts: $8,600 2,100 1,500 Gas Meals with clients Purchase of a laptop Phone call charges for business Consumable supplies Membership to the local Yacht club 490 250 5,800 Julie received an inheritance and purchased a new car on January 1 at a cost of $42,000 plus GST (5%) and PST (5%). During the year she drove it a total of 39,000 kilometres. She kept an accurate log and has indicated that her work related kilometres were 25,000. Required: Calculate the amount that Julie may deduct for employment related expenses on her tax return. Provide a list any expenses she may not claim

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started