Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hello im looking for if you could help me fill out requirment 2 and the chart for post the adjusting entries to the t accounts.

Hello im looking for if you could help me fill out requirment 2 and the chart for post the adjusting entries to the t accounts.

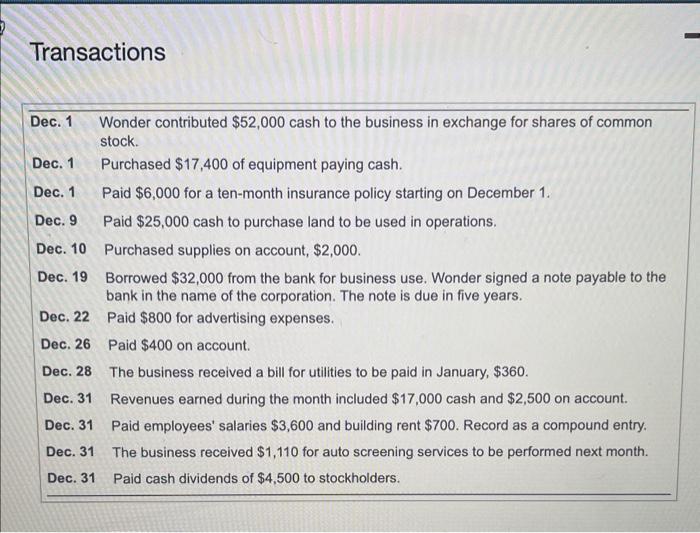

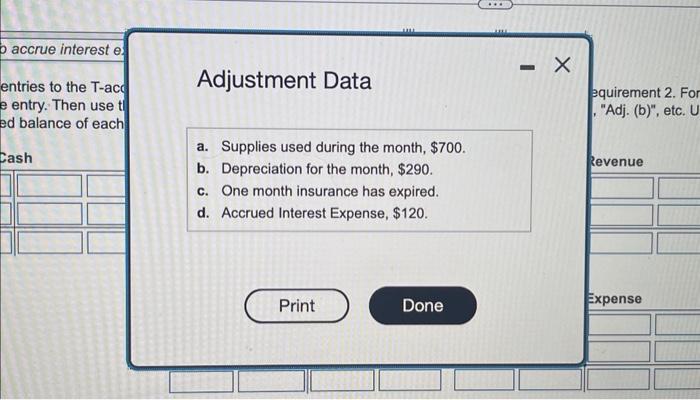

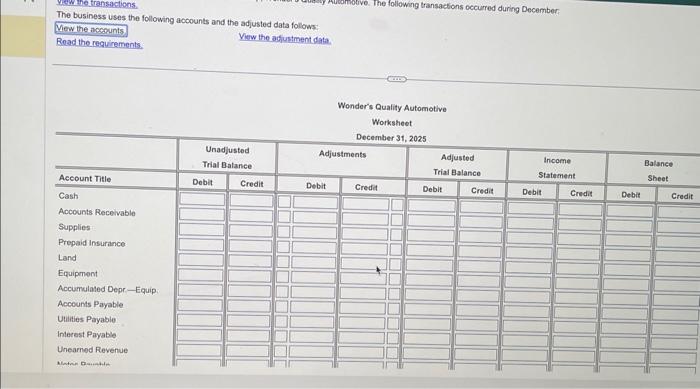

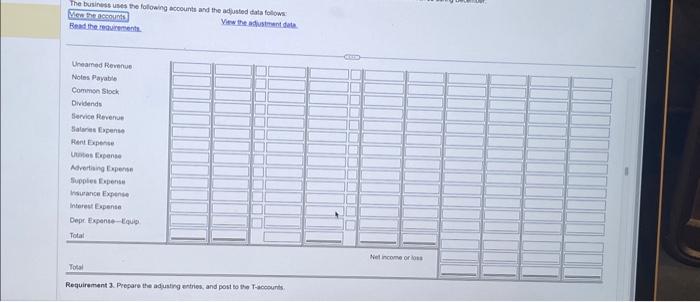

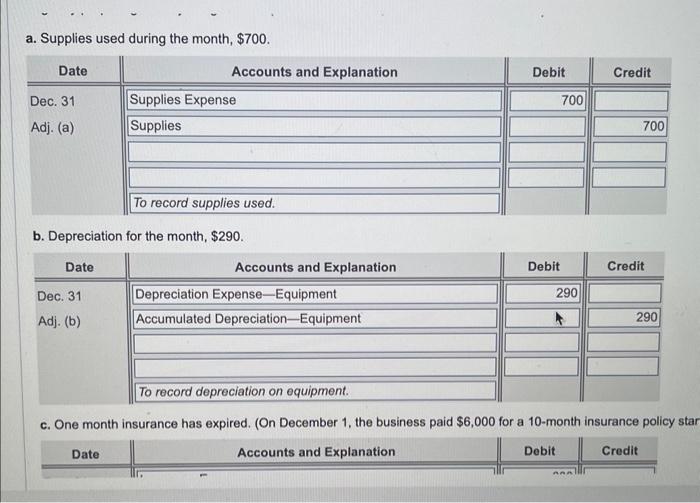

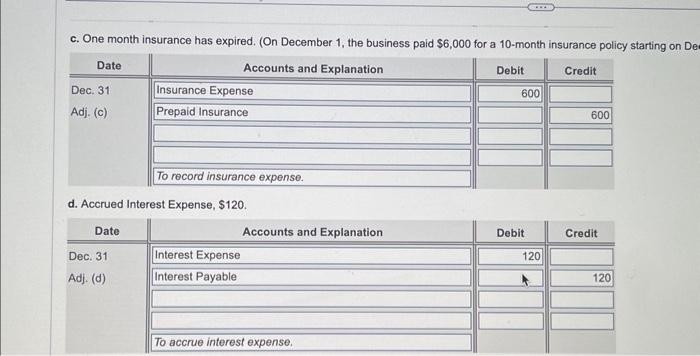

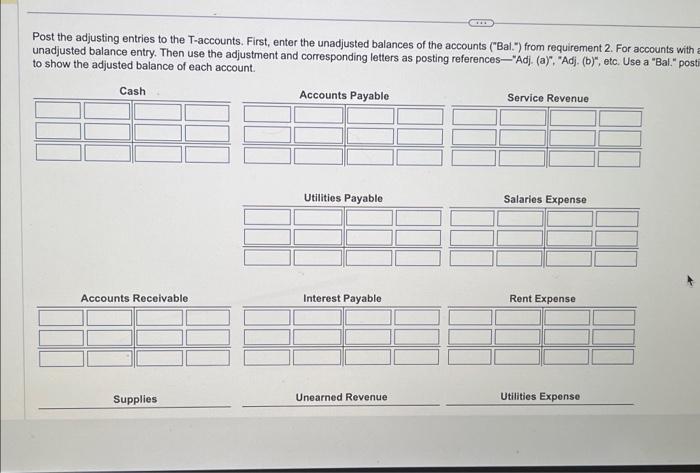

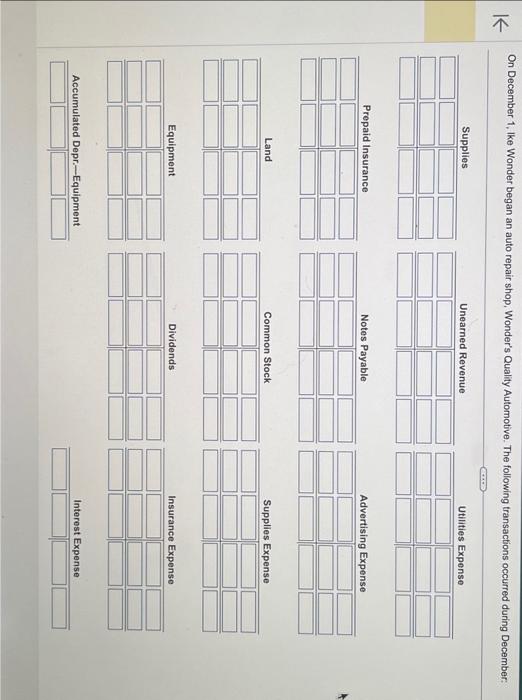

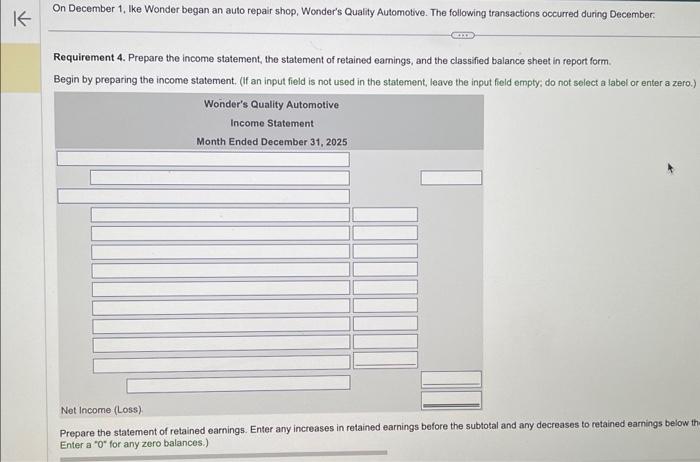

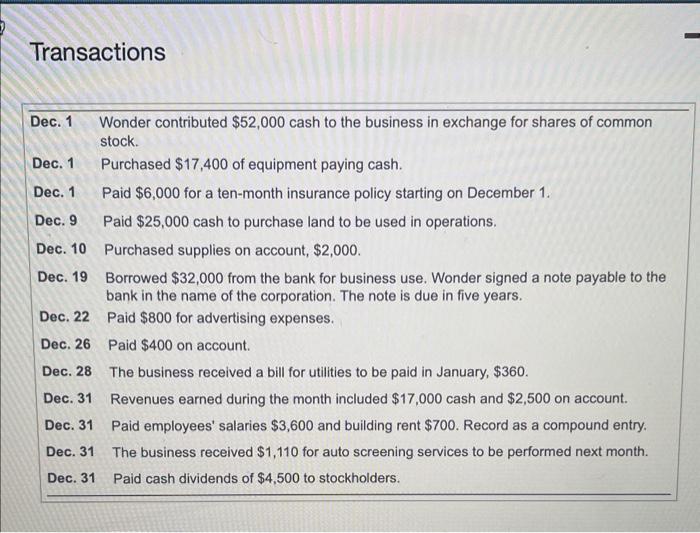

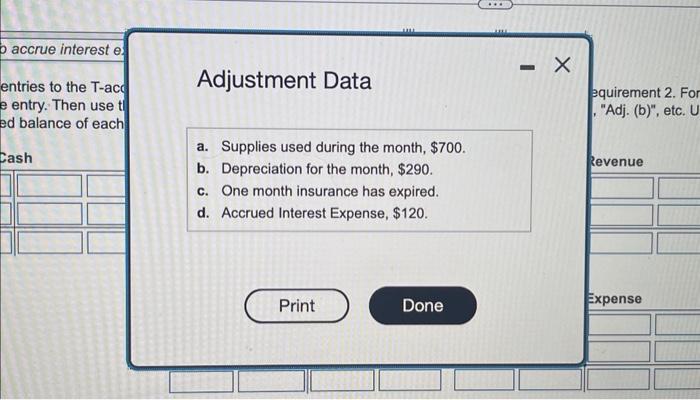

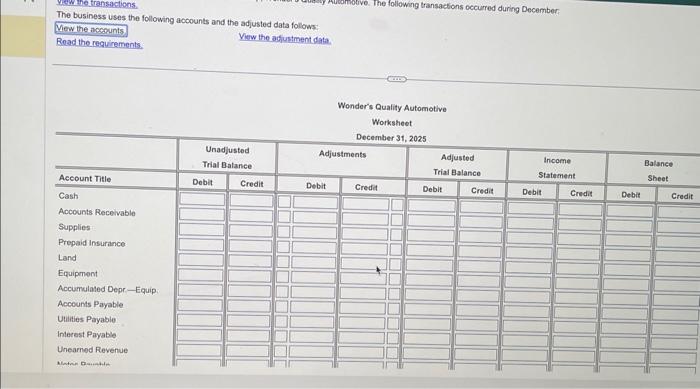

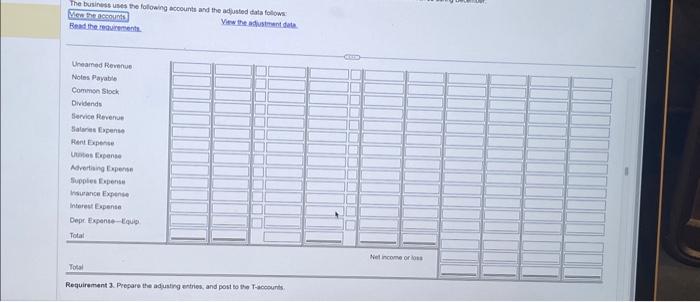

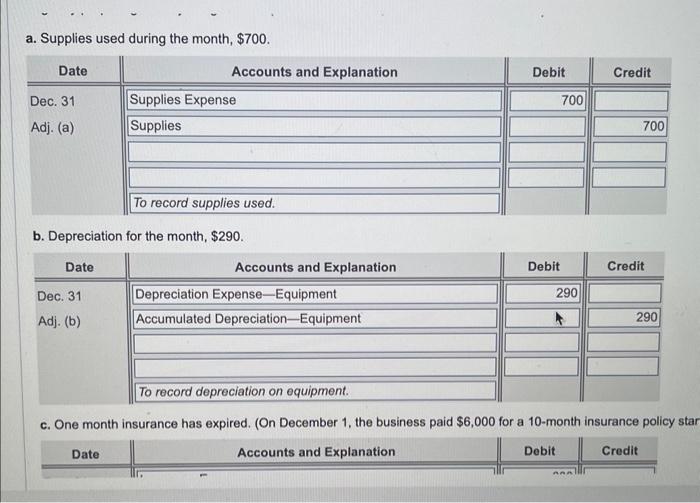

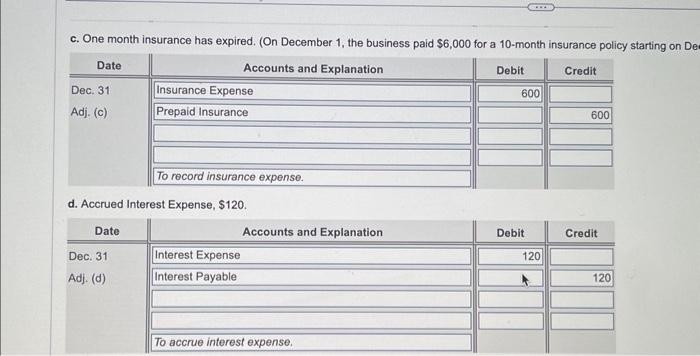

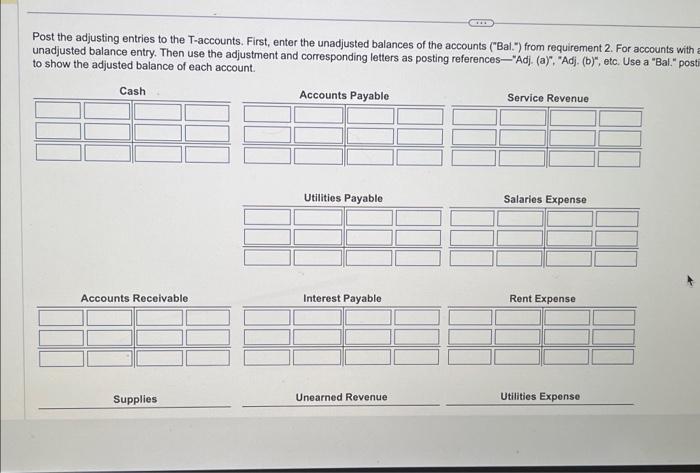

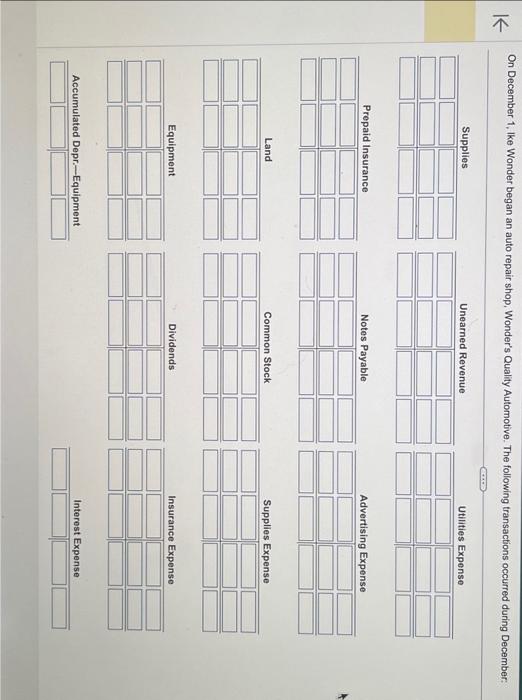

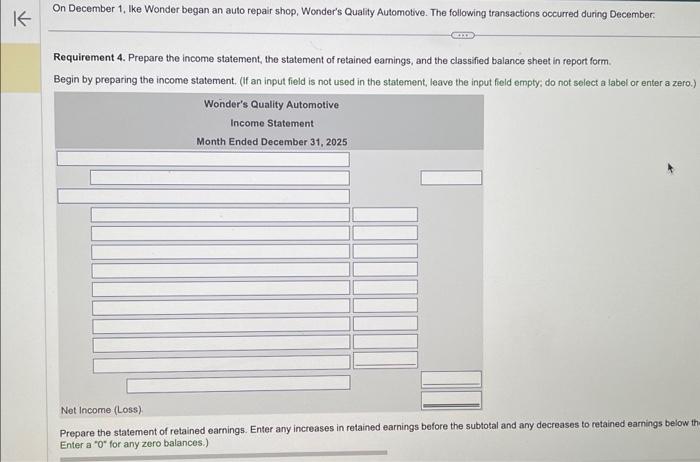

Transactions Dec. 1 Wonder contributed $52,000 cash to the business in exchange for shares of common stock. Dec. 1 Purchased $17,400 of equipment paying cash. Dec. 1 Paid $6,000 for a ten-month insurance policy starting on December 1. Dec. 9 Paid $25,000 cash to purchase land to be used in operations. Dec. 10 Purchased supplies on account, $2,000. Dec. 19 Borrowed $32,000 from the bank for business use. Wonder signed a note payable to the bank in the name of the corporation. The note is due in five years. Dec. 22 Paid $800 for advertising expenses. Dec. 26 Paid $400 on account. Dec. 28 The business received a bill for utilities to be paid in January, $360. Dec. 31 Revenues earned during the month included $17,000 cash and $2,500 on account. Dec. 31 Paid employees' salaries $3,600 and building rent $700. Record as a compound entry. Dec. 31 The business received $1,110 for auto screening services to be performed next month. Dec. 31 Paid cash dividends of $4,500 to stockholders. d. Accrued Interest Expense, $120. a. Supplies used during the month, $700. b. Depreciation for the month, $290. entriestotheT-acdentry.Thenusetedbalanceofeach\begin{tabular}{|l|l|} \hline a. Supplies used during the month, $700. \\ b. Depreciation for the month, $290. \\ c. One month insurance has expired. \\ d. Accrued Interest Expense, $120. \end{tabular} Post the adjusting entries to the T-accounts. First, enter the unadjusted balances of the accounts ("Bal.") from requirement 2. For accounts with unadjusted balance entry. Then use the adjustment and corresponding letters as posting references-"Adj. (a)", "Adj. (b)", etc. Use a "Bal." pos to show the adiusted balance of aarh armuint Requirement 4. Prepare the income statement, the statement of retained eamings, and the classified balance sheet in report form. Begin by preparing the income statement, (If an input field is not used in the statement, leave the input field empty; do not select a label or enter a zero. Net ancurrie yeuss? Prepare the statement of retained earnings. Enter any increases in retained earnings before the subtotal and any decreases to retained earnings below ti Enter a " 0 " for any zero balances.) On December 1, Ike Wonder began an auto repair shop, Wonder's Quality Automotive. The following transactions occurred during December: Supplies Prepaid Insurance Land Equipment Unearned Revenue Notes Payable Common Stock Utilities Expense Advertising Expense Supplies Expense Dividends Accumulated Depr-Equipment Interest Expense Transactions Dec. 1 Wonder contributed $52,000 cash to the business in exchange for shares of common stock. Dec. 1 Purchased $17,400 of equipment paying cash. Dec. 1 Paid $6,000 for a ten-month insurance policy starting on December 1. Dec. 9 Paid $25,000 cash to purchase land to be used in operations. Dec. 10 Purchased supplies on account, $2,000. Dec. 19 Borrowed $32,000 from the bank for business use. Wonder signed a note payable to the bank in the name of the corporation. The note is due in five years. Dec. 22 Paid $800 for advertising expenses. Dec. 26 Paid $400 on account. Dec. 28 The business received a bill for utilities to be paid in January, $360. Dec. 31 Revenues earned during the month included $17,000 cash and $2,500 on account. Dec. 31 Paid employees' salaries $3,600 and building rent $700. Record as a compound entry. Dec. 31 The business received $1,110 for auto screening services to be performed next month. Dec. 31 Paid cash dividends of $4,500 to stockholders. d. Accrued Interest Expense, $120. a. Supplies used during the month, $700. b. Depreciation for the month, $290. entriestotheT-acdentry.Thenusetedbalanceofeach\begin{tabular}{|l|l|} \hline a. Supplies used during the month, $700. \\ b. Depreciation for the month, $290. \\ c. One month insurance has expired. \\ d. Accrued Interest Expense, $120. \end{tabular} Post the adjusting entries to the T-accounts. First, enter the unadjusted balances of the accounts ("Bal.") from requirement 2. For accounts with unadjusted balance entry. Then use the adjustment and corresponding letters as posting references-"Adj. (a)", "Adj. (b)", etc. Use a "Bal." pos to show the adiusted balance of aarh armuint Requirement 4. Prepare the income statement, the statement of retained eamings, and the classified balance sheet in report form. Begin by preparing the income statement, (If an input field is not used in the statement, leave the input field empty; do not select a label or enter a zero. Net ancurrie yeuss? Prepare the statement of retained earnings. Enter any increases in retained earnings before the subtotal and any decreases to retained earnings below ti Enter a " 0 " for any zero balances.) On December 1, Ike Wonder began an auto repair shop, Wonder's Quality Automotive. The following transactions occurred during December: Supplies Prepaid Insurance Land Equipment Unearned Revenue Notes Payable Common Stock Utilities Expense Advertising Expense Supplies Expense Dividends Accumulated Depr-Equipment Interest Expense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started