Question: Can the same item be considered a long term asset in one company and a current asset in another? Is the asset's intended use

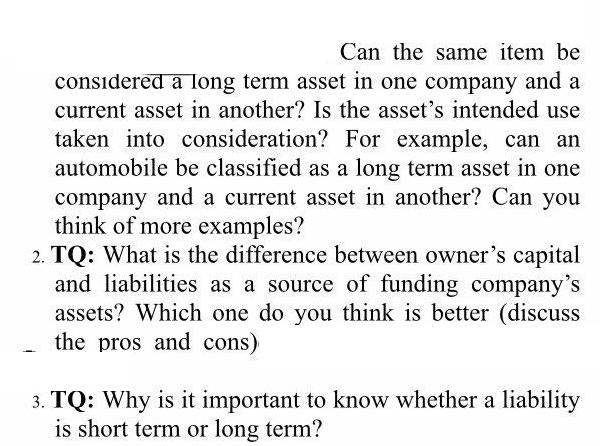

Can the same item be considered a long term asset in one company and a current asset in another? Is the asset's intended use taken into consideration? For example, can an automobile be classified as a long term asset in one company and a current asset in another? Can you think of more examples? 2. TQ: What is the difference between owner's capital and liabilities as a source of funding company's assets? Which one do you think is better (discuss the pros and cons) 3. TQ: Why is it important to know whether a liability is short term or long term?

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

1Longterm asset are the asset of a company which are permanent in nature and which are not high liquidity in nature Examples are property plant and Equipment Building Automobiles While current asset i... View full answer

Get step-by-step solutions from verified subject matter experts