Hello if you would kindly answer part 1 please on attached file

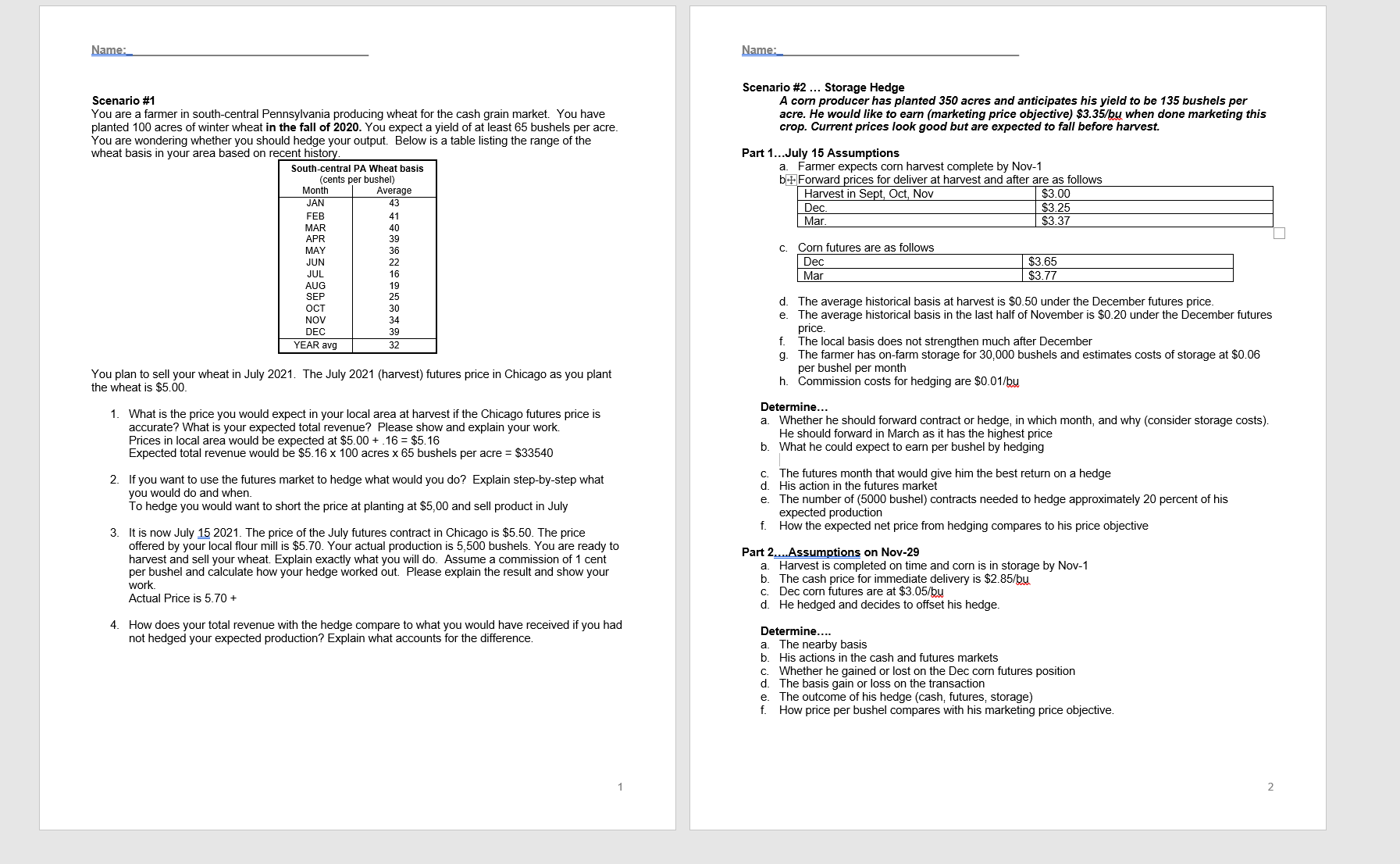

Name: Name: Scenario #2 ... Storage Hedge Scenario #1 A corn producer has planted 350 acres and anticipates his yield to be 135 bushels per You are a farmer in south-central Pennsylvania producing wheat for the cash grain market. You have acre. He would like to earn (marketing price objective) $3.35/bu when done marketing this planted 100 acres of winter wheat in the fall of 2020. You expect a yield of at least 65 bushels per acre. crop. Current prices look good but are expected to fall before harvest. You are wondering whether you should hedge your output. Below is a table listing the range of the wheat basis in your area based on recent history Part 1...July 15 Assumptions South-central PA Wheat basis a. Farmer expects corn harvest complete by Nov-1 (cents per bushel) but Forward prices for deliver at harvest and after are as follows Month Average Harvest in Sept, Oct, Nov $3.00 JAN 43 FEB Dec. $3.25 41 MAR 40 Mar. $3.37 APR 39 MAY 36 c. Corn futures are as follows JUN 22 Dec $3.65 JUL 16 Mar $3.77 AUG 19 SEP 25 OCT 30 d. The average historical basis at harvest is $0.50 under the December futures price. 34 e NO The average historical basis in the last half of November is $0.20 under the December futures DEC 39 price YEAR avg 37 f. The local basis does not strengthen much after December g. The farmer has on-farm storage for 30,000 bushels and estimates costs of storage at $0.06 You plan to sell your wheat in July 2021. The July 2021 (harvest) futures price in Chicago as you plant per bushel per month the wheat is $5.00. h. ion costs for hedging are $0.01/bu 1. What is the price you would expect in your local area at harvest if the Chicago futures price is Determine... accurate? What is your expected total revenue? Please show and explain your work. a. Whether he should forward contract or hedge, in which month, and why (consider storage costs). Prices in local area would be expected at $5.00 + .16 = $5.16 He should forward in March as it has the highest price Expected total revenue would be $5. 16 x 100 acres x 65 bushels per acre = $33540 6. What he could expect to earn per bushel by hedging 2. If you want to use the futures market to hedge what would you do? Explain step-by-step what C. The futures month that would give him the best return on a hedge d. His action in the futures market you would do and when. e To hedge you would want to short the price at planting at $5,00 and sell product in July The number of (5000 bushel) contracts needed to hedge approximately 20 percent of his expected production f. 3. It is now July 15 2021. The price of the July futures contract in Chicago is $5.50. The price How the expected net price from hedging compares to his price objective offered by your local flour mill is $5.70. Your actual production is 5,500 bushels. You are ready to harvest and sell your wheat. Explain exactly what you will do. Assume a commission of 1 cent Part 2..Assumptions on Nov-29 per bushel and calculate how your hedge worked out. Please explain the result and show your Harvest is completed on time and corn is in storage by Nov-1 work. b. The cash price for immediate delivery is $2.85/bu. Actual Price is 5.70 + . Dec corn futures are at $3.05/bu d. He hedged and decides to offset his hedge. 4. How does your total revenue with the hedge compare to what you would have received if you had not hedged your expected production? Explain what accounts for the difference Determine.... a. The nearby basis b. His actions in the cash and futures markets C. Whether he gained or lost on the Dec corn futures position d. The basis gain or loss on the transaction e. The outcome of his hedge (cash, futures, storage) f. How price per bushel compares with his marketing price objective