Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello, I would like to get the solution and the answer of this question. I am in a hurry, so quick response will be appreciated.

Hello,

I would like to get the solution and the answer of this question. I am in a hurry, so quick response will be appreciated. Thank you.

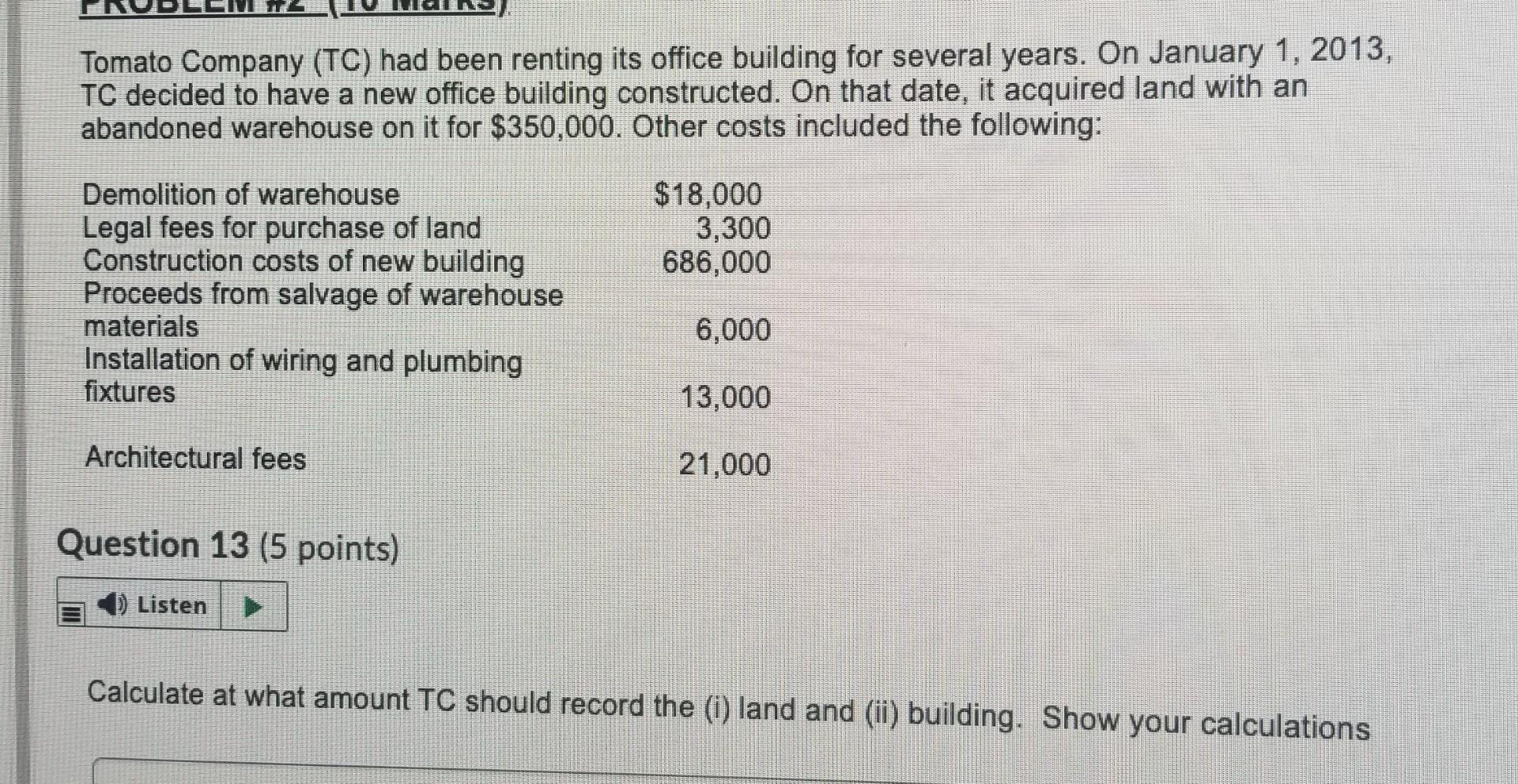

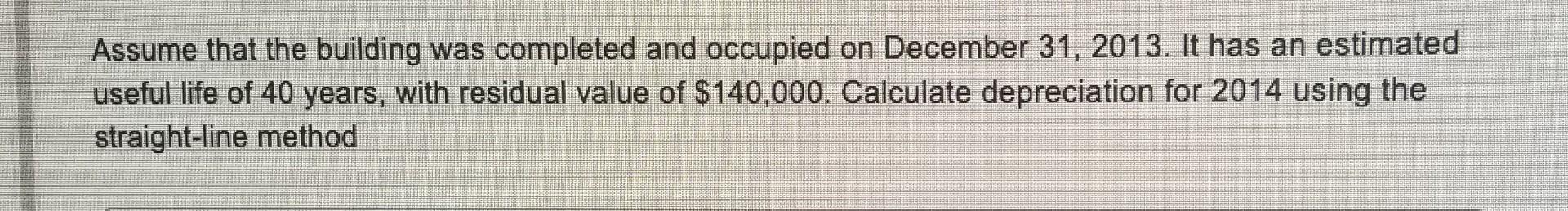

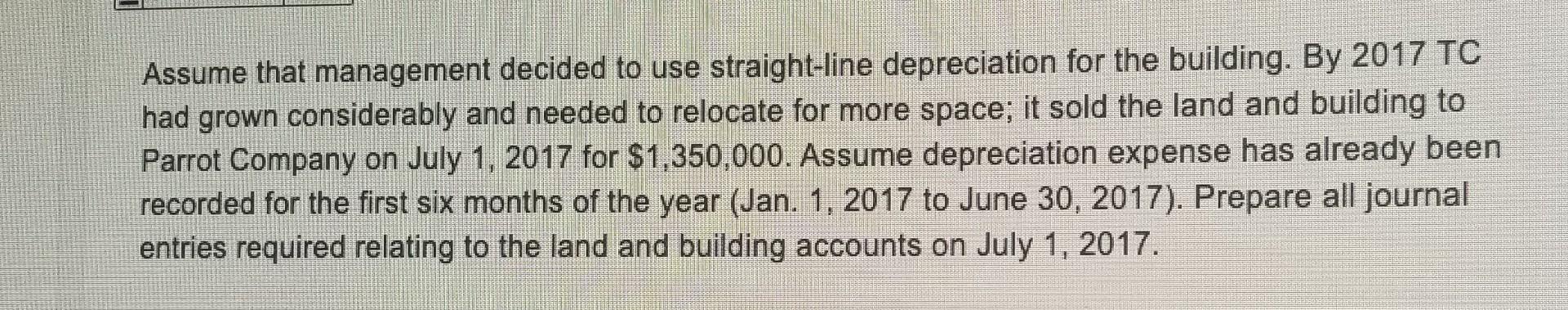

Tomato Company (TC) had been renting its office building for several years. On January 1, 2013, TC decided to have a new office building constructed. On that date, it acquired land with an abandoned warehouse on it for $350,000. Other costs included the following: $18,000 3,300 686,000 Demolition of warehouse Legal fees for purchase of land Construction costs of new building Proceeds from salvage of warehouse materials Installation of wiring and plumbing fixtures 6,000 13,000 Architectural fees 21,000 Question 13 (5 points) Listen Calculate at what amount TC should record the (1) land and (ii) building. Show your calculations Assume that the building was completed and occupied on December 31, 2013. It has an estimated useful life of 40 years, with residual value of $140,000. Calculate depreciation for 2014 using the straight-line method Assume that management decided to use straight-line depreciation for the building. By 2017 TC had grown considerably and needed to relocate for more space; it sold the land and building to Parrot Company on July 1, 2017 for $1,350,000. Assume depreciation expense has already been recorded for the first six months of the year (Jan. 1, 2017 to June 30, 2017). Prepare all journal entries required relating to the land and building accounts on July 1, 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started