Question

Hello, I'm having problem here with taxation question. i need someone to assist me with the assignment. This question paper consists of 4 questions on

Hello,

I'm having problem here with taxation question. i need someone to assist me with the assignment.

This question paper consists of 4 questions on 10 printed pages.

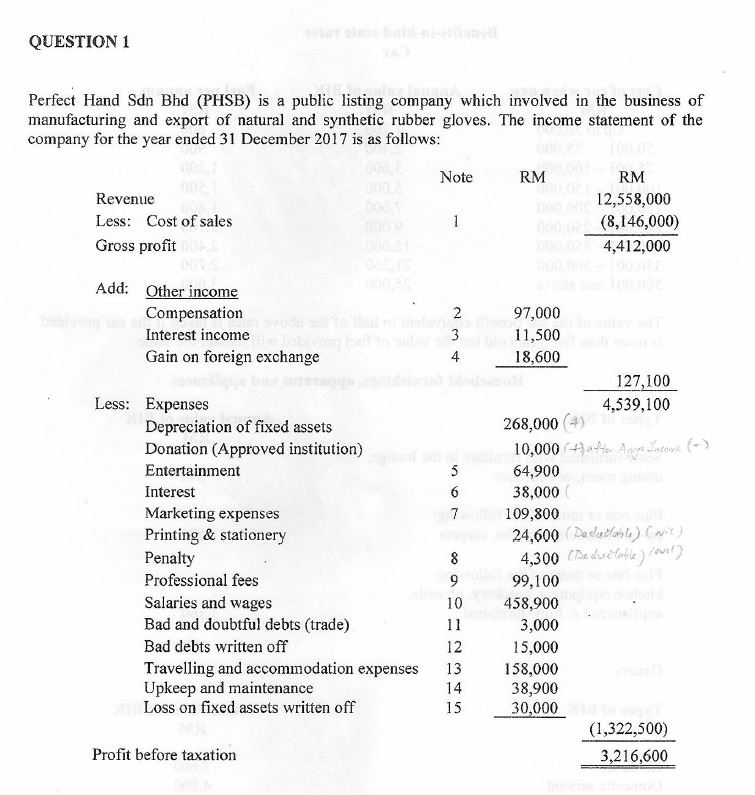

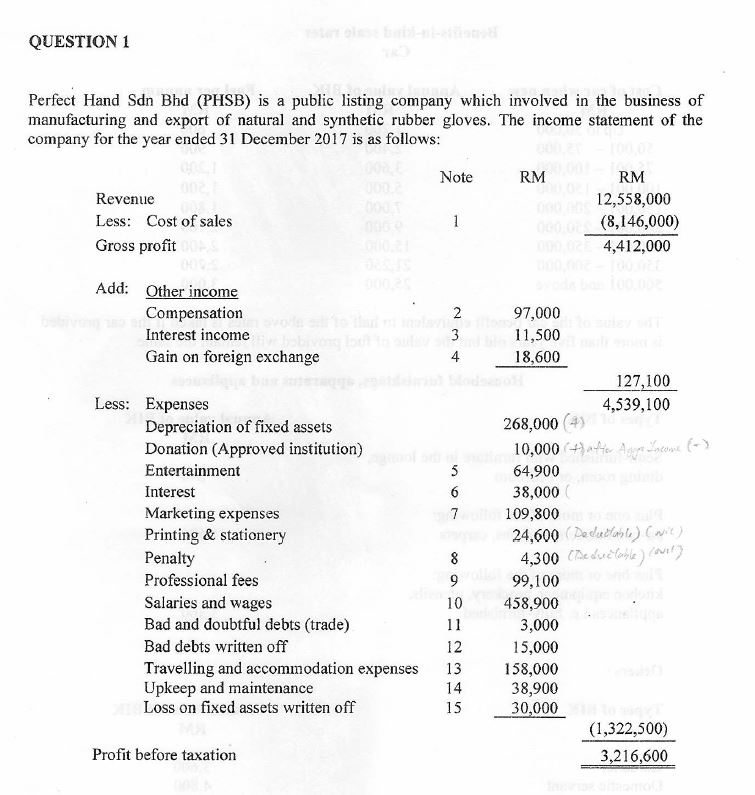

QUESTION 1

Perfect Hand Sdn Bhd (PHSB) is a public listing company which involved in the business of manufacturing and export of natural and synthetic rubber gloves. The income statement of the company for the year ended 31 December 2017 is as follows:

Note

RM

(-)

RM

(+)

Revenue = 12,558,000

Less: Cost of sales = (8,146,000)

Gross profit = 4,412,000

Add: Other income

Compensation (NOTE 2) = 97,000

Interest income Note 3 = 11,500

Gain on foreign exchange note 4 = 18600

total other income 127100

Less: Expenses

= 4,539,100

Depreciation of ?xed assets = 268200

Donation (Approved institution)= 10,000

Entertainment note 5 = 64,900

Interest note 6 = 38,000

Marketing expenses note 7 = 109,800

Printing & stationery = 24,600

Penalty note 8 = 4,300

Professional fees note 9 = 99,100

Salaries and wages note 10 = 458,900

Bad and doubtful debts (trade) note 11 = 3,000

Bad Debt Written off note 12 = 15,000

Travelling and accommodation expenses note 13 = 158,000

Upkeep and maintenance note 14 = 38,900

Loss on ?xed assets written off note 15 = 30,000

(1,322,500)

Pro?t before taxation = 3,216,600

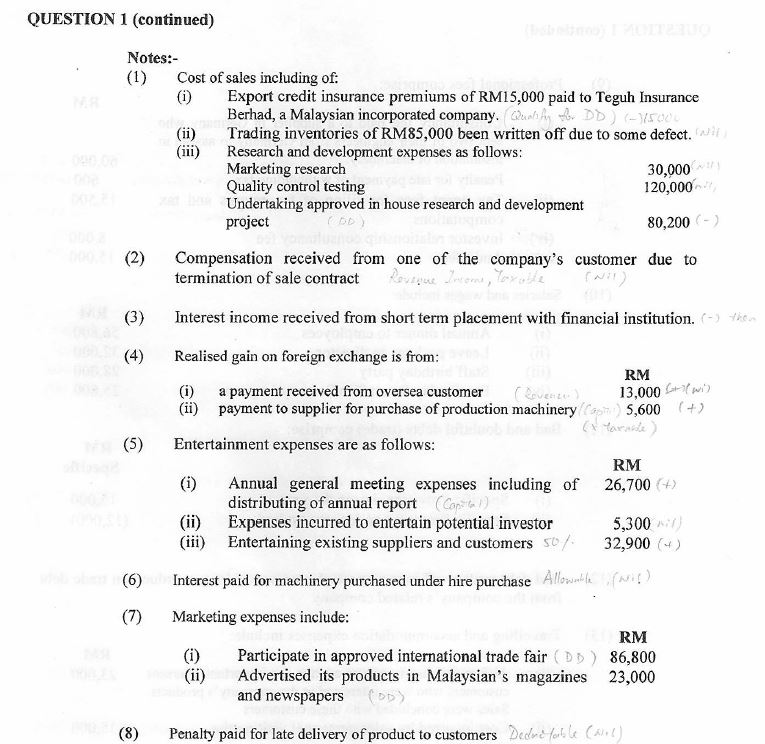

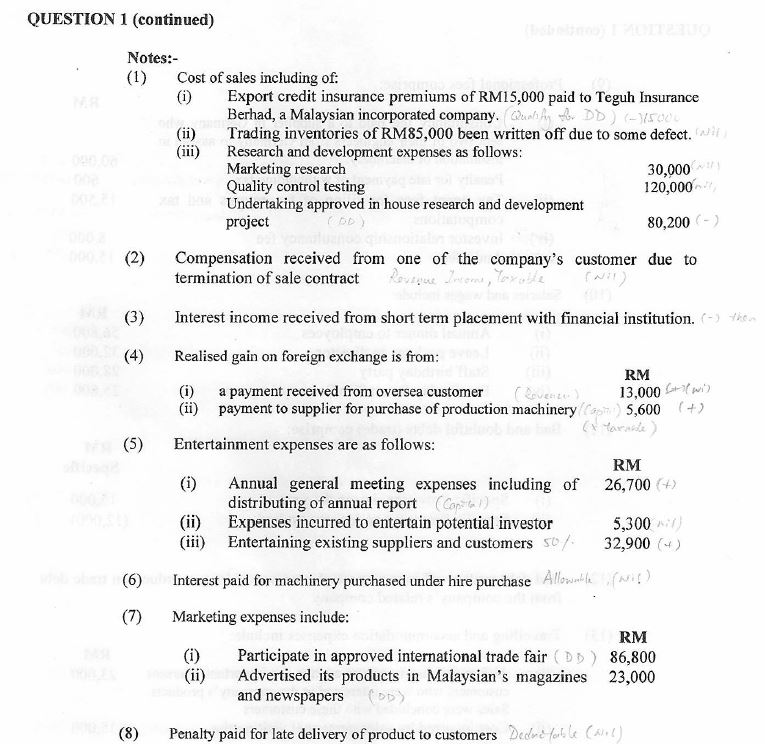

Notes:-

(1) Cost of sales including of:

Export credit msurance premiums of RM15, 000 paid to Teguh Insurance Berhad, a Malaysian incorporated company.

Trading inventories of RM85, 000 been written off due to some defect. Research and development expenses as follows:

Marketing research 30,000

Quality control testing 120,000

Undertaking approved in house research and development project 80,200

(2) Compensation received from one of the company's customer due to termination of sale contract

(3) Interest income received from short term placement with ?nancial institution.

(4) Realised gain on foreign exchange is from:

(i) a payment received from oversea customer 13,000

(ii) payment to supplier for purchase of production machinery 5,600

(5) Entertainment expenses are as follows:

i.Annual general meeting expenses including of distributing of annual report 26,700

ii.Expenses incurred to entertain potential investor 5,300

iii.Entertaining existing suppliers and customers 32,900

(6) Interest paid for machinery purchased under hire purchase

(7) Marketing expenses include:

i.Participate in approved international trade fair 86,800

ii.Advertised its products in Malaysian's magazines and newspapers 23,000

(8) Penalty paid for late delivery of product to customers

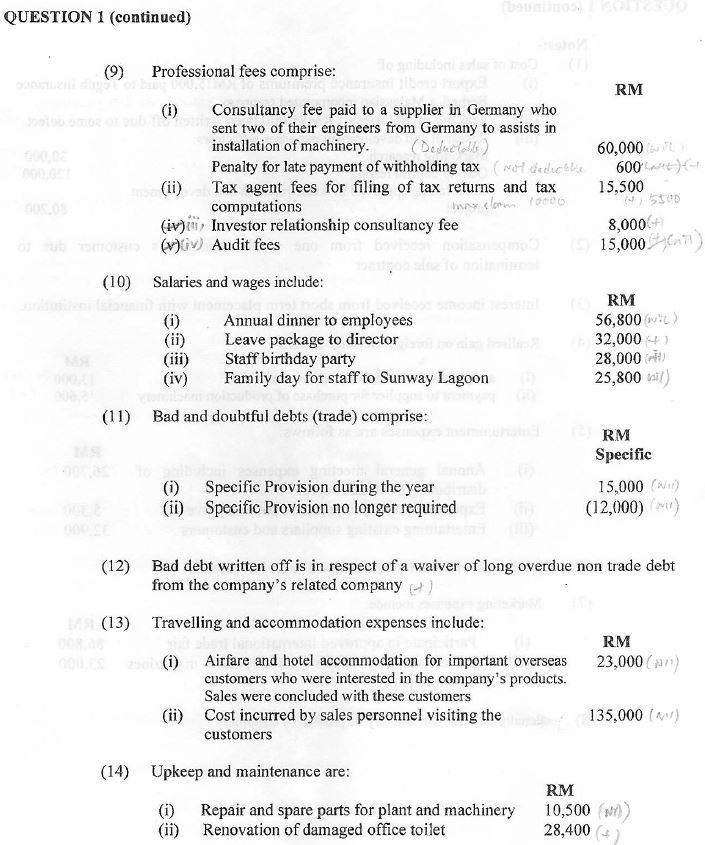

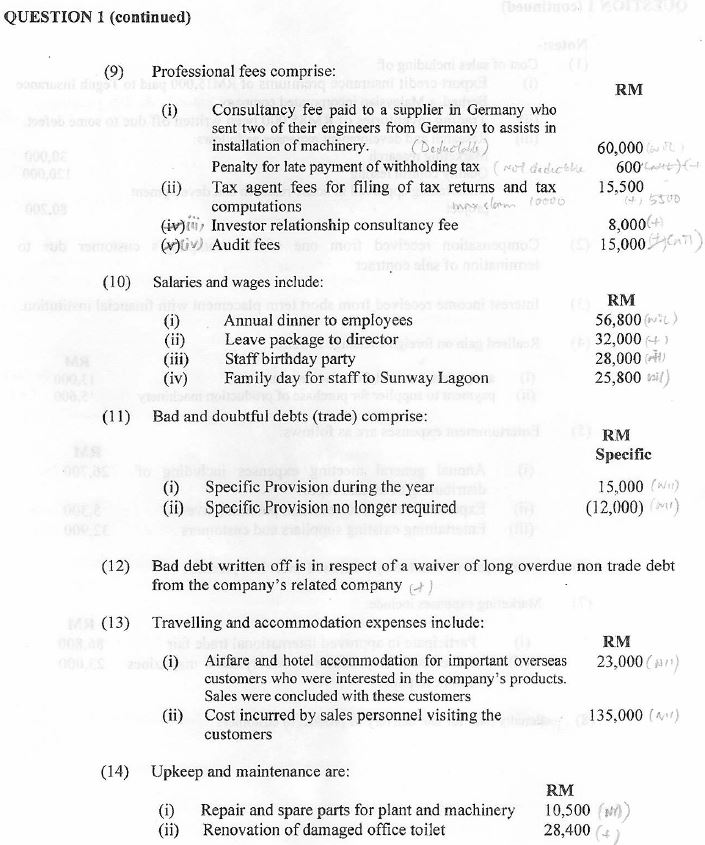

(9) Professional fees comprise:

i.Consultancy fee paid to a supplier in Germany who sent two of their engineers from Germany to assists in installation of machinery. - 505000

Penalty for late payment of withho1ding tax 600'

iii.Tax agent fees for ?ling of tax returns and tax computations - 15,500

iv.Investor relationship consultancy fee 8,000

v.Audit fees 15,000

(10) Salaries and wages include:

(i) Annual dinner to emponees 56,800

(ii) Leave package to director 32,000 -

(iii) Staff birthday paity 28,000

(iv) Family day for staff to Sunway Lagoon 25,800

(11) Bad and doubtful debts (trade) comprise:

(i) Speci?c Provision during the year 15,000 '

(ii) Speci?c Provision no longer required (12,000)

(12) Bad debt written off 15 in respect of a waiver of long overdue non trade debt from the company '3 related company

(13) Travelling and accommodation expenses include:

(i) Airfare and hotel accommodation for important overseas customers who were interested in the companys products. 23,000

Sales were concluded with these customers

(ii) Cost incurred by sales personnel visiting the customers 135,000

(14)Upkeep and maintenance are:

(1) Repair and spare pans for plant and machinery 10,500

(ii) Renovation ofdamaged of?ce toilet 28,400

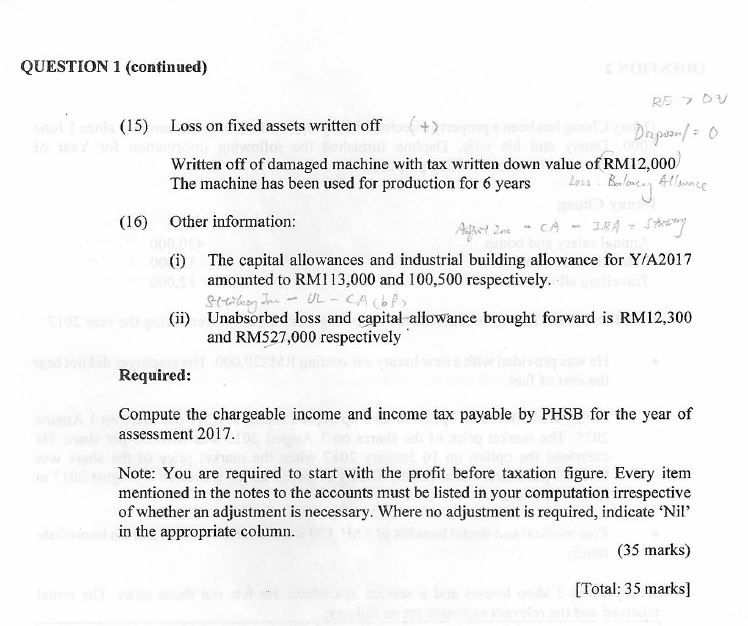

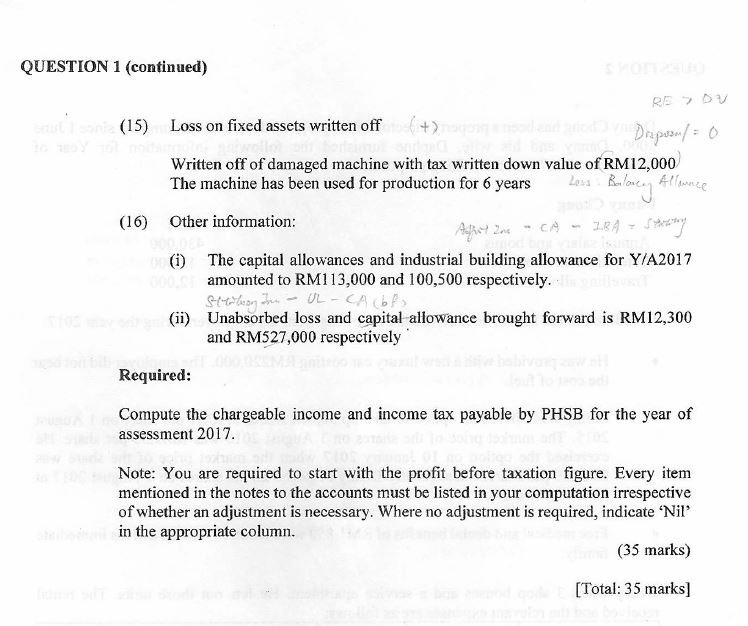

(15) Loss on ?xed assets written off

Written off of damaged machine with tax written down value of RM 12, 000

The machine has been used for production for 6 years 1

(l6) Other information:

(i) The capital allowances and industrial building allowance for Y/A2017

amounted to RM113,000 and 100,500 respectively.

(ii) Unabsorbed loss and capital allowance brought forward is RM12,300

and RM527,000 respectively '

Required:

Compute the chargeable income and income tax payable by PHSB for the year of

assessment 2017.

Note: You are required to start with the pro?t before taxation ?gure. Every item

mentioned in the notes to the accounts must be listed in your computation irrespective of whether an adjustment is necessary, Where no adjustment is required, indicate 'Nil'

(35 marks)

[Total: 3 5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started