Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello. I would like the solution of this question in Excel format. I'm in a hurry, so quick response will be very appreciated. Thanks! In

Hello. I would like the solution of this question in Excel format. I'm in a hurry, so quick response will be very appreciated. Thanks!

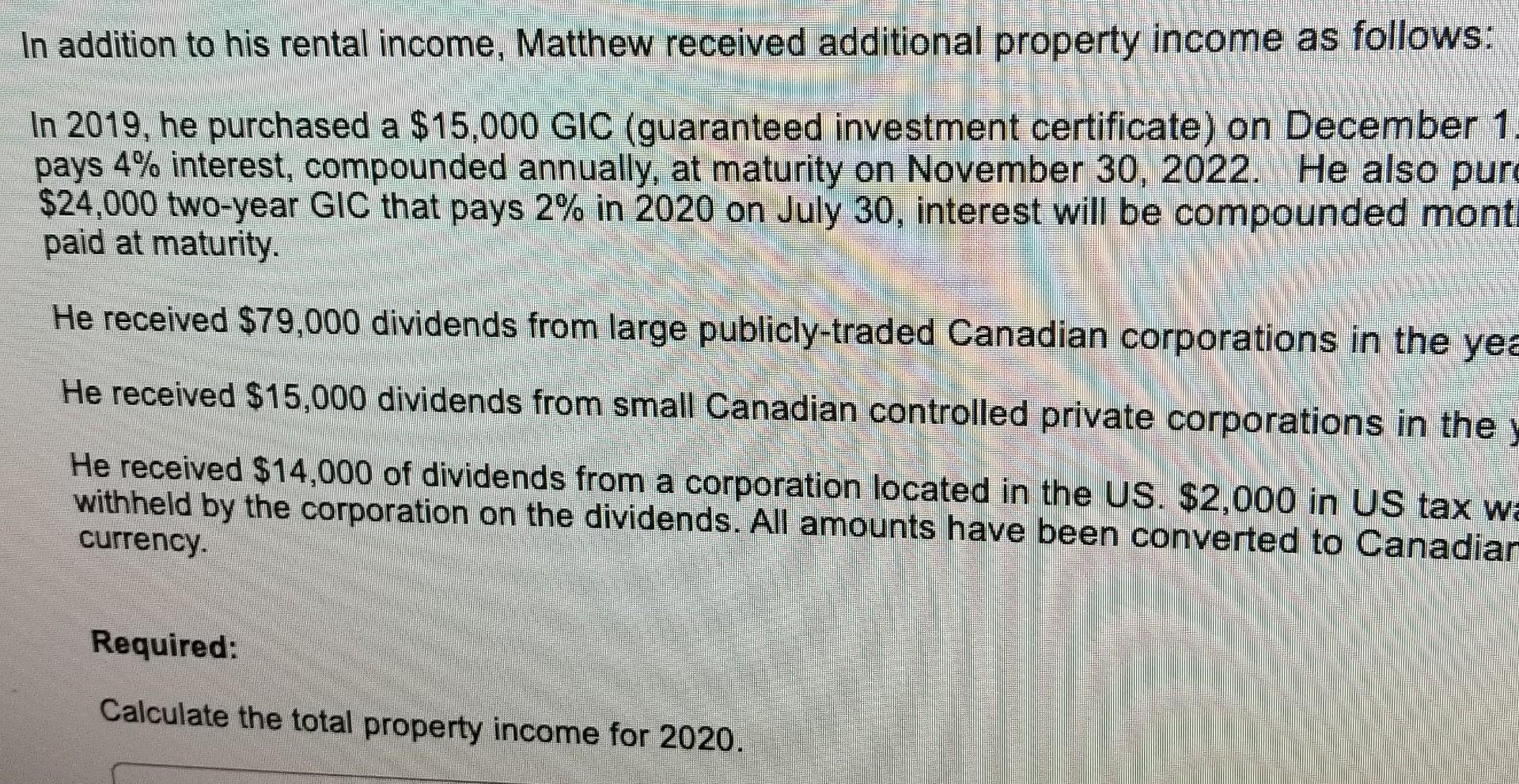

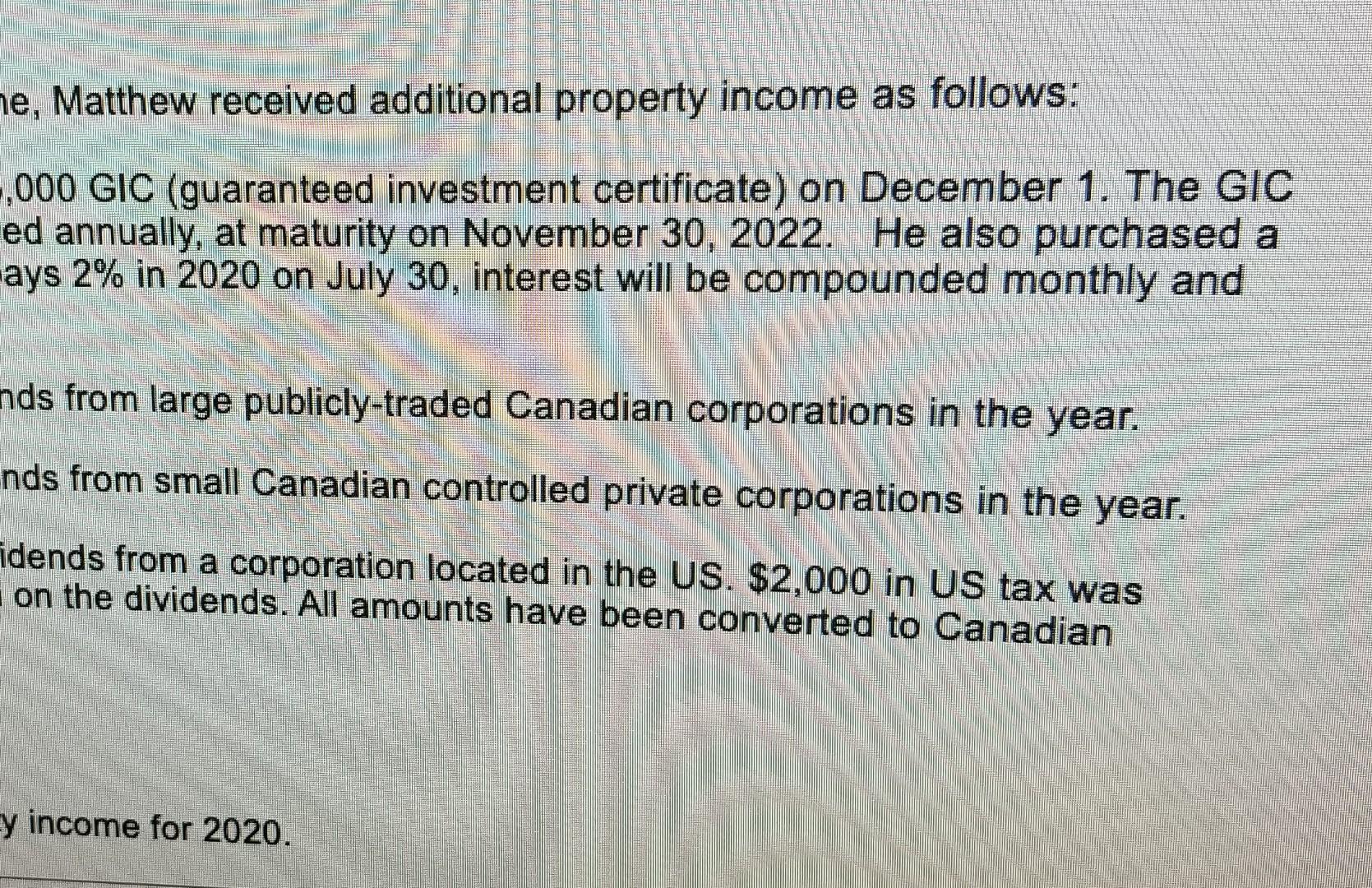

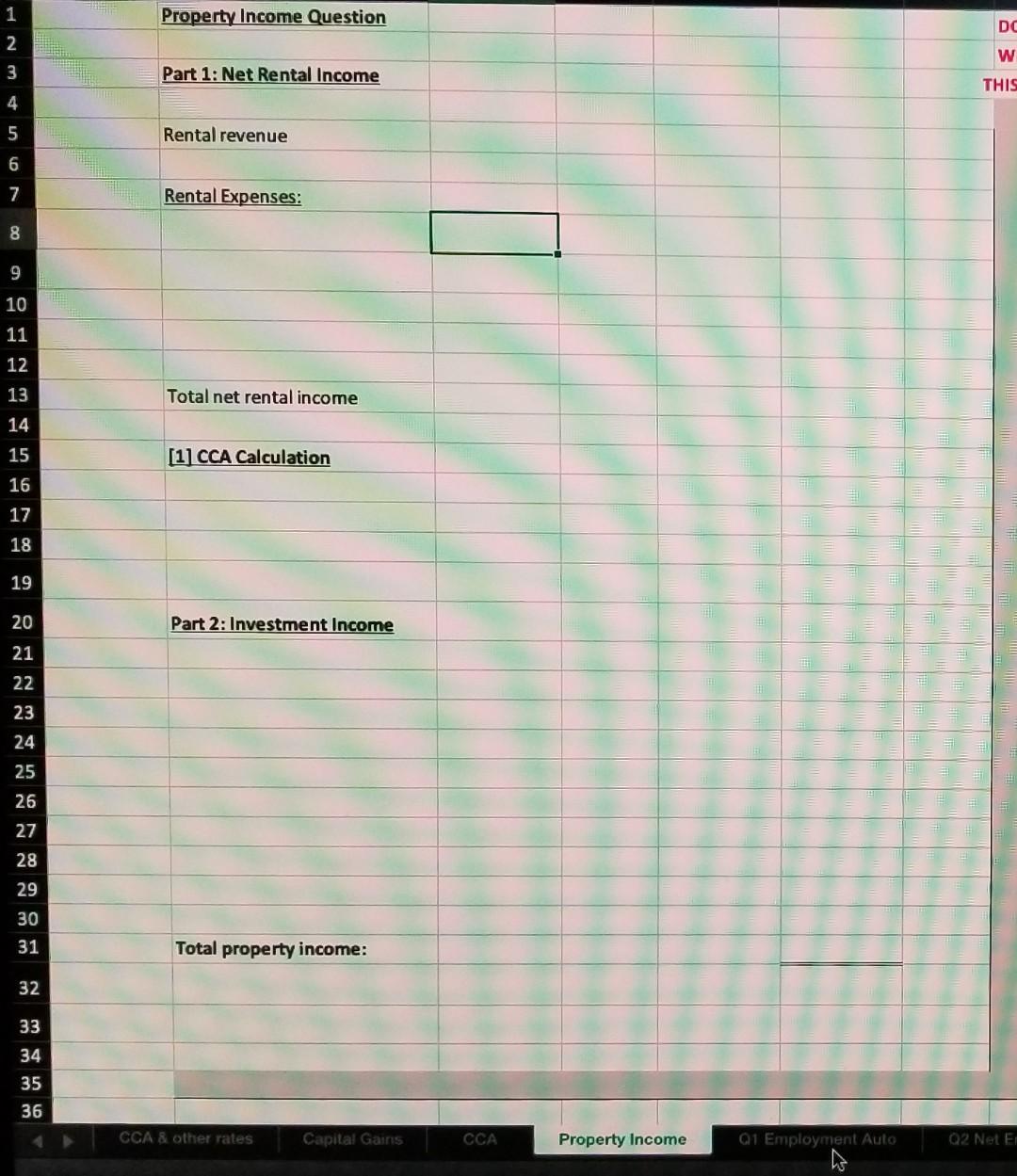

In addition to his rental income, Matthew received additional property income as follows: In 2019, he purchased a $15,000 GIC (guaranteed investment certificate) on December 1. pays 4% interest, compounded annually, at maturity on November 30, 2022. He also pur $24,000 two-year GIC that pays 2% in 2020 on July 30, interest will be compounded monti paid at maturity. He received $79,000 dividends from large publicly-traded Canadian corporations in the yea He received $15,000 dividends from small Canadian controlled private corporations in the He received $14,000 of dividends from a corporation located in the US. $2,000 in US tax wa withheld by the corporation on the dividends. All amounts have been converted to Canadiar currency. Required: Calculate the total property income for 2020. ne, Matthew received additional property income as follows: 2,000 GIC (guaranteed investment certificate) on December 1. The GIC ed annually, at maturity on November 30, 2022. He also purchased a ays 2% in 2020 on July 30, interest will be compounded monthly and nds from large publicly-traded Canadian corporations in the year. nds from small Canadian controlled private corporations in the year. idends from a corporation located in the US. $2,000 in US tax was on the dividends. All amounts have been converted to Canadian y income for 2020. 1 Property Income Question DO 2 w 3 Part 1: Net Rental Income THIS 4 5 Rental revenue 6 7 Rental Expenses: 8 9 10 11 12 13 Total net rental income 14 15 [1] CCA Calculation 16 17 18 19 20 Part 2: Investment Income 21 22 23 24 25 26 27 28 29 30 31 Total property income: 32 33 34 35 36 CCA & other rates Capital Gains CCA Property Income Q1 Employment Auto Q2 Net Ei In addition to his rental income, Matthew received additional property income as follows: In 2019, he purchased a $15,000 GIC (guaranteed investment certificate) on December 1. pays 4% interest, compounded annually, at maturity on November 30, 2022. He also pur $24,000 two-year GIC that pays 2% in 2020 on July 30, interest will be compounded monti paid at maturity. He received $79,000 dividends from large publicly-traded Canadian corporations in the yea He received $15,000 dividends from small Canadian controlled private corporations in the He received $14,000 of dividends from a corporation located in the US. $2,000 in US tax wa withheld by the corporation on the dividends. All amounts have been converted to Canadiar currency. Required: Calculate the total property income for 2020. ne, Matthew received additional property income as follows: 2,000 GIC (guaranteed investment certificate) on December 1. The GIC ed annually, at maturity on November 30, 2022. He also purchased a ays 2% in 2020 on July 30, interest will be compounded monthly and nds from large publicly-traded Canadian corporations in the year. nds from small Canadian controlled private corporations in the year. idends from a corporation located in the US. $2,000 in US tax was on the dividends. All amounts have been converted to Canadian y income for 2020. 1 Property Income Question DO 2 w 3 Part 1: Net Rental Income THIS 4 5 Rental revenue 6 7 Rental Expenses: 8 9 10 11 12 13 Total net rental income 14 15 [1] CCA Calculation 16 17 18 19 20 Part 2: Investment Income 21 22 23 24 25 26 27 28 29 30 31 Total property income: 32 33 34 35 36 CCA & other rates Capital Gains CCA Property Income Q1 Employment Auto Q2 Net Ei

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started